A joint venture is an agreement between two or more companies that pool resources, share profits, and work toward a common goal.

A joint venture can be a win-win way of partnering with another company to achieve goals, such as entering new markets, since you get to split the risk and costs of the venture with other parties.

However, effectively running a joint venture relies on many factors, including finding suitable partners and successfully onboarding employees. You’ll need a deep understanding of how joint ventures are defined, the risks involved, and how to set them up correctly to avoid financial and reputational losses.

That’s why we’re here to help. In this guide, we explain what a joint venture is and how to create one. Let’s dive in!

Key Takeaways

- The term “joint venture” refers to a goal-driven relationship between 2 or more organizations. When the goal is achieved, the venture usually ends or is integrated into one of the partners’ businesses.

- Entering a joint venture can help lower costs and risks associated with achieving business goals, such as entering a new market, while combining resources and expertise with other parties.

- Joint ventures also carry some risk. For example, you might be giving away your intellectual property (IP), the different workplace cultures might be incompatible, or slow decision-making could lead to missed opportunities.

- To ensure joint venture success, perform due diligence on potential partners, write a comprehensive agreement and business plan, and design an effective onboarding strategy.

What Is a Joint Venture?

A joint venture (JV) is a business entity or project co-owned by two or more organizations targeting the same goal — e.g., to design an innovative product or penetrate an unserved market. The parties invest varying amounts of capital and share the venture’s profits.

The JV is usually a separate financial and legal entity from the businesses entering it. It’s also intended to have a limited lifespan, ending when the goal is achieved.

Typically, a company will enter a joint venture agreement when it lacks the expertise or resources to enter a new market or wants to lower the risk of launching new services.

What Are the Benefits of a Joint Venture?

Joint ventures have attractive benefits. Here are the top ones.

Lower risk and costs

Around 20% of businesses fail within 2 years of opening, but starting a venture with other businesses can lower your risk of failure thanks to increased knowledge and infrastructure.

In addition, investment and operational costs are often lower because you’ll share infrastructure and overheads with another business. For example, larger companies as partners could allow you to use property and equipment more cheaply or for free, saving you significant upfront costs.

More resources and expertise

By venturing solo, you must buy physical assets and build expertise through hiring or research and development—all of which are expensive, time-consuming tasks.

Conversely, a joint venture allows you to use combined resources and expertise to run operations more smoothly and create better customer outcomes.

Specifically, teaming up with another company can provide you with:

- Specialized knowledge, skills, and abilities (KSA).

- Insight into a product, industry, or customer group.

- Property, plant, and equipment (PP&E).

- Relationships with suppliers, clients, or government agencies.

Easier new market entry—including foreign markets

Joint ventures can present an easier way of penetrating new markets, especially overseas ones. For instance, your co-venturer might have a recognizable brand, customer insights, or specialized products or supplies in a market, whereas you don’t. Also, some countries legally require you to create a joint venture with a local business when entering foreign markets.

Even when you’re not required to start one, a joint venture helps you enter new markets more easily. A partner in a foreign or specialized market can offer:

- A thorough understanding of cultural factors, government relations, and customer needs.

- Easier access to property, land, equipment, and supply and distribution chains.

- The ability to hire local talent more easily.

- Insight into local languages and dialects.

How Does a Joint Venture Work? Setting Up and Running a JV

Let’s dive into the key aspects of setting up and running a joint venture.

Find a joint venture partner(s)

Choosing the right partner(s) is central to your JV’s success. Here’s how to go about it.

Decide your partner’s role in the venture

Be specific about what your ideal joint venture partner should contribute. Is it subject-matter expertise, marketplace relationships, capital, or something else? Having a requirements checklist will help you identify the right JV partner.

You may also find it useful to categorize the joint venture relationship as one or more of the following types:

- Project-based: Working with a company with similar or different capabilities to complete a specific project (e.g., building a bridge).

- Functional: Choosing a firm with different expertise for a short- or long-term venture (e.g., a phone manufacturer and a software company).

- Vertical: Joining forces with a company in your supply chain to secure production or distribution channels (e.g., a food producer teaming up with a distributor).

- Horizontal: Partnering with a company that creates similar products but in different markets or to different customer groups.

Research and shortlist partner candidates

Once you’ve clarified your JV partnership type and requirements, perform market research to identify a shortlist of suitable partner candidates. Start broad and narrow your list by applying additional criteria.

For example, speak to your industry contacts and research companies based on their location, size, product type(s), and/or target customer. Create a long list of potential JV partners. Your list might be between a few dozen to 100+ businesses.

Then, reach a shortlist by applying more specific criteria. You could, for example, prioritize companies whose products have certain features. Remove any companies from your list that don’t fit your criteria. Typically, a shortlist will include up to 20 candidates you can start contacting.

Select your joint venture partner(s)

Engage your shortlisted JV candidates by email or phone and simply state you’re exploring a joint venture opportunity. Try to establish direct communication with a senior representative, such as the company CEO or head of sales, and book a meeting with them to explain your plans and requirements.

During the meeting, be sure to:

- Sign a non-disclosure agreement (NDA). Overlooking this step means sensitive information, such as strategic plans and product IP, could be leaked in the industry or the media—or your JV candidate may use it in their business. Protect your interests by co-signing a business confidentiality agreement.

- Ask questions about capabilities, goals, and finances. You must understand their business in-depth to confirm they can provide what you’re looking for. For example, are their leaders as passionate about the venture as you are? Do they have the financial health to invest in this opportunity?

- Understand their company culture. Culture clashes can ruin even the best JV plans. So, ensure your workplace cultures are compatible. You can, for example, visit your prospective partner’s offices and facilities and speak to employees and customers. Invite them to do the same at your workplace.

- Determine investment expectations. Firstly, bring your own financial estimates to the meeting. How much are you willing to invest, and what profit share percentage do you want? Then, discover your potential co-venturer’s expectations and check that you’re in the same ballpark. For example, it likely won’t be a good match if you’re both looking for 80% ownership.

- Perform due diligence. This helps ensure everything your prospective partner has told you about their company is true. Due diligence can involve reviewing your potential partner’s financial statements and equipment and assessing their employees’ skills. In complex cases, you can hire due diligence firms to do this for you.

Repeat these steps for additional companies if you plan to partner with more than 1.

Decide the joint venture’s legal status

Next, determine whether you’ll incorporate or not incorporate your joint venture.

You can enter a joint venture without creating a separate legal entity. These are commonly known as non-incorporated joint ventures. The JV partners sign an agreement outlining the joint venture terms, and they run the JV’s operations and finances as individual companies.

While easier and less expensive, this option could make your business liable for the JV’s financial, legal, and reputation risks, including lawsuits.

The other option is incorporating your JV, which may offer increased protection for the venture and its owners and workers. In addition, incorporation allows the venture to borrow money, own property, sue and be sued, and pool all parties’ costs and revenues in one place. These are all less likely to be possible under a non-incorporated entity.

In the US, common legal entities include:

- Corporation (either C Corp or S Corp): Owned by shareholders.

- Limited liability company (LLC): Owned by 1 or multiple individuals who aren’t personally liable for business outcomes.

- Partnership: Owned by 2 or more individuals who are personally liable for business outcomes.

- Charity or non-profit: Privately owned, typically donation-funded and tax-exempt.

Finally, consider taxation when deciding your JV’s legal status. For instance, a separate for-profit legal entity will need to declare revenues and costs and pay taxes. However, with a non-incorporated joint venture, your company’s tax return might need to include your portion of the JV’s revenues and costs.

Pro Tip

Research each incorporation option in-depth and consult a professional tax advisor before deciding your joint venture’s legal status.

Write an agreement

The best way to ensure your business interests are protected—and that all parties perform their duties—is by writing a joint venture agreement.

A basic joint venture agreement should include:

- How investments, assets, liabilities, profits, and losses are divided among the parties—e.g., 50/50, 40/60, etc.

- Each party’s responsibility in the case of losses and bankruptcy.

- Each party’s legal liability in various circumstances, such as a lawsuit.

- Each party’s voting rights.

- Whether the joint venture is being set up as a separate entity and, if so, the entity type.

- A description of the joint venture aims, estimated duration, location, and day-to-day operations.

- The persons or entities responsible for specific duties, such as managing government relations or attracting customers.

- When and how parties can exit the joint venture—for example, upon reaching the stated goals, if the venture is liquidated, or when 1 participant buys out the other(s).

Pro Tip

Get legal advice from a professional or firm that understands your business and is experienced in writing joint venture agreements. This helps ensure you don’t leave out vital clauses that protect your finances and reputation.

That said, not all joint ventures are backed by a formal agreement. A handshake agreement can also work for small business joint ventures or low-risk collaborations. An example of this kind of agreement would be an email thread where all JV parties agree on their share of investments and responsibilities.

Create a business plan

Your business plan is the blueprint that all JV parties consult when making decisions across operations, HR, marketing, and more. It can also help you get funding, such as investor capital. You and your collaborators must develop and agree on it together before kickstarting operations.

Here’s the basic structure of a business plan:

- Executive summary: Create a short “elevator pitch” summarizing all subsequent sections. It’s best to write this last, even though it appears first in your plan.

- Business model: Describe your mission, target market, and product or service. Highlight your venture’s unique selling point (USP)—why your venture is likely to be successful among competitors.

- Operational model: Include your organizational structure, hiring plans, and how you’ll manage daily operations.

- Market research: Describe the market you’re entering, including customer needs and competitor details. Use specialized frameworks—like SWOT analysis, which breaks down strengths, weaknesses, opportunities, and threats—to organize the information.

- Marketing and sales plan: Outline the strategies and resources you’ll use to market and sell your products. For example, discuss physical and online marketing channels and customers the parties already have access to.

- Financial plan: Estimate key figures such as revenues, costs, investor capital, and debt for the next 5 years. Explain how you calculated them—for instance, by including the prices and quantities of goods sold.

Onboard employees successfully

Your joint venture’s team members can be a combination of workers from partner companies and newly hired employees. Some of your current employees may even work part-time for your business and part-time for the JV.

Either way, properly onboarding the JV team is essential to avoiding costly outcomes such as productivity losses, culture clashes, and high employee turnover.

First, the partner companies must agree on the venture’s mission, values, and measurable goals, which help define the onboarding process.

Then, the companies must onboard the venture’s standalone leadership team, including the JV’s CEO, COO, and CFO. Since these individuals are critical to the venture’s success, it’s ideal they don’t hold full-time executive responsibilities in the partner companies.

Onboarding for the JV leadership team should comprise:

- Holding meetings to discuss the business plan components in depth—e.g. marketing, product strategy, customer insight, etc.

- Offering the leadership team time to process new information, perform their own research, and develop plans relevant to their roles.

- Organizing specialist training sessions as needed to fill executives’ skill gaps.

- Asking the team to build on the mission, values, and goals to develop a people strategy. This should include strategies and actions that help hire, retain, engage, and train employees.

Depending on the funds and goals of the JV, you might need additional employees to join the venture team. For instance, they may execute specialist responsibilities across research, product, or sales.

Onboarding for all JV employees should include:

- Industry, product, and customer insights to explain the venture’s position in the market.

- Role-specific training plus mentoring from an appropriate senior manager.

- Socialization opportunities such as team lunches, informal outings (or calls), and onboarding buddy chats.

- Employee management processes and systems, such as internal communication channels, payroll, time tracking and timesheets, labor contracts, and more.

- Company policies and legal obligations, from health and safety rules to anti-discrimination policies.

- Line management relationships and onboarding buddy schemes.

Did You Know?

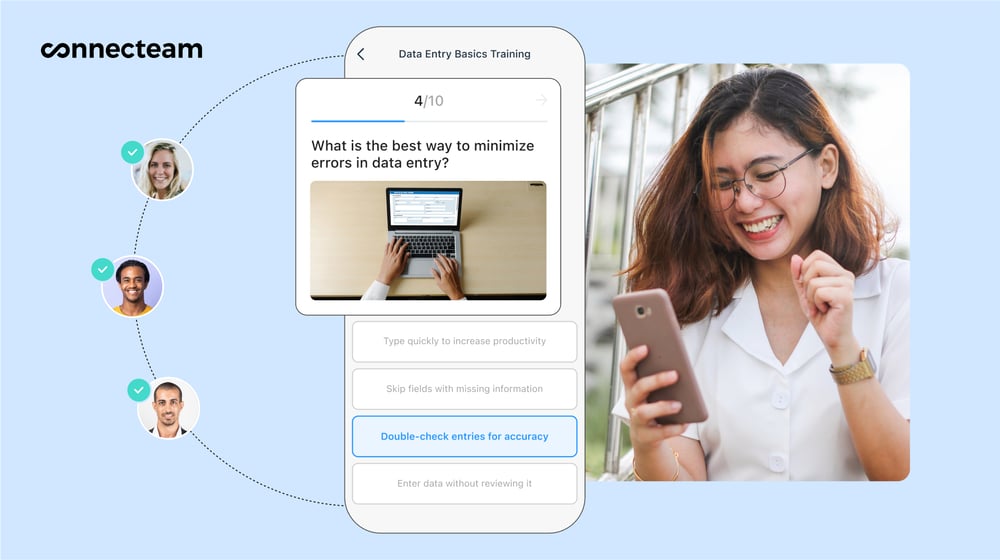

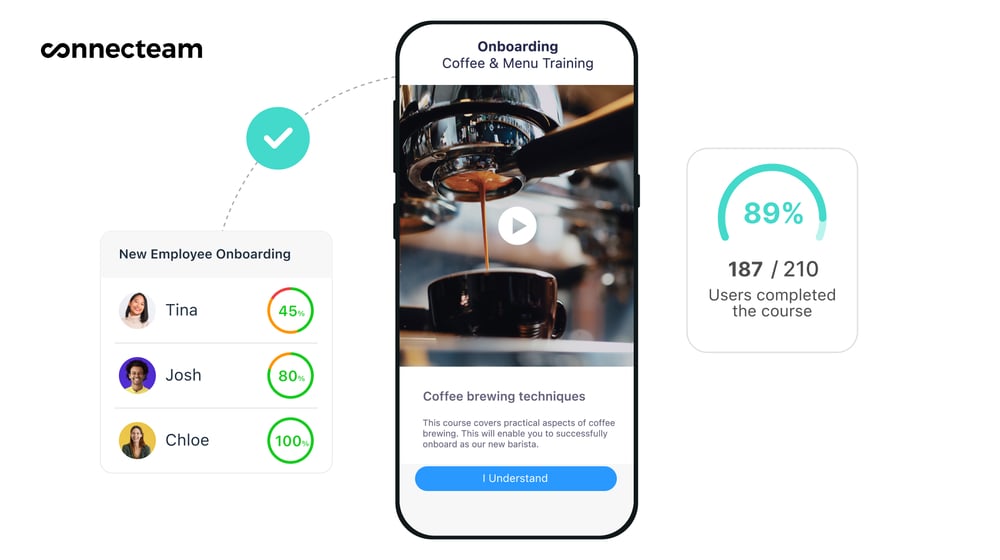

Employee management software like Connecteam combines training features with secure document management, chat, scheduling, and more—helping to ensure your joint venture team onboarding is smooth and effective.

Get started with Connecteam for free today!

Joint Venture Risks

Bringing together 2 or more companies to start a venture isn’t always problem-free. It’s why JVs are typically fixed-term endeavors: Trying to meet multiple businesses’ priorities can become counter-productive in the long run.

Here are the main risks of joint ventures to be aware of.

Incompatibility between joint venture partners

Joint venture partners might be incompatible, leading to internal conflicts, turnover, and loss of trust among employees.

One key compatibility factor is the partners’ company cultures. For example, 2 companies sharing a drive for innovation and disruption would likely work well together—but a business with a slower, more bureaucratic culture could face issues in partnering with a company with a fast-paced, creative culture.

The companies’ individual processes and systems are another factor. For instance, one might be tech-savvy and efficiency-led, while its counterparty relies on pen and paper. Clashing operational styles don’t just lower productivity— they can also prompt arguments about unequal levels of effort and impact.

It’s difficult to solve compatibility issues once the venture is operating. So, do your due diligence thoroughly before choosing your collaborators.

Placing intellectual property at risk

You might need to share some of your IP—such as product expertise and customer data—to run the joint venture effectively. This can place you at a commercial disadvantage if your joint venture partners are potential competitors.

That said, you can lower this risk in 2 ways:

- Share only the minimum amount of IP required for effective collaboration—or none at all, if you can.

- Co-sign a non-disclosure agreement (NDA) and add clauses to your joint venture agreement that prohibit storing or disseminating collaborators’ IP.

Did You Know?

Connecteam lets you store important team documents securely and choose who has access to each one. In addition, you can create and save training manuals, standard procedures, and much more. It’s all a few taps away on employees’ mobile devices.

Slow decision-making

Multiple management teams may take longer to reach decisions than just 1 team would—especially when tackling new products or markets. Each party might, for instance, fear making the wrong move and overthink decisions relating to products, sales, or operations.

Slow decision-making can lead to missed opportunities, lower productivity, bottlenecks, and even decreased revenue in the long run.

To avoid this, you could consider creating a separate leadership team for the joint venture, with the founding companies’ leaders acting as decision-makers.

Pro Tip

You can lower your joint venture risks by keeping your intellectual property secure, creating a healthy company culture, and ensuring effective communication and day-to-day management.

Connecteam can help you with all this and more. Team members can stay connected on the go, celebrate their achievements, review and complete tasks, access essential documents, and more. Plus, you can monitor team performance with real-time employee task tracking and time reporting.

Get started with Connecteam for free today!

Bottom Line on Joint Ventures

A joint venture (JV) allows you to join forces with 1 or more companies to work together toward a clear goal. Your joint venture partners share their expertise and resources (e.g., funding, product IP, stakeholder relationships, and more) to help achieve the objective. This enables you to grow as a business while lowering risk and costs.

Your JV can be a separate business entity with its own financial and legal responsibilities. Or, it can remain non-incorporated as an agreement between the independent partner companies. Either way, you and your partners must determine a clear responsibility and profit split, plus how and when you can exit the joint venture.

It’s also important to find partners who share your values and beliefs to avoid problems such as efficiency and turnover. Finally, you must design a thorough onboarding process so all staff members work toward the same goal.

FAQs

What is an example of a joint venture?

An example of a successful joint venture is Google Earth. The program that offers 3D images of Earth based on satellite imagery started when Google formed a joint venture with NASA in 2005. This was a functional joint venture where Google’s software and data management capabilities worked together with NASA’s satellite infrastructure.

Is a joint venture good or bad?

A joint venture has both advantages and disadvantages. It can be a lower-cost, lower-risk option when you want to expand your business—for instance, by entering a new market—because you pool resources with another company. However, without finding appropriate partners that complement your capabilities and company culture, you risk financial losses, high turnover, and even reputational damage.

Is a joint venture always 50/50?

A joint venture doesn’t always involve a 50/50 split of investments and profits. The companies in the joint venture can negotiate a percentage split that works for their financial goals—e.g., 40/60, 30/70, etc.

Disclaimer: This article offers general guidance on setting up joint ventures and isn’t a substitute for legal or professional advice. Individual situations may vary, and we recommend consulting with appropriate advisors. Connecteam isn’t liable for any outcomes—including costs—resulting from the use of this information.