Many business owners don’t fully understand what goes into structuring their companies as sole proprietorships. In this guide, you’ll learn what a sole proprietorship is, its pros and cons, and how to create one yourself in 8 straightforward steps.

Many business owners choose to run their companies as sole proprietorships because they’re easy to set up. But, you can face big issues—including legal and financial trouble—if you’re not fully aware of the tax and compliance rules associated with this business structure.

For instance, your personal assets could be at risk if your business faces debts or other legal issues. Plus, raising funds can also be more challenging because investors prefer a limited liability company (LLC) or a corporation business.

That’s why you must be aware of what starting a sole proprietorship means and how it differs from other types of businesses before rushing into it.

Thankfully, we’ve got you covered. In this guide, we explain what a sole proprietorship is, how it works, and how to create one. We also look at the pros and cons of this business structure so you can decide if it’s the right choice for you.

Key Takeaways

- A sole proprietorship is a business with a single owner responsible for all aspects of running the business.

- Sole proprietorships are simple to set up and have less administrative burden.

- But, they also have downsides—such as unlimited liability, continuity issues, and a lack of diverse expertise.

- Ensure you follow all relevant regulations when establishing your sole proprietorship.

- Also, use a work management app like Connecteam to run your business efficiently and stay compliant.

What Is a Sole Proprietorship?

A sole proprietorship is the simplest and most popular business structure. They’re common to independent contractors, home-based businesses, and other small to medium-sized companies.

Here are the key features of a sole proprietorship:

- Ownership: A single individual, known as its sole proprietor, owns the business entirely. This person has complete control over the business’s operations and decisions.

- Liability: Sole proprietors are personally liable under this business structure. That means their personal assets—including savings, property, and more—are at risk if the business faces debts, lawsuits, or other financial obligations. Legally, the business and its owner are treated as the same entity.

- Taxes: The owner files any business income that’s generated as part of their personal tax returns. This makes tax reporting fairly straightforward. However, the owner is responsible for paying self-employment taxes.

- Continuity: This type of business entity faces the risk of continuity. This means that if the owner can’t continue the business due to retirement, death, or other reasons, the business may cease to exist unless transferred to someone else.

Pro Tip

Consult with your attorney or certified public accountant (CPA) to ensure you choose the best business structure for your company goals.

Pros and Cons of a Sole Proprietorship

Consider these pros and cons when you register your business as a sole proprietorship.

Pros

Simplicity

Sole proprietorships are easy to set up and manage. You can start your business in no time by registering with your local government, securing any necessary licenses, and setting up a simple accounting system.

Also, you report any business profits and losses on your personal tax returns. This way, you can focus on your work rather than complex administrative tasks.

Complete control

As a sole proprietor, you’ll have complete control over business decisions. For instance, if you run a small bakery, you’ll oversee the menu, operating hours, marketing strategies, and other key decisions without needing approval from business partners or a board of directors.

Tax advantages

Reporting business income on your personal tax returns not only simplifies the process but also has monetary benefits. For example, owners of home-based businesses can take advantage of tax deductions for home office expenses.

Low operating costs

Sole proprietors often run smaller businesses with fewer workers. Plus, they usually work from small offices or their homes—thus reducing business expenses. Further, they don’t have complex audit and bookkeeping requirements. This means they avoid the expensive accounting and regulatory fees that businesses with other structures must pay.

Direct profit

You get to keep all the profits generated by your business without sharing it with partners or shareholders.

Cons

Unlimited liability

This is perhaps one of the biggest drawbacks of sole proprietorships. Your personal assets are at risk if the business faces financial obligations it can’t meet. Let’s say you run a small construction company and a client sues you for damages. Your home, personal savings, and other assets could be seized if the business can’t cover the legal costs.

Lack of continuity

In this structure, business continuity depends on the owner’s presence. For instance, say you’re unable to continue running your business due to illness, death, or other problems. Your business might cease to exist if you don’t have a clear succession plan in place.

Limited expertise

Sole proprietors are responsible for all aspects of their business. While having complete control over decisions is great, your business will lack diverse skills and knowledge. For example, a restaurant with an owner who excels at cooking but doesn’t know how to market could see its sales suffer.

For more expertise, you’d need to hire employees across all business areas—which can get expensive. Or, seek help from external agencies who may be good but lack the passion you need.

Difficulty in funding and scaling

Sole proprietorships can struggle to secure loans or attract investors. This is because of their unlimited liability structure. As a result, it’s challenging to grow and scale your business since you won’t have the funds required to rent a bigger space or hire additional staff.

How Do Sole Proprietorships Differ From Other Business Structures?

Other business structures have different advantages and disadvantages compared with sole proprietorships.

For example, corporations and LLCs protect owners’ personal assets from debts and lawsuits. However, they come with more complex regulations and tax requirements. Partnerships, on the other hand, share similarities with sole proprietorships but require agreements between the individuals who share management and profits.

Each business structure has unique implications for taxes, fundraising, and legal risks.

This Might Interest You

Want to learn more about the differences between these business structures? Read our guide on 10 important legal requirements for starting a small business.

Sole Proprietorship Examples

Sole proprietorships are suitable for creative arts businesses, professional services, cleaning businesses, home-based businesses, and other small-scale companies that are simple to run and have low fixed costs and overheads.

Here are some sole proprietorship examples so you can better understand the types of companies that use this structure.

Sam’s landscaping business

Sam runs a small landscaping business with 10 independent contractors on his team. The company provides various services, including tree trimming, garden design, and lawn mowing. Sam manages everything from sales and client relations to service delivery and bookkeeping.

Jordan’s plumbing company

Jordan is a licensed plumber who operates a business that provides plumbing repairs, installations, and maintenance for residential and commercial customers. As a sole proprietor, Jordan schedules appointments, assigns shifts, handles invoicing, interacts with customers, and oversees his workers. However, Jordan’s personal assets could be at risk if a customer sues his company for negligence.

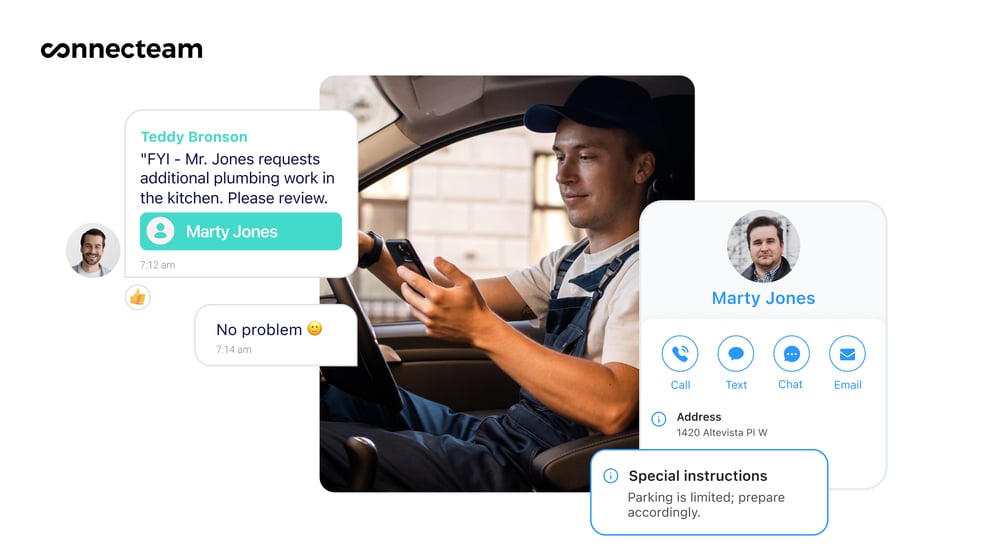

Did You Know?

With Connecteam’s team instant messaging features, sole proprietors managing teams can effortlessly and securely communicate with team members. It’s an affordable and straightforward solution for handling workplace conversations, even on the go.

Get started with Connecteam for free today!

Alex’s content creation services

Alex is a freelance writer who provides customers with blog posts, website copy, and marketing materials. Alex has complete control over projects and pricing and works from home —significantly reducing operating costs and the administrative tasks of running a business.

Pro Tip

Sole proprietorships work well for Sam, Jordan, and Alex’s businesses because they have low overheads and administrative simplicity. But, as their businesses grow or face increased liability, they should consider restructuring to entities that provide greater legal protection and potential tax benefits.

How To Start a Sole Proprietorship

Once you’ve decided on your business and created a business plan, you can establish your sole proprietorship by following these essential steps.

Choose a business name

Many sole proprietors conduct business under their own legal name. This is because creating a separate business name isn’t necessary. You can do this or establish a unique business name.

Either way, ensure your chosen business name isn’t already in use. Do this by conducting a simple internet search or checking on the US Patent and Trademark Office.

Register your business name

There’s no need to register your business name if you’re using your full legal name for your business. You can simply operate your company using your own name and use your social security number for filing taxes.

Operating under a different name? You must register your business under its “doing business as” (DBA) name. You can do this by filing with your local secretary of state or county clerk’s office.

Obtain the required licenses and permits

Determine which permits and licenses you need to run your business. For example, you’ll need an electrical contractor license or a journeyperson electrician license to operate as an electrician in the US. You can find information for your relevant industry on the Small Business Administration (SBA) website or your state’s business portal.

Did You Know?

You can use Connecteam’s document center to store all your team documents, tax IDs, licenses, and permits. You can even set expiry dates on documents so you renew them on time.

Get tax ready (if applicable)

If you run your business under a different name or have employees, you must register for a Federal Tax Identification Number (EIN). This also applies to businesses that must pay excise taxes for certain goods, services, and activities. These include transportation, alcohol, luxury goods, and more.

You can apply for an EIN for free on the IRS website or with a paper application.

You also need to apply for a sales tax license with your state if you’re going to sell taxable products such as clothing, electronics, and more.

When none of these apply, you can report business income and expenses on your personal tax filing using Schedule C. Don’t forget you must still file self-employment taxes that cover your Social Security and Medicare contributions.

Pro Tip

Consider consulting with a tax advisor for guidance on which taxes apply to your business so you don’t make any mistakes.

Set up a bank account (recommended)

Sole proprietors don’t need to open separate business bank accounts. However, there are many benefits to having a separate bank account for your sole proprietorship. Some of these are listed below:

- It keeps your finances organized and makes it easy to identify business expenses and pay taxes correctly.

- It helps you manage your budgets and check your business’s financial health.

- You can also accept credit card payments using merchant services, making it easier to transact with customers. Plus, you’ll build business credit that’ll help you secure loans or lines of credit in the future.

Understand your legal and compliance responsibilities

Ensure you’re aware of any other regulations—in addition to tax responsibilities, licenses, and permits—that apply to your business. Here are some examples:

- Businesses that collect customer information must follow data protection laws that apply to their locations and industries.

- If you hire employees, you must adhere to local, state, and federal labor laws.

- Home-based businesses must follow local zoning regulations and homeowners association rules.

Speak to an attorney or compliance advisor to fully understand which rules apply to your business so you’re never on the wrong side of the law.

Obtain insurance

All sole proprietors should consider insurance needs for their businesses, regardless of business size. Depending on your industry, you may consider some of the below types of insurance:

- Liability insurance: Protects your business against claims for property damage or bodily injury caused by your company’s activities.

- Professional liability insurance: Covers you from claims for negligence or errors in the professional services your company provides.

- Business owners policy (BOP): Combines various types of coverage to protect your business and personal assets.

Run and manage your business

Once you’ve established your sole proprietorship, you can begin operating your business. Stay on top of managing daily operations like customer interactions and service quality assurance. Don’t neglect your legal and tax obligations—even after your company is up and running. Consider using digital tools to streamline these processes.

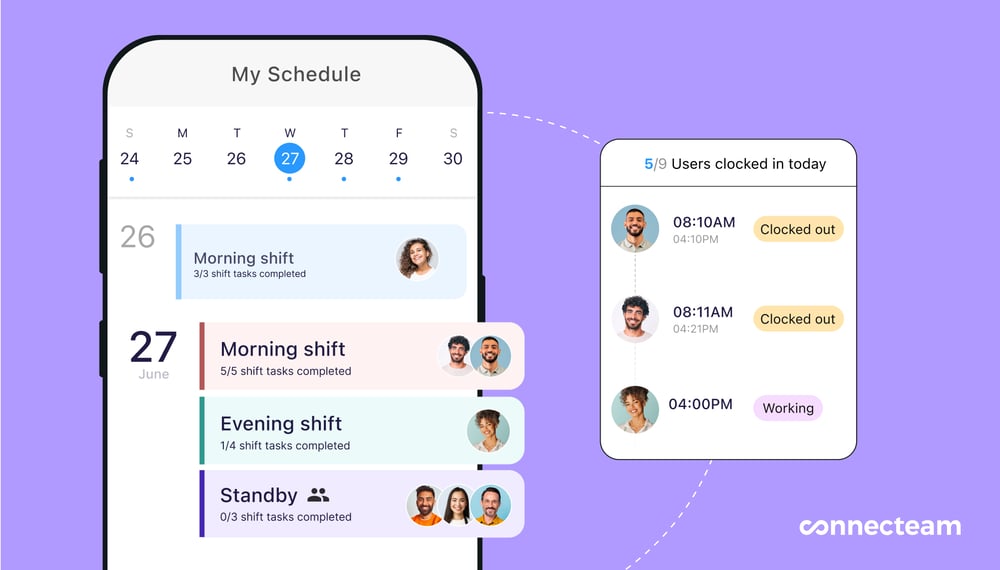

Did You Know?

For sole proprietors who oversee employees, Connecteam offers an all-in-one solution to manage daily operations. You can easily create work schedules, track employees’ time, monitor tasks, and more—even when you’re on the go. This makes it an ideal choice for sole proprietors who must stay agile and efficient in managing their businesses single-handedly.

Get started with Connecteam for free today!

Summary

Establishing a sole proprietorship is a quick way to get your business up and running. It’s simple to set up and gives you complete control over business decisions. Plus, you get to keep all the profits.

But, it also comes with several implications and downsides. For example, your personal assets could be at risk if your business can’t meet its financial or legal obligations. Sole proprietorships also struggle to raise capital—making it difficult to expand your business without converting it into another structure like an LLC.

That’s why it’s important to consider the pros and cons of a sole proprietorship and decide whether the structure aligns with your goals before creating one for your business.

But your responsibilities don’t end there. Once you’ve established your business, consider using work management software like Connecteam to run it effectively and stay compliant with the law.

Get started with Connecteam for free today.

FAQs

What is the best way to manage my sole proprietorship?

Use a work management software solution to simplify managing your sole proprietorship. Connecteam, for example, offers tools for employee task tracking, employee scheduling, team document management, and more. It also has a free plan for businesses with fewer than 10 users.