When launching a cleaning business, getting the necessary licenses and permits is essential. This article provides insights into the required licenses and guides you through the application process.

When starting your cleaning business, getting the right licenses, permits, and registrations is crucial. However, with federal, state, and local licensing laws, knowing where to start can be difficult.

This article guides you through the licenses you may need for your cleaning business and how to apply for them.

Key Takeaways

- Most cleaning businesses must apply for at least 1 license—usually a business license. Depending on your business activities, size, and location, you may also need to apply for a vendor’s license, Doing Business As (DBA) registration, and other permits.

- Failure to get the necessary licenses for your business can lead to penalties, including fines.

- To ensure you fully understand your licensing obligations, consult with your local licensing authorities or a business lawyer.

What Licenses Are Needed To Start a Cleaning Business?

When starting a cleaning business, applying for the necessary licenses and permits is one of the first steps.

Whether you need a license to start a cleaning business and the specific types you require depend on various factors, including:

- The location of your business. States, counties, and cities have different licensing laws and regulations.

- Your business structure. Whether you are a sole proprietorship, partnership, LLC, or corporation can impact the licenses you need.

- The size of your business. The number of employees your business has or the amount of revenue it generates may determine licensing requirements

- The type of business you do—meaning the type of cleaning services you offer. Different services—like window cleaning, janitorial services, and industrial cleaning—may require specific licenses and permits.

Here are some licenses you may need.

Business license

Many states require all businesses to obtain a business license. This allows you to legally run a business in the state, county, or city where your business is based. Business licenses are often connected to taxes and are typically issued by the Secretary of State.

Vendor license

Some states require businesses that sell specific goods and services to get a vendor’s license. This license enables a business to collect sales tax from its customers and clients. For example, a carpet cleaning company that sells carpet cleaning foaming spray to its customers will likely need this license.

The Department of Revenue or Taxation in your state usually deals with vendor’s licenses.

Contractor license

You may need a contractor’s license if your cleaning business works on construction or building sites. Contractor licenses are closely regulated and often require specific insurance coverage and training.

Doing Business As (DBA) registration

Generally, sole proprietorships and partnerships operate under their own names, and corporations trade under the name on their formation documents. If you use another name, like a trade name, you must usually apply for DBA registration.

Registering your business as a DBA makes the public aware that your business uses a different name.

Some owners don’t want to use their own names for privacy reasons. Other businesses register a DBA name for branding purposes and to differentiate between their products or services.

DBA registration isn’t the same as registering a trademark. If you want to trademark your business name, you must do so separately.

You must also check that your DBA name isn’t already in use before registering it. Many Secretary of State’s websites have a search function for this purpose.

Specific cleaning business licenses or permits

Some localities require business owners to register or get licenses for specific cleaning activities.

For example, janitorial employers in California must register each year with the Labor Commissioner’s Office. This registration requires employers to deliver sexual harassment prevention training every 2 years.

Permits

Depending on your location and activities, you may also need to apply for certain permits to run your cleaning business. Permits may include:

- Environmental permits: If your cleaning business deals with hazardous chemicals, you may need environmental permits. These permits regulate issues like waste disposal and water usage.

- Health and safety permits: Handling biohazardous waste, such as waste from crime scenes or medical facilities, may require a permit to transport and dispose of the waste.

- Signage permits: If you run your cleaning business from home and want to advertise it, you may need a permit to put signage on your house.

How To Get a License for Your Cleaning Business

Here are the steps involved in applying for a license.

Confirm which licenses, permits, and registrations your business needs

A good starting point for understanding your obligations is to contact the relevant government department. This may be the revenue, commerce, or taxation department or a specific licensing authority.

Your local city hall or Small Business Development Center may also offer guidance on licensing requirements.

The best way to ensure you comply with all the licensing laws that apply to your business is to speak to a lawyer. They can provide you with advice tailored to your business’s situation.

Submit an application form and supporting documents

The relevant form and documents for your license application vary depending on the type of license you’re applying for. Some standard pieces of information you may need to provide include:

- Your business’s name and address.

- Your name and contact details.

- A description of your business activities.

- Your Federal Employer Identification Number (EIN).

- Your employees’ details.

Pro Tip

An EIN is an identification number for federal tax purposes. It’s a requirement for opening business bank accounts and applying for some business licenses.

Pay the application fee

Many licenses, permits, and registrations involve an application fee. These fees vary depending on the type of permission you’re applying for and where you’re applying. For example, DBA registration usually costs between $25 and $100.

Renew your licenses

Licenses typically have expiration dates and must be regularly renewed, sometimes annually. Some licenses and registrations last longer. For example, DBA registrations generally last for 5 years.

How Much Does a Cleaning Business License Cost?

The cost of licenses, permits, and registrations for your cleaning business depends on several factors, including your business’s location and size and the license type you need.

For example, the cost of a 1-year business license in Alaska is $50, while in Nevada, it’s $500 for corporations and $200 for other businesses.

Before launching your cleaning business, do your research. This allows you to factor licensing costs into your financial projections.

How Long Does It Take To Get a License?

The length of the license application process varies between states and government agencies. You can apply for many licenses, permits, and registrations online, streamlining the process.

Ensure you start applying for the licenses you need early to avoid delays in starting your cleaning business.

Why Do You Need a Cleaning Business License?

You might need a license for your cleaning business for several reasons.

Some licenses are required by law. Licensing laws and regulations exist at the federal, state, county, and city levels, so checking licensing requirements based on your business’s location is important. Being correctly licensed is a prerequisite to bidding for public or regulated tenders and securing a business contract for cleaning.

Mandatory licenses also vary depending on the type of cleaning services you offer. For example, a housekeeping business may require different licenses than a commercial cleaning company.

Even if they’re not legally required, licenses can add to your business’s credibility. They show your willingness to be transparent about your business operations and reassure clients of its legitimacy. This may help you attract clients, especially larger commercial ones.

Some licenses or permits come with education and training requirements. These help ensure your business follows industry standards and best practices, improving the quality of your services.

This Might Interest You

Licenses and permits are an essential part of business compliance. Cleaning company software is useful for managing your compliance and reducing the risk of associated penalties. Learn more in our guide to the best cleaning business software solutions.

Why Do You Need a License To Start a Cleaning Business?

Operating without legally required licenses exposes your business to compliance risk. As a result, you may be penalized and fined.

What Else Do You Need To Consider When Starting a Cleaning Business?

Licenses and permits are only one consideration when starting your cleaning business. Here are some other issues to address.

Applying for an EIN

Many businesses need a federal EIN to open a bank account, hire staff, and apply for licenses. You can easily apply for one for free online.

You must also check whether you need an EIN at the state level. To find the relevant government department in your state to contact, look on the Small Business Administration’s website.

Opening a business bank account

Business owners typically open up a dedicated bank account for their business. This may be a legal requirement. It also helps keep your personal finances separate from your business’s and streamlines your business taxes and accounting.

Taking out insurance

You may also need to take the required insurance or bonds for your cleaning business. Both offer protection in the event something goes wrong. While insurance protects your business, bonds protect your client or customer.

Common types of insurance and bonds relevant to the cleaning industry include:

- General liability insurance or business liability insurance provides financial protection for your business in case of property damage or injury to a person other than an employee.

- Workers’ compensation insurance covers the cost of employees’ work-related illnesses or injuries, including medical expenses and lost wages. This type of insurance is mandatory in every state except Texas.

- Janitorial bonds protect customers and clients from theft by one of your employees. They’re a surety bond or agreement between your business, the bond company, and your client. If a theft occurs, the bond company compensates the client up to a certain amount. Your business then reimburses the bond company.

You should seek professional advice from a lawyer or insurance broker regarding the type of insurance your business needs.

FAQs

How do I start my own cleaning business from scratch?

Preparing a business plan is the first step in starting a cleaning business. A business plan details how you intend to structure and run your business and includes financial projections. Once you have a business plan, consider obtaining an EIN, applying for the necessary licenses and permits, and opening a business bank account.

What types of cleaning businesses make the most money?

Commercial cleaning companies often make the most money working with large corporate clients. Other specialty cleaning businesses, such as window washers, industrial cleaners, and medical cleaners, can also be very profitable.

Use Connecteam To Manage Your Cleaning Business Operations

Obtaining the right licenses is an essential step in launching your cleaning business. By law, your business may need 1 or more licenses. Failure to obtain them can result in costly fines. You can understand your licensing obligations and ensure compliance by speaking to the relevant licensing authorities or a lawyer.

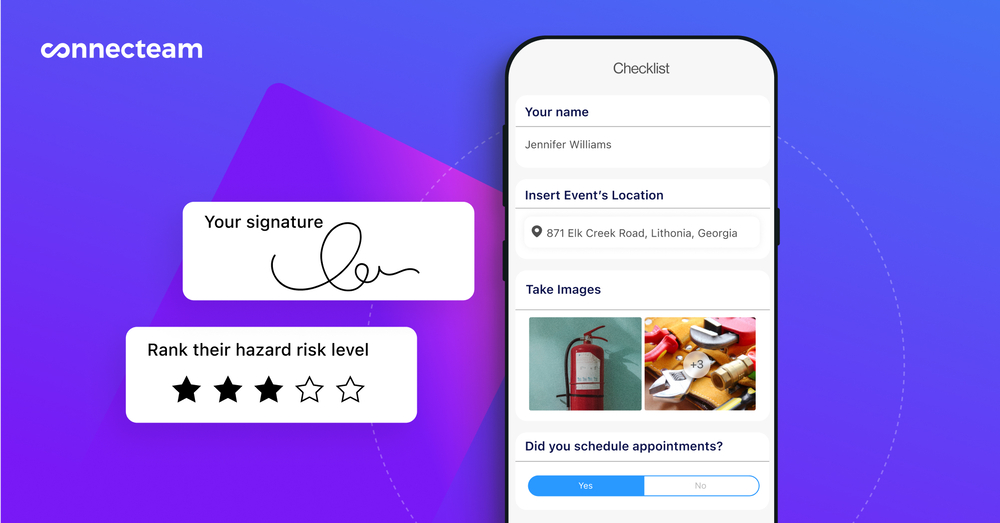

Whether running a small house cleaning company or a commercial cleaning business, Connecteam is the ideal solution for streamlining your operations, including keeping track of license documents and renewals. Our all-in-one app offers various features tailored to the cleaning industry, including time tracking, employee training, cleaning checklists, and more.

Try Connecteam for free today.

Disclaimer

The information on this website about cleaning business licenses in the United States is intended to be a summary for informational purposes only. However, laws and regulations regularly change and may vary depending on individual circumstances. While we have made every effort to ensure the information provided is up to date and reliable, we cannot guarantee its completeness, accuracy, or applicability to your specific situation. Therefore, we strongly recommend that readers seek guidance from their legal department or a qualified attorney to ensure compliance with applicable laws and regulations. Please note that we cannot be held liable for any actions taken or not taken based on the information presented on this website.