In order to pay your employees correctly, you need to accurately track their time and understand how to calculate payroll hours. We explain the best way to calculate payroll hours and highlight 3 top time tracking apps to help.

Calculating payroll for your hourly employees starts with keeping track of how many hours they work. You can track hours manually, but handwritten timesheets and manual time clocks are prone to human errors that can be costly.

Thankfully, there are now many digital time clock platforms that can help you track time and calculate hours for payroll accurately. In this guide, we explain how to calculate payroll hours and highlight 3 of the best time tracking apps your business can use today.

Key Takeaways

- In order to calculate payroll hours, you must accurately track the hours your employees spend working. The best way to do this is by using digital time clock software.

- You can calculate payroll hours manually by subtracting an employee’s clock-in time from their clock-out time, then subtracting any breaks.

- You can also calculate payroll using a time card calculator. Alternatively, most time clock apps will generate a timesheet for you automatically.

- The best time clock apps to use today are Connecteam, Timely, and Harvest.

Different Methods for Tracking Hours Worked

In order to calculate how many hours an employee worked, you first need to keep track of their hours throughout the week. There are several different approaches you can take.

Handwritten timecards

Handwritten timecards are the simplest way to keep track of time, but also the most error-prone. With handwritten timecards, it’s up to employees or managers to simply write down the hours they work each day on a piece of paper.

This method is problematic because it’s easy for employees to forget to write down their hours. If they do forget, it’s difficult to go back and fill in clock-in and clock-out times from memory.

Even if your employees record their hours with 100% accuracy, handwritten timecards still pose issues. You’ll need to count up each employees’ hours by hand, which can result in errors when calculating hours for payroll.

You’ll also need to store these physical timecards for a minimum of 3 years to comply with federal tax regulations. That takes up space in your office that could be put to better use.

- For a deeper dive into yearly work hour calculations, check out our article on How Many Work Hours Are in a Year.

Manual time clocks

Manual time clocks use punch cards, swipe cards, or biometric readings (such as fingerprint scans) to clock employees in and out of work. These time clocks are typically located in a central area where employees have to pass by them, making it harder for employees to forget to track their hours.

Advantages

One advantage to manual time clocks is that employees have to be physically present at the time clock in order to clock in or out. This can help reduce time theft, which occurs when an employee clocks extra time before they arrive at work or after they leave.

Disadvantages

A major drawback to manual time clocks is that they don’t work well for employees who spend most of their time in the field. If an employee doesn’t come into the office or a central workplace, they may not have a way to clock in or out.

Another disadvantage to manual time clocks is that they typically produce paper timecards. Like handwritten timecards, these require you to add up employees’ hours manually and must be stored in your office.

Did You Know?

Some digital time clock apps also let you set up a centralized time clock. Even though the time clock is digital, employees still have to be physically present at it to punch in using a shared device, such as a tablet.

Spreadsheets

A spreadsheet offers a basic digital alternative to physical timecards. You can create spreadsheets using platforms like Microsoft Excel or Google Sheets.

Advantages

Going digital has numerous advantages. First, it’s easy to access digital timecards from your computer or mobile device. There’s no risk of a digital timecard being lost in the shuffle of paperwork.

You and your workers can also share access to a digital timecard, enabling your team to leave notes or comments for one another.

Additionally, spreadsheets also enable employees to track information other than just their clock-in and clock-out times. For example, they could provide notes on what task they were working on. This can be very useful for understanding how productive your employees are and how long it takes to complete a particular project.

Another benefit to digital time tracking is that you can add up hours automatically. Most spreadsheet software offers a sum function that helps eliminate errors when calculating payroll hours.

Finally, digital timesheets are easy to store. They can live on a hard drive or in your company’s cloud storage instead of taking up valuable space in your office. This is also beneficial for compliance with record-keeping requirements since there’s less chance of digital timesheets being lost compared to physical timesheets.

Pro Tip

Storing your digital timesheets in the cloud can be much safer than storing them on a hard drive in your office. Physical hard drives can break or get lost, while data stored in the cloud is typically backed up across multiple data centers.

Disadvantages

While spreadsheets offer major advantages over manual time clocks and handwritten notes, they still have drawbacks.

First, it’s easy to misenter time information in a spreadsheet, which can lead to errors in payroll.

Employees also need to remember to enter their hours manually, just like with handwritten timecards.

There’s also no built-in way to verify the hours that an employee enters into a time tracking spreadsheet. This can increase incidences of time theft at your business, costing you money.

Digital time clock software

Digital time clock software is the best solution for tracking employees’ time and calculating hours for payroll.

Advantages

This software offers all of the advantages of digital time tracking, plus addresses some of the key shortcomings of spreadsheets.

Time tracking apps can automatically start and stop time tracking based on what an employee is doing. For example, a time tracking app can start tracking time when an employee opens their email. Some options, like Connecteam, also will send employees reminders to start their time clock when they arrive at a job site.

This Might Interest You

We put together a list of the best employee time tracking apps of 2025.

We compiled a list of the best payroll software for SMBs for 2025.

Another advantage to digital time clock software is that it typically includes features to prevent time theft. Employees can be required to take a selfie, for example, which prevents someone else from clocking in on their behalf.

You can also deploy time clock software on a central kiosk, which employees must be physically present at in order to clock in or out. This replicates one of the key advantages of manual time clocks.

In addition, many time clock apps calculate payroll hours automatically, eliminating the need for you to add up employees’ hours at all.

They can also integrate directly with your payroll software. So, you can run payroll in a few clicks instead of spending a whole day tallying hours and double-checking your math.

How to Calculate Payroll Hours

Once you have an employee’s timecard, you can calculate their total hours worked for payroll. How you go about this depends on whether you’re tracking time manually or using time tracking software.

Method 1: Calculate hours worked manually

If you’re tracking time with physical timecards or a spreadsheet, you’ll need to manually calculate hours worked.

Start by converting all hours from an am/pm format to a 24-hour format. For example, 3 pm becomes 15:00. This makes it much simpler to subtract an employee’s start time from their end time.

Next, convert minutes into decimal format. You can do this by dividing the minutes of each time entry by 60. For example, 14:15 would become 14.25 (15/60 equals 0.25).

Now you can subtract the employee’s start time from their end time. If an employee started work at 9:05 am and ended at 5:15 pm, that becomes 17.25 – 9.08 = 8.17 hours worked.

Finally, remember to subtract any breaks the employee took during the day. If they took a 45-minute lunch break, for example, you would calculate 8.17 – 0.75 = 7.42 hours worked.

Method 2: Calculate time worked with a payroll calculator

Instead of calculating hours by hand, you can use a free payroll calculator.

This time card calculator lets you input an employee’s start and end time each day and automatically calculates their daily hours. You can calculate hours for 1 or 2 weeks at a time.

If you enter an employee’s pay rate and overtime threshold, the calculator will also determine their pay for the pay period. You can print the timesheet or download it and transfer it into your payroll software.

Method 3: Calculate hours worked automatically

If you track time using a time clock app, your software will calculate hours worked automatically. It handles all of the calculations above behind the scenes and displays the hours worked each day.

Helpfully, many time clock apps also highlight inconsistencies in an employee’s timecard. For example, if an employee didn’t enter any hours during one day, the software may flag that for you to review. This gives you an opportunity to ask the employee if they forgot to activate their time clock or spot other problems before you run payroll.

Using hours worked to calculate gross wage

Once you know the total number of hours an employee worked in a week, you can calculate their gross wage.

If an employee worked 40 hours or fewer, simply multiply their weekly hours by their base wage rate to determine their gross wage.

If an employee worked more than 40 hours per week, you must pay them overtime. Here’s how to do it:

- Multiply the employee’s base wage rate by 40 and then write this number down.

- Multiply the number of overtime hours an employee worked by their base wage rate, then by 1.5 to calculate their overtime pay.

- Add the first number and overtime pay together to determine the employee’s gross pay.

As an example, let’s say an employee worked 46 hours at a base wage rate of $10 per hour. You would calculate: (40 x $10) + (6 x $10 x 1.5) = $490.

Did You Know?

Connecteam will send you real-time alerts when an employee is about to go into overtime. These alerts give you a chance to reassign work so that you can minimize the amount of overtime you have to pay.

Get started with Connecteam for free today!

Best Software for Tracking Employee Hours

Digital time clock software is the best solution for tracking employees’ hours and calculating hours for payroll.

Let’s take a closer look at 3 of the top time clock platforms your business can use today.

Connecteam

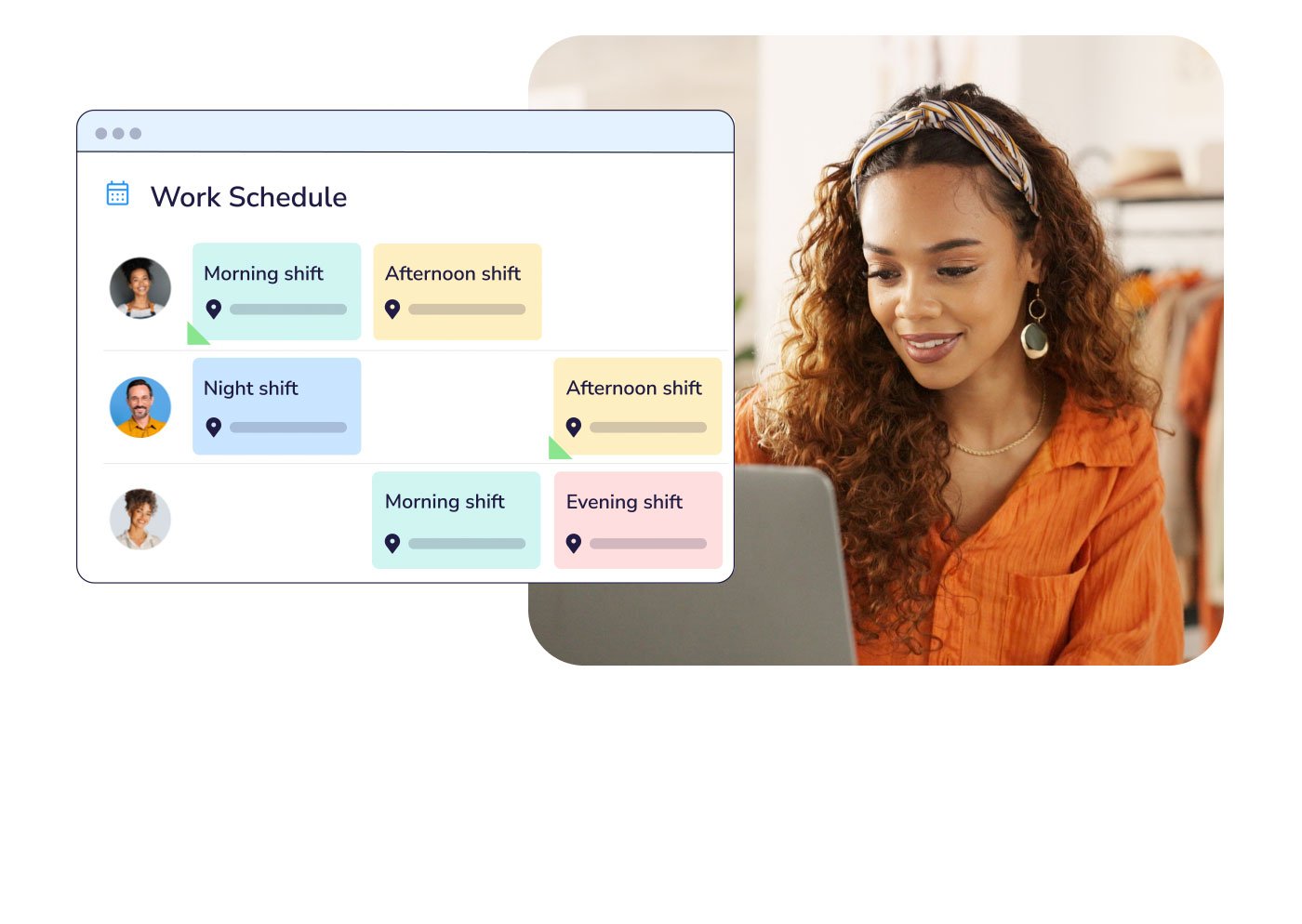

Connecteam is an all-in-one work management solution with a built-in digital time clock and tons of features to help you track hours, run payroll, and streamline your business.

The time clock is automatic and accurate down to the second. But if employees forget to clock in or out, they can manually add time entries too.

Our platform is available on the web and for mobile devices, so employees can easily track their hours in the office or on the go.

Connecteam also offers a centralized time kiosk. You can set up Connecteam on a shared tablet or smartphone and require employees to clock in and out on this central device.

To reduce time theft, you can also require employees to take a selfie when they clock in.

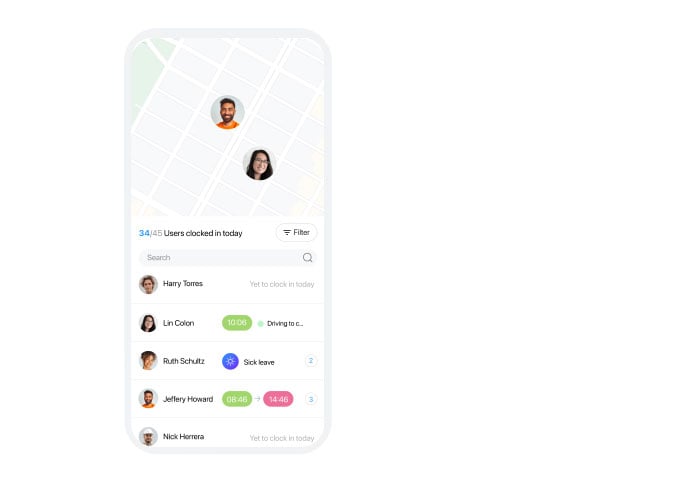

Additionally, you can set up geofences around your office or job site. (There’s no limit on the number of geofences you can create.) Connecteam uses GPS location tracking to ensure employees can only clock in from inside the geofenced area. Employees will receive a reminder to clock in when they arrive at a job site.

The GPS location tracking feature is also useful for verifying employees’ on-the-clock locations.

In addition, if employees are about to go into overtime, you’ll receive an alert. This can help you cut down on unnecessary overtime and save money on payroll.

Speaking of, Connecteam makes it easy to calculate hours for payroll. Our software automatically calculates break time, absences, overtime, and paid time off and generates automated digital timesheets in seconds. It also flags erroneous time entries and enables managers to approve or reject timesheets from any device.

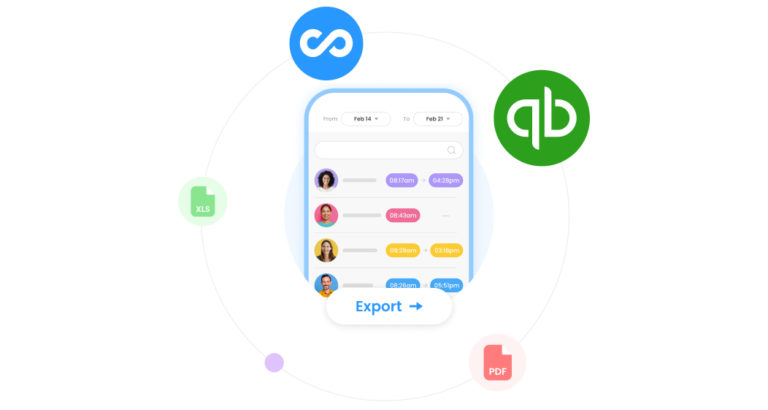

Once you’re ready to run payroll, you can export your timesheets in a few clicks. Connecteam offers direct integrations with QuickBooks Online and Gusto for even faster payroll.

All of the time data that Connecteam collects is available to view through automated reports and a centralized dashboard. It even keeps track of employee time-off balances, making it easier to manage your employees’ PTO requests.

Connecteam is completely free for businesses with up to 10 employees. For larger businesses, pricing starts at just $29 per month for up to 30 employees.

Try out Connecteam free for 14 days to see how it can help you track hours and run payroll with ease.

Timely

Timely is an AI-powered time tracking software that automatically captures how much time employees spend in different productivity apps. It learns what work is associated with what project, becoming more accurate the more employees use the platform.

Employees can mark the time entries that Timely creates as billable or non-billable hours. This is useful for creating client invoices since managers can pull up a report of all billable hours spent on a project. Managers can also use this data to monitor productivity and see which projects might benefit from more manpower.

Timely can create timesheets automatically, but it doesn’t have a built-in approval system. Employees need to manually send their timesheets to managers, and any questions about time entries need to be resolved outside of Timely.

Timely starts at $9 per user, per month.

Harvest

Harvest is a time tracking software designed for freelancers and small teams. It enables users to track time on the web, or desktop or mobile devices. Users can also create custom reminders to ensure that they never forget to start and stop the time tracker.

Harvest lets users organize time entries into projects and tag hours as billable or non-billable. The software can create client invoices automatically and integrates with PayPal and Stripe to enable clients to pay online. Harvest also integrates with QuickBooks Online and Xero.

Notably, Harvest doesn’t generate timesheets for employees. It supports customizable reports that include employees’ total hours, but managers will need to manually enter these hours into their payroll software.

Harvest is free for an individual user with up to 2 projects. Harvest for teams starts at $10.80 per user, per month.

Conclusion

Accurately tracking the time that employees spend working is key to calculating payroll hours. While you can track time and add up employees’ hours manually, digital time clock software is a superior approach that saves time and eliminates costly errors.

The best digital time clock app today is Connecteam. It offers a mobile time clock, a central time kiosk, alerts for field employees, a centralized reporting dashboard for managers, and so much more. It’s a do-it-all solution for all your work management needs.

Get started with Connecteam for free today!

FAQs

How do you calculate hours worked in Excel?

If you have an employee’s clock-in time and clock-out time in Excel, you can simply subtract the clock-in time from the clock-out time. For the calculation to be accurate, the time entries must be formatted as time data in Excel, not as text or numbers.

What is the best way to calculate payroll hours?

The best way to calculate payroll hours is to use digital time tracking app, also known as time clock apps. These tools help you accurately track employees’ hours and can generate timesheets for payroll automatically.