Many business owners who are new to payroll and filling in tax forms might wonder what the difference is between 1099 and W-2 employees. But don’t worry – the answer isn’t that complicated. Let’s take a look at the main differences between 1099 and W-2 employees and show you the tools you can use to manage both.

So you’re a business owner, or working in HR, and you’ve just started looking at the different kinds of tax forms for your payroll.

You’ll need to fill in 1099 tax forms for some of your workers, and W-2 forms for others.

And it can be pretty confusing telling the difference between the two.

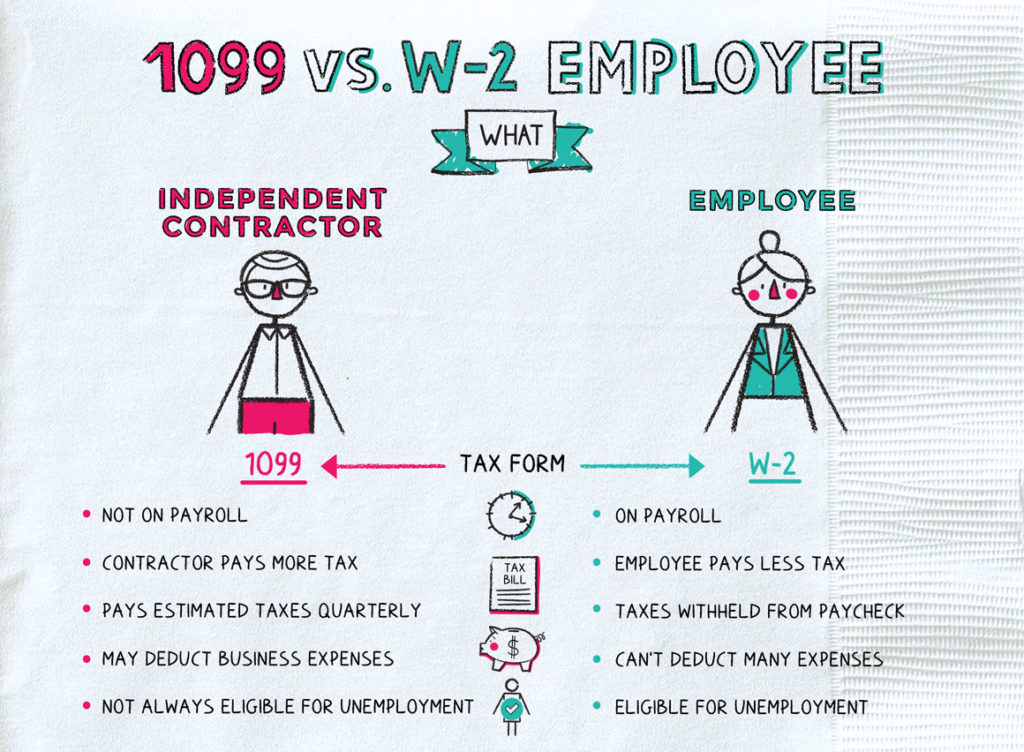

While there is plenty to consider, the main thing to take note of is that different workers get taxed differently.

Even if you have an accountant or payroll service doing the hard work, HR and business owners should know the basics when it comes to classifying workers.

Why Is It Important To Know The Difference Between 1099 And W-2 Employees?

When you consider that staffing can account for anywhere between 40% and 80% of your company’s budget, it’s no surprise that this requires the highest level of attention to detail. Otherwise, you could potentially face financial repercussions or your company’s reputation could be tarnished.

There are a few reasons why it’s crucial to know the difference between 1099 and W-2 workers.

- If you misclassify an employee as an independent contractor, then the IRS can financially penalize you, or even sue your company.

- Classifying your workers directly affects how all staff members are taxed. When companies pay W-2 employees, they are obligated to withhold income and pay taxes. This usually isn’t required when it comes to 1099 contractors.

- When a worker is classified, various aspects of their job are affected such as payment and their schedule. Contractors and freelancers establish the terms of their employment, such as where, how and when they work, while an employee’s conditions are predetermined.

Owners of small and medium-sized businesses need to know these classifications and their differences so that they know when to hire one and not the other. Truth be told though, W-2 and 1099 classifications have many more differences. Let’s take a deeper look at each of them.

What Is A 1099 Employee?

Generally speaking, a 1099 worker is hired to complete a specific job for a limited period of time – like a freelancer. However, many 1099 workers serve multiple clients at any given time, providing a service in the process.

A classic example of this could be a truck driver who potentially works for more than one company at any given time. As a result, they don’t receive a traditional salary.

The driver is self-employed, which allows them to take on multiple jobs at once. From a payment perspective, if the driver is self-employed, then they will file their own taxes.

Companies may consider hiring this kind of worker during busier seasons as their contract can be renewed more flexibly – making the working relationship mutually beneficial for both parties.

1099 workers generally outline the conditions of their job such as where they work (for example, if they’re remote workers, when, and what tools they use for the job. 1099 contractors can also choose their own team to help provide the service asked for.

The Advantages Of 1099 Employee

- Flexible workers – while full-time workers are potentially huge investments for companies, hiring a flexible 1099 worker for a couple of jobs here and there can be much more efficient and cost effective. A flexible work schedule has its advantages as well.

- Specialized expertise – one of the great perks of hiring 1099 workers is that they are usually highly skilled in one specific area. Jobs that require specific skills can benefit from the contribution of independent contractors.

- Minimal legal risk – As previously mentioned, companies usually aren’t as legally responsible when using independent contractors. 1099 workers usually have their own insurance, aren’t eligible for workers compensation coverage and can’t make most kinds of wrongful termination claims.

- More affordable – 1099 workers can cost your companies a lot less money than W-2 employees. No benefits, minimum wage, and overtime are required. Also, there is no need to withhold payroll or income taxes, meaning less paperwork.

- Less legal obstacles – One of the benefits of using 1099 workers is that you don’t have much financial or legal responsibility over them. For example, independent contractors pay their employer’s self-employment taxes and their own. This means that your company isn’t required to pay payroll taxes. Moreover, 1099 workers don’t receive the same financial benefits that W-2 workers do. These include paid time off, health insurance and overtime.

The Disadvantages Of 1099 Employee

- Employers have less control – 1099 workers set the terms of how they work and how they are paid, which might not suit the company’s interests. It is imperative that you read their terms carefully before you actually give them the job.

- No protection of workers’ compensation – while companies might be delighted not to be obligated to provide compensation or health benefits, this isn’t necessarily a good thing. 1099 workers can still hold you accountable if something happens to them on the job.

Easier to breach contracts – it can be a lot trickier parting ways with a contractor than it is to sever ties with a W-2 employee. Always make sure that a legal professional checks the worker’s contract early on.

What Is A W-2 Employee?

Unlike 1099 workers, W-2 employees don’t have their own business. They work for you and receive a traditional salary, employee benefits and work in accordance with the company’s schedule and needs.

It is legally required for W-2 employees to be paid at least minimum wage based on how much time they work on an ongoing or regular basis. When it comes to W-2 workers, their social security and medicare taxes are withheld by the company. Also, the company pays employer payroll taxes. While an independent contractor is paid according to the terms established in their contract, W-2 employees can be let go in the event of poor performance, or for other valid reasons.

W-2 workers also receive all of the tools they need to perform their job from their employer. They are also eligible for retirement contributions and health insurance, amongst other things.

The Advantages Of W-2 Employees

- Loyal servants to your company – W-2 employees can prove to be committed and integral parts of a company’s success, providing long-term rewards. Part-time and full-time employees are more likely to go the extra mile.

- More adaptable – while 1099 workers are more likely to be specialized in one skill, W-2 employees are more likely to be called upon to execute a wider range of skills, regardless of business needs. For example, a full-time employee can rotate jobs and may find it easier to shift focus and help out with other projects on short notice.

- Business owners save more time – owners of small businesses (and medium-sized ones) may feel overwhelmed by the amount of responsibilities they have. If you have W-2 employees though, you can delegate specific jobs to them, giving you more time to focus on high-level business matters.

- Shorter training time – while training is usually ongoing throughout a W-2 employee’s job, they will learn the basics of their position, as well as general company expectations. The expectations for 1099 workers to meet company standards are much lower.

The Disadvantages Of W-2 Employees

- More time and effort required – when you hire W-2 employees, it takes time to train and manage them; time that business owners might not have.

- Companies need to provide all resources – as a company, you are obligated to provide the employee with everything they need to execute their jobs to your standards. This includes tools, equipment, materials and training resources. Business expenses also need to be reimbursed.

- They cost a lot of money – as previously mentioned, W-2 employees don’t just get paid in salary. Companies are also responsible for paying medicare taxes and social security.

How To Determine Whether You Should Hire 1099 VS. W-2 Employees

When deciding what is the best kind of worker to hire, it completely depends on your short-term and long-term goals, as well as your budget.

When you employ a W-2 employee, they become an official component of your company. This means that they now require company essentials like HR and payroll. This is not the case with 1099 workers.

Here are some factors one should consider when deciding how to classify workers:

- Level of oversight: can you control how, when and where the worker performs on a daily basis? Some jobs might require higher levels of oversight than others. For example, if you need a social media expert who is expected to meet specific deadlines, then this is a standard that should be noted in their contract.

- Type of payment: different kinds of workers require varying types of payment. For example, if you work in retail, an industry where sales are a regular KPI, paying workers a weekly or monthly salary is expected and they would therefore be classified as W-2 employees. However, if you need a driver to complete a couple of one-off deliveries, then one single payment will be sufficient and it will make sense to classify them as a1099 worker.

- Type of relationship: do you need the candidate to work full-time, part-time or as a one-off job? Does the employee require benefits? Can you hire a worker who also works for other clients? Does the worker’s demands suit your budget?

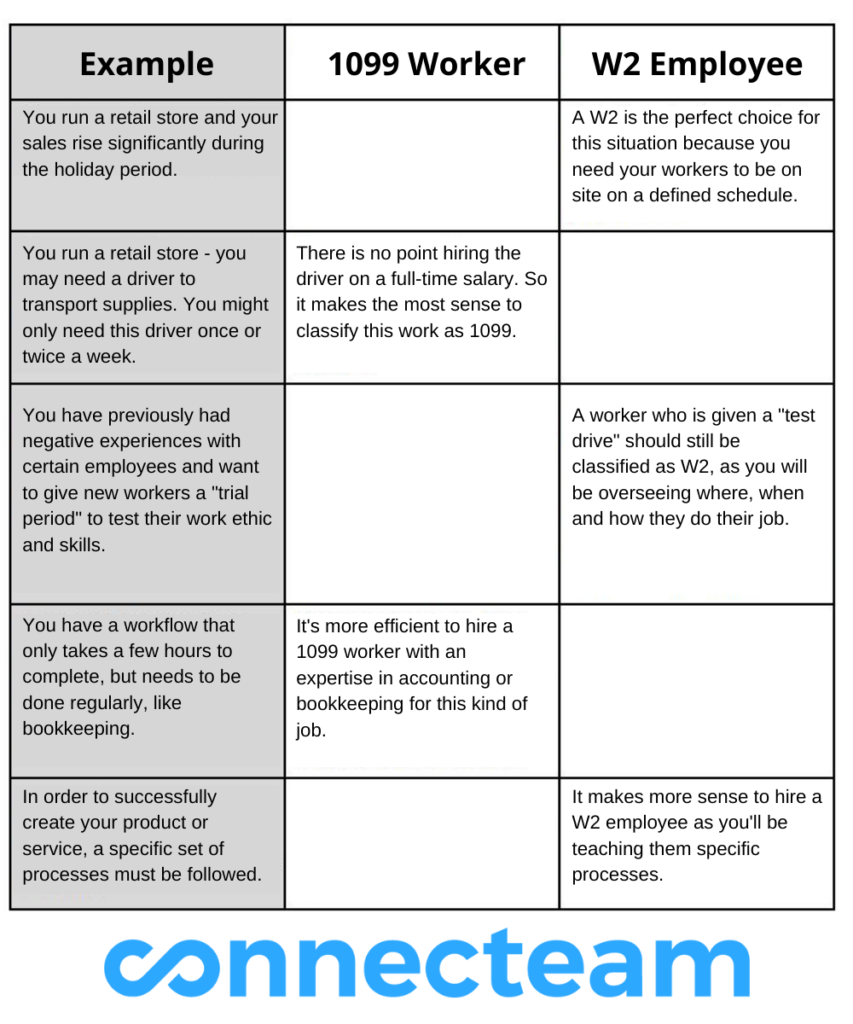

The following table includes a handful of scenarios that you might face as a business owner, as well as the most suitable worker for each one:

After considering these three factors, you will more likely be able to determine whether or not the work should be classified as 1099 or W-2. It’s also worth noting that even 1099 workers can be reclassified as W-2 employees over time, and vice versa.

Use The Latest Tech To Manage 1099 And W-2 Employees

Using digital software like Connecteam helps to make payroll affordable, easier and more efficient, no matter what kind of workers you hire.

Here are some of the all-in-one app’s most useful features for business owners using both 1099 independent contractors or W-2 employees:

- The app’s time clock allows business owners to lock the timesheet at the end of the day and export it for an easy, convenient payroll process (including via Connecteam’s QuickBooks Online and Gusto integration).

- Overtime is tracked automatically, allowing employers to pay according to regulations.

- Managers get a full overview of the timesheet, are able to easily see absence/vacation days, and are able to send reminders to workers to clock in clock out, regardless of their classification.

Better Time Tracking For Your Team

Make payroll easier and more efficient, no matter where you are.

- Set accurate schedules in just minutes for your 1009 workers and W-2 employees in accordance with their contract.

- Create schedule templates from previous weeks and easily copy and paste.

- Duplicate or set recurring schedules, drag & drop, and open shifts up for grabs.

- Customize shifts, attaching pictures, videos, guides and notes so that workers know everything they need to do.

- Receive notifications when shifts have been completed.

The Bottom Line On 1099 VS. W-2 Employees

As previously mentioned, knowing about 1099 independent contractors and W-2 employees can be quite overwhelming for business owners who are new to the terms. But after reading this blog, we think that you will have a better understanding of the differences between the two and how they affect small to medium-sized businesses.

It is inconclusive whether or not W-2 employees are more beneficial to companies than 1099 workers. However, it is clear that business owners should consider both and select one or the other depending on what fits their company’s needs the most. At any rate, it is important to make sure that all staff members are classified accurately to ensure your business doesn’t waste money.

Using an all-in-one business app like Connecteam can help business owners keep track of how much time 1099 and W-2 workers spend working, making payroll more accurate and simplified, and lower chances of tax errors. They can also make sure that shift schedules are always filled and that they are getting the most out of their workers, regardless of classification.