Don’t let the thought of writing a business plan intimidate you. Our comprehensive guide breaks it down into manageable steps so you can create a plan that will help you achieve your goals.

Creating a strong business plan is the first step in your entrepreneurial journey to start a business. It gives your business a sense of direction and helps you make strategic decisions.

However, crafting one can seem intimidating. It involves organizing your ideas, determining the right structure, performing market research, projecting finances, and expressing a clear vision for your business.

To lend you a hand, we’ve created this comprehensive guide on how to write a business plan. We break the process down into 9 key steps and offer tips and resources to help you get started.

Key Takeaways

- A business plan is a document that outlines a business’s goals, strategies, and financial projections.

- It helps you clarify your vision, set goals, align strategies, track progress, identify strengths and weaknesses, and mitigate risks.

- It typically includes an executive summary, company description, product or service details, market analysis, marketing and sales plan, financial analysis, and projections.

- Business plans should be regularly updated to reflect changes in the company and market conditions.

Why Write a Business Plan?

Understanding how to create a business plan is vital for any budding entrepreneur. But why are business plans so important?

A comprehensive business plan demonstrates to investors your preparedness, showcases your business potential, and provides a clear blueprint for the future. Investors are more likely to offer funding if they see you have a solid plan in place and a strategic vision for success.

Even if you aren’t seeking funding, a business plan serves as a roadmap for your entrepreneurial journey. It helps you chart a course from where you are now to where you want to be in the future. By outlining your goals, strategies, and action steps, a business plan provides a framework for decision-making and keeps you focused on your long-term objectives.

Here are some examples of what a great business plan can help you do.

- Clarify your vision. You might have a brilliant idea, but until you put it down on paper, it remains an abstract thought. A business plan helps you make your idea concrete and express it to others.

- Set realistic and measurable objectives. It can be hard to see the bigger picture when you’re in the thick of starting a business. A business plan allows you to define achievable goals, which is crucial for tracking your progress and making informed decisions.

- Align your strategies with your goals. Every business needs strategies to achieve its objectives. These approaches should be rooted in a thorough understanding of your industry, market, customers, and competitors. A business plan helps you map out these tactics, ensuring they’re aligned with your aims and are feasible with your resources.

- Track progress and performance. A business plan isn’t just a document you write once and forget. It’s something you should update regularly. Compare your actual performance against your plan to identify areas where you’re falling short. Then, make the necessary adjustments.

- Identify strengths and weaknesses. As you’re writing your business plan, you’ll likely uncover strengths you didn’t realize you had and weaknesses you hadn’t considered. This knowledge can help you capitalize on your strong points and address your shortcomings, positioning your company for success.

- Mitigate risks and challenges: Every company faces uncertainties and obstacles. A business plan enables you to anticipate these obstacles and formulate avoidance plans. This proactive approach can save you time, money, and stress in the long run.

🧠 Did You Know?

Entrepreneurs who take the time to create a business plan are 152% more likely to start their business.

How to Write a Business Plan in 9 Steps

Step 1: Write an executive summary

Your executive summary is a concise overview of the key elements of your business plan. It summarizes the business concept, market analysis, competitive advantage, target market, financial projections, and overall strategy.

It’s also the part investors or partners considering your proposal will read first. Thus, you must capture their attention and make them want to learn more about your business.

Executive summaries can vary based on the purpose of the business plan. For example:

- If you’re looking for funding, your executive summary should highlight the growth potential, profitability, unique selling proposition, and financial projections of your company.

- If your business plan is mostly for internal use, the executive summary should emphasize strategy, milestones, and action plans.

The executive summary is placed at the beginning of a business plan, but it’s often best to write the summary last. This allows you to distill the most important points from each section of your completed plan.

So, how do you craft an effective executive summary? Follow these steps.

- Start with a strong opening. Your first sentence should hook the reader. Think of this as your elevator pitch. It should briefly explain what your business does and why it will be successful.

- Summarize your mission and vision statements. Your mission statement defines your company’s business, its objectives, and how it will reach these company goals. Your vision statement describes the desired future position of your company. Both are essential in setting the tone for the rest of your business strategy.

- Describe your product or service. What problem does it solve? What makes it unique or superior to the competition? Be concise and focus on the value you provide to the customer.

- Identify your target market. Briefly outline your target customer and why your offerings appeal to them. You’ll go into more detail in your market analysis section.

- Outline your competition. Describe the competitive landscape and why your business will succeed where others have failed. This shows that you understand your market and are ready to compete.

- Introduce your team. Include their names, professional and/or educational backgrounds, qualifications, and skills. This proves you have the team necessary to execute your business plan.

- Summarize your finances and funding needs. Provide an overview of your financial situation, including your revenue and profit projections. If you’re seeking funding, include how much you need and how it will be used.

- Craft a compelling conclusion: Leave your reader with a powerful reason to continue reading the rest of the document.

💡 Pro Tip:

The executive summary should be clear, concise, and 2 pages long at most. Avoid industry jargon and stick to the main points: your mission, product or service, target market, competition, team, financials, and funding needs.

Step 2: Describe your company

The company description offers a snapshot of your business. It gives readers a glimpse into what you do, why you do it, and how you stand out.

Here’s how to write it.

- Describe your company: Include your business name, legal structure (LLC, Corporation, etc.), and ownership details.

- Share your history: Explain when and why you started your company and the journey so far.

- State your mission and vision: Your company mission defines your business’s purpose, while your company vision outlines your long-term goals.

- Declare your values: What ethical principles guide your business decisions? Make your company’s core values clear.

- Specify your objectives: What are your short and long-term goals? Make sure they’re measurable and achievable.

- Discuss who you are: Highlight your key team members, their roles, and their unique skills or experience that contribute to your company.

- Note your location: State your business location(s) and why you chose to do business there.

Your company description should capture the heart and soul of your business. It paints a picture of your identity, your aspirations, and what sets you apart from the competition.

Step 3: Describe your products and/or services

Next, focus on what you’re offering: your goods and/or services. This section should clearly state the advantages of your products or services to customers.

Here’s how to do it.

- Detail your products and/or services: Describe what you’re selling. If it’s a product, how does it work, and what are its features? If it’s a service, what does the process look like, and what results can customers expect?

- Explain the problem you solve: Describe how what you sell solves customer problems or meets their needs. What benefits do they get from using your products or seeking your services?

- Discuss your unique position: Explain how your products and/or services differ from competitors. What makes you special?

- Describe revenue generation: Clarify how you’ll generate income. Will you sell directly to consumers, use subscription models, or license to other businesses?

Also, share details about intellectual property rights, patents, and trademarks if applicable.

This section should leave no doubts about what your business offers and why it’s valuable to customers.

Grow Your Business With the #1 Employee Management App

Connecteam includes everything you need to manage, train, and communicate with your non-desk workforce in one easy-to-use app. Run your business operations, communicat with your staff, and manage all HR matters. 100% free for up to 10 users!

Step 4: Conduct market analysis

The next thing to include in your business plan is a thorough analysis of your market. Your market analysis should include details on your industry, target market, and competitors, as well as a SWOT analysis.

A well-executed market study shows you understand your sector, intended audience, and rivals. It demonstrates to potential investors that there’s a viable and profitable market for your goods.

The first step in this process is to gather information on your industry.

Gather information

Every business is different, but there are some top research resources to consider when performing market analysis:

- Industry reports: Published online by industry associations or government agencies, they offer the latest information on trends in the sector.

- Reputable sources: Academic journals, research firms, and government sites can give you concrete, accurate research on which to base business decisions.

- Online databases: Provide access to market research reports, industry statistics, and a wealth of other data.

- Surveys or focus groups: Offer valuable insights into consumer behavior and preferences directly from the public.

- Social media search tools: Track what people are saying about your industry or competitors.

- Competitors’ websites: These can provide valuable information on their products or services, pricing strategy, and marketing tactics.

- Current customers: If your business is up and running, you can get industry insights directly from your customers by running surveys or measuring sales.

💡Pro Tip:

These resources aren’t just useful for market analysis. They also come in handy when you’re building your marketing and sales plan, performing financial analysis, and making financial projections for the future.

Include an industry description

Now that you’ve gathered data on your industry, it’s time to add a broad description of your industry for readers who may not be familiar with it.

Here are some questions your industry description should answer:

- What’s the size of the industry?

- Is it growing or shrinking?

- What are the trends and characteristics?

- Are there any industry challenges?

Below is an example of a short industry overview that includes key details.

“Microgreens is a growing industry centered on producing and selling edible young seedlings. The industry is characterized by a focus on sustainability and health, with many microgreens producers using environmentally friendly farming practices and avoiding the use of synthetic pesticides and fertilizers.

According to a report by Gartner, the American microgreens market was valued at $540 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030.

The microgreens industry faces several challenges, including high production costs and limited consumer awareness. However, the industry also sees several positive trends, including a growing interest in plant-based diets and locally sourced foods.”

Outline your target market

Now, list the details of your target market as precisely as you can.

Start by gathering data on your existing customers if you’re already in business. This includes their demographics: age, gender, income level, geographic location, and psychographic information—aka their interests, values, and attitudes. You can collect this data by surveying your customers or by analyzing your sales data.

You’ll need to perform research into your expected customer base if you don’t have existing customers. You can do this using the resources listed above.

Once you’ve gathered this data, use it to create several customer profiles. These profiles should include information about your typical customers’ needs, preferences, and behaviors. You can use this information to identify patterns and trends in your customer base.

Here’s an example customer profile you could create based on your research:

- Company name: Example Customer Inc.

- Industry: Technology

- Company size: 50-100 employees

- Location: United States

- Annual revenue: $1 million-$5 million

- Target audience: Small and medium-sized businesses

- Customer needs: Affordable and reliable technology solutions

- Customer pain points: Limited IT resources, outdated technology

Analyzing your current and potential customer base can help you identify growth opportunities. Understanding customers’ needs and preferences is crucial for creating effective marketing campaigns, too.

💡Pro Tip:

Once you’ve defined your target market, confirm your assumptions by conducting surveys or focus groups.

Perform competitor analysis

Here, you want to identify your competitors and their strengths and weaknesses. Below are a few ways to do it, as well as what to look for.

- First, search for the leading companies in your industry, using the tips outlined above.

- Look at your competitors’ websites. Analyze their product or service offerings. Do they have variety? Do they offer extra features or benefits? Look for things that set them apart, such as exclusive products, unique packaging, or superior customer service. This could be their strength. Conversely, spot any overlooked areas, such as limited payment options or poor product descriptions. These could indicate their weaknesses.

- Inspect their marketing strategy. Notice how they talk about their products, what keywords they use, and how they position themselves. Are they portraying themselves as cost-effective, high-quality, or eco-friendly? Identifying these strategies can help you better position your business and express its strengths.

- Review their social media accounts. This can tell you a lot about a company’s relationship with its customers. Look at how often they post, the kind of content they share, and how much engagement (likes, comments, shares) they receive. High engagement is usually a sign of strong customer relationships. By reviewing their accounts, you can identify strategies you might want to use or avoid.

- Analyze how your competitors price their products or services. If they’re expensive, do they offer value or benefits to justify the higher price? If they’re inexpensive, where are they cutting corners? This gives you an idea of what pricing strategies work in your market and helps you position your own pricing effectively.

- Look through customer reviews. These provide unfiltered insights into a company’s performance. Positive reviews signify satisfied customers, while repeated negative reviews could point to unresolved issues. This helps you understand what customers value and what issues to avoid in your own business.

Add a SWOT analysis

A SWOT analysis examines your company’s strengths, weaknesses, opportunities, and threats. This exercise can help you identify opportunities for growth and areas of improvement.

Follow these steps to conduct a SWOT analysis:

- Identify your business’s strengths. What are you good at? What do you do better than anyone else?

- Identify your business’s weaknesses. What are you not so good at? What do your competitors do better than you?

- Identify opportunities for growth. What new markets could you enter? What new products or services could you offer?

- Identify potential threats to your business. What are your competitors doing? Are there any changes in regulations that could impact your business?

Here’s an example SWOT analysis that a growing bakery might make:

| Strengths | Weaknesses | Opportunities | Threats |

| Unique and creative recipes | Limited operating hours | Growing demand for artisanal baked goods | Increasing competition from established bakeries |

| High-quality ingredients | Small marketing budget | Expansion into online sales | Rising cost of ingredients and supplies |

| Attentive customer service | Limited product offerings | Collaborations with local coffee shops and restaurants | Changing dietary trends and preferences |

Together, your industry description, target market, competitor analysis, and SWOT analysis present a clear and realistic picture of your business environment. Including them demonstrates that you’ve done your homework and understand the challenges and opportunities in your market.

💡 Pro Tip:

Market analysis isn’t just a one-time task. It’s something you should revisit regularly. Markets can change rapidly, and staying on top of these changes can help you adjust your business strategy accordingly.

Step 5: Outline your marketing and sales plan

In the previous step, you identified your target market, analyzed your competition, and determined potential strengths, weaknesses, opportunities, and threats.

In the next step—building your marketing and sales plan—you’ll use this information to outline how you’ll reach and convert potential customers.

Here are some things to discuss.

- Market positioning: Identify the unique selling proposition (USP) of your product or service. What makes you different in a way that’s appealing to your target market? Are you cheaper, faster, and more environmentally friendly than others? Or are you more innovative, offer better customer support, and have more convenient locations? Use your competitor and industry research from above to identify where you fit into the industry.

- Pricing strategy: Establish your approach to pricing and explain your rationale for it. Your price should reflect the value you offer and be competitive in your market. Perhaps you attract price-sensitive customers by offering lower prices than your competitors. Or maybe you maximize profits by charging a higher price while remaining competitive in your market. Alternatively, perhaps you build brand loyalty by offering high-quality products at prices connoisseurs will pay.

- Promotion strategy: Detail how you’ll promote your line of products. This could include online advertising, social media, search engine optimization (SEO), content marketing, events, public relations, and more.

- Distribution: How will customers buy your products or services? This could be through a physical store, an online shop, direct sales, or third-party distributors.

- Sales strategy: How will you make sales? You might have a direct sales team, use e-commerce, or partner with retailers.

- Customer retention: Specify how you will keep your customers coming back. Consider loyalty programs, excellent customer service, regular updates, or incentives for repeat purchases.

Step 6: Perform financial analysis

The financial analysis section of your business plan shows the company’s current financial status.

Don’t fret if the list of statements and reports you need to make for this seems intimidating. You can easily generate most of these statements, sheets, and reports using accounting software. Often, they’re just a click of a button away. Or, you can speak with your accountant, who can generate these reports for you.

Here are the sections to include in this section whenever possible.

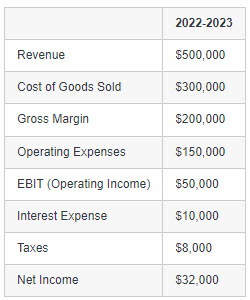

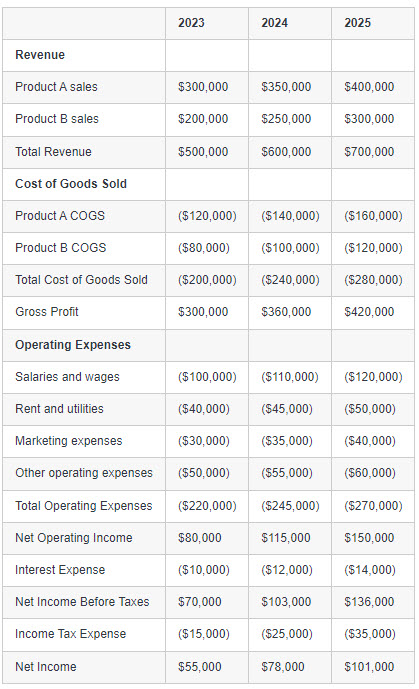

Income statement

An income statement shows your company’s profitability over a specific period. It includes revenue, cost of goods sold (COGS), gross margin, operating expenses, net income, and earnings before interest and tax (EBIT).

💡 Pro Tip:

You can compare income statements over time to track and analyze trends in your business’s financial performance. This can help you identify patterns, changes, or inconsistencies in revenue, expenses, and profitability.

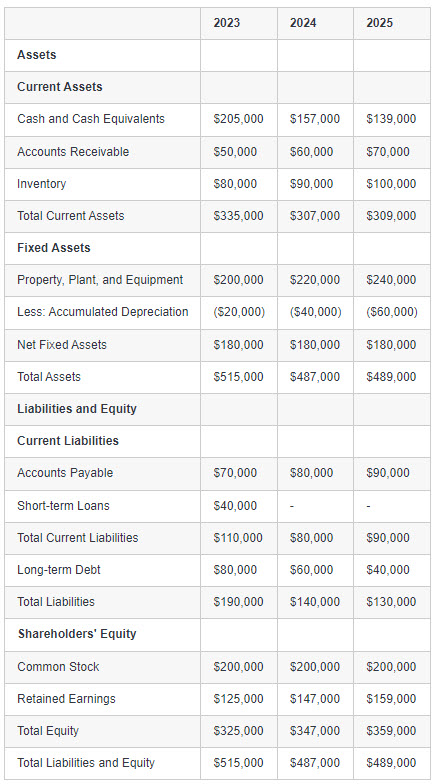

Balance sheet

A balance sheet summarizes your company’s financial situation at a specific point in time. It lists:

- Assets: What you own

- Liabilities: What you owe

- Equity: Your net worth or book value

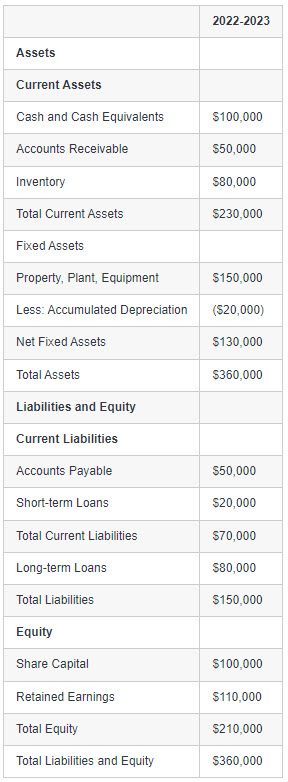

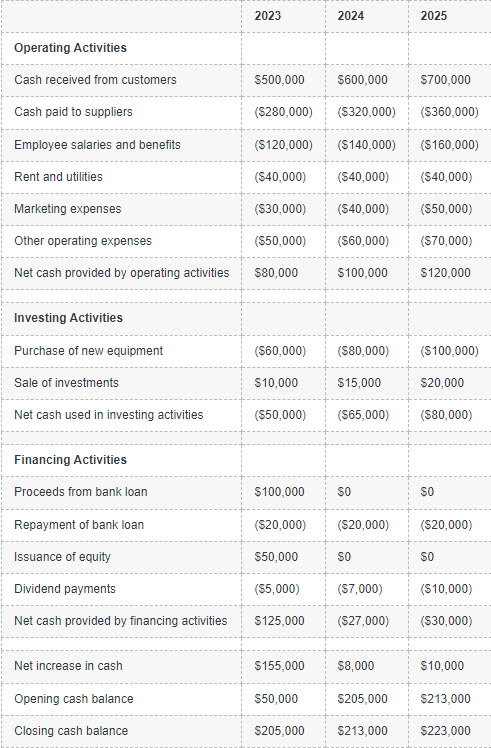

Cash flow statement

A cash flow statement shows how cash moves into and out of your business, helping you and investors understand your company’s liquidity. It can be split up monthly, quarterly, or annually.

It includes 3 categories:

- Operating activities: Core business activities like sales, salaries, and payments to suppliers

- Investing activities: Buying and selling assets

- Financing activities: Borrowing and paying debt

Return on investment (ROI) analysis

This analysis shows the efficiency of an investment. The higher the ROI, the better the opportunity for making a profit.

Below is an overview of calculating the ROI of your business venture.

- Determine costs: Identify and quantify all the costs associated with the project. This includes the initial investment required, ongoing operating expenses, maintenance costs, and any other relevant expenses throughout the project’s lifespan.

- Estimate returns: Estimate the expected returns generated by the project. This may include increased sales, cost savings, improved efficiency, additional revenue streams, or any other measurable benefits directly attributable to the project.

- Calculate net profit: Subtract the total costs (identified in Step 2) from the expected returns (identified in Step 3). The result is the net profit generated by the project.

- Calculate ROI: Divide the net profit (calculated in Step 4) by the total investment (identified in Step 2). Multiply the result by 100 to get the ROI percentage. ROI = (Net Profit / Total Investment) x 100.

Profit margin analysis

Profit margin measures a business’s profitability as a percentage. It calculates the portion of the revenue you keep as profit after deducting all the costs and expenses of producing and selling your goods and services.

A healthy profit margin is essential for sustaining operations, covering expenses, and generating income for reinvestment and growth.

Profit margin analysis helps assess a business’s viability and long-term sustainability. Consistently low or negative profit margins indicate the business is struggling to generate profits or may even be operating at a loss.

To work out the profit margin, divide your business’s net profit by its total revenue. Then, multiply the result by 100 to express it as a percentage.

Funding sources

Detail any sources of funding your business has received. This can include bank loans, angel investments, venture capital, crowdfunding, or personal funds. Mention the terms of any loans and how you plan to repay them.

Your financial analysis should be transparent, using concrete numbers and factual data. Keep in mind that investors use this section to assess your business’s viability and growth potential.

💡 Pro Tip:

Consider hiring an accountant or a financial professional to help if you’re unsure about anything. Mistakes in financial analysis can seriously harm your chances of securing investment or cause you to make poor business decisions based on wrong data.

Step 7: Make financial projections

The financial projection section forecasts your business’s revenue and expenses over the next 3-5 years.

Be realistic and conservative when creating these projections. Overly optimistic predictions can make the rest of your information unreliable and cause you to make bad financial decisions.

All your projections should be based on sound assumptions. These include industry and market trends, economic forecasts, and pricing strategies. State your assumptions clearly and provide reasoning for them.

In this section, include a sales forecast, expenses budget, cash flow statement, profit and loss (P&L) statement, and a balance sheet showing the figures you expect for the next 3-5 years.

Maximize Business Growth with the #1 Employee Management App

Unleash the true potential of your non-desk workforce using Connecteam—the ultimate app that combines management, training, and communication in one seamless solution. Streamline your business operations, empower your staff, and efficiently manage all HR tasks. Enjoy all the features absolutely free for up to 10 users!

Sales forecast

A sales forecast is a projection of future sales revenue that a business expects to generate within a specific period, typically 3-5 years. Here’s how to estimate your future sales.

- Itemize what you sell. You can’t guess your future sales if you don’t know what you’re selling. Write down each product or service. Be precise, and your forecast will be too.

- Predict your sales. There’s more than one way to estimate your future sales. For example, you can look at previous sales and go from there. This is known as historical forecasting. Or, you can work out the total market for your item, estimate the slice of that market you’ll get, and work out your sales from that. This is known as top-down forecasting.

- Adjust as needed. Think about what might change. Markets can shift, rules can change, and new marketing tactics can boost sales. Make sure to adapt your forecasts accordingly.

- Subtract costs. Finally, take your forecast sales and subtract what it costs to make your goods or services. The result is your potential profit.

Projected expenses budget

In a projected expenses budget, you list your expected operating expenses—such as rent, utilities, marketing costs, salaries, and production costs—over a period of 3-5 years.

📚 This Might Interest You:

We explain everything you need to know about calculating labor costs.

Projected cash flow statement

A projected cash flow statement typically shows your projections for a period of 3-5 years. It presents the flow of cash in (revenue) and out (expenses) of your business.

This helps you understand and demonstrate if you can cover all expenses and what months might require additional financing.

The statement usually includes the following sections:

- Operating activities: This section outlines the cash received from customers and cash paid to suppliers, along with various operating expenses such as employee salaries, rent, utilities, and marketing expenses.

- Investing activities: This section covers the purchase or sale of assets, such as equipment or investments, and reflects the cash flows associated with these activities.

- Financing activities: These activities include the cash flows related to financing the business, such as proceeds from loans or equity issuances, loan repayments, and dividend payments.

- Net increase in cash: This figure represents how much the business’s cash is expected to increase or decrease based on the above.

- Opening and closing cash balances: The opening cash balance represents the cash on hand at the beginning of the period, while the closing cash balance shows the projected cash at the end of the period.

Projected profit and loss (P&L) statement

A projected P&L statement shows the expected revenue, costs, and expenses expected over a period of time, typically 3-5 years.

It provides information about your company’s ability or inability to generate profit by increasing revenue, reducing costs, or both.

Projected balance sheet

This statement provides a snapshot of your company’s projected net worth at particular points in time, typically every year for 3-5 years. It lists all of your business’s assets, liabilities, and equity.

💡 Pro Tip:

Your financial projections aren’t set in stone. You should update them regularly as you get more information about your business’s performance and the market you’re operating in.

Step 8: Review and edit your business plan

After drafting your business plan, you need to review and edit it. This ensures your plan is clear, accurate, and persuasive.

Follow these steps to review and edit your plan:

- Review for errors: Check for factual, calculation, or logical errors. Ensure all claims are supported by data or evidence.

- Check for consistency: Ensure all sections are consistent in tone, format, language, and information.

- Check for clarity: Make sure your plan is easy to understand. Use simple language and clear visuals. Charts, graphs, infographics, tables, location photos, flowcharts, and product mock-ups can all help to make your vision clear to the reader.

- Check for completeness: Ensure you’ve included all relevant information and addressed all critical areas.

- Proofread: Check for grammar, spelling, punctuation, and formatting errors. A well-presented plan appears professional and credible.

- Seek feedback: Get advice from mentors, peers, or experts. Their perspective can help identify any gaps or weaknesses in your plan.

- Update regularly: Come back to your plan often, altering it to reflect any changes in your company or market.

Step 9: Add appendices if needed

Appendices include any additional documents that support your business plan. While not always necessary, they can provide valuable supplemental information.

Make sure your appendices are:

- Relevant: They should include only information that supports your business plan. This could be market research data, legal documents, or product samples.

- Complementary: Appendices should provide only additional supporting information. They shouldn’t distract from the main points of your plan.

- Organized: The appendices should be ordered in the sequence they’re mentioned in the business plan. Use a table of contents for easy navigation.

- Clear: All information should be easy to read. Avoid long blocks of text, use bullet points or numbered lists where appropriate, and ensure any images or graphics you use are high-quality.

Tips and Resources for Creating a Business Plan

Here are some quick tips for making a business plan that impresses.

- Use simple language: Make your business plan easy to understand. Avoid jargon and use plain, straightforward language.

- Incorporate visuals: Bullet points, charts, graphs, and images can make your plan more engaging and easier to understand.

- Use facts and data: Support your claims with evidence. This adds credibility to your plan.

- Use examples: Include case studies or success stories. This can demonstrate your understanding and ability to apply business principles.

- Include testimonials: If possible, include quotes from customers or experts to validate your value proposition.

- Turn to Connecteam: We’ve put together a free example business plan template to help get you started!

💡Pro Tip:

You’ll find a wealth of information on the Connecteam blog to help guide your journey as a business owner. From tips on how to create an employee handbook for your team to a guide showing you how to establish democracy in the workplace, our blog has all the info you need.

Conclusion

A well-crafted business plan serves as the blueprint for your venture, underlining the vision, goals, market strategy, and financial projections you’ll follow. It includes a strong executive summary, a description of your industry and company, a market analysis, a marketing and sales plan, and financial data you can use to build and grow.

By following the steps above, you can create a plan that’s comprehensive and practical—helping you attract investors and establish a clear path forward for your company.

FAQs

What are the common parts of a good business plan?

A good business plan should include an executive summary, company description, product or service description, market analysis, marketing and sales strategy, financial analysis, and financial projections. Each section provides critical insights into your business, from your vision to how you plan to achieve your goals.

What is the most important part of a business plan?

The executive summary is arguably the most crucial segment of your business strategy. It’s the first thing potential investors or partners will read and should provide a captivating snapshot of your entire business plan. It’s vital to make it concise, engaging, and informative.

How should a business plan be formatted?

A business plan should be formatted in a clear and organized way. Use concise language, include relevant visuals, and maintain consistency in style throughout. It’s crucial to organize information logically, with headings and subheadings for easy navigation. Always back up claims with accurate data and references.