Creating a small business can feel overwhelming, especially when it comes to understanding your legal obligations. To help make the process easier, we take you through 10 legal issues you need to consider and recommend where to find further information.

Starting a new business can feel exciting yet overwhelming. There’s a lot you need to consider—from creating a solid business plan to securing funding and more.

But before you can get the ball rolling, you must know your legal obligations as a small business owner. Otherwise, you risk facing compliance issues from day 1, costing you time and money.

Below, we walk you through 10 essential legal requirements when setting up your small business. Our overview is a great starting point for your research, and we share resources to gather even more information. Let’s dive in!

Key Takeaways

- There are many steps involved in starting a small business. The most crucial of them is understanding and following various legal requirements.

- These include choosing the legal structure for your business, registering its name, understanding your tax obligations, and protecting your intellectual property.

- By addressing these requirements, you can help ensure your business is legally compliant, reducing the risk of any penalties for non-compliance.

What Are the Legal Requirements for Starting a Small Business?

Choose how to structure your business entity

One of the first—and most important—steps when starting a small business is choosing how to structure it. This choice affects ownership arrangements, personal liability for your business’s debts, fundraising options, distribution of profits, and how you pay taxes.

You can choose from several structures depending on your business’s circumstances, needs, and long-term goals. The most common business structures are:

Sole proprietorship

This is a business with a single owner/employee. There’s no distinction between the business and its owner, meaning the owner is personally liable for the business’s debts and lawsuits. Owners report the business’s profits and losses on their personal tax returns.

Sole proprietorships are straightforward and affordable to set up and don’t require formal registration.

Partnership

Under this structure, 2 or more owners share the business’s profits. There are different types of partnerships, including general partnerships, limited partnerships (LPs), and limited liability partnerships (LLPs).

In a general partnership, partners are personally liable for the business’s debts and liabilities. Partners report the business’s profits and losses on their personal tax returns. They’re also responsible for the actions of other partners.

Corporation

Corporations have a separate legal identity from their owners, called shareholders. Shareholders’ liability is limited to their investments. Corporations can be S-corps and C-corps, which affects how the business is taxed.

To form a corporation, you must incorporate the business by filing articles of incorporation in the relevant state.

Limited liability company (LLC)

LLCs offer flexibility by combining features of partnerships and corporations. They have a separate legal identity from their owners, called members. This limits members’ personal liability. The business’s profits and losses pass to owners who pay taxes.

You form an LLC by filing articles of organization in the relevant state. It’s also a good idea to create an operating agreement outlining how your LLC is managed and run.

Register your business name

Unless you’re a sole proprietor and run your business under your own name, you usually need to register your business name. Before choosing one, make sure the business name doesn’t already exist in your state or elsewhere.

💡 Pro Tip:

Search the United States Patent and Trademark Office’s (USPTO) online database to see if your business name is already trademarked in the US.

You may need to register in several ways, including:

- Entity name. This registers and protects your business’s name at the state level and is typically done when filing articles of organization or incorporation.

- Trademark. This protects your name at a federal level. You must apply to the USPTO to trademark a business name.

- “Doing business as” (DBA) or trade name. You may also be required to register a DBA if, for example, you’re a sole proprietor running a business under a different name. Each state has an authority for DBAs, so you’ll need to check their rules.

- Domain name. Registering a domain name isn’t a legal requirement. But doing so early gives you a better chance of securing the domain name you want for your business’s website.

Protect any intellectual property

Intellectual property (IP) refers to the creations of the mind. In a business context, it relates to intangible assets like slogans, logos, or designs. Your business’s IP can be extremely valuable, and it’s essential to protect it by preventing others from using it.

You can do this by trademarking your business name, logo, and slogan via the USPTO. If you own a specific original creation, you can apply to patent it via the USPTO.

💡 Pro Tip:

IP is a complex area of law. Speak with an IP lawyer about your situation to get the best guidance.

Apply for federal and state tax ID numbers

Any business with employees must apply for an employer identification number (EIN). Applying takes only a few minutes via the Internal Revenue Service (IRS) website and is 100% free.

An EIN is an identification number used for tax purposes. You may be required to provide when filing federal taxes, opening your business bank account, and applying for licenses or permits.

Sole proprietorships and single-owner LLCs don’t need an EIN. However, many get one to avoid using their personal Social Security number on business documents.

You usually need a state tax ID if your business also pays state taxes. Confirm this requirement and the process with your local state authority.

Read our in-depth guide on how to apply for an EIN in 2025

Apply for any necessary business licenses

Depending on your business’s activities and location, you may need to apply for a business license or permit. Examples include liquor licenses, building permits, home-based business permits, and industry-specific licenses.

The Small Business Administration has a list of federal licensing and permits requirements. You must also check with your state and local business licensing authorities to determine your obligations at that level. You may need to apply for multiple licenses or permits at all federal, state, and local levels.

Applying for a license or permit typically involves submitting an application and paying a fee. Research this early to account for costs and processing times when setting up your business.

Understand your tax obligations

All businesses need to pay taxes at the federal level. The structure and circumstances of your business determine what taxes you pay and whether you pay them as a business or an individual.

Federal taxes that can apply to small businesses include:

- Income tax.

- Self-employment tax.

- Employment taxes, including social security, Medicare taxes, and federal unemployment taxes.

- Excise taxes, which are “imposed on certain goods, services, and activities.”

Many businesses also pay taxes at the state level.

To determine what taxes may apply to you, you can check with the IRS and your local tax authority. It also pays to speak with a financial advisor specializing in small businesses.

Open a business bank account

Opening a business bank account separates your personal and business finances. This makes complying with your business’s accounting and tax obligations easier.

It’s worth speaking with several banks before choosing a business account. Fees, rates, and inclusions can vary between banks.

Also, check with the bank what documents you need to open your account. These may include your EIN, business registration documents, ownership agreement documents, identification documents, and specific licenses or permits.

Take out business insurance

Business insurance covers your business’s financial losses. The type of insurance you need depends on your business’s nature, size, and structure.

Below are 6 common types of business insurance.

- General liability insurance: Broad coverage for general losses like damage to business property or legal representation to defend lawsuits, such as personal injury lawsuits.

- Workers’ compensation insurance: Covers payments to employees in the event of workplace injuries or illnesses. All states except Texas require businesses to have this insurance.

- Professional liability insurance (or errors and omissions insurance): Protects you if you don’t do a key part of your job, causing a financial loss to a client.

- Product liability insurance: You may need this to protect your business against lawsuits arising from harm caused by your product

- Home-based business insurance: For sole proprietors and other businesses that operate from home.

- Commercial property insurance: Insures business property from events like floods or fires.

💡 Pro Tip:

Speak with an insurance broker or advisor, who can guide you on the insurance you need for your business.

Create a compliance plan

Businesses must comply with all applicable laws and regulations at a federal, state, and local level. A compliance plan identifies what steps your business will take to do this.

To create a compliance plan, you must identify and understand the laws that apply to your business. These can include:

- Advertising and marketing laws.

- Wage and hour laws.

- Labor laws.

- Anti-discrimination laws.

- Workplace poster laws.

- Workers’ compensation laws.

- Workplace health and safety laws.

- Privacy laws, especially concerning the collection of customers’ data.

- Securities laws.

Once you know what laws apply to you, you can develop company policies, strategies, processes, and training to ensure your business stays legally compliant.

For example, to ensure compliance with anti-discrimination laws, you could first develop a policy that sets out the protected characteristics under federal and state law and clearly states a zero-tolerance policy for discrimination.

Your policy can also detail your procedures for both internal and external complaints. This ensures your employees know what to do if they’re subject to or witness discrimination in the workplace.

🧠 Did You Know?

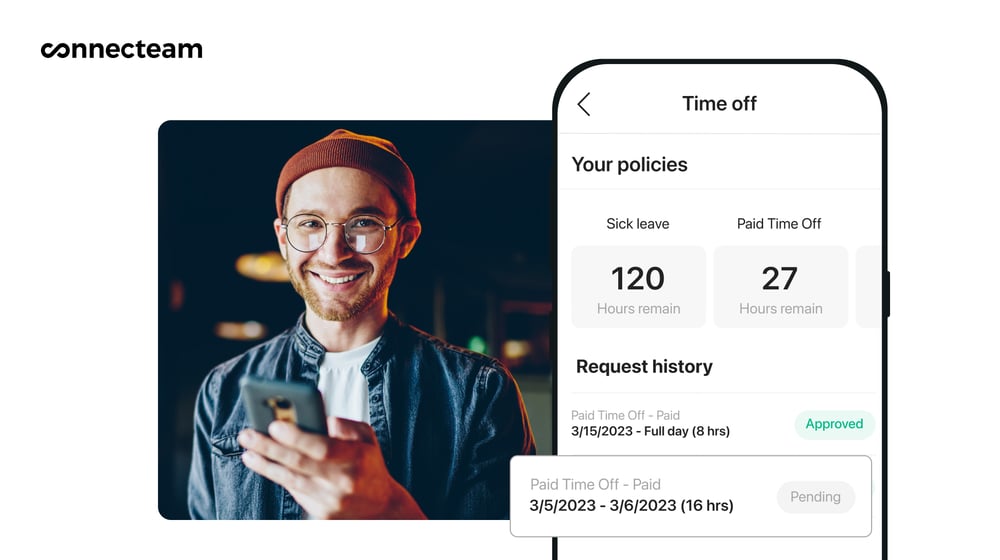

Connecteam’s employee training software makes it incredibly simple to create and deliver mobile training courses for your frontline teams, saving you valuable time and money and ensuring compliance.

Including this policy in your employee handbook and onboarding materials helps raise awareness among your employees.

You could also develop anti-discrimination training for your managers, supervisors, and hiring team to ensure they understand their legal obligations and know how to prevent discrimination in the workplace.

🧠 Did You Know?

Connecteam’s knowledge base is perfect for securely storing your policies, procedures, and employee handbook for easy access. You can easily update files and restrict user access permissions to protect sensitive information.

Get started with Connecteam’s free Small Business Plan today.

Classify workers correctly

If your business hires workers, you must properly classify them. Types of workers you might have include:

- Full-time and part-time employees: Usually paid a salary or wages by their employer, who controls their work and how and when they do it. Employers are responsible for employees’ payroll taxes.

- Independent contractors: Workers who run their own businesses and provide services to individuals or organizations for a fee. The hiring individual or organization doesn’t have control over the contractor. Independent contractors are responsible for their own taxes.

- Seasonal workers: Additional workers employers hire to meet increased labor needs during recurring, defined periods—for example, during the holiday season.

- Temporary workers: Employees hired for a set period—for instance, to cover a permanent employee on maternity leave.

- Interns: Typically students or young people seeking short-term work experience relating to their studies. They may be paid or unpaid.

- Volunteers: Someone who gives their time to an organization—typically a non-profit or charity—without being paid.

How you classify workers affects their rights and protections and tax arrangements. For example, federal minimum wage and overtime provisions apply to employees but not to independent contractors. Misclassifying employees as independent contractors, or vice versa, can also result in harsh financial penalties.

💡 Pro Tip:

Understanding the correct classifications for your workers can be tricky. For more information on worker classifications in the US, head to the IRS website. We also recommend speaking with a lawyer for specialized guidance.

Conclusion

Knowing where to start when creating your small business can feel overwhelming, as there are many boxes to tick before you even open your doors.

At a minimum, there are some necessary legal steps that all new businesses need to follow.

These include choosing your business structure, registering the business name, applying for an EIN, and taking out business insurance.

By working through these steps—with the help of professional financial and legal advisors—you can ensure your small business is legally compliant and running in no time.

FAQs

What is the most common type of small business in the US?

Sole proprietorships are the most common small business in the US. In fact, according to the US Chamber of Commerce, 86.4% of small non-employer businesses are sole proprietorships.

When it comes to small employer businesses (1-100 employees), the most common type is S-corporations.

What is legal compliance in business?

Legal compliance in business involves a business following the laws and regulations that apply to it. These laws and regulations may exist at the federal, state, and local levels. Legal compliance is essential for businesses to avoid harsh financial and sometimes criminal penalties.

Disclaimer

The information on this website about the legal steps to start a small business is intended to be a summary for informational purposes only. Laws and regulations regularly change and may vary depending on individual circumstances. While we have made every effort to ensure the information provided is up-to-date and reliable, we cannot guarantee its completeness, accuracy, or applicability to your specific situation. Therefore, we strongly recommend that readers seek guidance from their legal department or a qualified attorney to ensure compliance with applicable laws and regulations. Please note that we cannot be held liable for any actions taken or not taken based on the information presented on this website.