Still using pen and paper for employee time record keeping? Relying on shift schedules for payroll calculations? Then your company is leaking money and you’re probably open to lawsuits and IRS penalties.

If it’s any consolation, you’re not alone. 33% of employers make payroll errors costing billions of dollars annually, according to the IRS. The American Payroll Association shows an error rate of between 1-8% of total payroll in companies that use traditional timecards, and roughly 40% of small businesses incur an average of $845 a year in IRS penalties as a result of mismanaged payroll processes.

“Errors are going to happen,” Bill Dunn, director of government relations for the American Payroll Association, said to CNBC Make It. “They are not common, but they do happen.”

You already know that payroll mistakes harm your business from a net revenue perspective. However, don’t forget that payroll mistakes hurt your employees even more.

Employees Should Pay Attention To These Payroll Mistakes

Don’t lose any of the money you’ve worked so hard for, instead make sure that you review your pay stub on a regular basis, and pay special attention to:

- Look at the gross or net pay, do you see any changes?

- Were your wages recorded correctly? (If you work hourly, were you paid for all the hours worked? If you are a salaried employee, was your salary recorded correctly for the pay period?)

- What taxes were withheld (federal and state)?

- Are your 401(k) contributions correct?

- Are other employee benefits, like healthcare, life insurance, disability, or commuter, being withheld correctly?

Unleash the Full Potential of Your Business with Connecteam’s All-in-One Management Software –

In addition, you and your manager should read up on time clock rules so you are both abiding by what’s required by law.

If you spot mistakes then you can take this to human resources to quickly correct the mistake and to help future payroll errors from occurring again. It’s all about fixing payroll errors before it gets out of control.

Payroll Made Simple

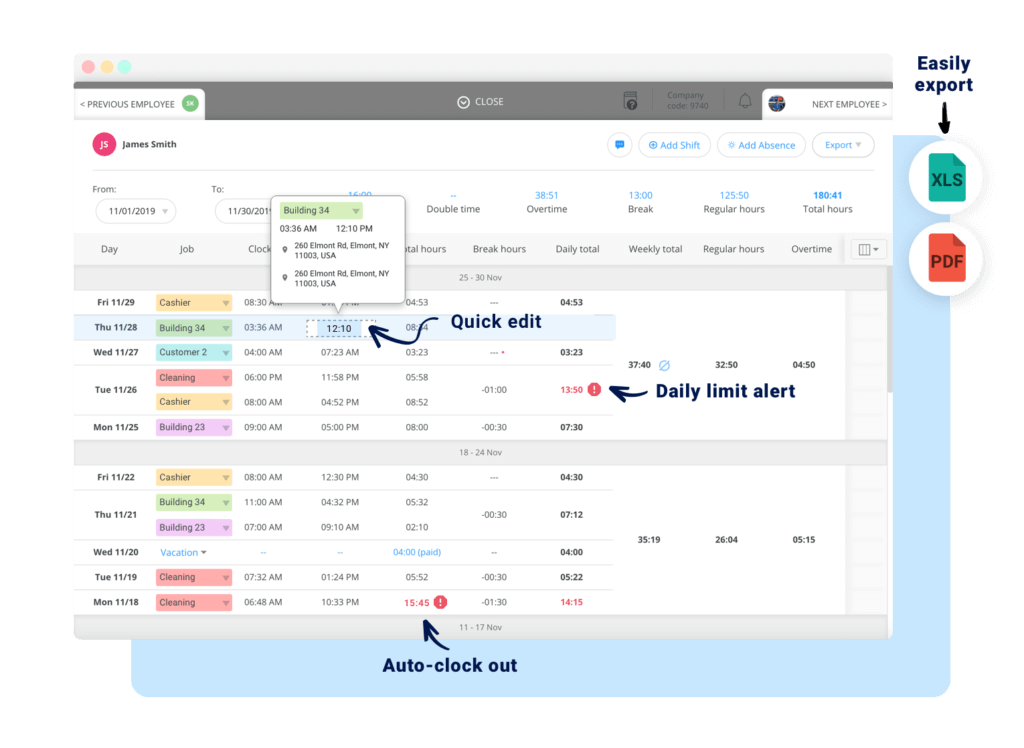

Easily track and manage work hours on jobs and projects, improve your payroll process and the way you manage timesheets, and collaborate with your out-of-office employees like never before.

Payroll Errors Managers Face on a Daily Basis

As a small business owner, you do everything in your power to manage payroll efficiently and without mistakes. Well, maybe not everything. After all, you have a business to run, and there’s only so much time you or your HR team (if there actually is one) can invest in checking and re-checking employee timesheets. if you are interested in more tools, we compiled a list of tested payroll software for small businesses for your convenience.

However, some of the errors hiding in that pile of timesheets are costing you money already and might cost more in the future.

This is why so many companies are investing in Connecteam’s payroll software to curb payroll mistakes and automate time tracking processes.

Easily Fix All of Your Payroll Errors With Connecteam

Here are just a few of the issues plaguing businesses still depending on outdated timekeeping practices:

Payroll Document Mess (or “Who moved my timesheet?”)

One of the main disadvantages of paper over digital media is the challenge of keeping up-to-date backups. Paper timesheets and punch cards are fragile and perishable. It’s a liability! They can be swapped, altered manually with no record of the changes made, destroyed, or simply misplaced.

Just imagine having to deal with a fire or a flood in your business, while at the same time freaking out about having no records of employee hours to calculate payrolls.

Overtime Wages Are Miscalculated

As a small business owner, you have to calculate overtime wages correctly – overtime wages are completely different than regular wages. You will owe wages, penalties, and interest if you don’t pay the correct overtime rate. Fixing payroll errors means taking a close look at the overtime wages.

Learn more here about new overtime rules that went into effect in 2026.

According to the FLSA, you are required to pay employees 1.5 times their regular rate of pay, or time and a half, for time worked past 40 hours in a workweek. For example, if an employee is regularly paid $10 per hour, then you owe them $15 per hour for overtime worked. Note that most states and cities have different overtime wage laws so be sure to study if you are required to follow the more stringent rules.

Absence Kerfuffle (Working on Vacation)

Depending on how you calculate payroll and what sources of data you rely on (time clocks, shift schedules, employee reporting), you might come across overlapping time clock entries and payable time accidentally misclassified.

At best, this sort of mix-up will demand time to figure out. At worst, you might end up paying a lot more than you need to.

For example, consider an employee on vacation suddenly having to work to take care of an urgent matter. Your records might then have an employee on paid leave clocking in work hours. Sorting this whole mess out can be a small headache when you have a team of a dozen. But as your workforce grows, these sort of overlaps can turn into full-blown payroll migraines.

Sleepy Payroll Staff (Making Errors in Data Entry)

If you’re lucky you have a payroll staff or you outsource. If you’re not. you DIY (handling restaurant payroll, for example). In the end, though, you can’t eliminate 100% of the mistakes.

You can only reduce them. It doesn’t really matter if it’s you or someone else making the mistakes – we’re all just human.

We all make typos, and anyone can accidentally enter 20 hours instead of 2. That’s 18 billable hours birthed by a typo.

Buddies of the Buddy Punching System (and Other Time Thieves)

This problem is an oldie but a goodie…well, maybe just an oldie. 19 percent of employees (1 out of 5) have participated in some form of time theft, which can cost companies up to 7 percent of their gross annual payroll.

It’s not just about “buddy punching” – employees “covering” for each other and clocking in for one another to steal time. The average weekly “theft” of time is 4 hours and 5 minutes per employee per pay period. This included long lunches and breaks, tardiness, early departures, etc.

Paying the Wrong Tax Rates

At any given moment, the tax rates are changing so whatever rates you first started using to pay your employees may not be applicable or correct now. Paying the wrong rate means you need to make up any taxes, penalties, and interest.

On a regular basis, check your employment tax rates as most tax rates are updated each year. Keep an eye on the following on how to fix payroll mistakes:

Depending on your location, then keep your eye on any rates for additional taxes.

Classifying Employees Incorrectly

You may employ independent contractors while others are full-time employees. However, when you mix up these workers, it’s a costly mistake. For example, a contractor doesn’t need to be paid minimum wage or overtime wages.

Additionally, you don’t withhold employment taxes from their wages. Therefore, if an employee is classified as a contractor, they can lose out on wages and governments will miss out on tax revenues.

When you misclassify a worker then you are forced to pay the employee and employer’s share of taxes, plus all penalties and interest. In addition, you could even owe back wages to the employee. How can you know if a worker should be classified as an independent contractor or an employee?

The U.S. Department of Labor recommends that you use the six-part economic realities test. And if you still are not sure, then file a Form SS-8 in order to avoid misclassification payroll issues. By filling this form, you request that the IRS determine the worker’s status.

Law & Order (Compliance, State Laws and You)

Don’t you just love IRS audits?! How about employee lawsuits for unfair pay?! You might think that regulations that demand you keep precise records of employee work hours are a bureaucratic drag, but they’re actually there to protect you. As are state laws regulating payroll processes.

Sure, you can still comply with regulations while using traditional solutions, or just your good old pen and paper. But it’s simply easier with an app.

How To Correct Payroll Errors: Going Digital

Switching to digital attendance and payroll management is not as expensive or complicated as you might think, or as it might have been when you last checked.

Cloud-based mobile app solutions, like Connecteam, allow business owners and managers to handle nearly every aspect of payroll.

From tracking your employees’ time easily, making sure they clock in without having to check in on them with a clock in app, or sending out clear employee timesheets for payroll, Connecteam covers all bases, and more.

Let’s break that down even further on how Connecteam helps with payroll errors:

- Different job types should be paid differently: Connecteam ensures that different employees can be visibly qualified for different jobs. As a result, their time worked on each job is calculated in their timesheet.

- Employees need to be reimbursed on their expenses in their payroll: With Connecteam, employees can add their expenses, car mileage or any other relevant information to their timesheet so it would be easy to reimburse.

- Employees don’t have access to their past timesheets to pinpoint mistakes: Connecteam guarantees can do exactly this, directly from their mobile app. They can send edit requests to their manager in real-time and all changes are automatically updated upon approval.

- Difficult to spot employees’ overtime, meaning overtime gets paid by accident: You can use Connecteam to color-code your employees’ overtime, meaning you will never miss it again on their timesheets.

- Managers need to collect timesheets every time they need to send them to payroll: Connecteam’s auto-reports makes it easy to set when timesheets are sent automatically to the person responsible for payroll.

- The need to use multiple softwares to handle payroll: Technically speaking, you can handle all aspects of payroll with Connecteam – as long as you are already using QuickBooks Online and Gusto. If this is the case, then you can seamlessly integrate the two softwares, meaning that you can send your timesheets directly to QBO with the click of a button.

- Managers struggle to keep track of employees’ work hours/location: With Connecteam’s in-built Breadcrumbs technology via GPS tracking, employees can clock in and out on schedule and in between that time, random location points are collected, providing managers with a basic idea of where (and when) each employee worked.

The Bottom Line on Correcting Payroll Mistakes

People don’t change, so technology has to. People will always find a way to error cheat in attendance reporting.

However, by switching to a mobile time clock, you can greatly reduce the frequency of errors, save money, and increase efficiency in your business.

While it may seem like making a digital switch is a tough task to undertake, when you consider the benefits time tracking solutions present to burn payroll mistakes, it is clear that it’s worth the effort.

The #1 Payroll Software Solution for Your Business

Designed for you to save time with quick actions and visual flags pointing out what matters: auto calculated breaks, overtime, double-time, daily limit, auto clock-out, and more!