Overtime and double time pay are important incentives and compensation for employees who work beyond their standard hours. This article explains how to understand the differences, how to determine which type of pay to use, and how to calculate the correct payout.

Understanding payroll terms can feel challenging, especially when it comes to additional employee compensation like overtime and double time. What exactly is overtime, and what is double overtime? And how are they different?

It’s important to understand the differences between overtime and double time. Misinterpreting these terms can result in payroll errors, non-compliance with labor laws, increased costs, and even legal repercussions.

That’s why we’re here to help. In this article, we help you understand what double overtime is and how it differs from overtime. We also explain how to calculate double time and overtime, so you’re prepared to pay your employees what they’ve earned.

Let’s jump in.

Key Takeaways

- Businesses should understand overtime vs. double time to avoid payroll errors and non-compliance with labor laws.

- Overtime pay is typically 1.5 times an employee’s regular hourly wage.

- Usually, employees who work more than 40 hours in a given week must receive overtime pay, but laws vary by state.

- Double time pay amounts to twice an employee’s regular wages. It’s typically for special circumstances like holiday work or excessive overtime.

What’s the Purpose of Double Time and Overtime?

Put simply, overtime and double time incentivize and compensate employees working more than the standard set of hours. These standards are set by law, whether that’s the Federal Labor Standards Act (FLSA) or individual state labor laws.

Because United States laws require overtime pay, and California law requires double time, employers must understand these concepts to comply with labor laws.

Why Should Employers Understand Overtime vs. Double Time?

Understanding the differences between overtime and double time will enable you to:

- Pay your employees correctly for their time. They deserve to receive accurate pay for their extra work. Employees who don’t receive the overtime or double time pay they’re owed may bring lawsuits against your company to claim these unpaid wages.

- Comply with labor laws. This ensures you maintain a fair and legal workplace. Failing to comply with these laws can lead to legal penalties, including back pay and fines, or even lawsuits.

- Protect your reputation. Not paying legally mandated overtime wages can impact your business’s reputation and prevent future success. For example, candidates might avoid applying to your open positions if they know you don’t pay overtime and double time properly. Similarly, customers, clients, and other organizations might refrain from doing business with you.

What Is Overtime?

Overtime is any time worked past the standard workweek. In most cases, a workweek is 40 hours.

When an employee works more than the standard 40 hours, they’re paid what’s known as overtime pay. Typically, overtime pay is 1.5 times the employee’s regular wage rate. For example, if your employee earns a regular wage of $20/hour but works 45 hours in a week, they’ll earn $30/hour for 5 of those hours.

The federal government has established overtime standards through the FLSA. It sets a national 40-hour threshold after which an employer must pay their employees overtime pay.

However, this threshold may differ in some states. And some states, like California, require employers to pay overtime to employees who work more than 8 hours a day instead of more than 40 hours a week. This is known as “daily overtime.”

Overtime rates can depend on state laws, too. Although none currently pay less than the federal rate (1.5 times the regular wage), this is open to change. Some states also provide additional overtime benefits—like double time.

Who gets overtime?

You don’t have to pay all employees overtime. Employees are either “exempt” or “non-exempt” from overtime under the FLSA.

Exempt employees usually don’t receive overtime pay, even if they work more than the standard hours. It’s most common for hourly workers to receive overtime pay, but some salaried workers are eligible as well.

To be classified as exempt, employees must meet specific criteria. Exempt employees:

- Earn at least $684 per week or $35,568 per year.

- Are paid a consistent wage each week regardless of hours worked.

Employees who are considered executive, professional, or administrative professionals based on their duties may also be exempt.

States and local jurisdictions can have different or additional overtime exemptions. For example, Maine has a higher salary requirement than the FLSA for determining exempt employees. Under Maine state law, an employee must earn at least $796.17 a week or $41,401 a year to qualify as exempt.

When there are differences between local and federal laws, employers must generally comply with the law that benefits the employee the most.

Employers can still offer exempt employees overtime pay, although the law doesn’t require them to. For example, some employers might offer all employees, including exempt employees, overtime pay for working over a certain number of hours. Some unionized employees might also be entitled to overtime pay.

In California, where employers must pay employees double time, the criteria for being exempt from overtime and double time are typically the same.

Pro Tip

Consult with a legal professional to ensure you properly classify your employees as exempt or non-exempt.The Department of Labor and your state labor department can offer further guidance.

What Is Double Overtime?

Double time, also called double overtime, is a payout that’s typically twice an employee’s regular wage. For example, your employee’s $20/hour wage would become $40/hour with double time.

Double time is less common than traditional overtime. It’s usually used in special situations, outlined in employment contracts or union agreements.

An employment contract spells out the agreement between the employer and employee, including the conditions and terms of the employment relationship—such as wages, hours, and benefits. A company might choose to offer double time pay (and overtime pay) and outline this offering in an employment contract.

Similarly, union agreements—which outline fair working conditions, wages, benefits, and other privisions—might detail specific double time (and overtime) requirements.

Did You Know?

Connecteam lets you upload, share, and store important team documents like employment or union contracts so you can keep information centralized and easy to access.

California is the only state that legally mandates double time. There, employers must pay “daily double time” to employees who work more than 12 hours in a day.

When do companies offer double time pay?

Companies typically offer double time for holiday work or excessively long hours. For instance, an employee who works on Christmas Day might receive double time pay for giving up a holiday to work.

In industries with safety concerns (like healthcare or construction), unions often negotiate for double time pay to ensure worker safety and well-being. In these industries, fatigue can lead to accidents in these jobs. By asking for double time pay, unions encourage employers to prioritize reasonable working hours and adequate rest for workers.

Differences Between Double Time and Overtime

Although double time and overtime have similarities, it’s important to understand their differences so you can accurately compensate your employees.

Pay rate

The biggest difference between double time and regular overtime is the pay rate. Overtime is typically 1.5 times an employee’s regular rate of pay, while double time is twice the employee’s regular hourly rate.

Applicability

Overtime and double time apply to different scenarios.

Employees are entitled to overtime when they work more than 40 hours in a single week—or, in some states, when they work more than 8 hours a day. It’s common for workers in most industries to receive overtime when they work extra hours.

On the other hand, double time is offered when employees work beyond typical overtime hours. An employee who works on Thanksgiving, for instance, might receive double time.

In addition to California’s requirement to pay daily double time for daily hours exceeding 12 hours, the state also mandates double time if an employee works more than 8 hours a day on the seventh consecutive day of a given workweek.

Legal requirements

Federal law mandates overtime pay for excess hours, and all states adhere to this law. However, regulations rarely mandate double time. An exception is California’s requirement that employers pay double time for any time worked over 8 hours on the seventh consecutive workday.

This Might Interest You

Looking for software to help track your workers’ overtime? Check out our list of the best overtime tracking software.

How To Calculate Double Time Pay

Calculating double time wages doesn’t have to be stressful. Follow the steps below for a simple calculation.

First, you’ll need to understand the number of hours for which your employee must receive double time pay. Let’s assume this employee should receive double time for 5 hours.

You’ll calculate double time pay with this formula:

Hourly wage x 2 = Double time pay.

If the worker earns $20/hour, your calculation will look like this: $20 x 2 = $40.

Then, multiply the double time wage by the number of hours that require double time pay. Use this formula:

Double time pay x Hours = Total payout.

In this case, that would be: $40 x 5 = $200.

In addition to paying your employee standard wages for their standard hours, you’ll add $200 in double time.

How To Calculate Overtime Pay

Calculating overtime pay is similar to calculating double time pay.

Start by calculating how many overtime hours your employee worked in a workweek. Use this formula:

Hours worked – Standard workweek hours (40) = Overtime hours.

For example, say your employee worked 50 hours in a week. You’d calculate 50 – 40 = 10 hours of overtime.

Next, determine the employee’s overtime wage using this formula:

Regular wage x 1.5 = Overtime wage.

If the employee earns $30/hour, you would calculate $30 x 1.5 = $45.

Finally, multiply this overtime wage by the number of overtime hours to get the overtime pay amount. As a formula, this looks like:

Overtime wage x Overtime hours = Overtime pay amount.

In our example, that would be: $45 x 10 = $450.

Pro Tip

Ensure your employee handbook has clear overtime and double time policies. Your policies should comply with federal and local laws, but you might choose to offer more generous compensation than the legal minimum—like double time for all holiday work.

How Connecteam Can Help You with Overtime and Double Time

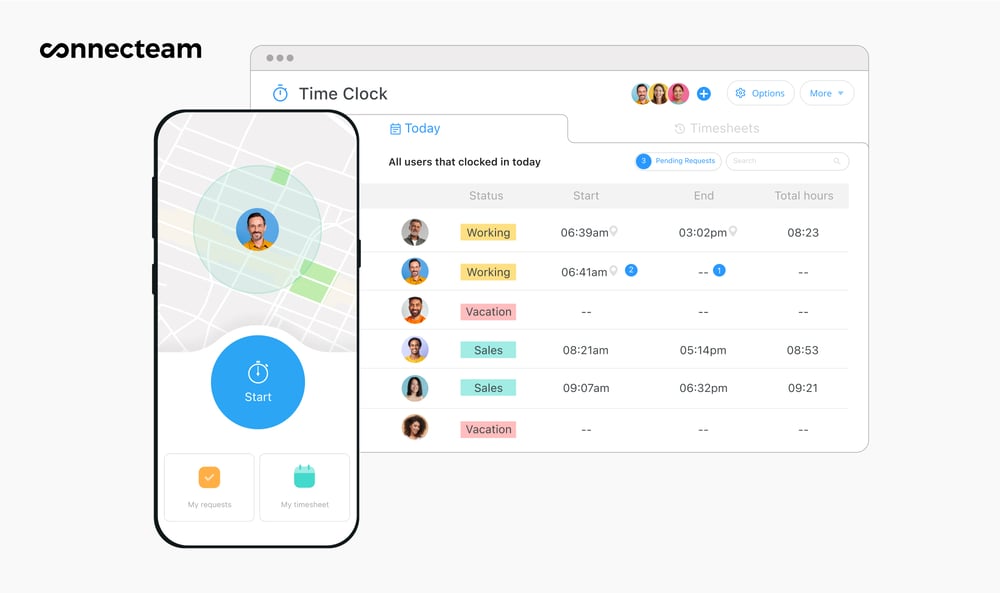

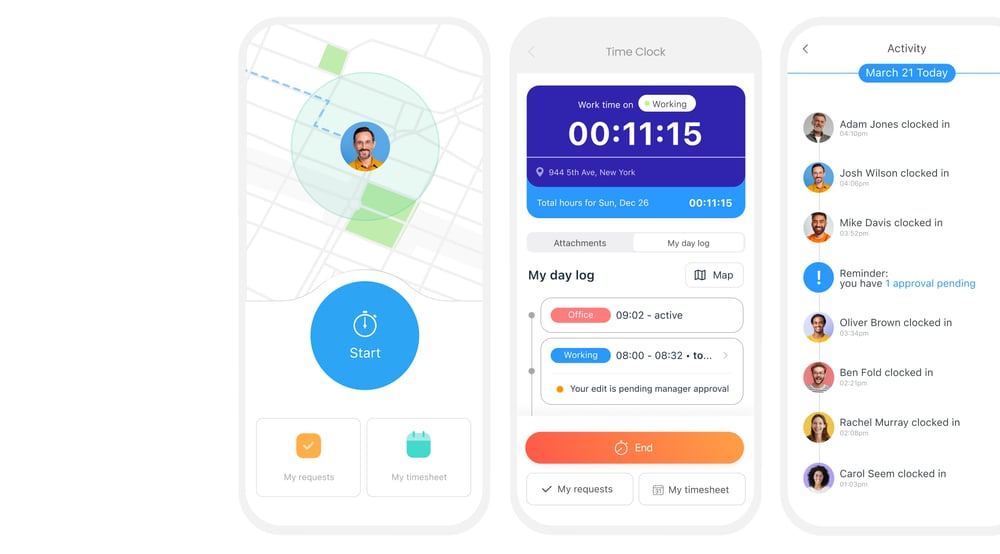

Connecteam is an all-in-one workforce management app with a powerful time tracking clock. Our time clock enables you to track, manage, and pay overtime and double time easily. Here’s how.

Track overtime and double time effortlessly

Using the time clock, employees can track their hours from anywhere and punch in and out with just a few touches. The app’s color-coded timesheets display your workers’ overtime, double time, and total hours in separate columns, which can help you understand their earnings at a glance.

You can even use Connecteam’s overtime tracking to customize your overtime settings according to your workers’ time zones. This way, you can easily comply with state labor laws.

Prevent unnecessary overtime and double time

With Connecteam, you can choose to receive notifications when employees go into overtime or double time. The app allows you to automatically clock out employees when they go into unapproved overtime or double time.

What’s more, the geofence time clock lets you customize areas where shifts or jobs can take place by creating a virtual boundary using GPS. You can then limit geofences to specific hours.

For example, you might restrict clock-in access to the worksite from 8am to 6pm on weekdays. This way, you can decline any clock-in or clock-out requests outside of that location and those defined hours, helping you minimize unwanted overtime.

Process payroll accurately

When you need your employees to go into overtime or double time, Connecteam ensures that these hours are precisely tracked and reflected in timesheets for payroll.

Integrating Connecteam with your payroll processor or exporting your timesheets to another system is also easy. This way, you can pay your employees accurately for their extra time.

Maintain accurate records

In addition to helping you stay compliant with labor laws, Connecteam helps you comply with the FLSA’s record-keeping requirements. It automatically records and stores detailed time logs for each employee, including overtime and double time hours.

Try Connecteam’s employee time tracking for free today!

Conclusion

A firm grasp of the distinctions between overtime and double time is essential for business owners and managers. Without understanding these, you risk falling out of compliance with labor laws—which can result in legal troubles, fees, payroll pitfalls, and costly errors.

The application, calculation, and laws differ for overtime vs. double time. Overtime typically applies to hours above 40 in a workweek and is federally mandated. Double time, however, is less common and usually applies to unique circumstances. For now, only California mandates it.

Connecteam can help you track employee hours, calculate overtime and double time, and simplifies the process of paying your team.

Get started with Connecteam for free today.

FAQs:

What is the difference between overtime and extra hours?

An employee can work extra hours but not require overtime pay. For example, if an employee usually works 20 hours but works 25 hours one week, they’ve worked fewer than 40 hours and don’t need overtime pay. However, if they’re located in a state like California, they would get overtime for any daily hours exceeding 8 hours.

Is overtime taxed more?

Overtime or double time pay isn’t taxed at a different rate than your standard wage. However, earning higher wages from overtime or double time can increase an employee’s pay. This might mean they move into a higher tax bracket, which will increase taxes on a percentage of their gross pay.