By understanding the various costs involved, calculating key financial metrics, and implementing cost-saving strategies, you can set your restaurant up for success.

Imagine the aroma of delicious food wafting through the air as you welcome a steady stream of happy customers into your very own restaurant.

As thrilling as it may be to embark on this culinary journey, it’s essential to understand the financial side of things, including how much it costs to open a restaurant.

In this definitive guide, we’ll navigate you through the restaurant startup costs in 2025, providing insights and tips to ensure your venture’s success.

Key Takeaways

- This article provides an overview of restaurant startup costs, including fixed, variable and mixed expenses.

- Strategies for controlling and reducing costs are explored to increase profitability in 2025.

- Financing options such as traditional loans or alternative funding sources are discussed to help secure necessary funds.

Understanding Restaurant Startup Costs

Any aspiring restaurateur must comprehend the intricacies of restaurant startup costs. When you’re aware of all the costs involved in opening your establishment, you’ll be better equipped to budget effectively and make well-informed decisions.

We have divided the costs into one-time and recurring expenses, including payment processing fees, to assist you in understanding the financial aspects of the restaurant industry. Here are the details:

One-Time Expenses

One-time expenses are the initial costs that you’ll need to cover when starting your restaurant. These include equipment purchases, renovations, and permits. For example, the estimated cost of kitchen and bar equipment is around $115,655.

Depending on the concept and condition of the commercial space, renovation costs can range from $5,000 to $50,000 or more. Keep in mind that a customized kitchen build-out can cost as much as $250,000. You’ll also need to budget for furniture and tables, which can cost approximately $40,000.

Construction costs, in this context, are an essential factor to consider when planning your project, and you might be wondering how much does it cost in total.

Lastly, you’ll need to factor in licenses, permits, insurance, and utility deposits.

Recurring Expenses

Recurring expenses are the ongoing costs that you’ll need to budget for on a regular basis.

Some examples of recurring expenses for running a restaurant include:

- Rent: Rent can range between $2,000 and $12,000 a month.

- Utilities: The average annual cost of utilities per square foot is $3.75.

- Labor: The cost of paying your employees.

These are just a few examples of the recurring expenses you’ll need to consider when budgeting for your restaurant.

Projecting the number of employees needed for each service and determining the budget for weekly wages is necessary for managing labor costs. The size of the dining room and the type of service offered will have an impact on your staffing needs. It is essential to assess both of these parameters in order to determine the required staffing.

Keep in mind that food and beverage costs are also a significant part of your recurring expenses, and you’ll need to monitor and manage these costs effectively.

📚 This Might Interest You:

Check out our in-depth guide on restaurant operations management to make your restaurant a success.

Breaking Down Restaurant Costs: Fixed, Variable, and Mixed

As you explore the realm of restaurant costs further, understanding the distinctions between fixed, variable, and mixed costs becomes crucial. Categorizing your expenses will clarify your financial situation and better equip you to make strategic decisions.

Next, we will dissect these costs and provide examples to help you comprehend their effects on your restaurant’s bottom line.

Fixed Costs

Fixed costs are expenses that remain constant, regardless of your sales volume. These costs include rent, insurance, and loan payments.

Considering fixed costs like:

- location rental

- equipment purchases

- furniture and fixtures

- permits and licenses

- initial inventory

is important when opening a restaurant in 2025. Keeping a close eye on these expenses will help you maintain a strong financial foundation for your restaurant.

Variable Costs

Variable costs are expenses that fluctuate based on your sales volume. Food, labor, and utilities are prime examples of variable costs in the restaurant industry. Food, for instance, can vary depending on market prices and purchasing habits.

Labor costs, on the other hand, may change depending on the number of employees and their hourly wages. These can also include the costs of training your employees or booking advanced training for your management team. By understanding and managing your variable costs, you’ll be better equipped to control your overall expenses and maximize profitability.

📚 This Might Interest You:

Read our in-depth guide on how to calculate the real cost of an employee

Mixed Costs

Mixed costs are those that have both fixed and variable components. For example, rent may include a fixed base amount plus a variable portion based on sales, while utility costs can be fixed (i.e., a set monthly fee) or variable (i.e., based on usage).

Equipment maintenance may also be considered a mixed cost, as it can include both scheduled maintenance (fixed) and unexpected repairs (variable). By identifying and managing mixed costs, you can optimize your budget and ensure the financial health of your restaurant.

Calculating Key Financial Metrics

Calculating key financial metrics is crucial for effective management of your restaurant’s finances. Some of the most important metrics to consider include prime cost, food cost percentage, and labor cost percentage.

These calculations provide valuable insights into your restaurant’s financial health and help you make informed decisions about pricing, staffing, and more.

Next, we will explain the calculation of these metrics and their importance to the success of your restaurant.

Prime Cost Calculation

The prime cost is the sum of your labor and food costs. To calculate your prime cost, simply add together your total labor costs and Cost of Goods Sold (CoGS).

This metric is crucial for understanding the relationship between your expenses and your overall profitability.

By monitoring your prime cost regularly, you can identify areas where you may need to cut costs or adjust your pricing strategy to maintain a healthy profit margin.

Food Cost Percentage

Food cost percentage is another critical financial metric that helps you assess your restaurant’s profitability. To calculate your food cost percentage, divide your food cost by your food sales and then multiply the result by 100.

The expected food cost percentage for opening a restaurant in 2025 is generally between 28% and 35% of the revenue. By monitoring your food cost percentage, you can ensure that you’re pricing your menu items accurately and maintaining a profitable business.

Labor Cost Percentage

Labor cost percentage is a crucial metric that evaluates the effectiveness of your labor in generating profits. To calculate your labor cost percentage, simply divide your total labor costs by your total sales.

Tracking your labor cost percentage is essential for evaluating staffing efficiency and overall profitability. If you notice a consistent increase in your labor cost percentage, it may be time to reassess your staffing strategy to ensure you’re operating as efficiently as possible.

Controlling and Reducing Restaurant Costs

Having covered the different types of costs and key financial metrics, we now turn our attention to strategies for controlling and reducing your restaurant expenses.

By implementing cost-saving measures, you can increase your profitability and ensure the long-term success of your establishment.

Next, we will discuss strategies for managing labor costs, minimizing food costs, and reducing utility and equipment expenses.

Managing Labor Costs

Controlling labor costs is essential for maintaining the profitability of your restaurant. However, you don’t want to sacrifice the quality of your customer service in the process.

To manage labor costs without compromising service, consider efficiently scheduling staff, leveraging technology to optimize processes, and offering incentives to employees to increase efficiency.

By implementing these strategies, you can strike the right balance between maintaining excellent service and controlling labor costs.

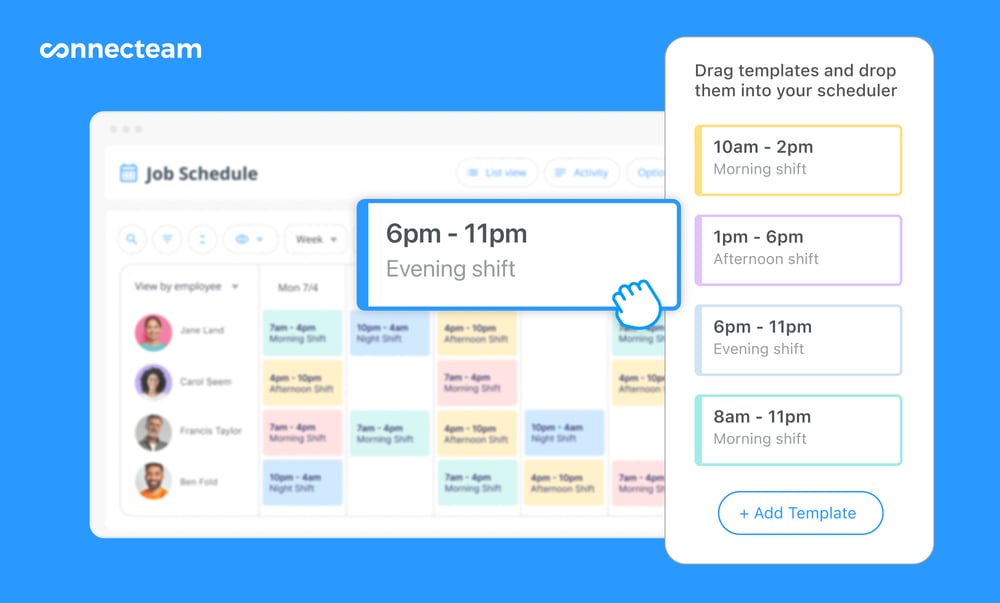

🧠 Did You Know?

Dedicated employee scheduling software like Connecteam will significantly reduce the time you spend making employee schedules, reduce no-shows, and create an overall happier workforce.

Minimizing Food Costs

Reducing food costs and waste is another crucial aspect of controlling your restaurant expenses. To minimize food costs, consider implementing measures to reduce waste, such as portion control, inventory management, and menu engineering.

By carefully monitoring your food costs and implementing waste reduction strategies, you can save money, lower your expenses, and increase your restaurant’s profitability.

Reducing Utility and Equipment Costs

Lowering your utility and equipment costs can also contribute to a more profitable restaurant. To reduce utility bills, consider using energy-efficient appliances, installing insulation, and taking advantage of natural light.

For equipment expenses, consider purchasing used equipment, leasing equipment, or negotiating with suppliers to get the best possible prices. By focusing on these areas, you can significantly cut your restaurant’s costs and improve your bottom line.

Navigating Licensing and Legal Fees

Budgeting for licensing and legal fees is an important step when opening a restaurant. As a restaurant owner, obtaining the necessary licenses and permits ensures that your business operates within the confines of local, state, and federal regulations.

For restaurant owners, staying compliant with these regulations is crucial to the success of their business.

Next, we will discuss the costs involved in obtaining licenses and permits, as well as the importance of budgeting for legal fees.

Licensing Costs

Obtaining the necessary licenses and permits for your restaurant is crucial for operating legally. The costs of these licenses and permits can range from $50 to $500 or more annually, depending on the location and size of your restaurant. Some examples of licenses and permits you may need include:

- Food Service License: Average Cost: Around $250 (usually annual)

- Liquor License: Average Cost: $1,000 to $4,500 (usually annual, but can be significantly higher in some locations)

- Health Department Permit: Average Cost: $100 to $500 (usually annual)

- Fire Safety Inspection: Average Cost: $50 to $200 (usually annual)

- Signage Permit: Average Cost: $20 to $50 per sign (usually a one-time fee)

Make sure to research the specific requirements for your area to ensure you have all the necessary licenses and permits in place.

Legal Fees

Budgeting for legal fees is another important aspect of opening a restaurant. Legal fees can vary depending on the location and specific requirements of your business, but they can range from $50 to $500 for obtaining licenses and permits.

To determine the exact legal fees for your restaurant, consult with a lawyer who specializes in the industry. By accounting for these costs in your budget, you can ensure that your restaurant operates within the confines of the law and avoid any potential legal issues down the line.

Marketing Your New Restaurant

Marketing is fundamental to the success of your new restaurant, necessitating the allocation of a portion of your budget towards efforts that will attract customers and establish a robust brand presence.

Next, we will discuss the significance of marketing for your restaurant and provide guidance on how to budget for marketing costs.

Importance of Marketing

The success of your own restaurant relies heavily on your ability to attract customers and create a memorable dining experience. Marketing is a key component in achieving this, as it helps build awareness and generate interest in your restaurant.

By utilizing various marketing strategies, such as social media, digital advertising, and public relations, you can effectively promote your restaurant and establish a loyal customer base.

Budgeting for Marketing Costs

When budgeting for marketing costs, it’s essential to consider various factors, such as the size and concept of your restaurant, competition, and target audience. As a general guideline, it’s recommended to allocate between 3% and 6% of your projected sales towards marketing expenses.

By setting aside funds for marketing efforts, you’ll be better positioned to attract customers and achieve success in the competitive restaurant industry.

Financing Your Restaurant Startup

Starting a restaurant can be expensive, making securing the necessary financing often a crucial part of realizing your dream. In this section, we will look at various financing options for restaurant startups, such as traditional loans and alternative funding sources.

Understanding the different financing options available will enable you to make an informed decision about the best way to fund your restaurant venture.

Traditional Loans

Obtaining a traditional loan is one option for financing your restaurant startup. These loans are typically provided by banks or other financial institutions and are secured by collateral, such as a house or car. Traditional loans offer several advantages, such as lower interest rates, longer repayment terms, and more flexible repayment options.

To apply for a traditional loan, you’ll need to submit an application to a bank or financial institution, provide necessary documentation, and negotiate the terms of the loan.

Alternative Funding Options

If you’re looking for alternative financing options, consider crowdfunding or seeking support from angel investors. Crowdfunding involves raising capital through the collective contributions of friends, family, customers, and individual investors. This method can provide quick access to funds without incurring debt.

Angel investors, on the other hand, are wealthy individuals who provide capital in exchange for ownership stakes in your business. These investors can offer not only financial support but also valuable advice and mentorship.

By exploring various funding sources, you can find the best financing option for your restaurant startup.

Summary

Opening a restaurant is an exciting journey filled with challenges and opportunities. By understanding the various costs involved, calculating key financial metrics, and implementing cost-saving strategies, you can set your restaurant up for success.

As you navigate the process of launching your restaurant, remember that a strong financial foundation, coupled with effective marketing and financing strategies, will help you achieve your dream of owning a thriving, profitable establishment.

Remember, the recipe for success begins with a clear understanding of your restaurant’s startup costs and a commitment to managing them effectively.

Make Your Restaurant a Success with Connecteam

Connecteam’s advanced scheduling, time-tracking, and employee communication features help you focus on what’s truly important – your business.

FAQs

How much money should you have to open a small restaurant?

To open a small restaurant, you should plan to have between $50,000 and $100,000. However, depending on specific factors such as location, the cost could range from $175,000 to over $700,000.

Is $10,000 enough to open a restaurant?

Although $10,000 might be enough to purchase a pre-existing restaurant and put additional funds into it, building one from the ground up could be significantly more costly.

Is it profitable to buy a restaurant?

Is it profitable to buy a restaurant? Buying an established restaurant with good cash flow can potentially yield 5-10% profit most months, but whether this is enough to offset the cost of buying the restaurant depends on the original purchase price. Restaurant profitability also varies depending on factors such as size, type of restaurant, and economic conditions. Typically a restaurant takes around two years to turn a profit.

Is owning a restaurant a good business?

Owning a restaurant can be a good business if done with proper planning and capital. However, it has low-profit margins and a high failure rate, so it’s critical to know your operational costs and expected revenue before opening a restaurant. It may take two years for your restaurant to turn a profit, so plan accordingly.

What is the most common expense in a restaurant?

Food and beverage expenses are by far the most common expenditure in a restaurant, making up a large percentage of a restaurant’s monthly costs.