Understanding overtime is crucial to ensuring compliance, supporting employees’ rights and well-being, and managing labor costs. With our complete guide, learn what overtime is, how to calculate it, and more.

While overtime can be a useful solution to understaffing and peak demand periods, you should use it carefully to avoid high labor costs and protect employees’ health and well-being.

Read on for our comprehensive guide on overtime—so you can navigate overtime laws responsibly and effectively.

Key Takeaways

- Overtime is additional compensation paid to eligible employees who work more than a certain number of hours a day or week. The specific requirements for overtime vary between federal and state laws.

- The federal Fair Labor Standards Act (FLSA) requires covered employers to pay non-exempt employees 1.5 times their regular rate of pay for time worked over 40 hours in a week.

- Understanding the overtime laws that apply to your business is essential to avoiding compliance issues, reducing labor costs, and supporting your employees’ well-being.

What Is Overtime?

Overtime is premium compensation paid to eligible employees who work beyond a certain number of hours in a week or day. The specific employees entitled to overtime, thresholds, and rates vary according to federal and state laws.

Employees may work overtime as part of their regular schedule or at short notice to cover business demands.

Overtime Laws and Legal Requirements

Federal overtime law

How many hours qualify as overtime?

The Fair Labor Standards Act (FLSA) requires employers to pay non-exempt employees at least 1.5 times their regular rate of pay for any time worked over 40 hours in a workweek, which is often considered the standard workweek for full-time hours.

Under the FLSA, a workweek is 7 consecutive 24-hour periods (168 hours). Employers can choose what constitutes a workweek—the hours can start at any time on any day but must be fixed and recur regularly.

Night shifts, holidays, and weekend work aren’t overtime unless they exceed 40 hours.

Employers generally must pay employees for overtime on their next regular payday following the pay period where the overtime was worked.

Employers covered by the FLSA must keep wage and hour records for at least 3 years, including:

- The regular hourly pay rate for any week the employee works overtime.

- Total overtime pay for the week.

Under the FLSA, employers can’t retaliate against employees who report overtime violations to the Department of Labor (DOL) or take legal action.

Covered employers must also display a Minimum Wage Poster where employees can easily see it. This poster includes overtime information for employees.

What is an employee’s regular rate of pay?

The FLSA defines an employee’s regular rate of pay as “all remuneration for employment paid to, or on behalf of the employee.”

Remuneration includes:

- Regular wage or salaries.

- Tip credits.

- Non-discretionary bonuses.

- Shift differentials.

- Commissions.

There are some specific exceptions to this, including:

- Certain gifts.

- Paid leave when no work is done.

- Discretionary bonuses that meet specific criteria.

- Expenses reimbursed by the employer, like travel and mobile plans.

- Reporting pay.

- Payments made under a profit-sharing plan.

Regular rates of pay can’t be less than the applicable minimum wage under the FLSA or relevant state law—whichever is higher.

Which employers must comply with the FLSA overtime provisions?

The FLSA applies to your business if it meets at least one of the following criteria:

- Its workers engage in interstate commerce, including regularly sending emails or making phone calls interstate.

- It generates annual gross sales/business of $500,000 or more.

- It’s a hospital, residential care, or educational facility.

- It’s an activity of a public agency.

Most employers are covered by meeting the first and second criteria.

Which employees are covered by the FLSA overtime provisions?

Even if the FLSA covers your business, you need to pay overtime to non-exempt employees only.

Exempt employees don’t receive overtime pay. Employees exempt from the overtime provisions of the FLSA include:

- Executive, administrative, and professional employees earning at least $684 weekly.

- Outside salespersons.

- Certain commissioned sales employees.

- Any computer employee who receives a salary or fees of at least $684 weekly.

- Employees in office or non-manual work who earn at least $107,432 annually (at least $684 weekly).

- Farmworkers.

- Airline employees.

- Local delivery drivers.

This isn’t an exhaustive list, and each exemption has specific criteria.

Pro Tip

The salary thresholds for FLSA-exempt employees are due to change. On July 1, 2024, the minimum weekly salary increases to $844—and to $1,128 in January 2025. This means some employees may no longer be exempt, and overtime provisions will apply to them. Review your workforce’s salaries closely to prepare for these changes and ensure you don’t violate federal overtime laws unintentionally.

Contractors and freelancers aren’t entitled to overtime pay under federal law.

State laws on overtime

In addition to the FLSA, state laws regarding overtime may apply to your business.

Some of these laws mirror the FLSA’s requirements. Where they’re different, the law that’s more generous to the employee usually applies.

Several states have overtime laws that offer better benefits to employees than the FLSA. For example, they may:

- Apply to employees not covered by the FLSA. In New York, for instance, farm workers receive overtime pay.

- Require employers to also calculate and pay employees for daily overtime. For instance, in Alaska, workers earn overtime pay for any hours worked in excess of 8 in a single day.

- Impose a higher overtime rate—for example, a double time rate. For example, in California, employees receive double time pay for any hours worked over 12 in a 24-hour period.

Check with the DOL or equivalent in your state and speak with a labor attorney to confirm your overtime obligations in the state where you and your employees are located. Even if you employ remote employees located in a different state, the law of the state where the employee is based usually applies.

Did You Know?

Federal and state laws set minimum overtime requirements. Many employers go beyond this and pay employees a higher overtime rate or overtime on holidays to attract and retain employees.

Collective bargaining agreements

Collective bargaining agreements are formal agreements between employers and unions that set out the pay and other working conditions for groups of workers. They may also address overtime.

While unions can’t waive employees’ rights under the FLSA or state laws, collective bargaining agreements can contain more generous overtime rules or address issues the FLSA doesn’t, such as requiring notice periods.

As a manager, you must be aware of any collective bargaining agreements covering your employees and their overtime provisions.

What Happens if You Violate Overtime Laws?

If you fail to pay your employees overtime as required, you may face various consequences at the federal and state levels.

The federal DOL can start administrative, litigation, and criminal proceedings against your business for FLSA overtime violations.

Administrative

The DOL can investigate alleged overtime violations and supervise repayments to employees. It can also help employees reach settlements with employers, requiring employers to pay back wages and liquidated damages.

Employers may face civil money penalties for willful or repeated violations. Violations before January 16, 2024 attract a maximum penalty of $2,374. The maximum penalty for violations beginning January 16, 2024 is $2,451.

Litigation

The DOL has the power to sue employers for overtime violations on behalf of employees. Employees can also file their own lawsuits.

During litigation, the DOL can seek backpay (compensation for unpaid wages), liquidated damages, and civil money penalties, while employees can seek backpay, liquidated damages, attorney fees, and court costs.

Criminal

Willful or repeated overtime violations can result in criminal prosecution. Penalties for criminal prosecutions include fines and imprisonment in the most serious cases.

❌ What Not To Do:

Overtime violations can be costly—especially intentional ones. A Delaware home care agency was recently ordered to pay over $1 million in back pay, liquidated damages, and civil penalties for willfully failing to pay overtime wages. The Wage and Hour Division District Director James Cain explains, “The Department of Labor is committed to enforcing labor standards to ensure workers receive the highest protections to which they are entitled.”

Impact of Overtime on Employees’ Well-being

Overtime may seem like an easy solution to understaffing, last-minute shift changes, and unexpected workload increases.

However, it’s essential to consider the potential impacts on employee health, well-being, and productivity.

The federal Occupational Safety and Health Administration (OSHA) warns, “Long work hours may increase the risk of injuries and accidents and can contribute to poor health and worker fatigue. Studies show that long work hours can result in increased levels of stress, poor eating habits, lack of physical activity and illness.”

Too much overtime can put employees at increased risk of burnout and health issues, such as hypertension, diabetes, and depression.

Overtime also affects worker productivity. Fatigued workers are less productive and more likely to make mistakes.

This Might Interest You

The National Institute for Occupational Safety and Health (NIOSH) offers helpful resources and advice about fatigue and work.

How To Calculate Overtime Pay

Here are the steps to calculate overtime pay under the FLSA.

Work out how many overtime hours the employee worked

To calculate the number of overtime hours worked, subtract 40 from the total number of hours worked.

For example, an employee works 44 hours in 1 week. The total overtime hours for that week are 44 – 40 = 4.

Did You Know?

Do meal or rest breaks count towards hours worked? Generally speaking, employees must be paid for shorter breaks (of around 20 minutes or less), and these breaks count towards hours worked for overtime purposes. Breaks of 30 minutes or more don’t need to be paid and don’t count towards overtime—as long as the employee is relieved of all work duties.

Identify the employee’s regular rate of pay

The regular rate of pay is an employee’s total compensation in the workweek divided by the total number of hours they worked.

If an employee is paid hourly, their regular rate of pay is their normal hourly rate.

If they’re paid on a piece-rate basis (based on the amount of work they do rather than the hours they work), divide their total weekly earnings by the total number of hours they worked in the same week.

If the employee receives a salary, divide their weekly salary by the number of hours it covers.

Calculate their overtime rate

To work out their hourly overtime rate, multiply their regular rate of pay by 1.5.

Continuing the above example, the employee is paid $12.50 an hour. Their overtime rate is 12.50 x 1.5 = $18.75.

Calculate their total overtime pay

To do this, multiply the number of overtime hours they worked (step 1) by their hourly overtime rate (step 3).

In our example, the employee’s overtime pay is 4 x 18.75 = $75. This is in addition to their pay for their regular hours that week.

This Might Interest You

Check out our detailed guide to calculating overtime, which includes our handy overtime calculator.

Fluctuating workweek method

This method can be used for non-exempt employees who work fluctuating workweeks and receive a fixed weekly salary regardless of the number of hours they work. This method provides a different calculation for overtime, resulting in employees receiving 0.5 times for each hour of overtime.

Learn more about using this method here.

Overtime FAQs for Managers

Do I have to pay minor employees overtime?

Under the FLSA, employees under 16 can’t earn overtime due to the restrictions on their work hours. Fourteen-year-olds and 15-year-olds can’t work more than 18 hours in a workweek when school is in session and 40 hours when it isn’t.

The FLSA doesn’t restrict the number of hours that 16 and 17-year-olds can work. So, you must pay them overtime if they’re non-exempt employees and work more than 40 hours in a workweek.

Different laws may apply at the state level.

Do I have to provide employees with notice of overtime?

The FLSA doesn’t require you to give employees specific notice of mandatory overtime.

However, last-minute overtime requests can lead to unhappy employees. Not giving them enough notice often disrupts other commitments and plans they’ve made outside of work, including appointments, childcare arrangements, and social engagements.

For this reason, it’s a good idea to give employees as much notice as possible. This allows them to rearrange personal appointments or commitments.

Several state laws do require employers to provide employees with notice of overtime. Also, an employee’s employment contract, a collective bargaining agreement, or your employee handbook may set out minimum notice periods for overtime that you must comply with.

Also keep in mind that predictive scheduling laws or fair workweek laws may require you to compensate employees for last-minute schedule changes, including overtime.

Can I force employees to work overtime?

Under the FLSA, you can force an employee to work overtime as long as it doesn’t create a health or safety risk or contradict a term of their employment contract or a collective bargaining agreement. You must also pay them 1.5 times their regular pay rate for any overtime hours.

Some employees may be able to refuse overtime under anti-discrimination laws. For example, under the Americans with Disabilities Act (ADA), employers must make reasonable accommodations for workers with disabilities. Not requiring an employee to work mandatory overtime may be a reasonable accommodation, provided overtime isn’t an essential function of the job and the adjustment doesn’t cause undue hardship to your business.

Some states have laws related to mandatory overtime, often concerning healthcare workers. For example, New York’s mandatory overtime protection law prohibits employers from forcing nurses to work overtime—with some limited exceptions.

Several states also have “one day’s rest in seven” laws. For instance, in Illinois, employers must give employees at least 24 hours of rest time in every consecutive 7-day period. Illinois employees could legally refuse overtime that violates this requirement.

As a manager, you should weigh the potential costs and benefits of using mandatory overtime where it’s legal.

In addition to impacting employees’ well-being, mandatory overtime may lead to employee resentment, which can affect their job satisfaction.

Can I fire an employee who refuses to work overtime?

The FLSA doesn’t usually prevent employers from acting against employees who refuse mandatory overtime (where mandatory overtime is legally allowed). So, in an at-will employment relationship, you can terminate an employee who refuses to work overtime.

However, terminating or disciplining an employee for refusing to work overtime can raise other legal issues. For example, if you take action against some employees and not others, you may face allegations of discrimination.

Is there a limit to how much overtime employees can work?

The FLSA doesn’t limit how many hours employees can legally work in a day or how many hours they can work in a week. However, employees can refuse to work additional hours if doing so poses a health or safety risk. Employment contracts and collective bargaining agreements may also limit employees’ hours.

State laws may restrict working hours. These include child labor laws that limit the number of hours minors can work and “one day’s rest in seven” laws.

Several regulated industries also limit work hours. For example, federal regulations say that drivers carrying passengers can only drive up to 10 hours a day after 8 consecutive hours off. They also can’t drive more than 60 hours in 7 consecutive days or 70 hours in 8 consecutive days.

Again, you must consider the disadvantages of working too many hours—including the impact on employees’ work quality and health.

Do I have to give employees minimum time between shifts?

Nothing in the FLSA requires employers to give employees a certain number of days or hours between shifts, even if they’ve worked overtime.

However, some states regulate this issue. For example, they may require a minimum number of hours off for employees who work closing and consecutive opening shifts (called “clopening” shifts). They may also give employees the right to refuse clopening shifts or require employers to pay higher wages to employees who work consecutive shifts with only short breaks between them.

Can I offer compensatory time instead of overtime pay?

Compensatory time is paid time off for accrued overtime instead of overtime pay. Under the FLSA, only federal or state agencies can offer compensatory time to non-exempt employees.

Private employers can offer comp time to employees exempt from the FLSA overtime provisions.

How To Manage Overtime Effectively

Here are our tips for managing overtime.

Create an overtime policy

A clear policy ensures a consistent approach to overtime in your organization. It helps managers understand how to oversee overtime and employees understand what their responsibilities are.

It should set out:

- Which employees are entitled to overtime—e.g., exempt vs non-exempt employees.

- How overtime is calculated.

- Overtime pay rates.

- Whether employees are required to work mandatory overtime.

- Consequences of employees refusing to work mandatory overtime.

- The authorization process for overtime.

- Details of advance notice of overtime work, where possible.

- Any overtime caps.

- If employees are entitled to compensatory time rather than overtime.

Make sure your overtime policy complies with relevant federal and state laws. Store it somewhere your employees can easily access it, such as an intranet or employee handbook. You can also include it in employee onboarding materials.

Pro Tip

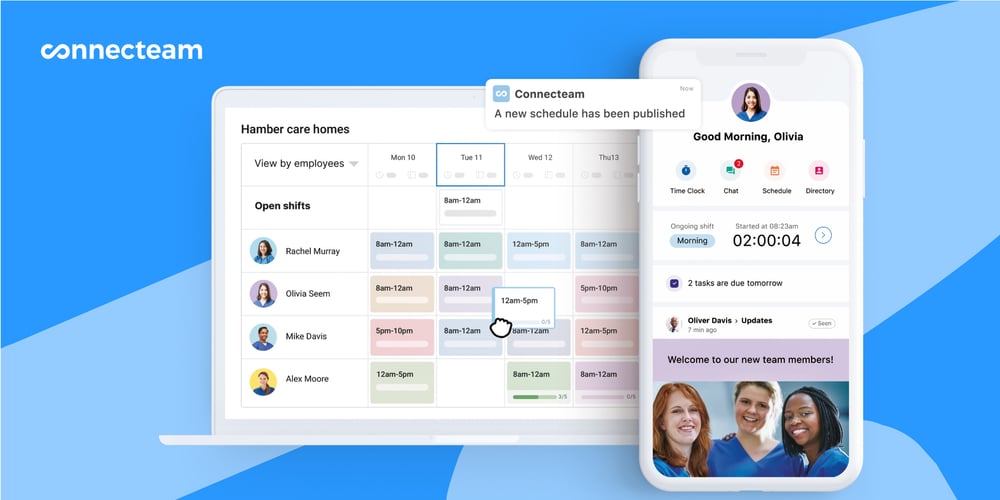

Use Connecteam’s company knowledge base to store important policies—like your overtime policy—so employees can access them anytime, anywhere.

Communicate with your employees

Ensure your employees are aware of and understand your overtime policies and procedures. Communicate any updates to them in real-time, for example, via a team chat app or email.

Make it clear who employees can contact with questions about overtime, such as the HR department, payroll, or their manager. Also, detail how they can get in contact—via email, phone, or in person.

Encourage feedback from your employees. They can help you understand which aspects of your overtime policy work well and which areas need improvement. Pulse surveys and regular employee check-ins are good ways to collect feedback.

Regular check-ins are also great for monitoring employee well-being and identifying workers who are fatigued or at risk of burnout.

Consider ways to reduce overtime

While overtime is sometimes unavoidable, it can be costly to your business and negatively impact employees.

For these reasons, you may look for ways to reduce the overtime you require employees to work. Here are some suggestions:

- Hire part-time or temporary workers to pick up the additional hours. This approach can be especially helpful during peak periods.

- Set an overtime cap. This may distribute overtime more evenly across employee schedules and make labor costs more predictable.

- Ask employees to work split shifts. This can give you the same schedule coverage as longer shifts while reducing employees’ total work hours and letting them take a break.

- Offer employees flexible work schedules. Flexible work schedules allow employees to choose their hours and have been shown to increase productivity. While flexible schedules don’t suit every business, they may help address overtime in yours.

- Cross-train employees. When employees have multiple skills, it’s easier to adjust schedules. This approach gives you other backup options, reducing reliance on 1 or 2 employees who quickly accrue overtime.

Pro Tip

Overtime can be a cost-effective tool when used strategically to manage short-term workload spikes or meet specific deadlines. Ideally, it should be used as an exception rather than regular practice.

Digitize overtime management

Using scheduling and time-tracking software can streamline your overtime management and support compliance. Most apps let you create digital schedules, which makes it easy to predict overtime totals and make adjustments before sharing schedules with your employees.

This type of software also typically creates a digital record of schedules and employee hours, including start, end, and break times. This helps you comply with the FLSA’s overtime recordkeeping requirements.

With overtime metrics—such as who’s working the most overtime and when—you can identify potential causes of unnecessary or excessive overtime and find ways to address them.

Did You Know?

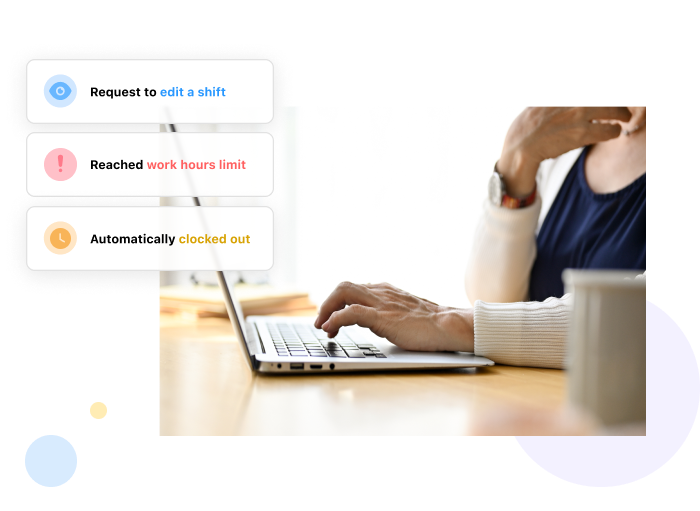

Connecteam is an overtime app that’s ideal for managing overtime. With just a few clicks, you can set custom rules for overtime compliance and receive alerts when employees exceed their hours. Plus, Connecteam can automatically clock out employees who go into unapproved overtime, helping keep it in check. Connecteam also generates accurate timesheets down to the second, making calculating overtime pay a breeze.

Common Overtime Mistakes and How To Avoid Them

Misclassifying employees

An essential aspect of overtime compliance is understanding which employees are covered by overtime laws. For example, if you incorrectly classify an employee as exempt from the FLSA when they’re not, you won’t pay them the overtime they’re entitled to.

A common FLSA classification mistake is the assumption that all salaried employees are automatically exempt without considering the detailed criteria related to their responsibilities. For example, a salaried restaurant manager who spends most of his time serving customers and clearing tables due to staff shortages may not be exempt from the FLSA’s overtime provisions based on his duties.

Authorities also look carefully at the classification of independent contractors vs. employees. Some employers try to avoid paying overtime by classifying workers as independent contractors when they’re employees.

Solution: To help reduce the risk of misclassification, create detailed job descriptions for each role to understand if they are covered by overtime provisions under the FLSA and state law. The DOL’s final rule provides guidance on how to classify workers for FLSA purposes. You should also speak to a labor lawyer to confirm your employee classification.

Miscalculating overtime

If you don’t calculate overtime correctly, you’ll underpay your employees, leading to overtime violations. Overtime miscalculations can occur as a result of:

- Not accurately tracking employees’ hours.

- Failing to calculate time worked accurately—for example, by not counting short breaks.

- Incorrectly calculating employees’ regular rate of pay.

- Using your pay period to calculate an average overtime rather than a workweek.

Solution: Ensure you understand overtime calculations under the FLSA and relevant state laws. Accurately tracking your employees’ time—ideally with time-tracking software—is crucial to avoiding this mistake.

Refusing to pay unauthorized overtime

Some employers think they can refuse to pay employees who work overtime without prior approval. But the rule is simple—if non-exempt employees work more than 40 hours in a workweek, they’re entitled to overtime regardless of pre-approval.

Solution: Always pay your employees for any overtime they work. If unauthorized overtime is a problem, review your overtime policy and train employees on the relevant overtime procedures.

Pro Tip

If unauthorized overtime continues to be a problem even after you’ve discussed it with employees, you might need to take more severe measures. Alison Green, author of the Ask a Manager blog, recommends requiring such team members to work fewer hours after overtime has occurred.

Support Effective Overtime Management with Connecteam

Understanding how overtime works is crucial to ensuring your business complies with the FLSA and relevant state labor laws. You can minimize labor costs and support your employees’ health and well-being by managing overtime effectively.

Scheduling and time-tracking software is one of the best overtime management tools. Connecteam offers various features, including automatic overtime calculations, real-time labor cost metrics, and custom scheduling rules to limit overtime and support compliance.

To learn more about how Connecteam can help you manage your overtime, try it for free today!

FAQs:

Is overtime a waste?

While small amounts of overtime may be occasionally necessary, overtime can increase labor costs and affect your employees’ health and well-being. Employees who work overtime are more tired and, as a result, more likely to make mistakes. They’re also at higher risk of burnout and health problems.

What is an example of overtime?

An example of overtime under the federal Fair Labor Standards Act is a restaurant server who works 42 hours in a workweek. In this example, she’s worked 2 hours over the standard 40-hour workweek and is entitled to overtime pay for those 2 hours.

Disclaimer

The information presented on this website about overtime is a summary for informational purposes only and is not intended as legal advice. However, laws and regulations regularly change and may vary depending on individual circumstances. While we have made every effort to ensure the information provided is up to date and reliable, we cannot guarantee its completeness, accuracy, or applicability to your specific situation. Therefore, we strongly recommend that readers seek guidance from their legal departments or qualified attorneys to ensure compliance with applicable laws and regulations. Please note that we cannot be held liable for any actions taken or not taken based on the information presented on this website.