Understanding the average cost per employee is vital for budgeting, profitable pricing, and worker evaluation at any business. In this article, we share some simple calculation formulas to use and cover the factors that impact employee cost.

Employers have to budget for much more than base salary when considering a new hire. Benefits and taxes add to the total employer cost per employee.

Plus, each worker needs resources to do their job—such as equipment, training materials, or even fuel to put in a company vehicle.

That all adds up. So, how much does an employee cost? And how can you calculate it?

In this article, we discuss the components of employee costs and provide some formulas for calculating the true cost of an employee.

We also look at the hidden costs of employees that many employers miss.

Key Takeaways

- Calculating how much an employee costs starts with salary but also takes into account factors like benefits, payroll taxes, and more.

- It’s important to understand cost per worker to improve budgeting, price estimates, and employee evaluations.

- The true employer cost for an employee is between 1.25 and 1.4 times the worker’s base salary.

- There are many factors that can affect the total employee cost, like benefits, role type, company size, and more.

- Likewise, employers can save on cost per employee by streamlining their operations.

Formula to Calculate the True Cost of an Employee

A commonly used formula to calculate employee cost was first coined by Massachusetts Institute of Technology senior lecturer Joseph Hadzima.

Hadzima proposes that the true employer cost for an employee is between 1.25 and 1.4 times the worker’s base salary. This factors into per-employee payroll taxes and employee benefits costs.

When a new employee joins your company, you can determine their cost by calculating:

Base salary x 1.25

Base salary x 1.4

The employee’s true cost should fall between these two figures.

For example, let’s say a new worker is hired at your business at a base salary of $45,000. Calculate the following:

$45,000 (base salary) x 1.25 = $56,250

$45,000 (base salary) x 1.4 = $63,000

Their real cost will be between $56,250 and $63,000.

The same formula applies to hourly employees. Simply multiply their hourly wage rate by 1.25 and 1.4 to determine the range of their true cost.

For instance, imagine you hire a new employee at a rate of $20 per hour.

$20 x 1.25 = $25

$20 x 1.4 = $28

The worker’s true cost falls between $25 and $28 per hour.

Keep in mind that this formula leaves out other expenses like costs of recruitment, office space, employee equipment, and onboarding and training. Below, we discuss common factors that impact employer cost per employee so you can make more precise calculations.

What Can Affect Employee Costs

A number of factors affect employee costs—some are internal to the company, while others are external influences. It’s important to understand these factors in order to accurately calculate employee costs.

Payroll taxes

Your business is responsible for paying payroll taxes based on each employee’s wages. This includes Social Security, Medicare, and state unemployment tax. Taxes are paid to the federal and state governments, depending on where work is performed.

Check the IRS website for help with federal tax calculations. You can also find contact details for state tax entities.

Did You Know?

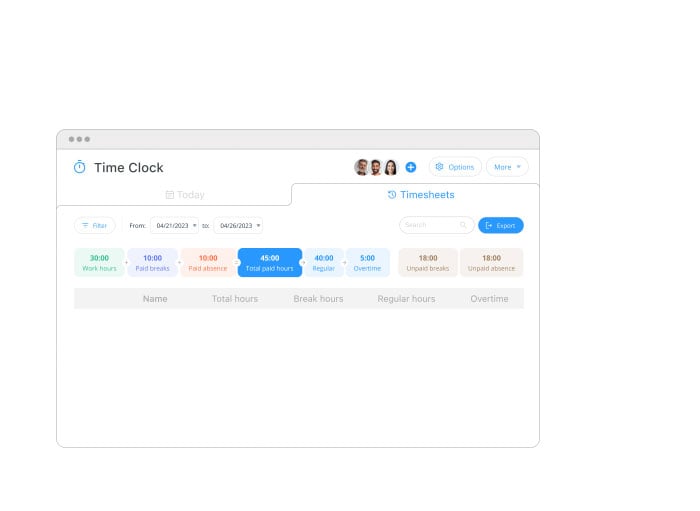

Work management platforms like Connecteam make it easy to calculate payroll accurately and track your staffing costs. With an accurate employee time clock, automated timesheets for payroll, and integrations with leading payroll software such as Quickbooks, Gusto, Xero, and Paychex, you can easily keep track of payroll and ensure staff are paid correctly.

Get started with Connecteam for free today!

Employee benefits

Employee benefits play a significant role in the overall cost of an employee. These include health insurance, retirement plans, paid time off, and other insurance and perks your business offers to employees.

Calculate the average per-employee cost of employee benefits by dividing the total cost of your benefits package by the total number of employees. Here’s the formula written out:

Total cost of benefits package / Total number of employees = Per-employee cost of benefits

Remember that benefits are ongoing costs and benefits like PTO and other insurance typically renew at certain periods. This means they won’t pay the per-employee cost of benefits just once. Keep this in mind during calculations.

Location

Location is one of the largest external factors that affect employee costs. For example, the same employee doing the same job in Denver, Colorado, will require a higher base salary in Los Angeles, California, to account for the difference in living costs. According to CNN Money’s cost of living calculator, Los Angeles’ living costs are 31.5% higher than those in Denver.

📚 This Might Interest You:

Learn how companies adjust salary bands across multiple locations with our guide to geographic pay differentials.

Market conditions

Hiring markets shift as supply and demand change. When the market favors employers, it’s possible to find top talent for lower costs. However, when the market favors employees, an increase in compensation and benefits may be required to attract the talent you need.

Industry

Understanding your industry is necessary to understand what employees will expect in their total compensation. Employees in some industries expect to pay for part or all of their health insurance plans. In other industries, employees expect the employer to offer fully corporate-paid health insurance.

Corporate perks like discounted gym memberships are also more common in some industries, while others offer very limited or no perks to employees.

Role type

Employee costs also vary with the norms expected by different roles within a company. Senior employees and those with in-demand skills are more likely to expect enhanced compensation and benefits compared to entry-level or general-skill employees. Recruitment processes can also be more robust and lengthy for high-level roles, which increases employee cost.

How employee pay is calculated can also affect employee cost. Hourly employees—and some salaried positions—are eligible for overtime. This can be harder to budget unless you have an efficient time-tracking system.

Connecteam is the #1 Employee Management App

Stay on top of payroll, scheduling, communication, and more all while on the go.

Company size

Larger companies are sometimes able to secure lower costs per employee, as overall costs are spread out over more workers.

Additionally, in bigger companies, costs for IT support services and digital systems like time tracking and payroll software can be spread across more employees. This also helps to bring down the cost of each employee.

💡 Pro Tip:

Opt for a software solution with affordable, scalable plans. Connecteam’s pricing starts with a 100% free plan for businesses with up to 10 employees and includes additional plans to support organizations of all sizes.

Recruiting costs

Finding the right employee for a role requires significant recruitment investments, including both internal and external recruiting costs.

Internal recruiting costs

These are the costs to pay recruiting staff and hiring managers for their time.

Recruiting staff

For example, let’s consider an HR generalist who spends 15 hours each week on recruitment tasks. That employee earns $20 per hour and works 50 weeks each year after taking 2 weeks’ vacation. Your calculation will look like:

15 [hours spent on recruiting] x $20 [hourly rate] x 50 [weeks worked per year] = $15,000 per year on internal recruiting

For salaried employees, first calculate their effective hourly rate with this formula:

Salary / (Weekly hours worked x Weeks per year) = Hourly rate

If your regular full-time employee works 40 hours per week, then they work 2,080 hours per year (40 x 52). With a salary of $45,000, their effective hourly rate is $21.63 ($45,000 / 2,080).

If your company has multiple employees managing recruitment, then you will need to add together their individual contributions to the internal recruitment costs. For instance, two HR employees spending 15 hours each per week on recruitment tasks as in our example above would result in $30,000 internal recruiting costs for the year.

Hiring managers

Hiring managers may only be involved in recruitment sporadically, but their time should also be considered when calculating your internal recruiting costs.

For example, let’s consider a hiring manager who spends an average of 5 hours per month on recruitment tasks. The hiring manager’s salary is $50,000, with an effective hourly rate of $24.04. With this in mind, your calculation will look like:

$24.04 [hourly rate] x (5 [recruitment hours] x 12 [months]) = $1,442.40 [annual cost]

As with recruiting staff, combine the total annual cost for each hiring manager to reach the total annual recruitment cost from hiring manager time.

External recruiting costs

After calculating your internal recruiting costs, you must calculate your external recruiting costs.

These can include the cost to pay third-party recruiters for their time, as well as external payments for:

- Job advertisements

- Business promotion events such as job fairs

- Recruiting software such as applicant tracking systems

- Background checks

- Relocation costs

- Referral bonuses to existing employees

Onboarding costs

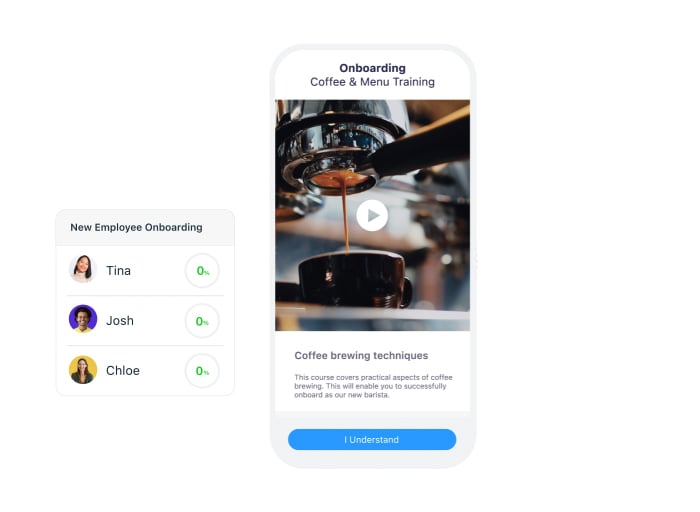

After a new employee is hired, they need to be equipped with the knowledge to contribute in their new role. Onboarding and training are necessary costs that can add up quickly.

Pro Tip

Using the right digital platform, you can significantly reduce onboarding and training costs. Connecteam’s employee training software streamlines onboarding and enables you to create fully customized, engaging training courses—all at an affordable price.

Get started with Connecteam today!

Overhead costs

These aren’t directly related to employees but cover expenses necessary to run the business.

They traditionally include things like the cost of rent for office space, utilities, office supplies, equipment, employee uniforms, mobile phones for workers, and more. Overhead can also include general technology such as business software and computers.

Turnover rate

Companies with higher turnover rates have higher overall employee costs. This is because they’re forced to invest in recruitment and onboarding more frequently.

💡Pro Tip:

Many companies are unaware of just how much turnover is costing them. Find out how much turnover is costing your business with our turnover calculator.

Why It’s Important to Calculate Employee Costs

Calculating employee costs is essential for effective business management. Knowing the cost of an employee allows you to accurately budget your staffing expenses. This knowledge can help you make more informed decisions about employee-related expenses such as benefits packages, equipment, training courses, and much more.

Similarly, staffing needs are easier to predict when you know how much an employee’s position costs your business. This way, you’re better able to identify where flexible options such as part-time staff or outsourcing to contractors can best benefit your organization.

Understanding the employer cost for each employee also informs pricing for products and services. By factoring in the cost of labor, your business can price products and services appropriately in order to turn a profit.

Additionally, calculating the cost of an employee can help evaluate employee performance. By comparing an employee’s cost to their productivity and revenue generation, you can make data-driven decisions about promotions, raises, bonuses, and performance improvement plans.

Conclusion

Employee cost calculations consider more than the employee’s base salary. The real cost of an employee is between 1.25 and 1.4 times their base salary, to account for employee benefits and tax costs. It’s essential to also consider the additional factors impacting employee cost, such as your company’s recruitment costs, the employee’s location, current job market conditions, and onboarding costs.

Businesses should take advantage of technological solutions, like Connecteam, to help them better understand the true cost of their employees. These companies are able to budget more effectively, factor labor costs into pricing, and accurately evaluate employee productivity.

FAQs

What percentage should an employee cost?

The average cost per employee is between 1.25 and 1.4 times their base salary. This figure will increase when considering variable costs like recruiter time, employee location, and job market conditions.

Most US companies spend 15% to 30% of their gross revenue on payroll. These figures vary across industries.

How much does it cost to replace an employee?

The Society for Human Resource Management (SHRM) has found $4,700 to be an average cost per hire. However, some employers told SHRM they expect a new hire to cost 3 to 4 times the position’s salary. This estimate considers soft costs like supervisor time invested in the hiring process, which can make the cost of employee replacement skyrocket.

Keep Your Costs in Check

Stay on top of all employee management responsibilities from one app.