Learning how to ask for payment professionally in messages helps you avoid financial losses while preserving client relationships. We cover 8 practical strategies to use when asking for payment and offer 3 templates for your use.

Not getting paid on time is an uncomfortable situation, especially for small businesses. It doesn’t only endanger your cash flow in the short-term—depending on how you respond, it can also damage client relationships.

Understanding how to ask for payment professionally can protect your finances and integrity. Being polite but firm and outlining your payment terms increases your chances of getting a speedy payment. That said, how you craft your request depends on the context.

We’re here to help. In this guide, we discuss how to ask for payment professionally in messages, emails, and calls. Plus, we offer a simple payment request letter you can use today.

Key Takeaways

- Learning how to ask for payment politely helps you avoid financial losses and client relationship damage.

- Creating a timeline for your payment request communications and giving your client clear deadlines and expectations is useful.

- Tried every alternative? Consider sending a demand letter, getting legal advice, or hiring a debt collection agency.

- Regular communication, employee time tracking, and strict contractual terms help ensure invoices are paid on time.

What To Consider Before Asking for a Payment

Consider these key questions before requesting payments.

Is it your first invoicing email?

Deciding how to ask for payment professionally in a message depends on whether you’ve already invoiced or followed up on your payment. When sending your invoice, assume your client will pay on time. Don’t add any unnecessary pressure or detailed consequences.

Similarly, chasing the payment after multiple follow-ups requires a change in tone or strategy. Say you’ve already emailed the message “The payment is now overdue. Please pay as soon as possible.” Rather than repeating the same message, consider adding new information to your follow-up email.

Are you past the payment due date?

There’s no harm in sending clients a friendly reminder just before your invoice is due. However, that will differ in tone and content from your post-deadline communications. So, ensure the due date has passed before preparing your chase-up strategy.

Are there ongoing communications about the project or payment?

Finalize any conversations concerning your client’s feedback on the services provided before sending follow-up emails regarding missed payments. The client might not have paid because of their perception of the work or amount due. For example, the work might not meet their standards, or they might mistakenly think they owe less than they do. Talking can help resolve disputes or misunderstandings.

For longer, more-complex projects with payment milestones at different phases, apply this advice for each billable phase to resolve problems as they arise.

How To Ask a Client for Payment Professionally

Here’s how to ask for payment professionally using 8 practical strategies.

Be polite but firm

Being rude can burn bridges with your client. Meanwhile, being vague could delay the payment further. However, there’s a middle way. Knowing how to ask for payment politely and firmly paints you as a professional who’s able to stay profitable while nurturing long-term relationships.

For example, “Send the payment by X date or you’ll hear from my lawyer” sounds aggressive, while “Friendly reminder that the bill isn’t paid, thanks” is too soft to speed things along. A polite and professional alternative is “The amount of [$$$] is outstanding. Please complete the payment per our agreement by [date]. Let me know if there are any issues.”

Set clear deadlines and expectations

Adding deadlines and expectations to your communications, including your initial invoicing email, adds gentle pressure on your client to pay the invoice.

When invoices are overdue, set new payment due dates alongside expectations and consequences. Also, plan the milestones at which you’ll send payment reminder emails to your client.

These could be:

- 1 day after the original due date: Offer a 1-week extension of the deadline.

- 2 weeks after the original due date: Offer an extra 2 weeks while adding additional payment methods or a payment plan solution.

- 1 month after the original due date: Request prompt payment within 48 hours and lay out consequences—like a collection agency intervention.

Follow up when clients don’t meet deadlines

Send a simple payment request letter each time the client misses a payment due date. This adds urgency to the payment process while signaling you take deadlines seriously.

Send an email the day after a missed deadline. Mention the date the payment was expected and the new deadline. Following the “polite but firm” principle, you can:

- Call the extended deadline a gesture of goodwill.

- Thank the client in case they already sent the payment but you didn’t receive it.

Bring up your payment terms

Knowing how to ask for payment in an email also involves referencing your payment terms. By reiterating these terms in your chase-up, you’re gently reminding the customer of the consequences of not honoring your payment agreement.

Pro Tip

Use formal contracts to set out payment terms. If creating a formal contract isn’t feasible, aim to have the client’s written confirmation of your payment terms via email before starting the work. Your terms should include cost per unit of service/product and payment due date.

You might consider referencing these terms in your emails:

- The maximum payment window clients have upon receiving the invoice.

- Any fees or interest due while the payment is outstanding.

- Your right to suspend services while invoices are unpaid.

- The need for the client to provide prompt communication regarding invoice concerns.

Did You Know?

Connecteam offers a company knowledge base that provides secure and accessible e-document storage for your business-critical docs—including client contracts. You can upload and view your files wherever you are and decide who sees them. There’s no limit to the number or size of documents you add.

Get started with Connecteam for free today!

Re-state project deliverables and timelines

You can also re-state project details in your invoicing and follow-up emails, including deliverables and timelines. This showcases the high-quality work you provided that the client hasn’t yet paid for.

Plus, it helps in cases where your main stakeholder forwards your payment request to team members less familiar with your work. Payment delays might be due to internal miscommunication or confusion around the work provided. Thus, clarifying the service linked to the payment can lead to a faster payment.

Propose a payment plan

Consider offering your client a payment plan, such as monthly installments over 3 months. This can serve as an incentive to start processing the payment and is an alternative to expensive procedures like hiring collection agencies. It’s especially useful when the invoice amount is large and/or your client is experiencing financial difficulties.

In addition to a flexible payment option, offer alternative payment processing methods, like:

- Credit card

- Digital wallet (for example, PayPal or Venmo)

- International transfer

Pick up the phone

Phone calls are harder to ignore than emails and provide clients with the opportunity to ask questions or share concerns. These can include, for instance, news of internal reorganization at the client’s company or perceived flaws in the delivered project.

Knowing how to ask for payment professionally in a message can also help. Text your client on short message service (SMS) or a business communication tool like Slack. Instead of sending a lengthy text, say, “Hi [name], I trust you’ve seen my recent email regarding the outstanding invoice. Are you free for a short call today or tomorrow?”

Send a demand letter

A demand letter is a formal way of requesting payment. Usually written by legal representatives on behalf of business owners, it comprehensively outlines the terms of the agreement and asks the client to pay the invoice.

This step signals to the client that non-payment is a serious issue and that paying now is better than waiting for a legal escalation. So resort to a demand letter only if you’ve run out of options and don’t think you’ll get your money otherwise.

You may wish to specify further escalations such as a lawsuit, especially if you’re owed significant income. But be aware this could burn bridges with your client.

Your demand letter should include:

- Invoice number

- Description of rendered services

- Amount due

- Payment methods

- Agreed-upon payment deadline and time elapsed since

- The new deadline

- Consequences of not paying

How To Ask for Payment in an Email: Templates

Here are 3 versions of a simple payment request letter for your initial invoicing email, your 1st invoice follow-up, and a subsequent follow-up further down the line.

Template 1: Invoice email

Timing: After the completion of the project or milestone

Subject line: [Your name/company] – Invoice #[number]

Email body:

Dear [client name],

It was a pleasure to work with you on [brief project summary].

Please find attached invoice #[number] for [type of service]. You will find a cost breakdown and total, as well as our bank details, in the document. Note the payment due date is [date].

Let me know if you have any questions. Thank you!

Best,

[your name]

Template 2: 1st invoice follow-up

Timing: 1 day after the due date

Subject line: Invoice #[number] Payment Reminder

Email body:

Dear [client name],

Hoping you are well.

Please find re-attached invoice #[number] for [type of service], which was due yesterday, [yesterday’s date]. I’d like to double-check that you received it when I sent it on [date the invoice was sent].

Since we haven’t received the payment amounting to [invoice total], I’m writing to request that the payment is made by [new due date].

Please let me know if you have any questions or have already made the payment. Thank you.

Best,

[your name]

Template 3: Subsequent invoice follow-up

Timing: 1 week, 2 weeks, or 1 month after the due date

Subject line: Request for Payment – Invoice #[number]

Email body:

Dear [name],

I trust you received my previous emails.

As a reminder, the invoice #[number] for [type of service] was due on [due date]. As it’s now [amount of time] overdue, I’m requesting the outstanding amount of [invoice total] to be paid as soon as possible.

Please find attached a copy of the invoice and the signed project agreement for your convenience.

To recap, we’ve delivered:

- [list of items quoted on the invoice and the dates delivered].

As per the signed agreement:

- [relevant terms from the agreement, such as interest accrued for outstanding payments or maximum time allowed for non-payment].

I’m sure we’d both prefer to resolve this matter amicably without involving third parties. Thus, I look forward to receiving your payment by the new deadline of [new due date]—which we’ve extended as a gesture of goodwill.

If you have any questions or concerns regarding this payment, let me know as a matter of urgency. I am also available for a call on [phone number].

Thank you.

Best,

[your name]

What To Do if Your Client Doesn’t Pay

Despite your efforts, your client might fail to pay.

Here are your options.

Cease your working relationship

You could decide the loss is small enough to stop chasing the payment—and never work with that client again. This saves you a future headache. In some cases, it could even help clear the bill. For instance, when services are on a retainer basis or a follow-up project is expected, threatening to cut off supply can force the client to pay.

Get legal advice

Speak to a legal advisor like an attorney to understand your options. You may, for instance, be able to file a suit in a small claims court. Be sure to get comprehensive advice before you threaten your client with legal action, though.

Hire a collection agency

Research which collection agencies are best suited to your circumstances, including your business size, debt amount, industry, and location. Many agencies recover payments only +90 days past due. Also, consider whether the costs of the collectors’ services are worth it.

How To Increase Your Chances of Invoice Payment

Increase your chances of timely payments with these top tips.

Track project hours

Avoid any doubt about your invoice accuracy by tracking your team’s hours worked as evidence of project outcomes, and send a time report alongside your invoice. There are several methods of tracking workers’ time, but the easiest and most secure is using a time tracking app.

Did You Know?

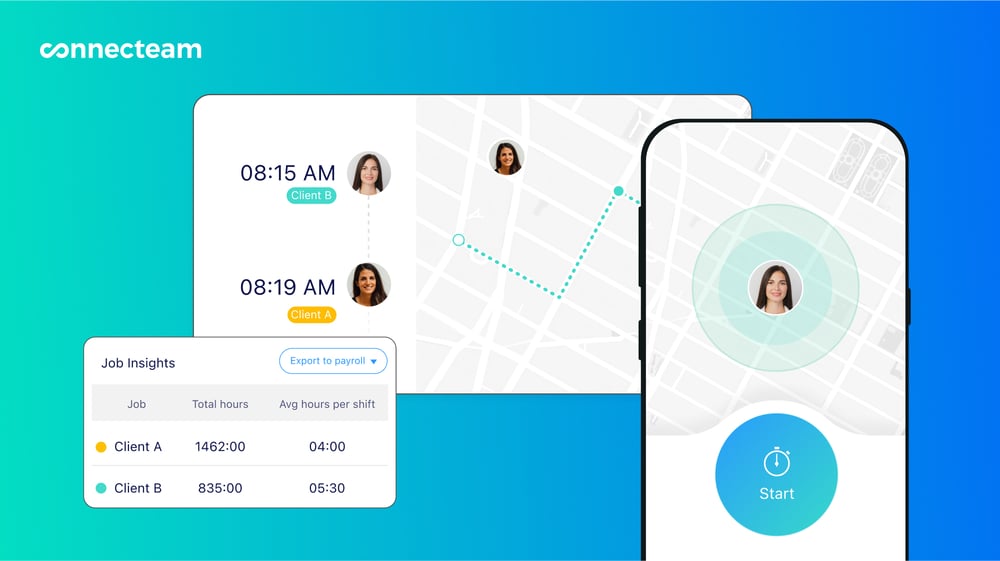

Platforms like Connecteam let staff members clock in and out or add time worked manually. Our app automatically calculates total time worked per individual, team, and project. Export employee time tracking reports in just a few clicks to provide crucial evidence with your invoice.

Client communication

Communicating with your client clearly and regularly helps tackle invoice issues earlier. For instance, you may learn that your client’s operations team is understaffed or your main stakeholder is on extended leave with no access to emails. Such knowledge can inform the way you craft your payment requests.

Plus, effective communication—including rapport building and regular project check-ins—strengthens the relationship between you and your client. This lowers the chances they’ll disregard your invoice due date and saves you from needing to figure out how to ask for payment politely.

Create a good contract

The best way to make payments legally binding is to prepare a formal contract. So before starting your client work, make your contract bulletproof. Strict payment terms discourage customers from making late payments.

For instance, consider including:

- Price per unit of service (for example, hours) or project milestone.

- Advance payment amount to be paid before the project start.

- Penalty fees on late payments.

- Interest charged per day/week on overdue payments.

Conclusion

Waiting on overdue invoices can strain your client relationship and cash flow. However, knowing how to ask a client for payment can get you past this hurdle. Being polite and firm, setting deadlines and following up, and resorting to demand letters when all else fails are some effective strategies.

You can use our email templates to ask for payment professionally to improve your invoicing and follow-up strategies today. Also, remember to create contracts with strict payment terms, communicate regularly with clients, and provide time tracking reports to ensure you’re paid on time in the future.

Connecteam is an all-in-one employee management app that helps you track hours and store vital documents. In addition, you can manage schedules in one place, chat with team members in real time, and more.

FAQs

Do payment reminders work?

Payment reminders—reminders sent 2 to 3 days before invoices are due—can be effective. They can prompt forgetful clients or clients with recurring payments to remember to pay on time.

How do you ask for an advance payment professionally?

Send a polite and concise email or letter outlining your request. Explaining the reasons for the advance payment (for instance, it might serve as a sign of the client’s commitment). Finally, specify the amount of advance payment needed. Here’s an example: “Dear [name]. As specified in our contract, [your company] will need an advance payment of [$$$] before beginning your project. This will help cover initial project costs.”

Disclaimer: This article offers general guidance on professional payment requests and isn’t a substitute for legal or professional advice. Individual situations may vary, and we recommend consulting with appropriate advisors. Connecteam isn’t liable for any outcomes—including costs—resulting from the use of this information.