Employers have many responsibilities. Some responsibilities involve complying with government rules and regulations. Many regulations involve time clock rules for hourly employees.

In the United States the Fair Labor Standards Act (FLSA) imposes rules regarding your employee’s wages, overtime, and hours. In the European Union the European Working Time Directive (EWTD) plays a crucial role in regulating working hours across EU member states, safeguarding the health and well-being of employees.

Breaking time clock rules and laws can lead to your company facing severe penalties and paying expensive fines. It’s safe to assume you want to avoid violating the Fair Labor Standards Act.

There’s an effective and efficient way to follow federal and state laws for time clock rules for hourly employees. That’s by using an employee time clock solution that includes an employe time clock and time-tracking functions.

According to the U.S. Commerce of Labor, Connecteam’s time-tracking app makes it easy to track your employees’ time, save money, and keep your business compliant.

In this article, you’ll learn about the importance of a digital time-tracking solution. But first, let’s dive into the various time clock rules for hourly employees in given situations. Then, we have a complete guide on how to stay compliant with these rules.

Let’s get into it!

Salaried VS Hourly Employee

When considering time clock rules, it’s important to understand the differences between salaried and hourly employees.

A salaried employee receives payment based on an annual sum or salary.

Employers decide pay periods for salaried employees. You can pay salaried employees once every two weeks, once a month, or something similar. Typically, salaried workers don’t complete or sign timesheets.

Instead of paying salaried employees for hours worked, they receive a flat payment every pay period. If a salaried employee works over or under a 40-hour workweek, this worker’s wages stay the same.

An hourly worker is paid for the number of hours they worked.

As the employer, you decide the number of hours worked for hourly employees. These workers, also called non-exempt employees, must receive minimum wage and overtime pay when working over 40 hours per week.

Most companies require hourly employees to record working hours with a timesheet or time card system. Then, an employer reviews their timesheets and pays them accordingly.

In the United States, certain states and cities authorize predictive scheduling laws. These laws require an employer to give hourly workers notices for the hours it needs them to work.

Depending on a company’s location, it might have to send notices a week, two weeks, or even a month ahead.

When working with time clocks, it’s also good to know the differences between:

- Full-time and part-time employees

- Exempt and non-exempt employees

- Meal and rest breaks

- Paid time off and unpaid time off

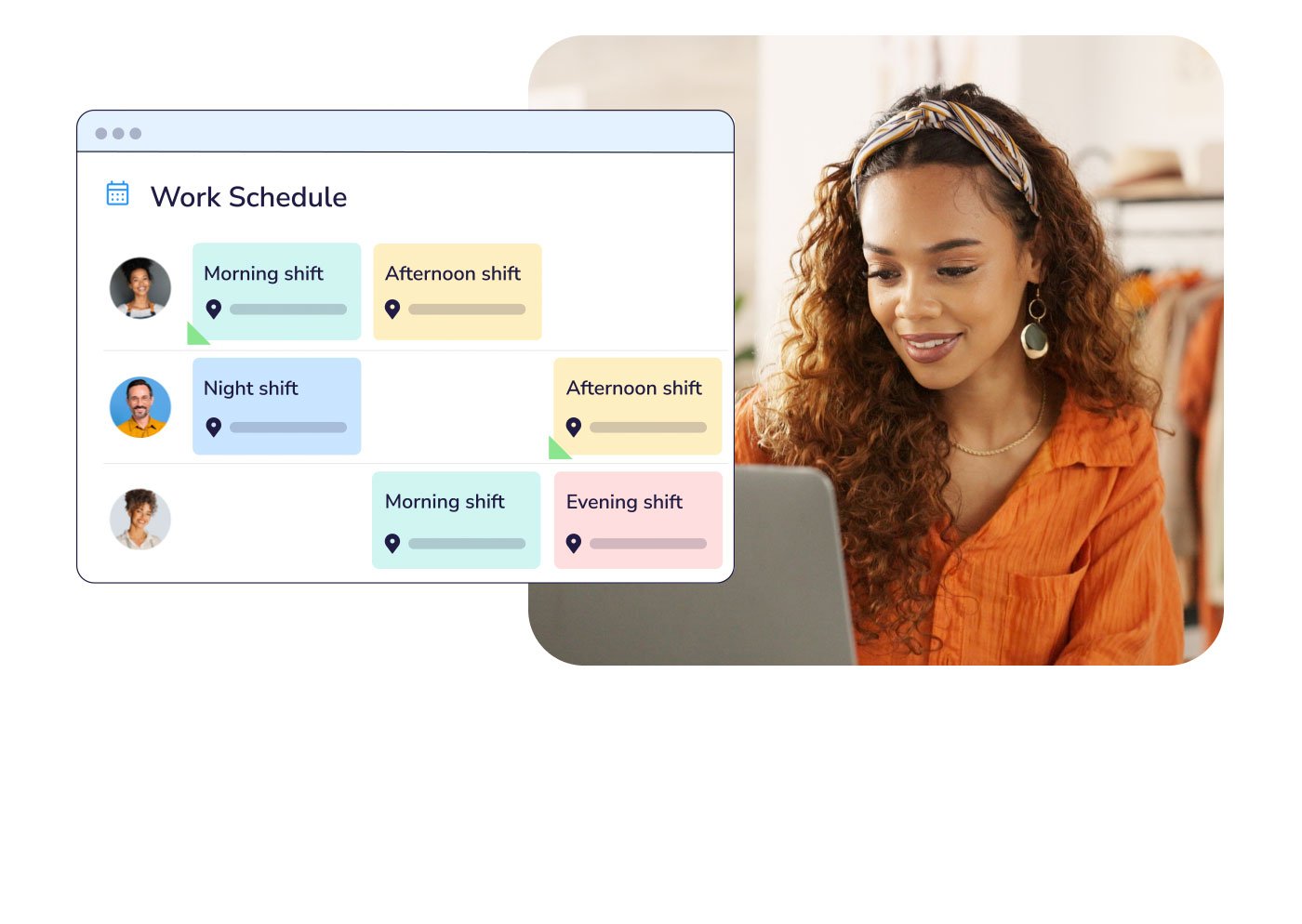

Using the right technology is key to managing your workforce. Solutions like Connecteam give companies an easy way to manage hours and stay compliant. These products can also let you create or update time-clock-related policies.

Being On-Call

Retail, hospitality, construction, and dining industries prefer to deal with shift changes using on-call work. When employees work on-call hours, they are available to clock in and must wait for their manager to contact them if they need to come in.

However, on-call schedules are illegal in some parts of the United States. This ban is due to on-call schedules making it incredibly difficult for employees to maintain a healthy work-life balance.

The U.S Department of Labor’s Hours Worked Advisor provides more information about on-call pay for employees and employers.

Whether hours spent on-call is hours worked is a question of fact to be decided on a case-by-case basis. All on-call time is not hours worked.

FLSA

Pay for on-call work is when an employer pays an employee for the time this person was available to work.

However, not all on-call employees need to receive on-call pay.

When employees wait for on-call work in your company’s workplace or office, your business must pay them. Why? Because federal law considers this a restricted condition.

Since workers were in the workplace, they couldn’t use their time for personal reasons. So, these hours would be payable as hours worked.

Working Off The Clock & Overtime Pay

Under the FLSA, non-exempt employees receive overtime pay when they work over 40 hours per week. Overtime pay must be at least 1.5 an employee’s regular rate. Managers must ensure that employees working more than 40 hours per week get overtime pay.

However, some employers aren’t aware they’re breaking overtime pay laws. Much of this confusion occurs when an hourly employee works off the clock. Working off the clock happens when an employee does a work-related task while not clocked in.

Here are a few examples of when an employee should receive payment:

- Changing or turning in uniforms: Many employers have workers wait at the start or end of shifts to hand in uniforms or work gear. Companies must pay workers for the time they spend waiting on-site.

- Helping customers: When an employee helps a customer after their shift ends, this worker must receive payment for the time they spent with that customer.

- Preparing for upcoming shifts: Employers must pay employees for work completed to open a business. For example, your company would need to pay an employee for stopping at the bank to pick up cash for registers before they open your business.

Doing tasks after a business closes: An employer must also pay employees for tasks they completed while clocked out. For instance, a company might require employees to clean up a store before their shifts are over.

- Learn how to create a time tracking policy the works.

Time Clock Rules For Hourly Employees

You learned how to help hourly employees track their hours. Now, you’ll learn how to outline common time clock rules for hourly employees.

Time Tracking System

The FLSA doesn’t force you to use one kind of time tracking system. Therefore, you’re free to choose your own time clock system. Before selecting a system for tracking hours, ensure it keeps accurate records of actual working hours and breaks.

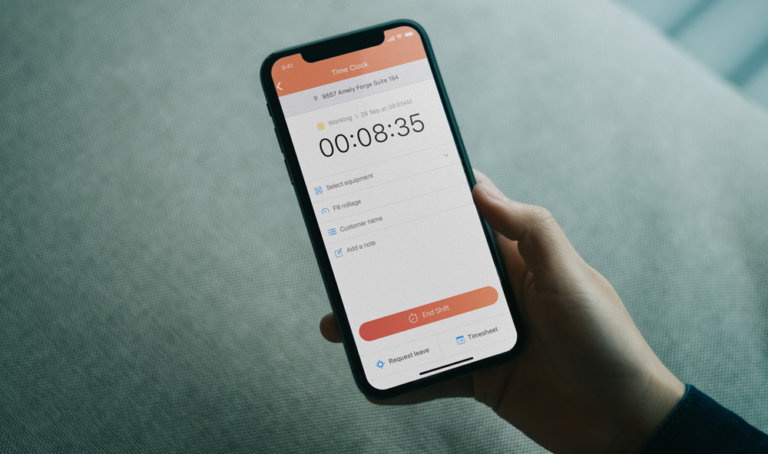

Companies use solutions like Connecteam’s employee time clock app to track time and ensure timesheets are accurate.

All-in-one time-tracking solutions make tracking and managing work hours easy — whether employees work on jobs or projects. These solutions can also help you improve payroll, manage timesheets, and easily collaborate with deskless employees in real-time and on the go.

Time-tracking systems like Connecteam:

- Let employees clock in and out with a GPS timestamp.

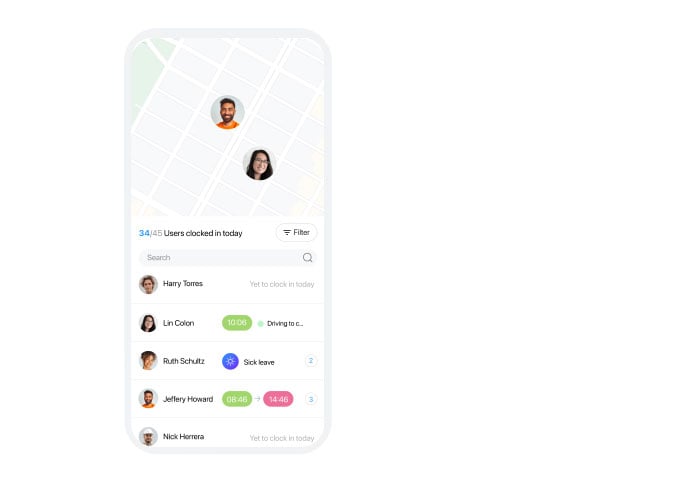

- Track employees throughout the day with live Breadcrumbs geo-tracking.

- Provide a real-time overview of where clocked-in employees are.

- Help workers request time off with ease.

- Display current and past timesheets.

- Easily export timesheets to Quickbooks Online or Gusto for 100% accurate payroll.

- Take notes while you’re on the go.

- Remind your employees with automatic notifications

- Set limitations and have direct control to prevent time theft.

#1 Time Clock App

Connecteam’s digital time-tracker is the time-saving solution you need. Keep your business perfectly legal and compliant with time-clock rules.

Still not convinced a digital solution is for you? Check out our complete guide on why switching to a digital time-tracking solution is the best choice for your business and your employees.

Rounding Time

FLSA guidelines allow companies to round employees’ hours to the nearest specified increment. Companies can choose to round the time up or down.

For example, let’s say your business rounds up to the nearest quarter hour. If an employee finished work at 5:11 pm, and you round up in 15-minute increments (quarter hours), you’d pay the worker up to 5:15 pm.

It’s important to pay close attention when tracking time, especially if your company rounds down hours. Most companies prefer to round up hours because rounding down too much time can lead to businesses breaking wage and labor laws.

Remember, your company must also pay overtime when rounding causes an hourly worker to receive overtime pay.

Keeping Records

Wage and labor laws require employers to keep accurate records of all employee wages. Under these laws, the U.S. Department of Labor can randomly inspect companies’ wage-related records.

Using outdated systems to track employee hours can lead to major problems. A few of these problems can include unpaid wages and violating federal or state labor laws.

Fortunately, solutions like Connecteam offer unlimited cloud storage of working-hour records. Cloud storage ensures that your company’s records are easily accessible from anywhere with an internet connection.

A time-tracking solution is also helpful for keeping time clocks confusion-free. Keeping time clock records on paper can lead to inaccuracies. The same holds true when you use outdated time-tracking systems for hourly employees.

Solutions like Connecteam store hourly employees’ hours and time-off balances in one program. This kind of feature prevents time-clock-related disputes. Updating how your company tracks time for hourly employees also helps it avoid compliance-related issues.

Clocking In And Out

As an employer, you decide whether hourly workers can clock in early or clock out late. However, most companies let employees have extra minutes (not hours) to clock in late or early. Some employees, especially ones at companies using outdated time-tracking systems, can easily game the system to get more time on their paychecks.

A time-clock app lets users add limits for clocking in early and clocking out late. Certain solutions offer geo-tracking to let you see where and when employees clock in and out.

Confirming Hours

Hourly workers deserve the opportunity to confirm that their clock-in and clock-out times are correct at the end of their pay periods. Fortunately, a time-clock app makes confirming hours incredibly simple for everyone.

A time-clock solution can send notifications when hourly employees submit their hours or request time off. It’s much easier to see a phone notification than to wade through a cluttered inbox or group chat. Look for a solution that lets you respond to these notifications in-app. Being able to use as few apps as possible always makes life easier.

Certain time-tracking apps can also integrate with popular payroll software. If the time-clock solution can integrate with your company’s payment systems, take advantage! Integrations that take a few minutes to set up can save you or your HR department a lot of time in the long run.

Setting Policies

Business owners must inform their employees about attendance policies and time clock laws. Most companies include this information in their employee handbooks.

When it comes to setting time-related policies, clarify the consequences of:

- Tampering, or attempting to tamper, with the clocking in and out system

- Time theft

- Buddy punching (clocking in or out for colleagues)

- Absenteeism

Wrapping Up Time Clock Rules For Hourly Employees

Companies must follow time clock rules for hourly employees. Following these rules protects a company from payroll and time-tracking errors. Make life easy for hourly employees by ditching outdated ways of tracking time and using a digital time-clock app.

Having an accurate digital time clock:

- Prevents potential legal disputes

- Stops incorrect hour and wage calculations

- Puts an end to time-consuming manual time tracking

- Saves money on incorrect employee payments

We can’t stress enough how critical time tracking is to the success of your business. Ensure that you’re on track and compliant with time clock rules for hourly employees by making the smart and easy choice – go digital!

Start Accurately Tracking Time Today

You won’t believe how easy employee time tracking can get.