Considering forming a C corp to run your business? You should understand its key features, including ownership structure, liability, and taxation. In our guide, learn what a C corporation is, how it’s taxed, and its pros and cons.

There are many types of business structures to choose from when starting a business. C corporations (C corps) often stand out to new business owners, offering features like limited shareholder liability and unlimited growth potential.

However, before forming a C corp, you must understand its specific features, advantages, and disadvantages. Otherwise, you may face unexpected tax liabilities and difficult regulatory requirements, resulting in unforeseen costs in both time and money.

This article provides a helpful starting point for understanding C corps. In it, we look at the definition of a C corporation, its key features, and the potential pros and cons of using a C corp to run your business. We also provide steps for forming a C corp and filing for C-corp status.

Key Takeaways

- A business that’s been incorporated usually becomes a C corp by default. C corps pay taxes on the business’s income at a corporate level, and the owners (shareholders) pay taxes on dividends at their personal tax rate.

- C corps offer unlimited growth potential and protect shareholders from personal responsibility for the company’s debts and liabilities.

- However, they’re subject to double taxation and demanding regulatory requirements.

- Speak with legal and tax advisors to decide whether a C corp is the right structure and tax status for your business.

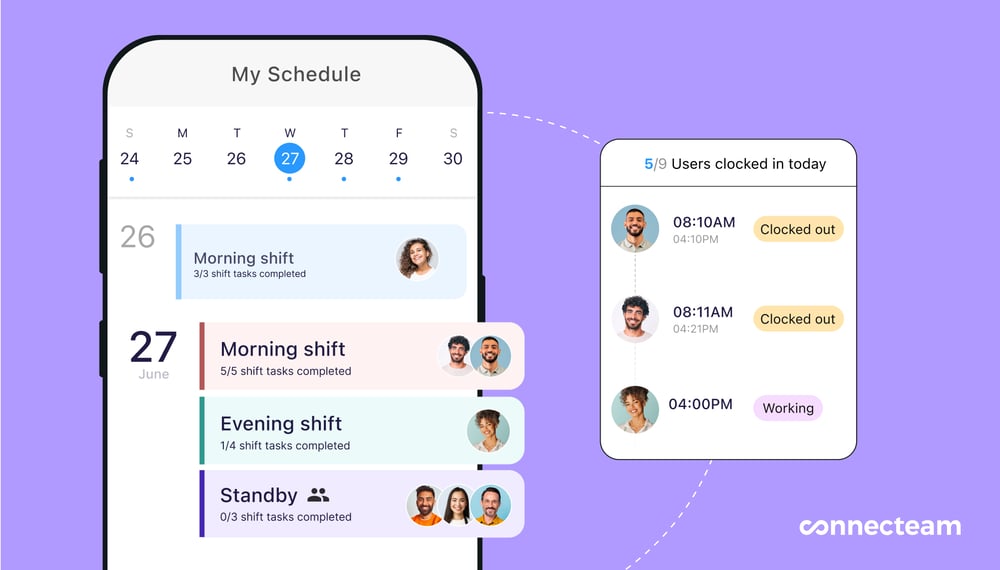

- Consider an employee management app like Connecteam to help run your C corp.

What Is a C Corporation? Definition and More

When you incorporate your business, it becomes a legal entity (a corporation) that’s separate from you. This process involves legally registering your company with a government authority.

In most states, once a business is incorporated, it becomes a C corp by default—unless you elect a different status, such as an S-corp status (if eligible). The “C” refers to the section of the Internal Revenue Code (the set of US tax code laws) that outlines how C corps are taxed at a federal level.

Shareholders own C corp and appoint a board of directors to oversee its governance. C corps can have unlimited shareholders.

However, C corps attract double taxation. (Learn more on this below). Also, a C corp is more complicated to set up and run than other business types—like limited liability companies (LLCs).

🧠 Did You Know?

C corps are a common type of company in the US. Examples of well-known C corps include Apple, Target, and Walmart.

Key Features of a C Corp

Limited liability

C corps are legal entities that are separate from their owners (shareholders), directors, and officers. With a separate legal identity, C corps can enter into contracts, sue, and be sued. Importantly, this separation means that the company’s debts and liabilities belong to the business—not the shareholders.

Shareholders’ liability (legal responsibility) for the businesses’ debts, losses, and liabilities (other financial obligations) is limited to the amount of their investment. They can’t be held personally liable beyond this. Shareholders’ personal assets are separate from the business’s assets. So if the company fails or is sued, their personal assets are protected.

This limited liability is an attractive feature for many business owners.

Double taxation

At the federal level, C corp business income is taxed at both a business and personal level—a situation called “double taxation.”

First, the business pays corporate income taxes on its profits, currently at 21%. Corporate profits are reported on IRS Form 1120.

Then, shareholders pay personal income taxes on the dividends or other distributions they receive from the company based on their individual rates.

🧠 Did You Know?

A dividend is the portion of the corporation’s earnings that’s distributed to a shareholder as a return on their investment in the company. Payment can come in the form of cash, additional shares of stock, or other property.

While double taxation might not sound appealing, C corps can offer tax planning advantages. For example, C corps can deduct certain charitable contributions as business expenses and choose to carry losses over into future tax years to offset profit and reduce their corporate tax.

💡 Pro Tip

Curious about the tax advantages of C corps? Speaking to a tax professional is essential to understanding the opportunities available to your business. Tax advantages are complex and vary according to several factors, including the state in which your business operates.

Ownership structure

C corps have ownership flexibility. There are no rules around who can own a C corp or how many owners a C corp can have. Its unlimited shareholders may include international investors or other corporations.

Shareholders are considered owners because they own stock in the C corp. Stock represents their ownership and signifies their claim on a portion of the company’s assets and earnings.

Some shareholders are investors who’ve bought stock in the corporation. Others may have inherited stock or received it as part of an employee stock ownership plan. Others might be the original founders who gave themselves stock when they incorporated the company.

C corps can issue different classes of stock. This allows them to manage owner control, distribute profits, and attract investors strategically.

For example, they might issue Class A shares that provide voting rights, which means shareholders who own that stock can vote on corporate matters like electing the board of directors. They might also issue Class B shares that offer no voting rights but higher dividend priorities, which means these shareholders get paid dividends before others—even when the company has limited profits to distribute.

However, companies that exceed certain asset and shareholder limits must register with the US Securities and Exchange Commission. Seek advice from an attorney regarding these.

This flexibility gives C corps an advantage over S corps, which are limited to 100 shareholders who can’t be non-resident non-citizens or corporations.

Companies seeking to list and sell shares on the stock exchange favor C corps because they offer unrestricted shareholder numbers and the option to issue various classes of stock. For this reason, most public companies are C corps. These are companies that have issued shares of stock to the public—becoming publicly traded companies.

Continued existence

Since C corps exist as their own entities, they’re not tied to specific owners. Shareholders can freely sell their shares. This separation means a C corp continues to exist even if its original owners leave the company.

This contrasts with other business structures, such as sole proprietorships, where the business ceases to exist upon the owner’s death.

Compliance

C corps are subject to various compliance obligations to ensure transparency. These include:

- Holding shareholder and director meetings at least annually.

- Preparing bylaws and keeping these at the primary business premises. Bylaws are the internal rules a company must follow and include officer titles and responsibilities, shareholder duties, and meeting processes. They also provide a framework for crucial business decisions.

- Keeping certain records, including minutes of shareholder and director meetings, company director voting records, and lists of shareholders and their ownership percentages.

- Filing annual reports, financial disclosure reports, and other financial statements with the relevant agency in the state where the business is registered.

🧠 Did You Know?

Connecteam’s all-in-one app lets you easily create digital forms, including documents containing bylaws and meeting minutes. You can also digitize and securely store documents electronically in a company knowledge base, which helps you with compliance.

Advantages of a C Corp

C corps offer several potential benefits:

- Shareholders enjoy limited liability protection.

- You can raise capital by issuing and selling more stock.

- Without limits on the number of shareholders or criteria for who can become a shareholder, C Corps offer unlimited potential for business growth.

- The high level of regulation associated with C corps gives businesses legitimacy, making the business appealing to investors.

- C corps continue to exist even when owners leave, providing stability and continuity for the business.

Disadvantages of a C Corp

There are also several drawbacks to C corps to consider:

- They’re subject to double taxation.

- Shareholders can’t write off business losses on their personal income statements.

- C corps are generally more expensive to create than other business structures due to registration fees and the need for professional legal and tax advice.

- C corps are subject to increased regulatory oversight. These obligations usually require the involvement of financial and legal professionals, creating additional business expenses.

How To Form a C Corp and File for C-Corp Status

The general steps for forming a corporation include:

- Register your business name with the relevant state agency—often the Secretary of State’s office.

- Appoint company officers, a board of directors, and a registered agent. Company officers are high-level executives who handle the company’s daily management (including chief executive officers/CEOs). The board of directors supervises its overall management and makes critical strategic choices. Finally, a registered agent is an individual (or business) in the state where your business is registered who can receive legal notices for your business.

- File articles of incorporation with the relevant state agency. Articles of incorporation are documents that set out information about the business, including the corporation’s name and address, number of shares, and details of the corporation’s registered agent. This step typically involves a filing fee, which varies between states. Use the Small Business Administration’s (SBA) website to find the relevant agency in your state.

- Prepare company bylaws. Prepare these documents with the assistance of an attorney to ensure they comply with relevant federal and state laws.

- Issue shares by way of share certificates. Share certificates are physical or electronic documents that include the name of the shareholder and the number and class of shares they own.

- Apply for any necessary federal, state, and local business licenses. These vary between industries. SBA provides a guide to federal and state licenses and permits.

- Apply for an Employer Identification Number (EIN) via the IRS.

- Check and apply for any other tax identification numbers required at the state level. These may include numbers for payroll, unemployment, and disability insurance taxes.

These steps are a general overview of the process. You should seek legal and financial advice before forming a C corp to understand the steps needed to create your business correctly.

📚 This Might Interest You

Learn how to apply for an EIN in our step-by-step guide.

Examples of C Corp Businesses

Due to their features, C corps are typically suitable for:

- Higher-risk businesses.

- Startups projecting rapid growth and expansion.

- Companies seeking venture capital or angel investors.

- Businesses planning to go public.

These are just some examples.

C Corps Compared to Other Business Structures

How are C corps different from S corps?

S and C corps are incorporated business structures that limit shareholder liability. They’re made up of shareholders, directors, and officers. The main difference lies in how they’re taxed.

While C corps are subject to double taxation at the corporate and individual level, S corps pass profits to shareholders to be taxed at the personal level only. There are also more restrictions on the ownership of S corps—only certain types of shareholders are allowed and S corps are limited to 100 shareholders.

C corps are the standard corporate structure in many states. Corporations must apply for S-corp status by filing the relevant form with the IRS.

How are C corps different from LLCs?

Like a C corp, LLCs protect their owners—called members—from personal responsibility for the business’s debts and liabilities but there are some important differences.

Check the table below for the differences between a C Corp and an LLC

| Feature | C Corp | LLC |

|---|---|---|

| Suitable for | Growing businesses seeking investment, potential for high profits | Startups, solopreneurs, businesses with simple ownership structure |

| Formation | More complex, requires filing Articles of Incorporation | Simpler, requires filing Articles of Organization |

| Management | Board of directors and officers required | Flexible management structure, not required |

| Formal Requirements | Must hold regular meetings, maintain detailed records | Less stringent record-keeping requirements |

| Taxes | Double taxation: corporation pays taxes on profits, then shareholders pay taxes on dividends | Pass-through taxation: profits and losses pass through to members’ personal tax returns |

| Ownership Flexibility | Can raise capital by issuing and selling stock to a larger pool of investors | Ownership generally limited to founders or a smaller group |

| Employee Benefits | Can offer qualified retirement plans and other employee benefits | May face limitations on offering certain benefits |

| Lifespan | Perpetual existence unless dissolved | May have a limited lifespan or perpetual, depending on state law and member agreement |

C corps are formed by filing articles of incorporation, while LLCs require articles of organization: formal documents setting out key details about an LLC’s structure and operation. LLCs don’t have shares or shareholders. Instead, a single member or group of members owns an LLC. LLCs are also subject to less strict regulatory requirements than C corps.

While C corps are subject to double taxation, LLCs are pass-through entities by default. In a pass-through entity, business profits and losses aren’t taxed at the corporate level but pass through to the owners, who report and pay taxes on them in their individual tax returns. However, LLCs can be taxed as C or S corps if their owners choose.

How are C corps different from general partnerships?

While C corps offer limited liability, partners are personally liable for the debts and liabilities of the business.

Unlike a C corp, partnerships are pass-through business entities for tax purposes. The business doesn’t pay corporate tax. Instead, its profits pass to the partners who report them on their personal tax returns.

How are C corps different from sole proprietorships?

Sole proprietorships are single-owner businesses that are simple to set up and run, with minimal administrative requirements. Owners of sole proprietors also have full control over the business, compared to shareholders in a C corp.

Unlike a C corp, sole proprietorships don’t separate business and personal liability. As a result, the owner of a sole proprietorship can be held personally liable for any business debts and liabilities. When the owner stops doing business or passes away, the business ceases.

Optimize Your C Corp Operations With Connecteam

Considering forming a C corp to start your business? Seek professional advice from a lawyer and tax advisor.

They can explain how C corps operate and what their pros and cons will be—taking your personal and business situation into account.

Once you’ve set up your C corp, finding the right tools to help you run your business and manage employees effectively is crucial.

Connecteam is an all-in-one employee management app that can help you manage operations, communications, and HR processes.

With features like task management, scheduling, in-app chat, and employee rewards and recognition, Connecteam is a great way to ensure your new C corp thrives.

Get started with Connecteam for free today!

FAQs

How do C corp owners get paid?

C corp owners (shareholders) may get salaries, dividends on their shares, or both. To understand C corp owner compensation, refer to the applicable laws and the corporation’s bylaws.

Am I self-employed if I own a C corp?

If you own a C corp and work in it, you receive a salary. Generally, you’re considered an employee rather than self-employed. This means you’re exempt from self-employment taxes. However, getting professional advice is essential to understanding your specific tax obligations.

Disclaimer

The information on this website about C corporations in the United States is intended to be a summary for informational purposes only. However, laws and regulations regularly change and may vary depending on individual circumstances. While we have made every effort to ensure the information provided is up to date and reliable, we cannot guarantee its completeness, accuracy, or applicability to your specific situation. Therefore, we strongly recommend that readers seek guidance from their legal departments or qualified attorneys to ensure compliance with applicable laws and regulations. Please note that we cannot be held liable for any actions taken or not taken based on the information presented on this website.