Time clock rounding is legal when it benefits the employee and is rounded to a maximum increment of 15 minutes. In this guide, we discuss the challenges, best practices, and easiest methods of time clock rounding.

Keeping track of employees’ work hours can be a challenging and time-consuming task, especially if they clock in or out a few minutes early or late. To make the process easier, companies may use time clock rounding. This involves rounding employees’ clock-ins and clock-outs up or down to the nearest time interval.

Key Takeaways

- Time clock rounding is legal if time is rounded to a maximum increment of 15 minutes and it doesn’t result in employees being consistently underpaid.

- There are different time clock rules by state. These states include Washington, California, Texas, and Michigan.

- There are three methods for rounding time: 5, 6, and 15-minute increments.

- Best practices for time clock rounding include using fair rounding increments, regularly communicating with employees about rounding, and reviewing your rounding policy annually.

- You must maintain accurate records of employees’ hours to ensure you remain compliant with labor laws and regulations.

Time clock rounding is not as common as it used to be, thanks to the popularity of digital time tracking software. However, there are benefits to time clock rounding. It can help streamline payroll processes, simplify wage calculations, and prevent employee time theft. But it can also lead to employee disputes and even legal issues if not done correctly.

Below, we discuss the best practices of time clock rounding and how to avoid biased rounding. We also cover three rounding methods and share several example time clock rounding charts.

What Is Time Clock Rounding?

Time clock rounding involves an employer rounding an employee’s hours up or down. Hours are rounded based on pre-set increments of time—usually 5, 6, or 15 minutes.

Employers often use time clock rounding to make it easier to figure out how much an employee has worked, which reduces the time it takes to do payroll. It’s generally legal if it’s done in a consistent and fair manner that doesn’t lead to employees being consistently underpaid.

For example, say your employee is paid $20 per hour and works 9-hour days. They clocked in at 8:02 am and clocked out at 5:01 pm. Without rounding, you would need to calculate the employee’s pay for the exact time they worked. It would look something like this:

($20 x 9 hours) + (1/60) x $20) – ((2/60) x $20) = $179.67

However, you could easily round their start time up to 8 am and round their end time down to 5 pm. The calculation is much simpler:

$20 x 9 hours = $180

The 33-cent difference is negligible. With time clock rounding, wage calculations are very straightforward.

Time clock rounding for exempt vs. non-exempt employees

There are different time clock rules for hourly employees and non-hourly or salaried employees. Hourly employees are “non-exempt” from time clock rounding, while non-hourly or salaried employees are “exempt.”

This means that you can round the hours of a non-exempt employee. This is because they must be paid for any overtime worked above 40 hours. They also must be paid the federal minimum wage.

On the other hand, exempt employees don’t need to be paid for overtime worked above 40 hours. However, you still need to prove to the Fair Labor Standards Act (FLSA) that these workers don’t regularly exceed 40-hour weeks. Rounding up even a few minutes here and there can push workers’ weekly time entries over 40 hours. Thus, it isn’t recommended that

Time clock rules by state

In addition to federal time clock laws, some states have their own time clock rules. These states include:

- Washington. Washington law requires employers to pay non-exempt employees at 1.5 times their regular pay rate for any time worked over 40 hours.

- California. The California Wage Order states that employee time cards must be filled out in English and in a way that can’t be tampered with. California requires employers to use paper time cards written in ink (not pencil) or digital timecards.

- Texas. The Texas Payday Law allows employers to use digital time clocks and time sheets to record work time. It also states that employers must create and store time records for each pay period for up to 3 years.

- Michigan. Employers in Michigan must keep records of the total hours employees work each day, clearly showing start and finish times. Time should be tracked to the nearest 10th of the hour (6 minutes) or less.

Why Do Employers Round Employees’ Time?

Now that you have a good idea of what time clock rounding is, let’s discuss some of the reasons employers round employees’ time. Rounding helps:

- Improve fairness. Rounding can help to ensure that all employees are treated fairly and equally when it comes to calculating the number of hours worked.

- Allow for flexibility. Rounding employee hours provides some flexibility in their work day. For example, employees can be 5 minutes late if they’re stuck in traffic or leave 5 minutes early to attend an appointment without the missed time impacting their pay.

- Simplify payroll calculations. Calculating pay based on whole numbers and simple fractions is easier than working out payments based on time down to the second.

- Reduce administrative time and boost productivity. Rounding can save time on tasks like data entry and payroll calculations, so you and your employees can focus on more important work.

- Minimize errors and reduce costs. Rounding time for payroll reduces errors, which prevents underpayments or overpayments to employees. It also means that managers won’t have to waste time correcting errors, which helps save on labor costs.

- Ensure compliance. By rounding time for payroll and keeping records of employees’ time, employers can be sure they’re complying with labor laws and regulations. These include the FLSA and Department of Labor’s regulations around break times, working times, overtime payments, and more.

Is Time Clock Rounding Legal?

Legal time clock rounding

The Department of Labor considers time clock rounding to be legal as long as employers follow these rules:

- Time clock rounding should be fair for the employee. You can’t round employee hours down simply to save on payroll costs. As a general rule, you should round your employees’ hours in a way that favors the employee.

For example, rounding an 8:03 am clock-in time to 8:00 am, so they are paid for those 3 minutes. This will help prevent complaints and pay disputes.

- Employers can’t round in increments larger than 15 minutes. This means you can’t round down in increments of half an hour or an hour. In addition to 15-minute rounding, the DOL allows for 5 minute rounding and 1/10th hours (6-minute) rounding.

- Employers must abide by the 7-minute rule. This rule applies to the 7-minute mark in a 15-minute window. For example, if an employee clocks in before 9:07 am, you can round the time down to 9:00 am. However, if an employee clocks in at 9:08 am, you should round this time up to 9:15 am.

Outside of these rules, rounding clock time could be considered illegal.

Illegal time clock rounding

Here are two examples of time clock rounding that could result in legal issues.

- Say an employee clocks in at 7:56 am and clocks out at 5:03 pm. You should round their start time down to 7:55 am and round their end time up to 5:05 pm. This allows the employee to be paid for an extra 3 minutes.

However, say you round their start time up to 8:00 am and round their end time down to 5:00 pm. By doing this, you’ve rounded their start and end times in a way that favors your business, not your employee.

In this example, the employee has lost 7 minutes of worked time. While this doesn’t seem like a big difference, if it’s done every day for a year, it adds up to 30 hours of unpaid work. This puts you at risk of an unpaid wages claim.

- Say that you round your employees’ time to the nearest half hour, as opposed to the nearest 5, 6, or 15-minute interval that the DOL allows for.

For example, imagine an employee clocks in late at 8:07 am. You should follow the 7-minute rule and round their clock time to 8:15 am. However, say that you round their clock time to 8:30 am instead.

This would result in 23 minutes of unpaid work for that day—up to 100 unpaid hours per year if done regularly.

Different Types of Time Clock Rounding

5 minutes

With 5-minute rounding, each 5-minute increment in an hour has a 2.5-minute threshold.

If an employee clocks in or out before this threshold, their clock time is rounded down. Their clock time is rounded up if they clock in or out after this threshold.

For example:

| Clock time | Rounded to |

| 8:03 am | 8:05 am |

| 8:02 am | 8:00 am |

| 8:59 am | 9:00 am |

| 10:11 am | 10:10 am |

6 minutes

6-minute rounding is also known as 1/10th hour rounding. With 6-minute rounding, the hour is split into 6-minute intervals with a 3-minute threshold.

If an employee clocks in or out before the 3-minute threshold, their clock time is rounded down to the lowest 6-minute interval. Their clock time is rounded up to the nearest 6-minute interval if they clock in or out after the 3-minute threshold.

For example:

| Clock time | Rounded to |

| 6:02 am | 6:00 am |

| 8:04 am | 8:06 am |

| 8:59 am | 9:00 am |

| 12:51 pm | 12:54 pm |

15 minutes

15-minute rounding abides by the 7-minute rule. This rule guides whether an employer should round employees’ time up or down.

If an employee clocks in or out before the 7-minute threshold, their clock time is rounded down to the previous quarter-hour. Their clock time is rounded up if they clock in or out after the 7-minute threshold.

For example:

| Clock time | Rounded to |

| 7:38 am | 7:45 am |

| 11:06 am | 11:00 am |

| 6:06 pm | 6:00 pm |

| 7:08 pm | 7:15 pm |

The Challenges of Time Clock Rounding

There are a few pitfalls you need to be aware of when rounding employee time.

- Work off the clock. Off-the-clock working is a major FLSA violation. For example, if an employee clocks in at 8:55 am and you round their start time to 9:00 am, they will have worked those 5 minutes for free.

Over the course of a week, this adds up to almost 25 minutes of unpaid time. Failing to pay employees for time worked could result in a claim to the FLSA.

- De minimis work. De minimis refers to any amount of time or task too small to cause concern. The DOL determines that a de minimis amount of time is anything below 15 minutes.

Thus, employers can round time up or down within 15 minutes. However, this is currently being re-evaluated in California.

- Inaccurate timesheets. Excessive rounding of employee timesheets may eventually create inaccurate timesheets. Employees could then claim unfair or illegal reduction of wages under the FLSA.

To avoid this, it’s important that timesheet rounding is consistent across your business. You should also include information on time clock rounding in your employee handbook to minimize misunderstandings.

- Payroll disputes. Excessively rounding employees’ time may lead to payroll discrepancies. Sometimes, employees may expect to be paid more than they actually were. To avoid this, you should communicate your rounding policy to employees and always round employee hours fairly.

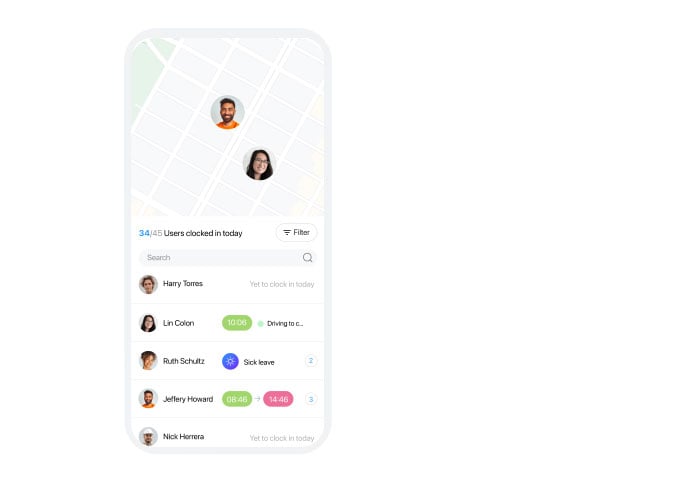

- Employee monitoring. Rounding employee hours might make your team feel like they’re being micromanaged. This could end up decreasing morale, reducing productivity, and even increasing employee turnover.

Best Practices for Time Clock Rounding

Consider whether you need to round employees’ time

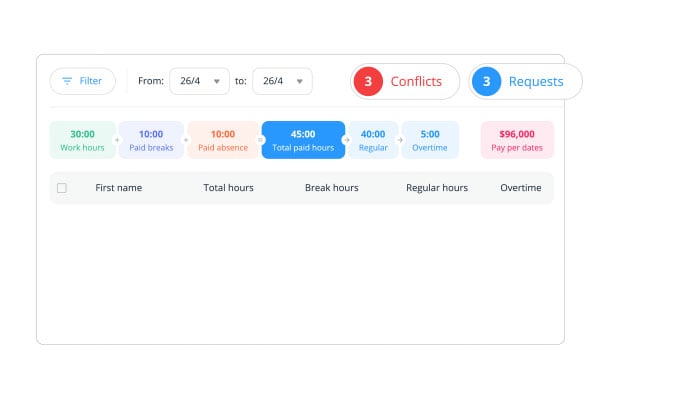

New technologies have made it simple to track workers’ time down to the second. Workers can use digital apps to clock in and out right from their mobile phones. Modern time tracking systems also generate automatic digital timesheets and often integrate with payroll software. This makes it easy for employers to pay staff exactly what they’re owed.

In this way, you may not need—or want—to use time clock rounding.

Create and follow a time clock policy

A robust time clock rounding policy is the best way to ensure you’re being consistent and fair with rounding.

Your policy should set out the following:

- The rounding increments that will be used. For example, 5 minutes, 6 minutes, or 15 minutes.

- At what point time will be rounded up or rounded down. For example, at minute 7 for a 15-minute rounding policy.

- An example table to illustrate how clock time will impact employees’ pay.

- The date that the policy was last reviewed.

You could also include a brief explanation on why you decided to round clock time in this way. This can help encourage a culture of honesty and transparency.

Once your policy is written, communicate it directly to employees. You can do this verbally during a meeting or phone call. Or you can send a memo or email, or post a message in your employee chat app to update your team.

It’s also essential to include your rounding policy in your employee handbook. Have your employees sign the handbook after they’ve read it to ensure they understand the policy.

Then, be sure to enforce the policy by applying your rounding method to all employee hours. This must be done consistently across all teams and working patterns to ensure fairness.

Finally, contact your payroll provider via email, phone call, or meeting to update them on your rounding policy.

Use fair rounding increments

Fair rounding increments are considered to be 5, 6, or 15 minutes. Increments that are too small (such as 2 minutes) or too large (such as 30 minutes) aren’t legal or fair to your employees. They may feel micromanaged, frustrated, or underpaid for their work.

Avoid biased rounding

Typically, biased rounding is when an employer rounds time down in a way that consistently results in unpaid work. This benefits the employer over the employee and can create mistrust among workers.

For example, a 15-minute rounding policy that rounds all time down to the nearest quarter-hour would be considered biased since it favors the employer.

Be sure to round time in a way that’s fair to everyone. For instance, a 15-minute rounding policy that abides by the 7-minute rule benefits both employers and employees equally.

Talk to your employees about time clock rounding

Timesheet rounding can be a tricky topic to discuss with employees, as some might feel that it only benefits the employer. For example, if employees consistently have their clock-ins and clock-outs rounded down, they may feel they’re losing pay.

Communicating with employees about your time clock rounding policy can help them feel more positive about it. For instance, employees who know their clock-ins and clock-outs will always be rounded to the nearest 5-minute interval will feel more confident that their paychecks are accurate.

This kind of open communication can also help foster an overall culture of trust and transparency within your organization.

Review your rounding policy annually

Reviewing your rounding policy each year ensures you’re staying up to date with the latest regulations so your business remains compliant.

It also shows employees that you’re following specific guidelines and aren’t rounding their time for no reason. This can help them feel more comfortable in your decision to round their hours.

Additionally, reviewing your rounding policy can highlight issues like employee lateness or excessive overtime. You can then make data-driven business decisions to tackle these problems.

Maintain accurate records

Even when using time clock rounding, employers need to maintain accurate records of employee work hours. Employers should keep copies of pay stubs and any other payroll records for up to 3 years.

Records should include clock-ins and clock-outs and any rounding adjustments that are made. They should also be readily available for employees, auditors, and regulatory agencies to review.

Overall, accurate records help prevent disputes and legal issues.

Conclusion

Although it’s less common today, employee time clock rounding can be a valuable tool for streamlining timekeeping and payroll processing. However, it’s essential to follow best practices when rounding time to avoid potential legal issues and employee disputes.

By using a consistent rounding policy and fair rounding increments, avoiding biased rounding, maintaining accurate records, and communicating with employees, employers can ensure that their time clock rounding practices are fair, efficient, and compliant with legal requirements.