Considering electing S-corp status for your business? First, you must understand the features of S corps, including taxation and ownership rules.

Many owners are interested in S-corp status for their new businesses due to potential tax benefits. But before deciding whether S-corp status is right for your business, you need a detailed understanding of how S corps work.

For example, S corps have extensive ownership restrictions that may not suit your longer-term plans for business growth.

This article provides a detailed overview of S corps—including what an S corp is, its key features, and its advantages and disadvantages.

We also discuss how to file for S corp status. Using this article as a starting point, you can start determining whether an S corp is the best choice for your business.

Key Takeaways

- S corps are corporations that have elected to be taxed under Subchapter 6 of the Internal Revenue Code.

- This allows S corps to be taxed as pass-through entities and avoid federal corporate income tax. Instead, the business’ profits and losses pass to the shareholders, who pay taxes on them at their individual rates.

- There are strict limitations on the number and types of shareholders S corps can have.

- Speak to a tax and legal advisor to determine whether an S corp is the best tax arrangement for your business.

- Using a tool like Connecteam is an ideal way to effectively manage your S corp’s workforce.

What Is an S Corporation? Definition and More

A corporation is a business entity that’s legally separate from its owners. To create a corporation, you must undergo a process called “incorporation” where you legally register your company with the state.

An S corporation, or S corp, is a corporation that has elected to be taxed under Subchapter S of the Internal Revenue Code (the laws that govern the US tax system).

Under their tax designation, S corps don’t pay federal corporate income tax. Instead, the company passes its income, losses, deductions, and credits to the business owners (shareholders) who report and pay tax on them at an individual level.

The default form of corporation is a C corp. C corps are subject to double taxation. They pay federal corporate income tax on profits, and their shareholders also pay income tax at their individual rate on the dividends (portions of the corporation’s earnings) they receive. S corps avoid this double taxation.

There are strict eligibility criteria around who can be a shareholder and how many shareholders S corps can have, which we discuss further below.

An S corporation’s shareholders own the business and appoint a board of directors and company officers to manage it. Company officers are high-level executives responsible for the company’s day-to-day management and operations, while a board of directors is a group of individuals the shareholders elect to oversee the company’s management and make key strategic decisions.

Shareholders can be directors and officers in a company as long as they keep each role separate and fulfill their duties under each.

To create an S corp, the business owner or owners form a C corp and apply for S-corporation status by submitting Form 2553 to the Internal Revenue Service (IRS).

Key Features of an S Corp

Eligibility criteria

Corporations must meet specific criteria to apply for S-corp status, including:

- The business must be incorporated in the US.

- Shareholders can be individuals, certain trusts (a person or entity who manages money on behalf of someone else), and estates (the assets of someone who’s passed away). They can’t be partnerships, corporations, or “non-resident aliens” (i.e., non-resident non-citizens).

- S corps can’t have more than 100 shareholders.

- S corps can have only 1 class (type) of stock. This means an S corp can’t issue different types of stock that give different shareholders different rights to the company’s profits and assets.

Certain corporations, including some financial institutions and insurance companies, can’t apply to become S corps.

Limited liability

Like C corps, S corps are separate legal entities from their owners, the shareholders. This separation shields the shareholders from personal responsibility for the business’s debts and liabilities, capping their liability up to the amount of their investment.

This separation between the business entity and shareholders ensures owners’ personal assets are protected if the business fails or faces a lawsuit. As the company has a separate legal identity, it can enter into contracts, sue other parties, and be sued. The company also continues to exist if an owner leaves or dies or there’s a change in ownership.

Pass-through taxation

One of the key features of S corps is that they’re pass-through entities for tax purposes.

This means they don’t pay federal corporate taxes. Instead, business profits and losses are passed to shareholders. Shareholders report them in their individual tax returns and pay personal income tax on them.

As a result, shareholders can deduct business expenses on their personal tax returns. This may allow some shareholders to counterbalance corporate losses on their tax returns with income from other sources.

Even though they don’t pay federal corporate income taxes, S corps must file tax returns with the IRS each year. They do this by filing Form 1120-S, detailing the business’s income, losses, and dividends.

While S corps don’t pay federal corporate income taxes, they may be required to pay taxes at the state level.

Other potential tax benefits

S corps offer other potential tax benefits to shareholders.

Under the Tax Cuts and Jobs Act, shareholders in an S corp can deduct up to 20% of qualified business income on their personal tax returns, which may help reduce their tax liability.

S corps may also lower self-employment tax for certain shareholders. For some business structures, like sole proprietorships and limited liability companies (LLCs), self-employment tax applies to the whole business’s income. With an S corp, shareholders receive business income as either salary or distributions. Shareholders pay payroll (Medicare and Social Security) taxes on their salaries and income tax on distributions.

However, the division between salary and distributions must be reasonable. A situation where shareholders are receiving a minimal salary with large distributions may attract the attention of the IRS and be considered tax avoidance. Shareholders might do this to reduce their payroll tax liability.

Compliance

As with C corps, certain administrative requirements are associated with running an S corp under state corporate law. For example, S corps must:

- Have a board of directors.

- Prepare corporate bylaws to be kept at the primary business premises. Bylaws are the internal rules that guide a business, especially when making key decisions.

- Hold annual shareholders’ meetings.

- Maintain records, including minutes of company meetings, director voting records, and details of shareholders and their percentage of ownership.

These requirements support transparency in S corps and ensure directors and officers are fulfilling their duties.

🧠 Did You Know?

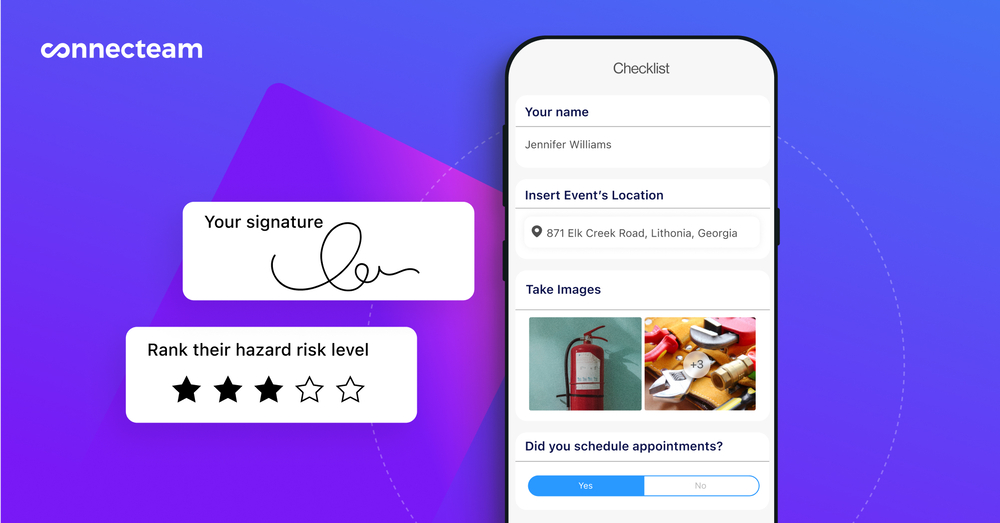

Connecteam’s comprehensive employee management app includes a company knowledge base, providing you with a secure location to electronically store and access important documents and support compliance. You can also use Connecteam’s digital forms to create documents easily.

Advantages of an S Corp

S corps offer businesses a variety of benefits.

- S corps limit the liability of shareholders, directors, and officers.

- They avoid the double taxation that C corps pay.

- S corps offer other potential tax savings, including reduced self-employment tax.

- S corps continue even if their ownership changes, ensuring business continuity.

Disadvantages of an S Corp

However, considering the potential cons of an S corp is important.

- S corps have more administrative requirements than other business types, such as partnerships. So, S corps generally require professional advice and support from accountants and lawyers to run, which adds to business expenses.

- The IRS keeps a close eye on S corps to ensure they meet eligibility requirements and salaries are reasonable and not done for tax avoidance purposes.

- S corps have less flexibility around ownership than C corps. They’re limited to 100 shareholders who must be US citizens or permanent residents.

- Fundraising is more difficult for S corps than for C corps due to the restrictions on shareholders and the requirement for only 1 class of stock.

How To Form an S Corp and File for S-Corp Status

The steps you generally need to follow when forming an S corp include:

- Register your business’s name with the relevant state agency. This is typically the Secretary of State.

- Choose a board of directors, officers, and a registered agent who can accept legal notices on behalf of your business in the state where it’s registered.

- File articles of incorporation with the relevant state agency. Articles of incorporation are formal documents that contain details like the company’s name and address, its registered agent, and the amount of stock to be issued. The information you must include varies between states. The Small Business Administration (SBA) lists relevant state agencies.

- Prepare the company’s bylaws. Speaking to an attorney during this process to ensure compliance with relevant laws is a good idea.

- Obtain a federal Employer Identification Number (EIN).

- File Form 2553 with the IRS to elect S-corp status. This must include a consent statement all shareholders have signed.

- Apply for any necessary federal, state, or local business licenses. Requirements vary between industries.

💡 Pro tip:

See the SBA’s website for guidance on federal and state business licensing.

If you change your mind after electing S corp status, you can revoke your S-corp status by sending a statement of revocation to the IRS. There are deadlines for sending a statement to the IRS and specific requirements for the statement—for example, the shareholders who own more than 50% of the company must consent to it. You should speak with a tax professional before choosing this option.

S Corps Compared to Other Business Structures

How are S corps different from C corps?

S and C corps are the same in all aspects except taxation. While C corps pay double taxation, S corps are pass-through entities.

As a trade-off, C corps have greater ownership flexibility and growth potential than S corps. There are no restrictions on the types or number of shareholders in a C corp. They can have unlimited shareholders, including other corporations and foreign investors.

How are S corps different from LLCs?

S corps and LLCs are both pass-through entities for tax purposes that limit business owners’ liability. These features make S corps and LLCs popular choices with small businesses.

However, LLCs offer more flexibility. There are more rules around running S corps regarding shareholders and governance procedures, whereas LLCs don’t have restrictions around the number or types of members they can have.

🧠 Did You Know?

LLCs—which are usually taxed like sole proprietorships or partnerships—can elect to be taxed as S corps. They must meet the same eligibility criteria as S corps to do this. Some business owners choose this to reduce their self-employment taxes, as S-corp owners can be employees and receive salaries. These are subject to payroll taxes rather than self-employment taxes.

While you file articles of incorporation to start an S corp, you file articles of organization to start an LLC. This is a formal document that sets out the structure of the LCC.

📚 This Might Interest You:

Thinking of starting a small business? Check out our step-by-step guide to starting a successful small business.

How are S corps different from general partnerships?

Like S corps, partnerships are pass-through entities. Partnership income isn’t taxed at a corporate level. Instead, partners include their shares of business income, expenses, profits, and losses on their individual tax returns.

However, an S corp offers owners limited liability whereas partners are personally responsible for debts and liabilities of the business.

How are S corps different from sole proprietorships?

Sole proprietorships have 1 owner. They’re straightforward business structures with less regulatory requirements than S corps.

There’s also no distinction between the owner and the business in a sole proprietorship. The owner is personally liable for the business’s debts.

Example of an S corp

S corps are often small to medium-sized, family-owned, or professional services businesses.

Take, for example, Amari, Lucy, and Ajay. They want to start a business providing project-management services to small and medium-sized construction clients. They live in the US and will base their business there. They all intend to invest capital to create the business and participate in its day-to-day operations.

The 3 owners are looking for a limited liability structure, separating their personal assets from the business. They plan to bring on 2 to 5 new owners as the business grows.

In this situation, they may choose to set up their business as an S corp. This would allow them to achieve their business objectives while avoiding double taxation.

Manage Your S Corp Workforce With Connecteam

Deciding whether an S corp is the right approach to taxation for your business depends on many factors. While pass-through taxation is an attractive feature for many business owners, there are various restrictions on the type and number of shareholders S corps can have. Speaking to an accountant and attorney is the best way to understand your options and determine what best suits your business’s needs.

If your S corp has employees, finding the right tools to manage your workforce is crucial. Connecteam offers an all-in-one employee management app to help you manage everything from scheduling and leave to employee motivation and employee training.

With a full-featured mobile app, Connecteam gives you and your employees access to key information in the palm of your hand. Connecteam can help you manage S corp compliance while ensuring a productive workforce.

FAQs

At what point should I switch from an LLC to an S corp?

You might consider changing when the self-employment tax you pay as an LLC becomes more than the tax you would pay as an S corp. The tipping point depends on various factors, including the salary amount and specific applicable taxes, so you should speak to an accountant for advice.

What is a reasonable salary for an S corp employee?

The IRS may review S corporation salaries to ensure they’re reasonable and not done to avoid tax. While there are no specific criteria for what’s a reasonable salary, the IRS looks at factors like the business’s financial position, the worker’s duties, and industry compensation standards for similar roles.

Disclaimer

The information in this article about S corps is intended to be an overview for informational purposes only. It is not intended as legal advice. Laws and regulations regularly change and may vary depending on individual circumstances. While we have made every effort to ensure the information provided is up-to-date and reliable, we cannot guarantee its completeness, accuracy, or applicability to your specific situation. Therefore, we strongly recommend that readers seek guidance from their legal department or a qualified lawyer to ensure compliance with applicable laws and regulations. Please note that we cannot be held liable for any actions taken or not taken based on the information presented on this website.