Running a small business isn’t easy. Here are 14 challenges small businesses face and some practical action items to solve these problems.

Running a small business is rewarding but comes with its fair set of challenges, too.

In fact, the best way to face all business challenges is to anticipate them and be ready!

In this article, I’ll be going over the most common challenges faced by small businesses that we’ve seen our customers face this year, plus action items on how to solve them.

Financial Management

Managing finances is one of the biggest small business challenges. In fact, 1 in 5 small businesses fail within the first year due to poor financial management and lack of capital.

So how can you avoid this pitfall? If your budget allows, you can hire an accountant or bookkeeper, or even a financial expert. However, there are also lots of online courses you can take that can teach you how to keep your books in order.

Action item:

Check out some free (or paid) courses about business finances. The Open University has a fantastic set of free courses that you can work through at your leisure. I also recommend checking out some of the Small Business Administration’s (SBA) free financial management tools.

Future Planning

It’s easy to become caught up in day-to-day activities. Between ensuring good customer service, managing employees, and simply getting the job done, small business owners may let future planning fall by the wayside.

Without a long-term vision, business goals can become murky, leading to decreased employee motivation and potential burnout. And without a clear understanding of your business’s future, you may also find yourself burned out.

Action item:

Regularly check in with your original business plan and update it as needed. Check if your original goals are still relevant, and add any new ones. Then, create a plan on how to reach these goals in a timely, logical, and cost-effective manner.

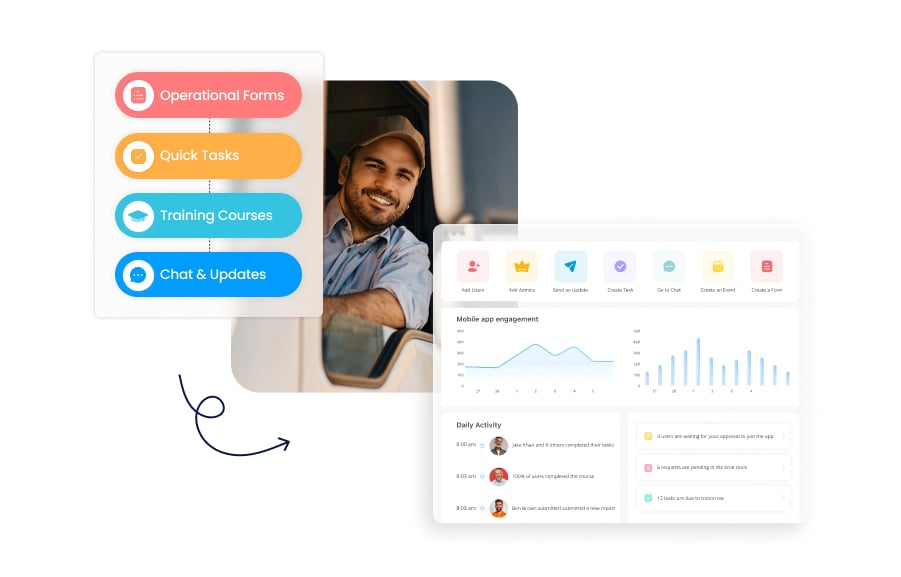

You should also take advantage of an employee management app, like Connecteam, to help streamline your daily activities, automate processes, and manage your team. This will help free up time and mental capacity to focus on future planning.

Economic Shifts and Inflation

Tight budgets and limited resources mean small businesses are particularly vulnerable to economic shifts. In fact, 52% of small businesses say inflation is their largest challenge, regardless of region, number of employees, and industry.

Post-pandemic inflation rates had an immediate effect on energy costs and caused massive supply chain disruptions, and businesses are still feeling the wrath.

John Lin, owner of JB Motor Works, in Philadelphia explains how inflation has affected his autoshop. “Inflation has had a two-fold impact on operations: On one hand, increasing costs of goods and services directly affect areas such as the cost of parts, thereby squeezing our margins. On the other hand, inflation affects customers, which indirectly influences the demand for our services.”

Many business owners have found themselves needing to diversify their products or services, or even offer something new completely. “As for economic shifts,” says Lin, “Their effects can be challenging to predict. With the recent trend of people holding onto their vehicles longer, we noticed an increase in servicing older vehicles. At the same time, advancements in electric cars can possibly reduce the demand for traditional car repair services, indicating that diversification and continual learning within the industry is key to sustaining and growing the business.”

Lin continues, “Delayed shipping times and shortage of parts were common scenarios that we had to navigate carefully to maintain customer satisfaction, sometimes leading us to source parts from different, often more expensive suppliers.”

Action item:

While inflation and other economic shifts can be challenging, small businesses can certainly weather the storm. As Lin optimistically explains, “Every struggle acts as a learning curve, reminding small businesses like mine that adaptability is the key to survival and growth. It’s all about understanding the changes, interpreting their implications, and adjusting the business strategy to continue to provide the best possible service to our customers.”

With that in mind, if you’re in a position where cutting costs becomes imminent, take a look at your current spending habits and see where you can cut costs without raising prices for current loyal customers. This may mean reducing overhead, such as maintaining a smaller inventory, cutting the marketing budget, or reducing employee wellness and incentive programs.

Employee Communication

By 2025, 32.6 million Americans will work remotely, making it more difficult for teams to communicate effectively with each other. Alarmingly, only 7% of workers agree that communication at their business is open, timely, and reliable.

Between not being in the same physical location and using multiple methods of communication, it’s easy for teams to feel misaligned and for information to fall through the cracks.

Action item:

Check out this list of the best employee communications apps to find the right one for your business. By taking advantage of technology, team members can communicate from anywhere, at any time, streamlining employee communication and promoting a sense of belonging.

Staff Retention

According to the US Chamber of Commerce, 15% of small businesses are concerned about employee retention, a statistic that’s up 8% since 2021. With inflation driving up the cost of living, employee salary expectations have also increased. However, many employers are unable to meet this expectation, which may give employees reason to seek work elsewhere.

Action item:

Take a look at employee happiness and satisfaction at your company and see if there’s a need to improve it. One of the most convenient ways to do this is by conducting employee polls and surveys to gauge the level of satisfaction amongst your team.

Employee Training

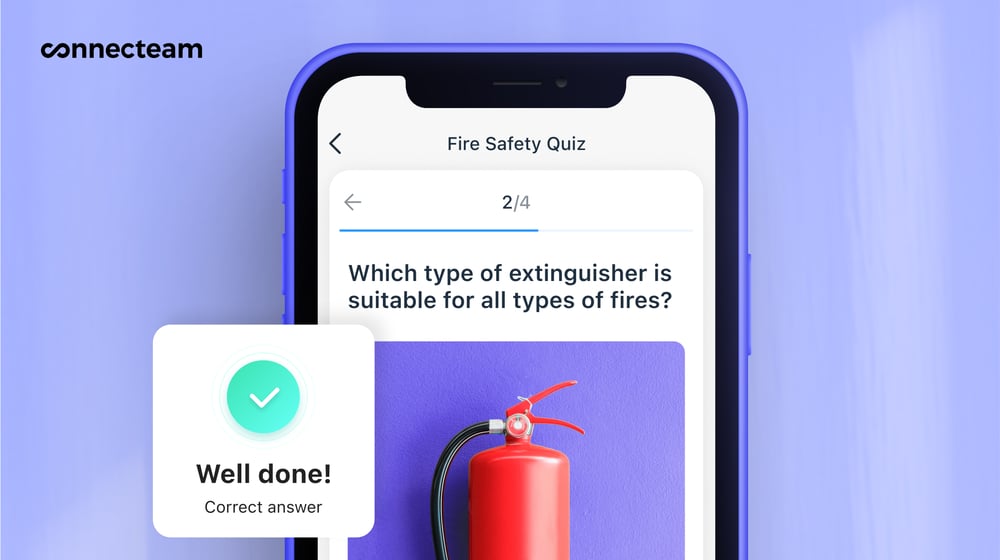

In a 2017 survey, 91% of employees said they’d want a training plan that’s personalized and relevant. However, creating and delivering personalized training can seem overwhelming, especially if you’re managing multiple aspects of your business.

To save time, you may outsource your training needs and rely on external instructors to conduct your team training. However, this can be costly and difficult to coordinate, since it requires new employees to come together in person for an extended period of time.

Action item:

I highly recommend implementing microlearning into your training, a teaching method in which you present short chunks of information in various formats, such as videos and quizzes. Then, use an employee training app, like Connecteam, to easily create training materials and deliver them to your employees right from their phones.

With a training app, you can upload the courses right to the app and update them whenever you need. Once you’ve done this, your training program will run itself. Your employees will be able to learn on the go, from anywhere.

Finding New Customers

Finding new customers isn’t easy, or cheap, for that matter. Outreach and marketing take time and money. For example, you need a point person to stay up-to-date with the latest marketing channels and social media platforms, industry trends, and competition.

Limited budgets may restrict marketing efforts and advertising reach, making it difficult to compete with large companies.

Action item:

Take a look at your current marketing strategy and see if it needs to be tweaked. You may also want to learn more about search engine optimization (SEO) since it’s completely free marketing for your business (If you’re unfamiliar, SEO involves optimizing your business website so it performs better on Google, allowing more potential customers to find your business).

If you want to upskill your marketing game, we also recommend checking out Buffer’s 35 free social media and marketing courses.

Increasing Brand Awareness

Brand awareness determines how well your product or service is recognized and trusted by consumers. It’s a huge factor in consumer purchasing decisions and should be a key part of your marketing strategy. In fact, marketers say that their primary goal of running marketing campaigns today is building brand awareness.

But doing so is particularly difficult for small businesses that have to compete with larger, more well-known companies.

Action item:

Have no fear, there are lots of strategies you can use to build up your brand awareness. Here are two effective ways you can start doing this:

- Start a blog on your business website: Creating informative articles and contributing to industry discussions is a great way to establish your small business as a thought leader. This can also help improve your website’s SEO.

- Take advantage of social media: The best social media platform for your business will vary based on industry, but you can easily narrow by doing a quick Google search. Then, create posts and videos that are aligned with your branding to get the word out about your company. It’s best if you can create a posting scheduling and publish content regularly.

Recruiting Top Talent

Small businesses may not have the same financial resources as larger companies, making it difficult to offer competitive salaries and benefits. Additionally, the lack of a widely recognized brand name can make it harder to attract candidates who are seeking the prestige or security associated with larger companies.

Limited career advancement opportunities within smaller businesses might also be a turnoff to potential employees. If your company doesn’t have a dedicated HR or recruitment team, the process of sourcing, interviewing, and onboarding can also be time-consuming and daunting.

Action item:

Employees want employers who prioritize work-life balance, and 70% of workers enrolled in wellness programs have actually reported higher job satisfaction. So, I highly recommend creating an employee wellness program if you don’t already have one. Be sure to highlight it on any job boards you use, along with other important benefits, to let potential candidates know about it.

Changing Labor Regulations and Policies

Adhering to state and federal labor laws can be overwhelming, and when laws change, adapting can be difficult.

Here’s a good example: California passed the Fast Food Accountability and Standards Recovery Act (AB 257), on January 1, 2023, which imposed standards across the industry for pay, working hours, and other factors associated with fast-food restaurant employees’ health, safety, and welfare. This law was the first bill in the country intended to enact specific workplace regulations and standards for fast-food employees.

All fast food restaurants were affected and had to make the necessary adjustments to their management practices to remain compliant. While the law is a positive step for the fast food industry and its employees, many restaurants struggled to meet its demand.

Action items:

To remain informed on labor laws:

- Sign up for updates on labor law or law enforcement websites to receive notifications and emails when there are changes.

- Use a compliance management app to maintain audit trails and fully manage all policies and procedures.

- You may want to work with a legal firm to ensure you remain compliant with these laws.

- Another option is to partner with another small business in your industry and establish a working relationship for information sharing.

Enhance Your Workplace Success

- 10 Ways to Foster Workplace Compliance: Discover practical strategies to create a compliant and harmonious work environment.

- 30 Best Small Business Apps: Explore tools designed to streamline operations and boost productivity for your team.

Empower your business with these essential resources!

Data Analysis

Analyzing business data related to finances, employees, and customers is crucial for providing actionable insights, driving informed decision-making, and identifying opportunities for growth. Data analytics also provides a competitive advantage – it allows small businesses to better understand business trends and customer insights, which can increase revenue.

However, without the proper resources, small businesses may struggle to accurately assess their numbers. Technology and software solutions can automate the process and make gathering data and analyzing it much easier.

Action item:

Data analysis doesn’t need to be expensive, and you don’t even need to hire an analyst. There are lots of software solutions available to help you.

Here are three of my favorite options:

- InsightSoftware: Allows you to create customized, visual dashboards of all your important data.

- Connecteam: Create automated and customized reports on employee data, like attendance and scheduling, payroll, time tracking, and project completion.

- Google Analytics: Tracks and reports website traffic so businesses can understand their online audience, optimize their web presence, and make data-driven marketing decisions.

Knowing When to Scale Your Business

As your small business grows and starts earning a profit, you’ll likely start to wonder: when is the right time to scale operations? Ding so too soon can result in financial loss, customer dissatisfaction, and can even lead to your business going under.

According to Forbes, a grow-fast grow-big mindset might be strategic for product-based businesses, but can be a killer for service-based companies. “Focusing on growth to the exclusion of all else sets the stage for dropping the ball on client service—not to mention the execution of client strategy.”

Therefore, make sure to fully understand the milestones you need to hit before deciding to expand your business.

Action item:

Take a look at these 4 points to get a better understanding of how to know when your business is ready to scale. To learn more, I also highly recommend reading this article from Entrepreneur.com, “How to Know When It’s the Right Time to Scale Your Business.”

- You have a solid team: Before scaling, having a reliable and skilled team in place is crucial because they’ll be the backbone of your business growth, helping you effectively execute your expansion plans and deliver consistent quality to new customers.

- Business infrastructure is flowing: Achieving a well-structured business infrastructure ensures that your operations are efficient and can handle increased demand, reducing the risk of bottlenecks and operational hiccups when scaling.

- You have a solid understanding of your cash flows: This enables you to make informed financial decisions, secure adequate funding, and manage resources effectively during the growth phase.

- You have more clients than you can handle: Having a surplus of clients before scaling is a positive sign that there is demand for your products or services. It indicates that you have a market to tap into and that scaling can help you capture even more of that market, provided your business is equipped to handle the increased workload.

Employee Motivation

Keeping your employees motivated is difficult, and if you’ve got remote or field workers, it can be even more challenging since many of your staff work independently. They’ve got to be self-driven to get the job done right.

Employee motivation doesn’t just help your staff work faster, but they’re more productive and efficient, too. Their energy can really make or break levels of customer satisfaction and the success of your business.

Action items:

Create customized polls and surveys to gauge employee satisfaction levels. You can get as specific as you want with your inquiries and even use a combination of multiple-choice and open-ended questions to really understand how your staff is feeling.

You may also want to re-evaluate your employee incentive program, or create one if you don’t have one already (we’ve got a great guide to get you started).

Lack of Time

As a small business owner, you’ve probably found yourself doing a bit (or a lot) of everything. Between managing paperwork and payroll, scheduling employees, and dealing with customers and staff, you may become overwhelmed due to lack of time. It can be difficult to manage it all and you may find that certain tasks or projects don’t get done.

Action items:

Prioritize your tasks and label them in terms of urgency. Delegate what you can to other team members, and manage your remaining tasks more effectively by using time management techniques, such as time blocking or batching.

We also recommend taking advantage of technology. Check out our list of the best planner apps and to-do list apps to find one that’s right for you and your business.

Set Your Business Up For Success

No matter what your business model is or your industry, the world of small business ownership comes with many common challenges. Time management, financial planning, and supply chain issues can all contribute to trouble with your business.

Tools like Connecteam are game-changers. They not only simplify our daily grind but also simplify team management and administrative tasks. So, while the challenges are real, so are the solutions. Let’s embrace them and make our entrepreneurial journeys a tad easier.