Fair and timely pay motivates cleaners to do a good job. Learn how much to pay your workers and which payroll app is best for your company.

Cleaning employees who aren’t paid well often work less, make more mistakes, and eventually leave for better-paying jobs. But some cleaning business owners don’t know how much to pay their workers, while others consistently make incorrect or late payments.

Below, I explain what to pay your employees and discuss the best cleaning company payroll solutions for quick and accurate payments.

Key Takeaways

- You can pay your cleaning employees hourly wages, fixed salaries, or through per-job or commission-based payment structures.

- The average hourly pay for cleaning employees in the US is $15. Aim to pay this or more (while considering other factors).

- To determine how much to pay your cleaning employees, consider local pay rates, labor laws, your cleaner’s skills and experience, labor laws, and your budget.

- Top payroll software for cleaning companies includes Gusto, Paychex, Xero and QuickBooks Online. You can integrate your payroll with Connecteam and others for advanced time tracking and more.

How Should I Pay My Cleaning Employees?

Below are 3 ways to pay your employees.

Hourly

Paying by the hour is the most popular way to compensate cleaners. It works well for small- to medium-sized cleaning companies that take on different projects and have varied needs.

How it works

You set an hourly pay rate for your employees and pay them based on their work hours.

For example, if a cleaner’s hourly wage is $17, and they’ve worked 100 hours this month, you can calculate their pay like this:

Total pay = Hourly rate x Number of hours worked in the month

In the above example, it’ll be $17×100 = $1,700 for the month.

You can use the same formula to calculate pay for a day, week, etc.

Best practices

Use mobile time-tracking apps

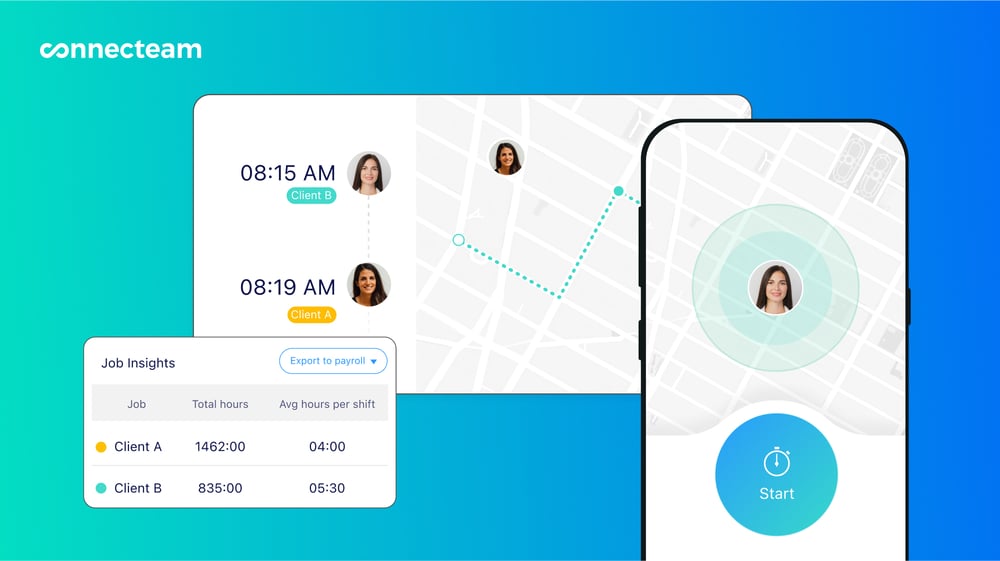

These apps let workers clock in and out of cleaning jobs easily from their phones. GPS tracking also lets you verify workers’ real-time locations so you know everyone is where they should be.

Did You Know?

Connecteam’s employee time clock offers GPS-enabled mobile time tracking and sends workers reminders to punch in and out when their shifts start and end. It also has geofencing, which prevents workers from tracking their hours outside their job sites.

Get started with Connecteam for free today!

Switch to digital timesheets

Look for apps that use time logs to create online timesheets for each employee, capturing their work hours, breaks, overtime hours, and more. You can use these to run payroll, saving the hassle of creating manual payroll reports and ensuring you pay workers accurately.

Did You Know?

Connecteam is a timesheet app that lets you review, edit, and approve automated timesheets before integrating them with popular payroll providers.

Get started with Connecteam for free today!

Track productivity

Regularly review time reports to see how workers spend their hours and where there’s room for improvement. For example, you might find that one cleaner consistently takes double the time to do the same jobs as others. They could be committing time theft or might need additional support to improve their speed.

Pro Tip

Pick time-tracking apps with built-in reporting features. Connecteam, for instance, lets you create custom time reports by employee, location, team, and more.

Fixed salary

You can also pay your employees fixed salaries. This pay structure is well-suited for larger cleaning businesses that cater to clients with regular and predictable cleaning needs.

How it works

You pay workers a fixed salary and expect them to work a specific number of hours. For example, you might set an annual salary of $35,000 for 30 work hours per week.

Best practices

Establish clear expectations

Clearly define daily duties, performance expectations, and other goals to motivate your salaried employees. Additionally, track their progress on tasks and monitor customer feedback to ensure no one is slacking.

Set competitive salaries

Employees who you pay well (i.e., at or above market rates) are more likely to be satisfied in their jobs and ensure quality in their work.

Monitor workloads

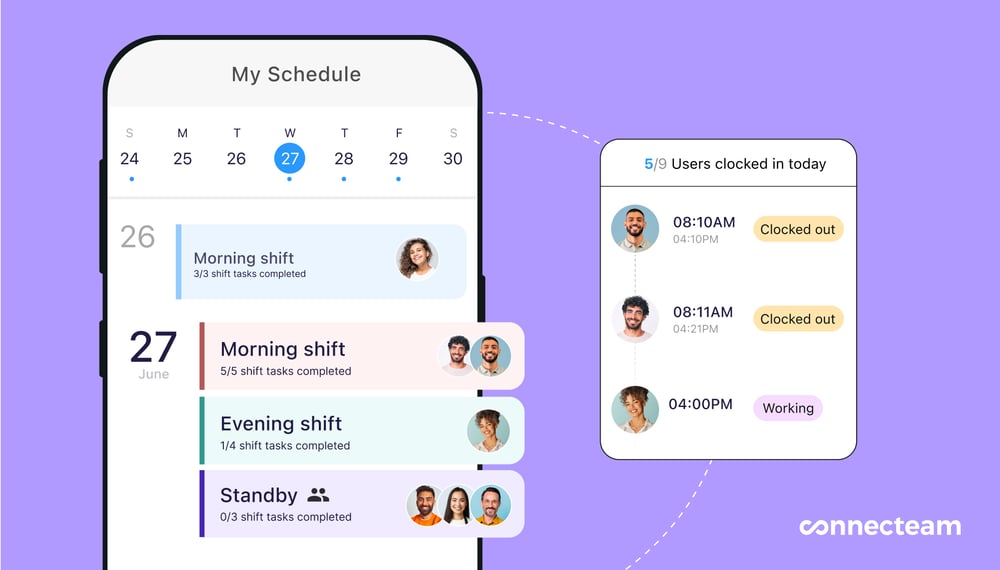

When you don’t track hours, you might overlook overworked employees. Monitor your team’s workloads regularly and check in with them to ensure they have the support they need.

Did You Know?

You can set Connecteam’s job scheduler software to automatically assign workers an equal number of shifts. You can also view weekly schedules from your mobile app and manually adjust workloads if needed.

Get started with Connecteam for free today!

Per job or task

You can also pay your workers a fixed amount for each job or task completed, regardless of client fees or the time it takes.

This model is good for companies that hire contractors or ad-hoc workers for specialized cleaning services with clearly defined outcomes and a predictable scope of work. It also helps you give clients a transparent quote upfront, which helps build trust with them.

How it works

You offer employees a pre-defined fee for completing a specific task or project. For example, you might pay workers $50 for residential carpet cleaning or $75 for commercial window washing.

Best practices

Ensure fair pay and quality of work

Ensure your employees’ pay reflects the time and effort required to complete the job. Finally, conduct quality checks to catch any mistakes workers could have made in a rush to finish tasks.

Did You Know?

You can use Connecteam’s digital forms to create a quality control checklist that workers can use to verify they’ve done everything properly before leaving their job sites.

Get started with Connecteam for free today!

Commissions

A commission-based model pays cleaners a portion of the customer’s fee. This works well for cleaning companies that want workers to upsell services. For instance, if your worker persuades a client to opt for an add-on cleaning service or better products, you and your worker benefit from additional income.

How it works

For every cleaning job an employee completes, you offer them a percentage of the income you make from the customer. For example, say you’ve agreed to a 20% commission for each cleaner. If you bill a customer $500 for a cleaning job, your cleaner will make 20% of $500, which is $100.

Best practices

Ensure fair, transparent pay and quality of work

Clearly communicate how you calculate commissions and pay employees to avoid confusion or disputes. Also, ensure the commission structure fairly compensates workers for their time and contributions. Finally, review customer feedback regularly to ensure that your workers aren’t rushing jobs or compromising the quality of cleaning services provided.

Did You Know?

You can customize Connecteam’s digital forms to create customer feedback forms. Customers can leave feedback and even add e-signatures to verify they’ve completed it themselves.

Benefits

While employee benefits aren’t a pay structure, you can use them alongside hourly or fixed salary payments.

Consider offering health insurance, retirement benefits, and PTO (paid time off) to boost employee engagement. Businesses with lower budgets can offer flexible scheduling, training and development, and other non-money benefits to help workers feel valued and appreciated.

Pro Tip

Some cleaning companies use hybrid pay structures. For example, they might give cleaners a flat fee for each project plus a percentage of the client’s fee.

The Best Payroll Software for Cleaning Companies

Paying employees accurately and on time is essential, and payroll software can help you do this. Here are the best solutions for {year}.

Gusto

Good for startups and small businesses

Gusto is a cloud-based payroll, benefits, and one of the most popular among many other HR management software solutions.

Why I chose Gusto: Gusto provides all the essential tools for payroll processing. I like that the app is user-friendly, making it ideal for everyone—from business owners to office managers and cleaners.

Here are some of Gusto’s key payroll features.

Payroll processing

Gusto lets you pay all your cleaning employees, regardless of their classification. You can set fixed salaries, hourly wages, bonus payments, and commissions and create payment schedules with your preferred pay frequencies.

Gusto automatically calculates and processes pay, ensuring employees receive pay on time. It also supports contractor payments, so you can pay your employees and 1099 contractors from a single platform. Additionally, you can pay international contractors from Gusto if you run a global business.

Multiple methods of payment

Your employees can receive their pay through direct deposit, check payments, or pay cards if required. However, I wish the platform supported credit card payments, which could be useful for ad-hoc contractors.

Tax calculation and filing

Gusto automatically calculates, pays, and files local, state, and federal payroll taxes on your behalf. This saves you the hassle of doing this manually and reduces the risk of errors and non-compliance.

Employee self-service

Gusto offers an employee portal where team members can access their pay stubs, tax forms, and personal information. They can also use this portal to submit expenses. Once you approve these, they’re paid automatically. I also find it useful that workers can update their bank details, ensuring you always send pay to the correct account.

Reporting, benefits administration, and more

Gusto lets you create and download custom payroll reports. You can view data by employee, department, location, and even classification. Gusto also offers benefits administration, including healthcare, dental, life insurance, and retirement plans.

While Gusto has plenty of great features, it lacks operations and communication tools that could make it an all-in-one workforce management app.

Pro Tip

Integrate Gusto with time tracking and scheduling software like Connecteam. Timesheets are used automatically for payroll processing, making payments easy and accurate.

Key Features

- Payroll processing

- Contractor payments

- Tax calculation and reporting

- Employee self-service

Pros

- Supports multiple modes of payment

- Lets you pay international contractors

Cons

- Doesn’t support credit card payments

- Lacks operations and communications tools

What users say about Gusto

As a user, I absolutely love how Gusto has streamlined the payroll process, making my job significantly easier.

The inability to add nicknames to bank accounts within Gusto’s platform has presented challenges in streamlining our financial management process.

Paychex

Good for large companies

Paychex is a payroll, benefits, and HR management platform.

Why I chose Paychex: It offers various powerful tools that simplify payroll processing for companies of all sizes.

Here are its core payroll features.

Payroll processing

Paychex’s payroll services allow you to pay hourly or salaried employees and 1099 contractors. Paychex automatically calculates payroll, including wages, bonuses, and deductions. It pays employees weekly, biweekly, semi-monthly, or monthly—depending on your needs.

Multiple payment methods

Paychex allows you to pay employees through direct deposits, paper checks, or payroll cards, according to their preferences.

Tax administration and compliance

Paychex handles all payroll-related tax calculations, filings, and payments, including federal, state, and local taxes. I find it reassuring that Paychex’s compliance experts stay current on regulatory changes across all locations and ensure you remain compliant. For example, you can use Paychex experts to set up workers’ compensation insurance for your cleaners.

Employee self-service tools

Workers can use Paychex’s online portal to update their personal and banking details and find their tax forms, pay stubs, and benefits plans. Paychex’s mobile apps also allow users to access the portal from anywhere on their smartphones. I think this is particularly useful for cleaning companies where workers might not need or have laptops.

Scalable plans

Paychex offers several plans. While the first plan provides basic payroll features, the others provide advanced tools, reporting, and HR support. This way, you can easily upgrade plans as you grow without changing your provider. However, I wish there was a free trial to explore features before picking a plan.

Time and attendance integration

Paychex integrates with time and attendance systems to track work hours, overtime, and leave information. For instance, you can sync Paychex with Connecteam using 1-click integration, then run payroll in minutes right from your Connecteam app—and handle the rest of your workforce management tasks, too.

Key Features

- Payroll processing

- Tax administration

- Compliance management

- Employee self-service tools

Pros

- Can be accessed from anywhere

- Integrates with Connecteam for all-in-one workforce management

Cons

- Reporting available only on advanced plans

- Doesn’t offer a free trial

What users say about Paychex

Our small company is very happy with the overall service from Paychex. We are always able to get someone on the phone if we need assistance.

I did have one hiccup about withholdings from an employee’s paycheck. It took a while to fix, but Paychex eventually resolved it.

QuickBooks Online

Good for small to mid-sized businesses

QuickBooks Online is part of QuickBooks Intuit’s larger offering of accounting, billing, invoicing, time tracking, and other business tools.

Why I chose QuickBooks Online: I love that QuickBooks’ payroll tool integrates with its accounting software, saving you the hassle of managing these independently.

Here are the features that make QuickBooks Online one of the best payroll software for cleaning companies.

Automated payroll

You can set your team’s payroll to run automatically at your chosen pay frequency. QuickBooks Online will pay your workers’ hourly wages, fixed salaries, commissions, and other bonuses on time. You can also pay employees through direct deposit; the system even offers same-day direct deposits.

Taxes and benefits deductions

QuickBooks Online also automatically deducts employee and employer payroll taxes, so neither you nor your workers need to worry about doing this manually. The best part, in my opinion, is that the platform offers tax penalty protection. QuickBooks pays up to $25,000 for fines relating to inaccurate tax deductions.

Additionally, QuickBooks Online provides benefits administration support and auto-deducts any contributions to healthcare packages or retirement plans from payroll.

Workforce app and payroll reports

QuickBooks Online’s workforce app lets employees access their pay stubs and year-end tax documents online.

You can use your admin account to generate detailed payroll reports, too. Customize these by employees, teams, and more to get the insights you need.

Integrations

QuickBooks Online payroll integrates with its accounting software, helping you manage business finances and payroll from a unified platform. You can also integrate the platform with QuickBooks’ time-tracking system, but this is available only on premium plans.

QuickBooks Online integrates with Connecteam as well, making it easy to review timesheets, spot errors, and ensure every detail is accurate before you run payroll.

Key Features

- Automated payroll

- Tax deductions

- Benefits administration

- Workforce app for employee self-service

Pros

- Offers tax penalty protection of up to $25,000

- Integrates with QuickBooks Accounting

Cons

- More expensive than some other payroll providers

- Time tracking available only on premium plans

What users say about QuickBooks Online

We use the software frequently, in fact on a daily basis because the features it has are just amazing. The customer support has been great as well.

Getting about was a bit complicated at first. But that’s the only downside I’ve encountered.

FAQs

How can I start a cleaning business?

To start a cleaning business, first decide whether you’ll focus on commercial, residential, or special cleaning. Then, create a business plan, get the necessary licenses and insurance, and buy cleaning supplies. Finally, hire a team of professional cleaners and market your services to start attracting customers.

What is a free time tracking app for cleaning companies?

Connecteam is the best time-tracking app for cleaning companies. Its GPS-enabled time clock lets you capture when and where your cleaning workers spend their scheduled hours. Small businesses can access it completely free forever.

- Check out our in-depth comparison of the best cleaning software to find the one that’s right for you.

Bottom Line on Ways To Pay Cleaning Employees and the Best Payroll Software for Cleaning Companies

Most cleaning businesses pay by the hour, set a fixed salary, or offer workers a commission for each job. Whichever payment structure you choose, you should match or exceed market rates, pay workers fairly for their skills and experience, and comply with local minimum wage and overtime laws.

Lastly, use Connecteam to capture employees’ working hours, create timesheets, and integrate these with popular payroll platforms like Gusto, Paychex, and QuickBooks Online. This way, you can always pay your employees accurately and on time.