Stop wasting money when you don’t need to! We share surefire ways that you can reduce business costs, and it’s easier than you think.

Stop wasting money when you don’t need to! Here are some surefire ways to reduce business costs.

True or false: Business owners are in the habit of making money. True, of course!

But here’s the catch…Far too many business owners are wasting money unnecessarily.

In fact, 82% of all businesses fail because of cash flow problems.

Reducing business costs doesn’t have to be time-consuming or take too much thought. It’s all about making smart choices in the name of cost reduction.

We’ve put together 13 easy tips to help you reduce business costs. Trust us; it isn’t as complicated as you think.

Use The Right Technology

Using technology wherever possible can help you with cost reduction and moving your business forward. With certain digital tools, you can:

- Hold meetings virtually to reduce the cost of petrol/gas money

- Use free online payment services like PayPal or Venmo

- Software solutions like Connecteam, Google Docs or Trello help organize and centralize your company documents. Plus, they assist in project management.

But if you’re looking for ways to effectively manage your business and cost-cutting measures, then you need Connecteam. This leading all-in-one staff management software offers robust features to help you streamline daily operations and increase employee engagement.

With Connecteam, you get:

- Accurate payroll with GPS-powered time tracking: Straight from mobile, employees can clock in and out, tagging a timestamp and GPS location in real-time.

- Stronger employee communication: Keep everyone up to date and engaged by sharing updates via a social feed. Start 1:1 or employee team chats and search for contacts with an in-app employee directory.

- Better employee engagement: Issue surveys, share photos, videos, or GIFs, and create an open-door policy to increase employee engagement.

- Efficient training & onboarding: Provide the best learning experience with direct access to employee training resources, including handbooks, vacation policies, benefits, dress code, etc.

- Send and receive reports in real-time: Streamline reporting while on the go with real-time reports that employees can submit from anywhere (expense reimbursements, for example).

- Efficient employee scheduling: Build a schedule based on different requirements. Provide all necessary information, such as time, address, and special instructions. Allow your team to accept and reject shifts.

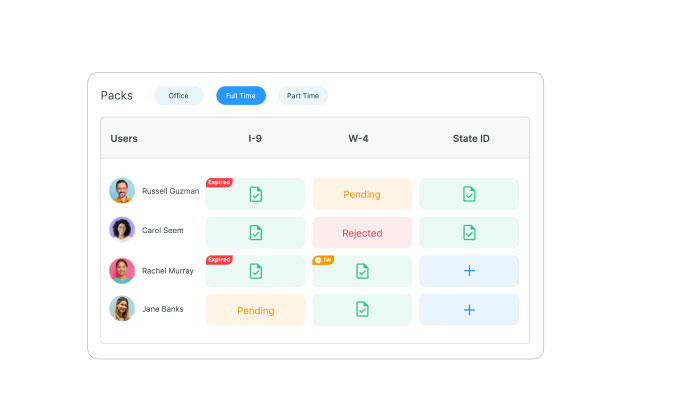

Ensure compliance: Keep your team compliant with digital ‘read-and-sign’ forms.

All Your Cost-Saving Tools in One Place Schedule efficiently, track employee time by the second, and reduce business expenses with Connecteam’s Operations hub.

Rely On Modern Marketing Methods

You don’t need to cut paid advertising entirely. But there are some cheaper alternatives you should explore to reduce business costs:

- Network! Customers are likelier to work with you because they recognize you. So taking on networking opportunities can only help.

- Do more of your marketing work in-house instead of paying someone else. Sure, there are plenty of experts out there. But you can research online to find tips and guides that work for you.

- Boost your social media presence by choosing the right platform for you. Be sure to set a goal and create a strategy. Posting randomly will get you nowhere. Just be genuine and engaging for your audience. Building an employee advocacy program could work wonders.

- Offer a referral program while building your customer email list. Recommendations from current customers can lead to sales more quickly.

These modern methods do work. To ensure you’re cutting business costs, try as many as possible to see what works and doesn’t work for you.

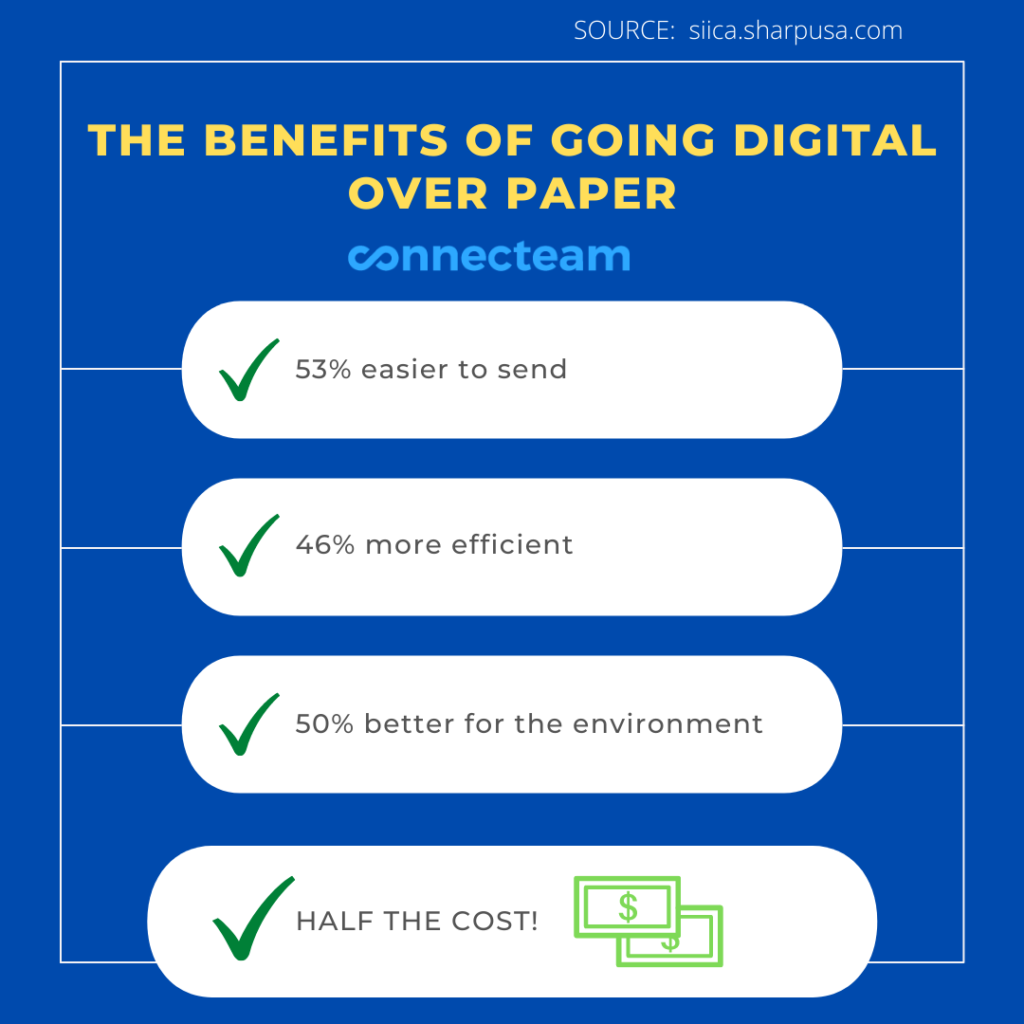

Go Paperless

Sure, the price of paper, ink, mailing supplies, and postage is minimal. But prices can get out of hand if you’re not careful.

Going paperless will help reduce business costs, find out how much you can save with our Paper & Printing Cost Calculator. By switching to digital checklists & forms, invoice and bill payment system, you can easily file all paperwork on your computer and reduce company overhead considerably.

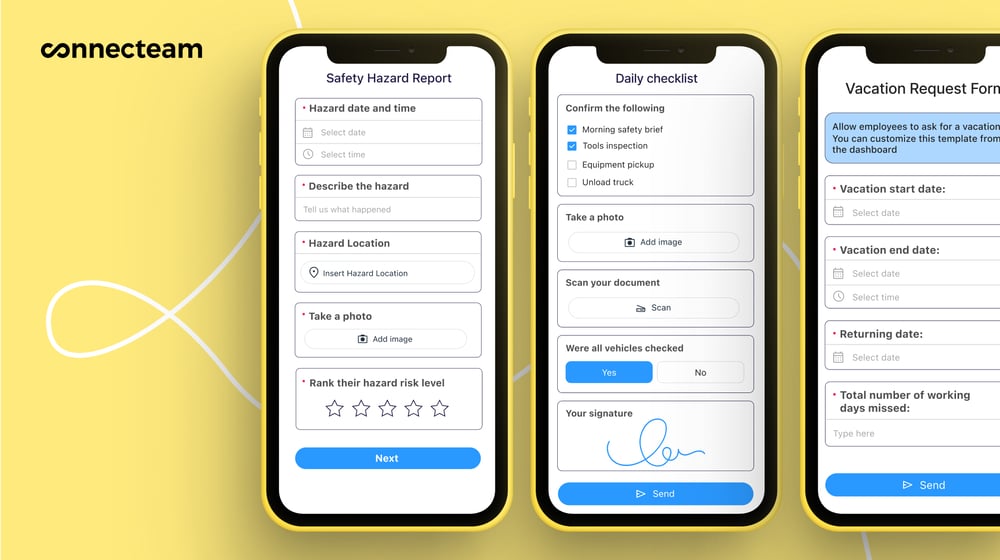

Your employees need easy access to forms, checklists, and reports for multiple purposes. They don’t want to lug around binders of forms while on the go. And the last thing you want to do is go through each form manually.

Connecteam is perfect for managing these workflows. With this software, you can:

- Create employee onboarding forms and expense reimbursement forms

- Manage vacation requests and sick leave forms

- Handle safety reports, invoices, equipment checkups, and much more.

These digital forms will automatically reach you in real-time. Everything you and your employees need is available at your fingertips.

Create a Budget

Budgeting is essential when it comes to reducing business costs. You can’t make smart financial decisions if you don’t know how much money is coming in and out each month. A budget allows you to have a daily view of how you can reduce business expenses.

A working budget allows you to make adjustments as you go. That way, you can cut business costs in real-time – not after the fact. As far as how to reduce business costs, this tip is simply a no-brainer.

Lower Your Financial Expenditures

Take a close look at your insurance policies and financial accounts to reduce business expenses:

- Compare insurance providers to reduce the costs of insurance, and then ask your current provider to match the rate.

- Merge insurance policies or business bank accounts if possible.

- Check if you are being over-insured or have duplicating coverage.

- Avoid unnecessary debt. Conduct a thorough cost-benefit analysis and future forecasting, looking into business expansion.

- Consider opportunity costs and the effects of debt payments on cash flow. Excess debt can strongly affect the company’s rating, interest rates, and borrowing in the future.

As a small business owner, chances are your business credit card is in your name. If that’s the case, you need to pay off the card in full every month.

Yet, interest charges can add up quickly. So get into the habit of paying them off each month instead of adding up the amount and paying it off at the end of the year

Time Management Cannot Be Overlooked

Time is money, right? So be sure to work productively without wasting time. Otherwise, you’re just wasting money. And that’s the total opposite of reducing business costs. You can:

- Cut distractions with apps like Focus Booster, Todoist, or Rescue Time. These solutions can help you focus by tracking sites that suck up your time so that you can stay on point.

- Meetings should run for a limited amount of time so everyone shows up promptly, sticks to the agenda, and wraps up at the right time.

Avoid unnecessary meetings by having a meeting agenda so to highlight what participants need to discuss. If you can answer most of their points in an email, then there’s no need for a meeting.

Apps like Connecteam and Toggl both work as employee hour trackers to track employee working hours and the time spent on jobs/projects. Not only does this show you how and where projects stand, but it also ensures you have accurate timesheets in time for payroll (with Connecteam, you can export timesheets directly to QuickBooks Online and Gusto for 100% accurate payroll).

Reduce Business Expenses with Accurate Time Tracking and Timesheets

Consider Location

If you don’t need a physical location for your business, then don’t buy or rent one. Consider working from home or using shared workplaces. This is an excellent tip for business expense reduction.

But if you do need a physical location, make the most of it. Analyze how much physical space you have because chances are you don’t need that much storage space. Merge different parts of your business, like having a good space for dual purposes. A meeting room could be a break room, for example.

Buy Refurbished Equipment

Brand-new retail-price equipment will have the exact opposite effect of cost reduction. Start by buying refurbished furniture and equipment when thinking about reducing business costs.

After all, it’s just as good as brand-new equipment. You don’t need the very best desk or chair on the market. Something from a Goodwill store or garage sale will do the trick.

Cut Down On Production Costs

There are ways to cut down on business costs, such as materials and resources. Try these:

- Sell leftover cardboard, paper, and metal instead of recycling. Look into ways you can use your waste to create another product.

- Get the most out of your real estate. Centralize or merge any space possible and look into leasing unused space.

- Adjust and optimize resources by tracking and measuring the company’s operational efficiency.

Hire a Freelancer When Possible

Consider if you need a full-time web developer, graphic designer, content writer, etc. Maybe you just need a few jobs a month. Offer part-time positions, and be sure to outsource work for specialized tasks.

Choosing the cheapest freelancer isn’t always the wisest option to reduce costs. You might not get quality work in return. A good freelancer may have a high up-front cost. But it’s better to pay someone once for high-quality work than to pay someone over and over to fix it.

Fiverr and Upwork are top sites for finding good quality and priced freelancers to get the job done. You’ll also reduce business expenses in the process.

Travel Less

Taking unnecessary trips will only eat up your time and cause travel expenses to add up. Reduce costs by using online applications that offer quality video service, like Skype or Zoom. You can do video conferences, hold webinars, screen-share, and more.

Remote work has grown more common over the last few years. Managing a remote team can be challenging, and it’s important to learn ways to make it less so.

Save On Electricity

Business expense consultants will advise you to keep a close eye on your electricity bill. So it’s crucial to be strict on company policies. Unplug unused electronics, turn off lights when not in use, and use sunlit rooms to save money. It seems like an obvious way to reduce business costs, but it should be overlooked.

Another tip for cost-cutting is to call your local electric company to have them run an electricity audit. This way, you can better understand how electricity is used at the office or at home.

A few other cost-reduction strategies include:

- Replacing the lightbulbs with energy-saving alternatives

- Checking for air leaks

- Replacing the air filter

- Setting the thermostat so you don’t change it often

- Setting refrigerators to 35–38 degrees.

Shop Locally

When thinking about how to reduce business costs…consider buying from the little guy!

Shopping locally offers more flexibility. Unlike big service providers, a small, local business can optimize its service to fit your needs like a glove. Write a list of all the major companies you work with and look into local listings. This way, you can see if another company costs less.

Buying locally benefits the whole community. For example:

- It creates more jobs

- Money stays in the community

- Locally owned, small businesses will contribute much more to local charities

- The community stays unique and offers one-of-a-kind services

- More consumer choices

- Less environmental impacts

The Bottom Line On How To Reduce Business Costs

No matter how well your business is doing, cutting business costs is always in the back of a business owner’s mind.

The tips provided are bound to help you reduce business costs, both in the short and long term. But the last thing you want to do is let go of staff. This can be a slippery slope to high turnover.

Try a combination of (or even all) these tips, and you’ll start to reduce business costs before you know it.

Get the #1 Tool to Put These Business Cost Reduction Tips Into Motion

Cost saving is much easier if you make some small changes using Connecteam’s employee management app.

Start Your Free Trial