Workers in the United States need far more money in order to retire comfortably, but reports show that they are struggling to save cash. There are many who believe state mandated retirement plans are the answer.

Retirement planning crisis

Studies have consistently shown that employees are far more likely to save when their employer provides access to a retirement plan. Furthermore, research has shown that whether an employer does provide retirement benefits, it is a huge factor when deciding to accept a position. However, reports show that a mere 4 in 10 employers that have less than 100 team members will even offer retirement benefits.

The National Institute of Retirement Security (NIRS) reported that a typical working household virtually had no retirement savings at all. Research also showed a median retirement account balance of $2,500 for all working-age households and $14,500 for those in near-retirement households. In addition, 62% of working households aged 55-64 have retirement savings that are less than one times their annual income, which is far below what’s needed to maintain a healthy living standard while retired.

“At any given moment, about half of the private-sector employees in the United States — some 60 million people — do not have any type of employer-sponsored retirement plan. The result is a growing American underclass, in which a third of current retirees live almost entirely on Social Security and fully half of future retirees will face reduced standards of living.

Worse, the coverage gap has long proved intractable, with Congress and the financial industry unable or unwilling to design or support truly simple and low-cost retirement savings plans.” – writes the New York Times Editorial Board

This gap is a huge economic concern in the United States which is why more and more states are implementing their own retirement plan.

What are state-mandated retirement plans?

A state-mandated retirement plan is a retirement savings program that is sponsored by the state. These plans target private-sector employees in small and midsize businesses and also low-to-moderate income households.

However, don’t confuse this with state retirement systems for public sector employees.

Most of the state-mandated retirement plans are structured as Roth individual retirement accounts (IRAs).

What is a Roth IRA?

There are two main types of IRAs: traditional and roth.

A traditional IRA relates to contributions that are eligible for a tax deduction the year they are made in. For example, if a contribution is made in 2020, then the individual can exclude the amount from their taxable income for 2020. However, the contributions are also taxed upon withdrawal.

A Roth IRA applies to contributions that are made after-tax money, so this means that the individual pays taxes on the amount upfront. Any contributions that are made for the year must also be included in their taxable income for that year. What’s good here is that qualified contributions are tax-free upon withdrawal.

However, if someone has an adjusted gross income that exceeds the IRS’ threshold, they cannot contribute to a Roth IRA.

Which states have mandatory retirement savings?

More than 30 states have considered legislation for state mandated retirement plans, the National Association of Insurance and Financial Advisors has found. Now, the states that have introduced legislation include Arizona, Colorado, Indiana, Kentucky, Louisiana, Maine, Ohio, North Dakota, Nebraska, New Hampshire, Utah, North Carolina, Wisconsin, Virginia, and West Virginia.

However, only 10 states have enacted legislation to establish state mandated retirement plans so far:

- California

- Connecticut

- Illinois

- Maryland

- Massachusetts

- New Jersey

- New York

- Oregon

- Vermont

- Washington

We highlight the requirements for mandatory retirement savings per state:

California

In California, employers with at least 5 employees must offer a retirement savings plan through either the private market or the state’s CalSavers program. CalSavers is a Roth IRA therefore the IRS’ contribution guidelines apply.

As CalSavers is operated solely through administrative fees, there is no cost to taxpayers. Eligible employers can register for CalSavers whenever they want and are required to comply by the following deadlines:

| Size of business | Deadline |

| Over 100 employees | June 30, 2020 |

| Over 50 employees | June 30, 2021 |

| Five or more employees | June 30, 2022 |

For employees to be eligible for CalSavers, they need to meet the following:

- Must be at least 18 years of age

- Must receive a Form W-2 with California wages

- The default savings amount is 5% of gross wages but employees can designate a different amount

- Contributions need to be made via payroll deduction

- Employer contributions are not allowed

- Employees must also be allowed to opt-out of the program.

Connecticut

The Connecticut Retirement Security Program focuses on businesses with five or more employees that have no pension or 401 K plan to allow employees to save up for retirement through payroll deductions into private IRA accounts at no cost to the employers.

It is voluntary for employees, who are automatically enrolled but do have the ability to opt out.

Illinois

In Illinois, employers are required to offer the mandatory retirement savings, known as Illinois Secure Choice, if they meet the following:

- Have at least 25 employees

- Have been in business for at least 2 years

- Don’t offer a qualified retirement savings plan, such as 401(k) or Simple IRA.

In addition,

- Default savings rate is set to 5% of gross wages

- Contributions are made via payroll deduction

- Employers cannot make contributions

- Employers don’t have to choose the state plan but can offer a different, qualified retirement plan

- Employers who choose Secure Choice must automatically enroll their team into the program

- Employees must be allowed to opt-out of the program or can choose to increase or decrease their payroll deduction amount (from the default 5%).

As Illinois Secure Choice is a Roth IRA, employees are required to meet the IRS’ income limits in order to contribute.

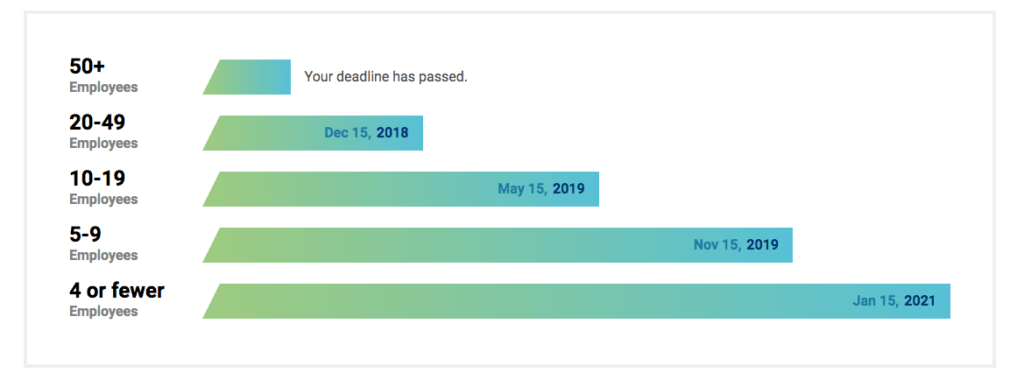

However, the deadlines for existing employers to enroll in Secure Choice has long passed, with the last cutoff in November 2019.

Maryland

The Maryland Small Business Retirement Savings Program provides workers with a payroll-deducted savings program if they aren’t eligible to participate in an existing employer plan.

If an employer joins the program or offers their employees a qualified plan, then the State will completely waive the $300 annual report filing fee.

The Maryland Program offers a selection of privately-managed investment options and also has a default option if an employee doesn’t want to choose. Anyone who is automatically enrolled can choose different contribution rates or can opt out of the program.

The Program will start operations sometime around mid-2020. Although it was created by the State, which will lend startup funds, the Program will be self-financing from fees collected on funds invested in the IRAs.

Massachusetts

Massachusetts has limits to its state mandated retirement plans to nonprofit organizations with 20 or fewer employees. The Massachusetts Defined Contribution CORE Plan does permit nonprofits with 20 or fewer employees to offer retirement benefits through a 401(k) multiple employer plan (MEP).

Additionally, the CORE Plan includes:

- Both pretax and Roth 401(k) options

- Employers can make “safe harbor” matching contributions

- Employee contributions are made through payroll deduction

- It’s voluntary for employers and employees

- The default savings amount is 6% of gross wages, on a pretax basis

- Employees must be permitted to opt out of the plan or can change their contribution amount.

New Jersey

The New Jersey Secure Choice applies to employers with 25 or more employees and who have been in business for at least two years.

Both nonprofit and for-profit employers are subject to the state mandated retirement plan, and employers of any size, even those with fewer than 25 employees, can participate if they want.

The program runs as a payroll deducted IRA program, where employees are automatically enrolled into the program contributing 3% of their salary. Employees can adjust their contribution during the enrollment period, and they can opt in or out during designated open enrollment periods.

New York

The New York State Secure Choice Savings Program includes these key features:

- Voluntary for employers, it doesn’t require employers of any size to participate.

- Roth IRA structure so contributions are made on an after-tax basis and IRA deduction limits apply.

- Employers cannot make contributions to the plan.

- Participating employers are required to auto-enroll employees, although employees may choose to opt out.

- Automatic payroll deduction is 3% of an employee’s paycheck.

- Participating employers are not considered fiduciaries, as their role is limited.

April 2020 is the proposed date of implementation.

Oregon

OregonSaves is a voluntary program but Oregon employers are required to offer OregonSaves if they don’t already offer an employer-sponsored retirement plan.

Vermont

The Vermont State Retirement System (VSRS) is determined by your service credit, your age at retirement, and your average final compensation.

There are five plans/group:

- Group A: original retirement plan that some members elected to remain in, predecessor to Plan F

- Group C: for state law enforcement officers

- Group D: for judges

- Group F: for the majority of classified state employees

- Defined Contribution: for exempt state employees

Washington

The Washington Small Business Retirement Marketplace is a virtual marketplace that offers plans to businesses with less than 100 employees.

Are there penalties?

PAI Retirement Services stated, “If mandated by the state, employers must enroll their workers into the state-run program through the payroll process.”

If an employer fails to abide by state mandates then this can lead to penalties which are imposed at the state level. For example, with CalSavers, the penalty for not allowing eligible employees to participate ranges from $250-$500 per eligible employee.

What’s next for small businesses?

If your business is in one of the states with mandatory retirement plans then you need to review the specifics. Write out the pros and cons of the plan compared to your business objectives and the needs of your employees. It can help to speak with an expert to make the best decision for your business and employees.

Connecteam: one app to manage your business and employees

Connecteam is your tool to manage employee engagement, development, and relationship. You can streamline communication, give your employees a platform to be heard, boost engagement, strengthen the company culture, align employees with company policies, streamline daily operations, build professional skills and so much more.