Many small businesses fail due to market competition, a lack of adaptability, low sales, and various other factors. However, you can increase your chances of success by having the right plans in place and the proper tools at your disposal. In this guide, we outline 8 things every small business needs to succeed.

There are many reasons a small business may struggle to succeed—or fail altogether. They may face insufficient sales, staffing issues, or industry trends they can’t adapt to.

But don’t let that discourage you—these challenges can be avoided. You can increase your chances of success by learning what helps small businesses survive and thrive.

The foundation of a solid small business includes creating a business plan, developing a marketing strategy, executing legal formalities, and prioritizing your cash flow.

In addition, building your revenue streams and retaining talented employees helps increase your bottom line and keeps your doors open so your small business can stay afloat.

In this article, we dive into 8 things your small business needs to prosper. We also share best practices to ensure you stay successful in the long term.

Key Takeaways

- To succeed as a small business, you’ll first need a solid business plan and marketing strategy, good cash flow, and multiple revenue streams.

- Additionally, small businesses have a better chance of thriving with a strong team and clear schedules. This helps avoid staffing issues.

- You should also regularly research your competitors and target audiences. This way, you can create products and services that fulfill genuine needs and generate sales.

- Finally, you should prioritize excellent customer management. This keeps your reputation strong and protects your bottom line.

- To ensure long-term success, stay adaptable, manage your finances well, reward your employees, and use technology to streamline your business operations.

What Every Small Business Needs to Succeed

A business plan

Before you start your business, develop a business plan. This is a comprehensive roadmap for how you’ll generate income, manage finances, conduct your operations, and outrun competitors.

A business plan also clearly defines your unique selling point (USP)—a short explanation of why your product or service is better than the competition’s. For example, Apple’s USP is offering beautifully designed and innovative technology products.

In addition, the plan contains a breakdown of how your business is structured and run. This includes how you plan to recruit talent, deliver services cost-effectively, and stay financially stable.

Pro Tip

Ensure your plan explains how you’ll mitigate risks in your chosen market. For example, consider how you might respond to intense competition, restrictive regulations, or unpredictable customer demands. This shows investors you have a thoughtful, comprehensive approach to your business venture.

Strong business plans help you secure funding from investors and lenders, plus partnerships with stakeholder organizations. Your employees can also use it to understand how their individual responsibilities contribute to overall business goals.

You should regularly update your business plan with new information, such as the decision to enter a new market, and align it with evolving industry trends and consumer demands.

Cash flow

Many small businesses fail due to cash inflow and outflow issues. To avoid this, ensure there’s always money in the bank to cover basic expenses such as employee salaries, supplier fees, production and overhead costs, and loan repayments.

Your cash inflows consist of money coming in, like customer receivables, capital investments, and capital borrowed from lenders. Use these cash inflows to cover your outflows, which is the money going out, like operational expenses and debt repayments.

To build a healthy cash flow in the long run, forecast monthly cash inflows and outflows, promptly resolve unpaid customer bills, and maintain an emergency fund. To do this, set aside money from your cash inflows. You should aim to cover around 3-6 months of operational expenses in your emergency fund.

You can also better manage your expenses by allowing flexibility in supplier relationships and internal operations. For example, you can negotiate flexible payment arrangements or rent rather than buy an office space.

Pro Tip

For even better money management, set up a business bank account and hire an experienced accountant to track your finances accurately.

Registration, licenses, ID numbers, and other legal admin

You must follow legal requirements in all jurisdictions your small business operates in. Registering your business and obtaining the right licenses is part of these requirements.

Multiple business registration options are available in the United States. Two of the most common are:

- Limited liability company (LLC), where the owners are legally separate from the business and aren’t liable for any debts if it goes bankrupt.

- Sole proprietorships, where the owner and the business are the same entity, and you have personal liability for debts.

Depending on your products and operations, you may also need certain licenses and permits—such as a liquor license if your business sells alcoholic beverages. If your business operates in multiple regions, check what local licenses the countries or states require.

Next, you’ll need to apply for a tax ID number (TIN) and an employer identification number (EIN). These help the Internal Revenue Service (IRS) manage business tax returns.

Finally, hire a tax expert to set up your business for tax purposes. This way, you can avoid legal issues and prevent unnecessary stress.

Pro Tip

Store all your legal documentation securely and make it available only to employees who require it, such as HR and finance staff. Document management software like Connecteam can help you safely store and set access permissions for your files.

Get started with Connecteam for free today!

A marketing strategy

Without an effective marketing strategy, you risk under-selling your products and missing out on potential revenue. Answering the following questions can help you create your strategy:

- Who is your target audience, and what are their pain points?

- Who are your main competitors? What makes you different from them?

- What are your products’ or services’ top benefits, and which channels can showcase them effectively?

A helpful framework to use is the “marketing mix,” which centers around the 4 Ps: product, price, promotion, and placement. You can use this model to outline how customers perceive your products and pricing and respond to promotion and marketing channels.

This approach then informs more detailed marketing plans. For example, if you’re targeting online audiences, your plans should include resources and skills for digital advertising, social media, and email campaigns.

Revenue streams

Building strong revenue streams doesn’t just increase your cash flow. It also helps you maintain financial stability as your business grows.

You can have several streams within a single customer base—for example, by providing different types of services. Another option is serving multiple geographies and industries, or covering both business and consumer clients.

One of the best ways to develop your revenue streams is to perform market research regularly. Gather data through surveys, interviews, competitor analysis, and online research to spot industry trends and consumer preferences. This helps you identify gaps left by competitors and trends that can strengthen your revenue streams.

You can then use this information to make strategic business decisions—such as entering new geographical markets, targeting a more specific demographic, or creating new products to meet customer demand. You might also consider introducing digital products, subscription services, and complementary offerings to build additional revenue streams.

A strong team

When businesses hire the wrong people for their open positions, they experience a high turnover rate, lower productivity, and poor team morale. Avoid this by creating an airtight recruitment plan.

Include detailed role responsibilities and employee qualities in your job descriptions. Also, manage candidates’ expectations by presenting the opportunity objectively—discussing both the good and the bad.

You should also aim to have a diverse team of workers who bring unique skills and experience to the table. Finally, ensure you offer fair and competitive compensation to your prospective employees. Ensure your wage or salary offerings are at or above market standard.

Once you have your dream team, focus on retention. Offering comprehensive training, professional development opportunities, showing appreciation, and maintaining transparent team communication all contribute to higher retention rates.

Looking for ways to enhance your team’s success and streamline operations? Dive into our expert guides:

- 24 Effective Strategies to Retain Your Top Talent: Learn More

- 30 Best Small Business Apps: Discover the Tools

Take your business to the next level today!

It’s also a good idea to use digital platforms to make managing candidates and employees easier. For example, an applicant tracking system (ATS) helps you track job candidates throughout recruitment. Meanwhile, employee management apps help streamline onboarding and training, manage internal communication, share company announcements, and more.

Pro Tip

Simplify your recruitment, onboarding, and retention efforts with an all-in-one employee management app like Connecteam. It offers tools for training, rewards and recognition, performance management, communication, and more in one app.

Get started with Connecteam for free today!

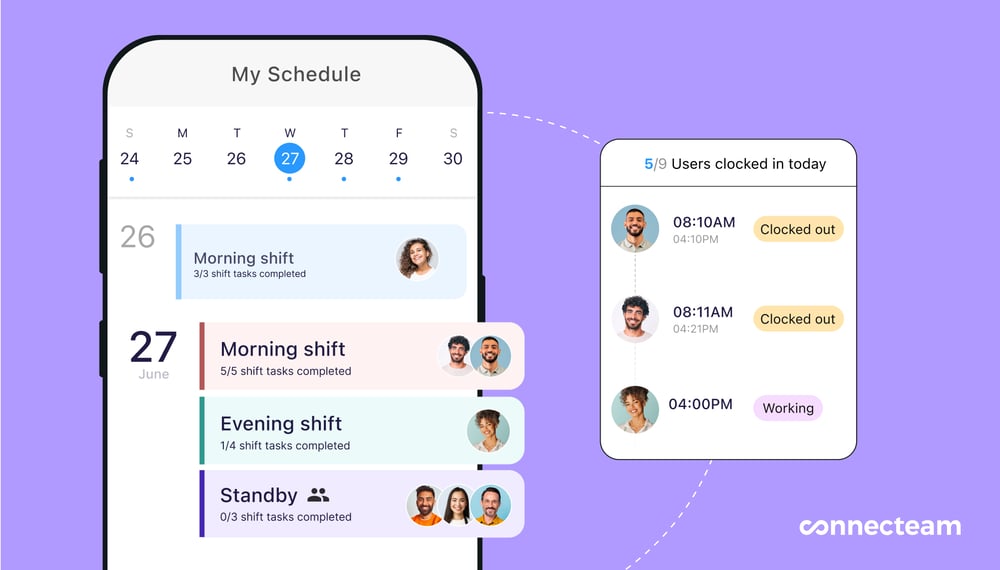

Clear schedules

Part of small businesses’ survival depends on employees showing up for work, ready to tackle important tasks each day. Without clear schedules, you risk miscommunication, missed shifts, schedule clashes, and incomplete or overdue tasks.

To create an effective employee schedule, first identify your peak hours. What days of the week are you open? When will your business be busiest? Do you plan to be open during major holidays?

Next, consider workers’ availability and preferences. Ask them for their preferred working hours, paid time off (PTO) and leave requests, and typical weekly availability. Building schedules that work for your team help reduce conflicts and increase employee satisfaction.

Then, factor in break times for each shift. Depending on state laws, you may be legally required to provide breaks of a certain length, so it’s important to include these in all your schedules.

Additionally, ensure your schedules include individual shifts, recurring events (like weekly team meetings), and one-off events (like a training session or a call with a new customer). This keeps everyone updated on what’s coming each week or month.

The best schedules will include task details, too. Note important to-do’s within each worker’s shifts so they always know what’s expected of them when they clock in. Doing so ensures your team stays focused and productive.

It’s also a good idea to allow employees to swap shifts with their coworkers when needed. This gives your team flexibility, helping reduce burnout and increase satisfaction.

Finally, be sure to share schedules well in advance. Post physical schedules at your workplace, or share digital ones via email or text.

Pro Tip

Creating schedules using pen and paper or spreadsheets is time-consuming and prone to errors. Using digital employee scheduling software like Connecteam is easier and more efficient. You can build schedules from scratch using the drag-and-drop tool or use handy templates to create schedules in minutes. Plus, you can add tasks and checklists to shifts as you see fit.

Get started with Connecteam for free today!

Excellent customer management

Top-notch customer management is a must for any small business. It’s all about creating a smooth experience for your customers and clients and building a strong relationship with them. This creates loyalty, leading to repeat business that boosts your bottom line. On top of this, happy customers are likely to refer you to new prospects, which helps your business grow.

Take a multi-faceted approach to customer management. Start by clearly communicating your products and services to your audience so they know what’s on offer.

Then, as your customer base grows, actively listen to their needs and concerns so you can tailor your products and services accordingly. Do this through customer surveys or discussions in client meetings if your business is client-focused.

In addition, personalize your interactions with customers by using their names and referring to past conversations you’ve had with them.

You should also provide your employees with customer service training. This ensures everyone provides the same quality service, understands how to handle customer interactions properly, and can solve customer problems quickly and effectively.

Finally, maintain regular communication to nurture relationships with customers and clients, and consider implementing loyalty programs for long-time customers.

Pro Tip

You can simplify all these efforts by using a customer relationship management (CRM) system. These platforms track customer data and communications, helping your team serve customers more effectively. They offer features to collect e-signatures on contracts and forms, generate invoices, provide instant customer support, and more.

How to Make Sure Your Small Business Is Successful

According to the Bureau of Labor Statistics, around half of businesses fail within their first 5 years of operation. So, what do small business owners need to do to keep their businesses thriving long-term?

While certain factors—like economic downturns and changes in customer demand—are out of your control, there are best practices you can follow to maximize your chances of success.

Below are some of the most important and easiest business practices to implement.

Stay adaptable

A business plan is central to starting a small business, but it requires adjustments based on new information. Keep an eye on competitors, review customer feedback, and develop new or improved products to adapt to evolving trends and demands.

Be customer-focused

Your products and services won’t sell or be well-received if you aren’t meeting customer needs effectively. It’s also vital to provide excellent customer service and great customer management to succeed. Ensure your entire team—including you—executes tasks with customers in mind.

Stay on top of your finances

Don’t ignore red flags such as customer non-payments and a lack of funds to pay employee salaries and wages. Instead, use cash flow management strategies, like getting a loan and using your emergency fund, to stay financially secure.

Incentivize your employees

Recruiting is expensive and time-consuming, so hang on to your skilled staff members. You can decrease turnover by communicating transparently, offering competitive pay, recognizing employees’ hard work, and providing professional development opportunities.

Get tech-savvy

Running a small business takes time, money, and effort. You can save in all these areas by using software to automate tasks, manage your budget and finances, and oversee your employees more effectively.

Consider apps and technology like scheduling platforms, customer relationship management (CRM) tools, digital file management solutions, payroll software, and more.

Did You Know?

Connecteam is an all-in-one workforce management platform with all the tools your small business needs to run smoothly—from internal communication to HR management and more. Get started with Connecteam for free today!

Conclusion

Small businesses face common problems that can endanger their survival. However, there are proven practices you can follow to increase your shot at success.

First, prepare a solid business plan to target the right market and attract new investors. You should also maintain a healthy cash flow and use solutions like an emergency fund as a backup to cover expenses. In addition, be sure to hire a strong team, create effective employee schedules, and prioritize great customer management.

To thrive in the long run, remain adaptable, focus on your customers, reward your employees, and don’t be afraid to embrace technology to simplify your operations. With this information in mind, you’ll be on your way to running a successful business!

FAQs

What are the things a business plan needs?

A business plan outlines how a company intends to make a profit and serve its customers. This includes the products and/or services offered, the target market and audience, and how the business will reach its sales goals. In addition, the plan includes a long-term financial forecast and its leadership team’s background and skills.

What do small businesses need help with most?

All small businesses are unique, and so are their struggles. So it’s tricky to give a definitive answer.

However, a common challenge small businesses face is identifying their target customers and building appropriate products or services to meet their needs. They may also fail to price their products correctly, which impacts their revenue figures.

Therefore, small business owners can benefit from seeking advisors who can point out potential opportunities and threats.

What do most small businesses lack?

Many small businesses lack funding, so there’s pressure to identify the right business model and start making income quickly. Small businesses typically don’t have many employees either, so staff members must often perform several roles at once.