When you ask someone what they do for a living there’s typically no longer a standard response of ‘plumber’, or ‘electrician’ or ‘doctor’. There is a proliferation of slash usage, particularly among young people. Slashies are people that don’t describe themselves by their day jobs alone. They have various side hustles, which means they could be a receptionist by day, Uber driver at night and a comedian over the weekend.

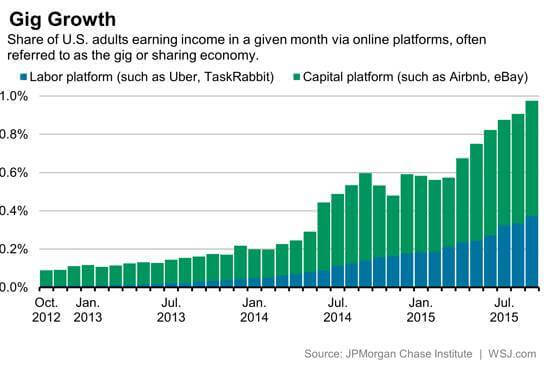

It’s not only the youth that have increased the number of gig-workers. Employment trends have changed in the past few years, because people are easily able to work from home or on the move and do multiple jobs. It may mean that their jobs aren’t secured in the way that you’d expect, because while they may get payment from a company it doesn’t mean that they are officially employed by it.

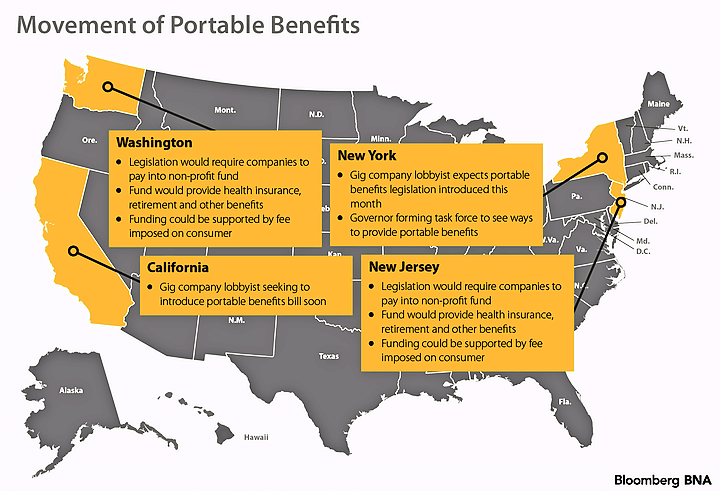

The Uber chief executive, Dara Khosrowshahi, recently called for Washington state to develop a ‘portable benefits system’ to give contract workers access to the benefits that full time workers typically get, such as health care, disability insurance and retirement planning accounts. This is because Uber doesn’t employ drivers directly as they simply make use of Uber’s platform in order to do business. So other than being compensated, drivers are not entitled to employee benefits.

Uber is not the only company to adopt this type of business model and this is why portable benefits are a hot topic among legislators and industry leaders. The gig economy is growing and it is showing no signs of slowing down. Part-time and full-time freelancers represent at least 35% of the U.S. workforce, and some estimates claim that by 2020, 7.6 million Americans will be working in the on-demand economy.

The trend is similar around the world, and with such a large percentage of the workforce lacking the benefits often provided to full-time employees, this can turn into a serious social and economical problem as this workforce will get injured, sick and eventually age without employer-backed insurance or pension. The potential solution: portable gig economy benefits.

In fact, just in February 2019 on the federal level, Senator Mark Warner introduced four bills that are aimed at solving this issue.

We can’t and shouldn’t try to regulate our economy into looking like it did 50 years ago. If we want to grow our economy and expand opportunity, Congress has to take steps to increase access to skills training and support workers with access to flexible, portable benefits that carry from job to job.

The four bills Warner introduced are Investing in American Workers Act, Lifelong Learning and Training Account Act, Self-Employed Mortgage Access Act, and Portable Benefits for Independent Workers Pilot Program Act. Warner wants businesses to be able to provide benefits for ALL of its workers and not just some of them.

What are portable benefits?

One of the main advantages traditional full or part-time work has over freelancing or “gigging” are the benefits. From sick leave to retirement to dental and medical – all these benefits are normally enjoyed by employees whose relationship with the organization is formalized in an employment contract. But this is not the case with taxi drivers, some independent artists, self-employed professionals and seasonal workers whose customers or employers can change rapidly.

While some independent workers, such as construction contractors and actors, enjoy these portable benefits through professional unions – many don’t. As more workers in different professions are switching to on-demand or gig-based jobs, the need for a different kind of benefits system is obvious.

With portable benefits the benefits are “tied” to the worker rather than the employer. Payments to these benefit funds can be facilitated through companies that act as intermediaries or paid by the customers or employers directly.

When saving for retirement the general advice is to ‘Save in your 401(k) or 403(b)’ but freelancers and gig workers don’t have access to them. But that doesn’t mean they can’t save for retirement, even if they leave their permanent job. 401(k) and 403(b) plans can usually be rolled into a new employer’s plan or into an individual retirement account (IRA).

IRAs are a type of retirement savings account that come with tax benefits too. Anyone with an earned income can open an IRA. Other alternatives include a self-employed 401(k), also known as a solo 401(k) and a SIMPLE IRA, which is ideal for small businesses with 100 employees or less.

Medical benefits can also be created if you are a freelancer or small business owner. In the United States, under the Health Insurance Portability and Accountability Act (HIPAA), pre-existing medical conditions won’t be excluded if a worker moves from one plan to another.

What does it mean for vendors and freelancers?

Portable benefits will mean that freelancers and gig workers should not have (as much) concerns about what should happen in the event that they want to retire or if they get sick or become disabled. If they are able to rely on the same kind of products and insurance that they could when they were fully employed it will reduce some of the stress out of being part of the gig economy, which in itself can create much uncertainty as incomes may not be as consistent as they are for full time employees.

It means that freelancers and contractors can retain the flexibility that allows them to concentrate on multiple tasks and do things like pick up children from school and attend soccer games without having concerns that they are not covered when it comes to benefits for themselves and their families.

It could also mean an end to being paid or subjected to accepting lower-paid wages as there are also calls for lawmakers to institute a minimum wage for contractors and for allowing workers, companies and government to negotiate for industry-specific wages and benefits.

Reforms such as these will enable gig workers to become more successful, create stable businesses and in turn even employ others and create more jobs.

What do portable benefits mean for gig economy style employers?

For gig economy employers it will likely mean having to pay more, particularly if minimum wages are instituted and if the same health and safety standards, that normally apply to permanent workers, are also given to gig-workers.

They may also have to help or advise freelancers about how they would be able to secure portable benefits and contribute to the contractor’s chosen financial product.

While their contractors may officially still be ‘self-employed’, they will be entitled to many other benefits and employers of gig-economy workers will have to factor these into their costings, limit the number of contractors they take on, or find a way in which to pass this cost on.

They may adopt a similar model to the Black Car Fund in New York which is a workers-compensation fund for drivers. It’s paid for by a 2.5% surcharge on their customer’s fees. So while portable benefits will one day be mandatory there could be various ways in which they could be funded.

What does it mean for small business owners in general?

Small business owners will have more flexibility and peace of mind as they will be able to enjoy benefits offered to full time employees. This will create more security, spending power and a boost the number of entrepreneurs, which in turn could create more jobs.

Small Business Majority supports portable benefits and says,

This is why today’s entrepreneurs and small business employees need a modernized benefits infrastructure that promotes quality jobs for those who do not work for large organizations. No one’s financial security, ability to afford benefits like healthcare or capacity to take time off of work to care for a new child or sick family member should depend on their employment status.

What will this mean for the economy in general?

There will be plenty of advantages to introducing more portable benefits into the market. It will create more jobs, more products, provide more security and give gig-economy workers more choice and freedom. Further, portable benefits are bound to boost the economy as higher wages and benefits would increase gig-economy worker’s spending power.

Connecteam: one app to manage your employees & business

Connecteam is your tool to manage employee engagement, development, and relationship. You can streamline communication, give your employees a platform to be heard, boost engagement, strengthen the company culture, align employees with company policies, streamline daily operations, build professional skills and so much more.