Starting your own business is a great way to monetize your ideas and fill the demand for a product or service that the world needs. We’ll explain how to start your own business today in just 15 steps.

Starting your own business can be both personally and financially rewarding. But it’s also a significant undertaking, and it can be hard to know where to start.

To launch a business, you need an idea for a product or service, a plan to market it, and startup funding. You also need to decide on the best legal and fiscal structure for your business and to open a business bank account. On top of that, you may need to hire employees, set up a supply chain, and establish a storefront or website.

It’s a lot to think about, and the path to launching a business can be challenging at times. But there are few things more rewarding than seeing your new enterprise come to life.

In this guide, we’ll break down how to start a business in 15 steps so you can get started today.

Key Takeaways

- Starting a business is challenging but can be very rewarding.

- You’ll need a marketable idea for your business and a detailed business plan. Then you need to secure funding, build a supply chain, and attract customers.

- You also need to consider business insurance, whether you need to hire employees, and how you want to develop a unique brand identity.

- Once your business is established and turning a profit, there are many possible ways to expand.

Step 1: Decide What Kind of Business You Want To Start

When you start a business, the first step is often the most challenging: you have to figure out what kind of business you want to create.

A good business idea will be something that you enjoy doing, that you’re good at, and that has a high likelihood of turning a profit. Hitting all three of these criteria isn’t always easy.

For example, say you have a passion for woodworking, but you’re not very good at it. In that case, it might not be a great business idea because you can’t compete with woodworking products already on the market.

As an example of a potentially successful idea, say you want to open a bicycle repair shop. You’re good at fixing bikes, and there isn’t already a shop in your town, so bike owners currently have to travel a long way to have their bikes serviced. This business idea potentially allows you to do work that you’re good at and to fill a need within your town.

How to come up with business ideas

Think about what you’re good at. Start by making a list of your interests and hobbies, and think carefully about whether any of them could serve as the foundation for a business.

Come up with a better solution: Keep an eye out for products that feel cumbersome and services that don’t work well. If you think you can offer a better way to do it, that could be a new business.

Think about niche opportunities: If you live in a city or good-sized town, you could also open a niche business with a narrow audience. In a city with enough people, there’s always demand for specialty stores, artisanal shops, and more. Visit other cities for inspiration, bring those ideas home, and start a business.

When evaluating ideas, it’s also important to think about some of the practical aspects of starting a business. An idea might seem great on paper, but it has to fit within constraints like funding, free time, and more.

Step 2: Research your market

As you narrow down your list of business ideas, it’s important to start thinking about your potential customers and competition. You need to think about how your business will fit into the existing landscape.

Customer research

It’s important to clearly identify who your business’s potential customers are. You should be able to describe your ideal customer and why they will want to use your business. This includes identifying any pain points that your customers have that your business idea will solve.

Surveys

Once you’ve identified your target customers, you need to find them and ask them whether they would actually use your business. Surveying your business’s audience can help you determine whether the demand you envision is really there.

Surveys can also help you learn more about what your audience actually wants out of a business like the one you’re launching. This will help you refine your business idea and better meet your future customers’ needs.

Competitor research

It’s important to consider whether your market can support another business like the one you want to open. For example, say you want to open a daycare center. Are daycare centers in your area operating at capacity and putting new families on waitlists? If so, that’s a promising sign there will be plenty of demand for your new daycare center.

💡 Pro Tip:

Competitors in your city might not be willing to share detailed information about their sales or how busy they are. But business owners in other cities—for whom your business is not a direct competitor—may be more willing to offer revenue data and advice.

Step 3: Create Your Business Plan

Once you have a business idea in mind, the next step to starting a business is to flesh it out with a detailed business plan.

Your business plan is the blueprint for your business. It should identify who your target customers are, how you’re going to run your new business, how you plan to make money, and more. It should also lay out a roadmap for your launch and identify key milestones you’ll hit along the way.

The goal of a business plan is to make a convincing case that your business can succeed.

While a business plan isn’t strictly required to start a business, it’s a document that every business owner should create.

You’ll need a business plan if you want to solicit funding to start your business. Potential investors will almost always ask for your business plan. If you need to give a presentation or apply for a grant, you can create materials based on the details in your business plan.

Even if you aren’t planning to seek funding, it’s still worth creating a business plan. Writing one out can help you ask hard questions about your business idea. It offers a chance to thoroughly vet your roadmap and lay out the tasks you’ll need to accomplish to be able to launch.

What should your business plan include?

Your business plan should be a comprehensive document that lays out your vision for your business and why the world needs it. Here’s how you can break your business plan down into different sections.

Executive summary: Although the executive summary is the first section of most business plans, you’ll want to write it last. The summary should succinctly describe the business you want to create, what it will do, and why it will succeed.

Business description: Lay out the scope of your business, including what market you’re entering and with what products or services. You should emphasize what problems your business solves and why you’re the best person to create this business.

Market research: Present the research you conducted on your potential customers and competitors. If you’re presenting your business plan to investors, be sure to mention industry growth rates and other trends that work in favor of your business.

Organizational structure: Explain how your business will be organized and how many employees you expect to hire. If you’ll have a management team, identify any potential candidates you’ve approached about working with your business and explain why they are a good fit.

Mission: Lay out your business’s mission statement. This should be brief and centered around the problem your business aims to solve.

Goals: Highlight specific goals that your business hopes to accomplish. This could be achieving a certain amount of revenue or opening a certain number of locations. Your goals should be actionable and you should be able to measure progress towards them.

Products and services: Explain the specific products or services your business will sell. Go into as much detail as possible and cover the rationale behind each offering.

Marketing: Detail how you plan to market your business to customers. Your marketing plan will likely evolve over time, but the ideas you include here should be well thought-out and clearly target your business’s intended audience.

Financial plan: Provide a detailed estimate of costs and revenue. Be realistic about startup costs and consider offering a range of revenue estimates based on different scenarios.

If you’re seeking outside funding to start a business, explain exactly why you need investors’ funds and what they will be used for.

Step 4: Decide on Your Business Structure

Businesses can have different structures for legal and tax purposes. Before you start a business, it’s important to understand the different options so you can choose the business entity that’s right for your situation.

Sole proprietorship

By default, a new business is structured as sole proprietorship. In this legal structure, you and your business are the same from a legal and tax standpoint.

The benefit of a sole proprietorship is that it’s simple. You don’t have to register with your state, like you do for other business structures, and you can pay your business taxes alongside your personal taxes.

The drawback of this legal structure is that if your business were to fail and go bankrupt, you have personal liability for any business debts. In other words, all of your personal assets—like your home and savings—are at risk if something happens to your business.

If you don’t plan to have employees or your business will be a side hustle, then a sole proprietorship may be sufficient. However, once your business has employees or you’re working on your business full-time, it’s typically a good idea to convert to a corporate structure to protect yourself from liability risks.

Limited liability corporation (LLC)

An LLC is one of the most widely used structures for small businesses. It turns your business into a standalone corporation that’s legally separate from you. So, unlike for a sole proprietorship, you are not liable for your business’s debts if an LLC goes bankrupt.

Many business owners choose to set up their business as an LLC to take advantage of the legal protections this structure provides. LLCs also enable your business to have multiple owners. This is beneficial if you want to share ownership of your company with a family member or if you need to sign over partial ownership as part of a funding arrangement.

Notably, an LLC doesn’t change your business’s tax status. You’ll still pay taxes as if you and your business are the same entity.

To set up an LLC, you’ll need to file with your state’s Secretary of State and pay a filing fee. This varies by state and can range from $50 to $500. You’ll also need to file an annual report, which comes with an annual fee ranging from free to $800 per year.

C-corporation

A C-corporation is a type of business structure that allows you to issue ownership shares in your company. It is most commonly used by businesses that want to attract funding since shares are a convenient way to pass ownership to investors.

Like LLCs, C-corporations provide liability protection for business owners. C-corporations also need to file annual reports with their state, which are similar to those required for LLCs.

However, C-corporations have very different tax regulations from LLCs. You must file taxes for your C-corporation separately from your personal taxes. Federal and state tax rates for C-corporations are often higher than those for individuals.

If your C-corporation issues dividends—cash payments or ownership shares—to shareholders, you must pay personal income taxes on these dividends. So, you could end up being double-taxed on your business’s profits: once when you file your corporate income tax return, and again when you file your personal income tax return that includes dividend payouts.

S-corporation

An S-corporation is a special designation that can be applied to either LLCs or C-corporations. It’s designed to prevent double taxation on dividends. With an S-corporation, you don’t have to pay personal income taxes on dividends paid to you by your business. So, setting up an S-corporation can save you money compared to a C-corporation.

However, there are limitations to how many owners an S-corporation can have and what types of shares they can issue. So, the S-corporation structure is best used for LLCs and C-corporations with only one or a handful of owners.

Once you choose your business structure, you’ll need to register your business with your state and the IRS. We’ll cover how to do this in Step 6.

Step 5: Choose Your Business’s Name

Now comes one of the most fun parts of launching a new business: choosing your business’s name.

You want to choose a name that’s memorable and to the point. If you name your painting business ‘Dave’s Painting,’ everyone will know exactly what you do as soon as they see your business’s name.

Clever or playful business names can work, but only if they’re easy to understand. If you name a pizza place ‘Saucy,’ people who see your sign but don’t know anything else about your restaurant might not have any idea that you sell pizza. It’s a good idea to ask potential customers what they think of a clever business name before you decide to use it.

In addition, make sure that your business name isn’t taken by another business already. You can do this with an internet search or by searching your state’s business registry.

If you’re planning on having an online presence, it’s also a good idea to claim a domain name that matches your business name at this stage.

Step 6: Register Your Business

Next, it’s time to make your new business official.

For LLCs and corporations, you must apply online with the IRS for an employer identification number (EIN), also known as a federal tax identification number. This is the number that you’ll use to file taxes on behalf of your business.

The online application requires you to enter:

- Your business’s structure

- How many owners your business has

- What state your business is located in

- The reason you’re requesting an EIN—select ‘Started a new business’

- Your name and Social Security number

- Your business’s name

- Your business’s address

You’ll receive your EIN immediately after completing the application.

You’ll also need to register with your state’s Secretary of State. This process is usually conducted online and asks many of the same questions as the EIN application. In most states, you’ll need to pay a filing fee that ranges from $50 to $500.

If you structure your business as a sole proprietorship, you don’t need to register with the IRS or your state. However, you can still apply for an EIN, which many banks require in order to open a business bank account.

Apply for local licenses

Some states and cities require licenses and permits above and beyond simply registering your business. For example, you might need a license from your city to operate as a contractor or to run an auto repair business.

License requirements vary depending on where your business is located, how many employees you will have, and what type of services you offer. You’ll need to contact your local government to find out what licenses you need.

💡 Pro Tip:

You will quickly start to accumulate a variety of important legal and fiscale documents. Some of them will need to be updated or renewed regularly, too. Keep everything together with a good document manager for stress-free business operations.

Step 7: Set Up Your Business Finances

There are a few steps you can take to get your business’s finances off on the right foot.

Open a business bank account

A business bank account is a necessity for LLCs and corporations so that you can keep your personal cash and your business’s cash separate.

You’re not required to have a business bank account as a sole proprietor, but it’s still a good idea. It looks a lot more professional to pay suppliers from an account with your business’s name than it does to pay them from your personal checking account.

Most banks and credit unions offer business accounts, and many offer zero-fee or low-fee accounts. One thing to keep in mind when choosing a business bank is that small, local banks can offer more personalized banking relationships than large, national banks. That’s important if you think you might need a business loan in the future.

📚 This Might Interest You:

Check out our full guide to the benefits of opening a business bank account.

Get a business credit card

You don’t need a business credit card, but it can make purchasing supplies for your business a lot easier. Just like you don’t want to mix your personal and business bank accounts, you shouldn’t put business purchases on your personal credit card.

Many business credit card issuers will issue a card based on your personal credit score, so it’s not a problem that your business is new. However, you usually need good to excellent credit to qualify for a business card.

Decide on an accounting system

Keeping track of all the money coming in and out of your business is extremely important. Detailed transaction data is required for filing taxes and it also gives you a window into your business’s financial health.

There are two main options for bookkeeping and accounting: you can do it yourself or hire an accountant.

Doing your own bookkeeping can save money compared to hiring an accountant. Accounting software makes it fairly easy to keep track of sales receipts, invoices, and expenses. You’ll pay around $300-$1,500 per year for reliable accounting software.

Hiring an accountant is more expensive than doing your own bookkeeping and accounting, but most business owners will feel more confident that the work is being done correctly. Many big accounting firms even provide audit protection, meaning they’ll cover costs if your tax returns are audited by the IRS. Hiring an accountant costs around $1,000-$5,000 per year.

Step 8: Consider Startup Financing

Most businesses require investment to get off the ground. Before you start considering funding options, though, you first need to know how much startup money you need.

Think about the major expenses your business will have in its first 6 months. These might include:

- Rent for a physical storefront

- Modifications to your building

- Employee wages

- Equipment

- Inventory

- Business insurance

- Website costs

- Office software

- Licensing and registration fees

- Utility costs

You also need to consider whether your business will be bringing in revenue during those first 6 months and whether you plan to pay yourself during those months.

For some businesses, it might take longer than 6 months to get off the ground. In that case, you might need funds to power your business for 12 months or even longer.

Add up your estimated expenditures to get an idea of how much capital you need. From there, you can decide what path you want to pursue to seek financing for your new business.

Self-financing

If you have the savings available to launch your own business, self-financing is a straightforward option. You simply pay for your business’s expenses out of pocket, with the expectation that your business’s future profits will more than make up for this initial expenditure.

Self-financing won’t work for many capital-intensive businesses, but it can be a good option for small businesses with minimal costs. For example, many freelancers, repairmen, restaurateurs, and small shop owners self-finance their businesses.

Of course, self-financing your business means risking a significant amount of your own money. If your business doesn’t succeed, you won’t be able to recover any of the funds you invested in it.

Family and friends

Sourcing funding from family and friends is another way to get your business off the ground. Typically, family and friends can offer better funding terms than banks and professional investors.

You can structure family and friends funding as a loan, which you’ll pay back with interest just like a bank loan.

Note that there are serious risks to getting funding from family and friends. You could strain personal relationships if something goes wrong with the business. It’s important to have clear agreements in place that protect everyone involved.

Small Business Administration (SBA) loan

The SBA offers several loan programs to help you start a business. Microloans offer up to $50,000, while 7(a) loans offer up to $5 million. SBA loans have lower interest rates than many other types of small business loans. Plus, you can qualify for them even if your business is just getting off the ground.

To get an SBA loan, you must apply through an SBA-approved lender—typically a bank or credit union. There’s a lot of paperwork involved, but the good news is that you don’t have to give up any ownership of your business when funding yourself with an SBA loan.

Small business grants

Small business grants are a lot like loans, except they don’t need to be paid back. The debt is simply forgiven once certain requirements are met.

Small business grants are available from a variety of sources, including the SBA and many local governments. Typically, grants are designed to promote certain categories of businesses, such as minority-owned businesses or businesses in low-income areas.

Personal loan

If you only need a small amount of money to launch your business and don’t qualify for an SBA microloan, a personal loan is another option. Personal loans typically have higher interest rates than SBA loans, but they’re much easier to get.

You can take out a personal loan from most banks as well as a wide range of online lenders.

Professional investors

While venture capitalists are best known for funding Silicon Valley startups, they can also provide funding for local small businesses.

Professional investors can offer relatively large amounts of capital, which makes them ideal for businesses with high startup costs. Some angel investors also offer mentorship for new business owners, which can make this type of investment even more valuable.

Importantly, venture capitalists and angel investors typically don’t offer loans. Instead, they will fund your business in exchange for an ownership stake. Giving up an ownership stake can significantly reduce your long-term profits if your business is successful.

Crowdfunding

Crowdfunding campaigns can be a good option to get the funding to start a business. These campaigns enable you to raise small amounts of money from hundreds or even thousands of individual backers. Crowdfunding typically takes place online through dedicated platforms such as Kickstarter and GoFundMe.

Crowdfunding requires strong marketing skills. You need to make your idea stand out in a sea of ideas that are all competing for funding. You also need to communicate frequently with people who have backed your business as you go from funding to launch.

Step 9: Invest in Business Insurance

Business insurance is one of the best expenditures you can make when launching a new business. With a business insurance policy, you can feel confident that unfortunate incidents like theft or a cyberattack won’t sink your business.

There are many different types of business insurance policies available, so it’s important to understand what kind of hazards your business faces. It’s a good idea to talk to an experienced insurance agent who can build a custom policy for your business.

Some of the key things to look for protection against include:

- Theft

- Property damage

- Business interruption due to a natural disaster

- Customer lawsuits

- Cyberattacks

- Worker’s compensation claims

- Vehicle accidents

Step 10: Set Up Your Supply Chain

Establishing a supply chain is a huge task that can make or break your new business. It’s important to think carefully about what raw materials to use to make products, what software to use to power your day-to-day operations, and more.

We’ll break creating a supply chain down into a few key components you need to consider.

Supplies and materials

Virtually all businesses need some sort of supplies. A toy shop needs toys to sell. A plumber needs faucets and valves. Restaurants need raw ingredients. Even professional businesses like law offices need paper and pens.

Who you get your supplies from matters. It’s important to choose vendors who not only have the materials your business needs, but who can reliably deliver high-quality supplies every time you place an order.

Communications and software tools

Most businesses today rely on a wide range of software platforms to run smoothly. Types of software your business might need include:

- Team scheduling software

- Employee time tracking software

- Training & onboarding software

- Employee communication software

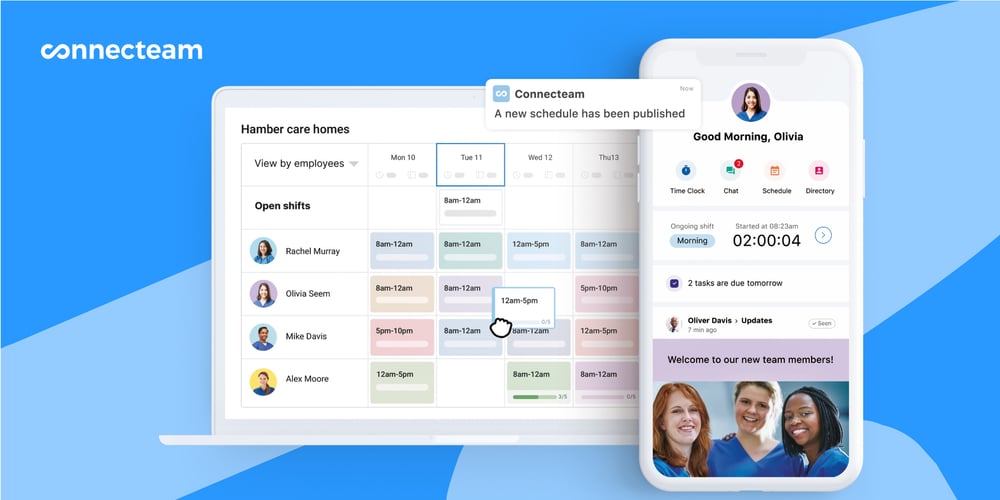

The most straightforward solution is to use a single platform that provides all of the features. For example, Connecteam has all the tools you need to manage operations, communicate effectively, train and develop teams, and stay compliant with local and federal regulations.

You can create schedules in minutes, build out recurring or one-time tasks lists, add forms and checklists to shifts, and even manage your employees’ and your own time on the job with comprehensive task tracking—an essential productivity tool for small businesses just getting off the ground.

A simple app for updates, secure instant messaging, and surveys ensure everybody stays aligned as your company grows. And as your operations become more complex, you can easily document everything in your Knowledge Base and share it with team members, vendors and suppliers, and more.

Finally, you can save yourself time and money by keeping all your employment and tax documents in one place. Tools for training and onboarding, recognition and rewards, and time off will help keep you and your new employees productive, motivated, and happy.

Connecteam stores all your operations securely in the cloud, so you can access tools, schedules, documents and more from anywhere and at any time. Best of all, it’s 100% free for small business with up to 10 employees, while premium plans for larger teams start at only $29 for up to 30 employees.

Payment systems

Your business also needs a way to accept payments other than cash. If you want to accept credit and debit cards, you’ll need a point-of-sale (POS) that can process card payments.

POS providers vary widely in what they offer and how much they charge. Many POS terminals include built-in accounting and inventory tools, which can save your business money on standalone software.

How to choose suppliers

When choosing vendors for your business’s supply chain, there are a few key things to consider.

- Reliability is critical when it comes to your suppliers. There’s nothing worse than seeing your business suffer because a supplier didn’t follow through on an order.

- Quality. The quality of a vendor’s product also matters. High-quality ingredients make for a better restaurant. High-quality components make for better, longer-lasting products.

- Value: Vendors can charge very different prices for similar products. Some offer discounts for large orders or contracts for repeated orders.

- Product fit: You need software, materials, and other supplies that fit your business’s specific needs. Make sure the products you purchase are what your business needs instead of settling for something good enough.

It’s a good idea to explore several vendors for each product, software, or payment system your business needs. That way, you can learn about the options available and directly compare quotes between vendors.

Step 11: Set Your Prices

There are a few different approaches businesses can take to set pricing. We’ll focus on cost-plus pricing, which is what most businesses use, and touch on alternative approaches.

Cost-plus pricing

Cost-plus pricing involves setting prices based on how much it costs to offer a product or service. You need to know—or estimate—your costs, the number of products or services you expect to sell, and the profit you want to make.

You can calculate the price to charge as:

(Target profit + Operating expenses + Cost of inventory)/Number of products sold = Price per item

As an example, say you want to open a t-shirt store. For simplicity, we’ll assume that all of your t-shirts are the same price.

Say you pay $6 per t-shirt to your supplier and the total cost of running your business—including employee salaries, rent, software fees, and any other costs—is $20,000 per year. You expect to sell 2,000 t-shirts per year and aim to make a net profit of $25,000 in your first year.

Following the formula above, you can calculate the price you should charge for your shirts as:

($25,000 + $20,000 + $12,000)/2,000 = $28.50

💡 Pro Tip:

When setting pricing, think about whether you’ll offer discounts. Discounts can be a good way to bring in customers, but you might need to set your base prices higher to ensure you turn a profit.

Alternative pricing approaches

While cost-plus pricing works for many businesses, you may want to consider other approaches. Some alternative pricing methods include:

- Competitor pricing: Base your pricing on what competitors are charging for similar products or services. This works well if you are selling highly commoditized products or services that customers can easily get from another business.

- Value-based pricing: Set prices based on what customers are willing to pay for a product or service. This type of pricing works best for businesses with highly unique products, such as artwork.

- Penetration pricing: Offer low prices for a limited time that may be below what competitors are charging or even below your cost of production. The goal is to attract customers to your business and take market share away from competitors. You may have to raise prices later, which can lead to losing customers.

Step 12: Develop a Marketing Strategy

Marketing is key to letting potential customers know about your new business and closing your first sales. In fact, your marketing strategy can be the difference in whether your business succeeds or fails. It’s that important.

There’s a ton to think about when it comes to marketing. Here are some of the critical things to consider.

Build your brand

Building a brand makes your business more memorable for customers. That’s important because when someone asks one of your customers for a recommendation, they’ll think of your business first.

Your brand can include elements such as your business’s name, logo, and color scheme.

It’s a good idea to work with a professional graphic designer to create your logo and choose brand colors. Designers know how to create simple, memorable logos that embody your business’s products or mission.

However, if you’re on a tight budget, you can also create your own logo. There are many free logo design tools available online, including from Logo.com and Canva.

💡 Pro Tip:

A quick and simple “style guide” will help ensure brand consistency, especially when you start working with designers and copywriters. Keep all your brand assets in one place with Connecteam’s Knowledge Base and easily share them with stakeholders.

Choose your marketing channels

There are tons of different ways that you can reach out to potential customers. You can share posts on social media, launch an email newsletter, send out physical mailers, or even send out text messages. To reach more people, you can rent a billboard, purchase online ads, or even make a TV or radio commercial.

It’s virtually impossible for you to pursue all of these channels, so you need to focus on the ones that will deliver the best bang for your buck. Let’s take a closer look at some of the different marketing channels available.

Website

Almost every successful business today has a website. It’s the first place most customers will look to find out more about your business.

Your website should be easy to navigate and clearly answer the questions customers will have about your business. These include:

- What products or services your business offers

- How much your products or services cost

- Why should customers choose your business over competitors

- How customers can get in touch

- Where your business is located

- What are your opening and closing times

Your website also offers an opportunity to get discovered through online searches. For example, if you sell pogo sticks, customers can find your business when they search for “pogo sticks” in Google or Bing.

It’s important that your website shows up in the first few search results when a potential customer searches for your product. The way to achieve that is through search engine optimization (SEO).

Good SEO techniques can include setting up a blog, linking to other websites, and having other websites link back to your site. If your website will be an important marketing channel for your business, consider working with an SEO consultant to make your website stand out.

Online directories

Online directories such as Google My Business and Yelp are free to register with and can help customers find your business. After registering for Google My Business, your business will show up on Google Maps.

Customers can also leave reviews on these platforms. So, having a business presence in directories can be a good way to showcase positive experiences customers have had with your business.

Social media

Social media is one of the best ways to connect with your potential customers. There’s a very good chance that your customers are on at least one social media platform, and many people use social media to find and follow new businesses.

Maintaining a strong social media presence can be a full-time job, so it’s important to focus on what really matters. Pick one or two social media networks to have a presence on at first. Which platforms you should choose will depend on your audience.

- Facebook is the largest social media platform and offers built-in features for selling products online. Most users are 35 or older, and Facebook doesn’t have as much engagement as other platforms.

- Instagram has an enormous audience, including many young users. However, it requires you to produce high-quality photos and videos, which not every business owner will be able to do.

- TikTok is one of the fastest-growing social media platforms, particularly among users under 30. It requires you to create video content, but the videos can be short and don’t need to be highly produced.

- Twitter has a large network of users, but it’s mainly used for sharing news and updates. For many businesses, the platform doesn’t lend itself easily to connecting with customers.

- YouTube isn’t as social as other platforms, but it has a huge user base and can be a great place to share videos of your products or services.

When using social media, your first priority should be to engage with your audience. You can create opportunities for users to click through to your website or invite them to visit your business, but you should avoid being overly “salesy.”

Digital advertising

Paid digital advertisements can help your business show up first in online search results or in customers’ social media feeds.

Digital advertisements are really powerful because you can create highly targeted campaigns based on your ideal customer. For example, say your perfect customer is 40, owns a house, and lives in a specific neighborhood. You can target your digital advertisements so that they are only shown to people who meet these criteria.

The benefit of this is that you only pay for advertising that will actually reach your target audience.

Sending an email newsletter to customers is a great way to stay in touch and let them know what your business is up to. Many businesses also use email to offer discounts and special deals to their existing customers.

To get the most out of email marketing, you need to develop a list of customer emails. One way to do this is to offer a discount to customers on their first purchase when they sign up for your mailing list.

Create your first marketing campaign

Your first marketing campaign should generally be around your business’s launch. You want to build excitement about your business and ensure that customers come knocking from the moment you open.

As a startup, it’s important for your first campaign to introduce your business, explain what it offers, and why people should choose it. You might also consider offering a discount or giveaway to customers who visit your business on opening day.

Step 13: Create Your Space

Now it’s time to design your business’s space. This could be a physical storefront, an office, or a website.

This process will be different for every business, so we won’t dive deep into specifics. However, there are a few principles every new business owner should keep in mind.

Stay on brand

Your physical space or website gives customers their first impression of your business. So, you want to emphasize what makes your business stand out—whether that’s being quirky, modern, vintage, helpful, or something else.

Keep it simple

Many new business owners are tempted to build a complex store layout or an intricate website. But the truth is that more complex business spaces are not only more expensive but also more confusing for customers to navigate.

The simpler your design is, the more customers can focus on your product.

Leave room to scale

You don’t want to rent a storefront that’s way bigger than you need or pay for high-traffic web hosting when your site only has a few visitors. However, you do want to plan for the future when setting up your business, which may mean taking on a bigger space than you initially need.

If you have a physical storefront, think about how many people you envision visiting your store at one time if your business is successful.

If you have a website, scaling up in the future is relatively easy. Most web hosts will allow you to move seamlessly from low-cost shared hosting, which is ideal for small websites with low traffic, to dedicated hosting plans that support thousands of site visitors per day.

Launch now, perfect later

Your storefront or website doesn’t need to be perfect before you launch. It’s usually better to launch—and start bringing in customers—as soon as possible. You can always fine-tune your space later.

Step 14: Hire Your First Employees

Depending on the type of business you’re launching, you may or may not need to hire employees at first. A restaurant will need a whole staff of chefs, waitstaff, and busboys, but a painting business or a small retail store could be run by just you.

If you do need to hire employees, you have a few options. You can hire full-time or part-time employees or bring on independent contractors for specific tasks.

Independent contractors are often less expensive than employees, but keep in mind there are strict limits on the level of control you can exercise over their work. Misclassifying employees as contractors can land you in hot water with labor regulators.

No matter what type of employee you hire, it’s important to find the right person for the job. That’s especially true at a new business where every employee needs to wear multiple hats.

Some ways to find employees include:

- Online job boards like Indeed

- Social media

- Physical advertisements around your business

- Freelance platforms like Upwork

Keep in mind that as you add employees, you also need to find ways to manage them. Tools like employee scheduling, team communication apps, and task management platforms, and employee self-service portals can make it much easier to keep everyone on the same page.

📚 This Might Interest You:

Learn how to create an employee handbook for your small business.

Step 15: Launch!

At this point, you’ve done all the behind-the-scenes work and you’re ready to officially launch your new business. Congratulations!

Launching is a huge step that introduces your business to the world. You should be ready to offer what customers want from the moment you launch. It’s very important to make a good first impression.

Keep in mind that it’s not uncommon for business to be slow in your first few weeks. Even with a great marketing campaign, it can take time for word to spread about your business and for customers to give it a try. Be patient in these early days.

Remember, you’ve done a lot of the hardest work just getting to launch. Now it’s time to enjoy running your business!

📚 This Might Interest You:

Explore 11 ways to increase foot traffic to your storefront.

Taking Your Business to the Next Level

If your business is humming along 6 or 12 months after launching, then it’s time to start thinking about ways to take it to the next level. Some options include:

- Hiring additional employees

- Introducing new products or services

- Expanding into new cities or countries

- Targeting new customer audiences

- Expanding your business’s online presence

- Using software to boost your business’s productivity

Think about what your business’s choke points are. Have you saturated your local market and want to open a storefront in a new city? Or are you limited by manpower and need to hire more employees so you can take on more work?

Whatever your path for expansion, you’ll find that it’s easier to get financing to invest in your business once you have a track record of profitability. Many banks and business lenders are willing to offer equipment and working capital loans for businesses that have been operating for at least one year.

Conclusion

Starting a business is a large undertaking and it can be hard to know where to start. After reading our guide, you now know how to go from brainstorming business ideas to launching a new company.

While the path to starting a business is challenging, it’s also extremely rewarding. There’s nothing quite like starting with an idea, turning it into a business plan, and then going through all the steps to bring your business to life.

In order to ensure your business succeeds, it’s important to learn as much as you can about how to start your own business. Check out our guides for launching specific types of businesses, including catering, cleaning, and trucking businesses.

FAQs

What are the initial steps to conduct market research when you want to start a business?

Market research is an essential first step to start a business. It helps in understanding the competition, target audience, and market trends. Begin by identifying your target customer, analyzing competitors, evaluating market size and segmentation, and assessing the demand for your product or service. Utilizing surveys, focus groups, and available market data can provide valuable insights to shape your business strategy.

When starting a business, how do I determine the best legal structure?

Choosing the correct legal structure is vital when you start a business. Options include sole proprietorship, partnership, LLC, and corporation. Consider factors such as your business type, number of owners, potential risks, and financial requirements. Consulting with legal and financial professionals will help you understand the implications of each option and guide you in selecting the structure best suited for your business.

What components should be in a business plan when planning to start a business?

A business plan is a comprehensive roadmap when you start a business. It should include an executive summary, business description, market analysis, marketing and sales strategy, product or service line details, funding request (if applicable), financial projections, and management information. This plan articulates your vision and strategy, and it’s vital for attracting potential investors or lenders.

How do I calculate the capital needed to start a business, and where can I find it?

The capital required to start a business varies widely. Estimate the startup costs, including licenses, equipment, inventory, and operating expenses. Possible funding sources are personal savings, bank loans, angel investors, venture capitalists, crowdfunding, or government grants. Understanding your capital needs and aligning them with the right funding sources is key to successfully launching your business.

What are the common challenges in starting a business, and how can they be overcome?

Starting a business comes with several challenges:

Capital Shortage: Careful planning, exploring various funding sources, and controlling expenses can help.

Market Competition: Focus on creating a unique value proposition and continuously innovate to stand out.

Talent Acquisition and Retention: Cultivate a positive work environment and provide growth opportunities.

Regulatory Hurdles: Stay informed and consult professionals to ensure compliance.

Scaling and Growth: Build a sustainable growth strategy and be adaptable to change.

Facing these challenges requires resilience, strategic planning, and a willingness to learn and adapt, which are crucial in the journey to start a business.