Business mistakes are inevitable – especially when payroll is concerned. Every once in a while, you’re going to underpay your employees by accident, for various reasons. This means you will owe them retroactive pay (or retro pay) in the next pay period. Let’s break down exactly what retroactive pay is and how you can calculate it.

Are you sure you’ve paid your employees accurately this month?

If not, prepare for some ugly phone calls and more pay costs down the road. You might even get sued.

So you’ll need to compensate your employees in retroactive pay.

But this can easily be avoided. With the right tools and habits, you can save your business a lot of money (and time).

Let’s dive deeper into exactly what retroactive pay is, how it could affect your business and how you can stop it from happening.

What Exactly Is Retroactive Pay?

In short, retroactive pay is the money an employer owes their employee for work they did in a previous pay period. So if you paid an employee less than what they expected, then you’d owe them retroactive pay in the future.

For example, let’s say you’re a retail manager and one of your employees (let’s call him John) makes $5 an hour. And last month, John worked for 60 hours. However, due to a payroll mistake, you paid John for only 55 hours. This means that you only paid him $275, when he should have actually earned $300. This month, you need to make sure that John receives $25 in retroactive pay.

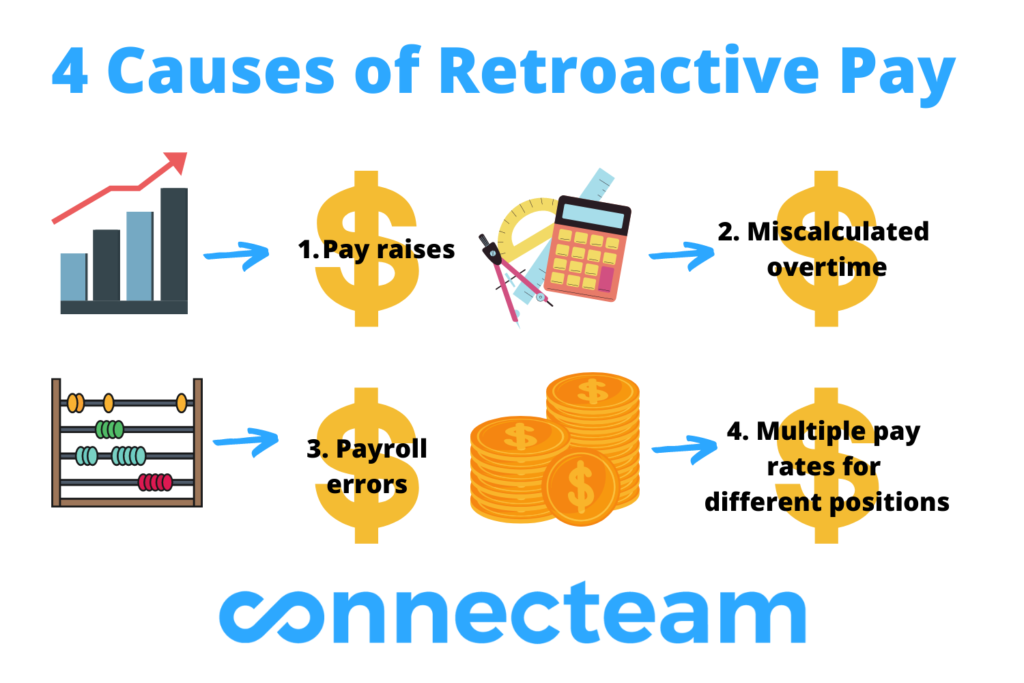

What Are The Causes Of Retroactive Pay?

Now you’re probably thinking this sounds familiar so you’re left wondering, “How did this happen?” No matter how organized you might be, many different scenarios can arise where retroactive pay is required. Whether you’re giving a raise or your payroll system is experiencing some errors, you might need to pay an employee a certain amount retroactively.

Here are some scenarios where you, as the employer, might be required to provide retroactive pay:

- Raises: You agreed to give an employee a raise but the rate wasn’t changed on time.

- Miscalculated overtime: You didn’t accurately calculate an employee’s overtime payment.

- Payroll errors: You either experienced a technical glitch or you paid the wrong amount. These errors are more likely to occur if your company doesn’t use a payroll software solution that calculates salary and wages digitally.

- Multiple pay rates for different positions: Some employees have multiple positions in the same company. For example, if you have an employee who has two positions, they have two separate pay rates. You may have used the wrong rate when calculating their earnings.

Whatever the cause may be, the harsh reality is that not all employees are awarded retroactive pay when they should. In fact, in 2021, there were 7,159 violation cases attributed to overtime and in a staggering 80% of those cases, employees didn’t receive retro pay. This just goes to show how common of a problem this is and that many employees, regardless of industry, are suffering because of it.

What Is The Difference Between Retroactive Pay And Back Pay?

Many companies often confuse the terms retroactive pay and back pay, assuming that they are one and the same. However, it is important for business owners to distinguish between the two.

When it comes to retroactive pay, employers need to fix payroll errors that occurred in the previous pay period. On the other hand, back pay is when employers need to pay employees compensation that wasn’t paid for a specific job. A usual backpay scenario arises when an employer is sued for failing to pay an employee’s salary.

What Happens When You Don’t Award Retroactive Pay?

It should come as no surprise that failure to reward employees with retro pay when it’s due can lead to severe legal ramifications. In 2020, $10.7 million was awarded to employees due to discrimination. This included employees who were treated unfairly for various reasons, including their race, religion and gender. (Be sure to offer workplace diversity to avoid such claims down the road.)

Retro pay can also result from a breach of an employee’s contract. For example, a hotel employee has the right to take legal action if they are paid $15 per hour, when it states in their contract that they should actually receive $17.

Also, let’s say that you started a cleaning business and you offered your employees overtime but then you didn’t proceed to pay them. You are obligated to pay them retroactively. And if you don’t, then your employees have the right to claim for it and take further legal action if necessary.

How Do I Calculate Retroactive Pay?

If you, the employer, notice a payroll error of any kind, then have no fear. You still have time to fix this. The first step is to calculate the retroactive pay depending on whether your employee works hourly or on a fixed salary. It is also important to take taxes into consideration, especially since they vary from state to state.

With this in mind, it’s also worth noting that retroactive pay varies depending on the type of pay period and pay rate the employee is classified under. Here are some key examples:

-

Hourly Employees

-

Salaried Employees

-

Employees Receiving Raises

Let’s say you run a manufacturing company, an employee earns $25 per hour and you need to pay them 10 hours worth of missing wages. It’s easy to calculate how much they should be owed in retroactive pay. 10 x $25 = $250!

On the other hand, salaried employees are usually paid the same amount for each pay period. Therefore, retro pay should be relatively simple. For example, if a retail employee is supposed to receive $3,000 per paycheck, but for some reason, they only received $2,450, then the employer would owe them $550 in retro pay.

Then there’s the case of a salaried employee getting a raise but accidentally being paid according to their salary, pre-raise. Let’s say you run a construction business, a worker currently earns $50,000 per year and they were recently awarded a raise. However, they still got paid the same amount, when they should have got $55,000 instead.

In order to find the difference, you need to determine how much they need to be paid on each paycheck with the new rate included. Then, subtract the old rate. Only then can you provide the relevant retro pay.

How Do I Make Retroactive Pay A Painless Process?

As previously established, all companies are going to face payroll issues from time to time. This includes needing to pay retro pay, and for various reasons. With that said, there are numerous tools and software that business owners can use to make this process painless.

Handling payroll with excel or pen and paper is bound to lead to mistakes and inevitable retro pay. But using an all-in-one time clock app, like Connecteam, you will dramatically decrease the chances of this happening in the future.

Here’s how Connecteam can help:

- The employee time clock records employees exact work hours, down to the second. This means that payroll issues like buddy punching and time theft are eradicated.

- Employers can receive detailed insights that help them understand how their employees’ time is spent, such as time per job and customer, etc.

- Managers can also add shift-related information using shift attachments.

- Payroll process is made smoother as managers are able to easily export timesheets.

- All times and details are documented and therefore transparent between employers and employees.

- The real time GPS tracker and geofencing ensures that employees are clocking in from the correct location, while breadcrumb technology collects random location points to give managers a basic idea of their employee’s whereabouts while clocked in.

- The time clock also allowed employers to easily manage workers’ absences, days off and sick days.

- Employees can send reminders and notifications to ensure that employees remember to clock in and out. Auto clock out is also included.

- Direct, seamless integrations with QuickBooks Online and Gusto – all you need to do is make sure your employees are clocking in and out!

Ultimately, Connecteam’s time clock and scheduling technology means that employers can cut out any payroll-related discrepancies.

Remove Retro Pay From Your Business For Good

The Bottom Line On Retroactive Pay

Ultimately, retro pay is an issue that provides zero benefits for an employer. It simply leads to potential lawsuits, bad will between the employer and employee and unwanted stress for everyone involved.

By now, you should have a better understanding of these four important things:

- What retroactive pay is

- The various scenarios where retro pay is required

- How to calculate retro pay

- Avoiding having to pay retroactively in the future

Now that you have the basics of retroactive pay locked down, you can take these valuable guidelines and implement them using the latest technology. Because without going digital, streamlining this process can be extremely difficult.

Connecteam’s rich array of features, especially its time clock, cover all of the employer’s time tracking bases to ensure zero discrepancies, 100% transparency, smooth payroll and a rapid decrease in retroactive pay.

Even after reading this, don’t worry if you make payroll mistakes in the future. As long as you treat this aspect of your business seriously and have your employee’s financial security in mind, then paying them what they have earned should be smooth and simple.