Per diem work is a flexible employment arrangement where individuals receive a fixed daily rate or an allowance to cover travel expenses. Discover how it works and if it is right for your business.

Flexibility has become a highly sought-after commodity for both employees and employers.

Per diem work offers an attractive solution, providing the adaptability and convenience of a daily pay structure while minimizing long-term commitments.

This comprehensive guide will help you understand the concept of per diem work, its relevance in various industries, and how it compares to other employment arrangements, such as independent contractors.

By the end, you’ll have a clear understanding of the ins and outs of this flexible work option and be equipped to determine if it’s the right choice for you or your business.

Key Takeaways

- Per diem work is a type of flexible employment arrangement with benefits for employers and employees.

- Per diem refers to payment for daily work or travel expenses, typically managed by an accountable reimbursement plan.

- It offers flexibility, clear spending boundaries, and simplified expense tracking allowing greater autonomy in managing time & finances.

Per diem work encompasses a range of temporary and as-needed employment opportunities, providing daily allowances to cover travel expenses and, in some cases, compensation for work performed.

Businesses across various industries utilize per diem employees to fulfill short-term or on-demand needs, offering an alternative to traditional hourly or salaried employment arrangements.

Given the rise of the gig economy and the growing demand for flexible work options, appreciating the nuances of per diem work and its potential benefits for both employees and employers becomes paramount.

Definition of Per Diem Work

Per diem work refers to employment arrangements where employees receive a fixed daily rate for their work or as an allowance to cover travel expenses.

This type of employment is typically used for short-term or on-demand positions, such as temporary coverage or project-based work. Common industries that employ per diem workers include healthcare, education, and government sectors.

We should highlight that per diem employees differ from independent contractors in their compensation structure and worker protections.

Meaning of Per Diem

“Per diem” is a Latin expression which means “per day” or “for each day.” Its origins can be traced back to the Latin language. In the context of employment, per diem work refers to positions where employees are compensated on a daily basis rather than hourly or salaried.

This daily allowance can cover both work performed and travel expenses, such as lodging, meals, and incidental costs.

Employers may use an accountable reimbursement plan to manage these business expenses, ensuring that expenses are adequately documented and within established parameters.

Types of Per Diem Employees

Per diem employees can be found in various forms, including:

- Temporary workers filling in for staff absences

- Professionals providing specialized services on an as-needed basis

- Travel nurses

- Substitute teachers

- Freelance writers

Unlike hourly employees, per diem workers receive a fixed daily rate, which may offer higher earning potential.

However, they may not be eligible for the same benefits as full-time employees, such as health insurance or paid time off.

How Per Diem Work Works

The mechanics of per diem work revolve around a daily compensation structure, where employees are paid a predetermined rate for each day they work, also known as a diem payment. This rate can vary depending on the job and industry, but diem payments generally offer flexibility in terms of scheduling and commitment.

Employers must adhere to relevant labor laws concerning minimum wage and overtime pay when employing per diem workers, to guarantee fair and equitable diem labor compensation.

Daily Compensation Structure

Per diem employees are compensated at a fixed daily rate, which is determined by various factors, such as the nature of the job, industry standards, and location.

As a per diem employee, this rate is often higher than hourly employees, as employers are willing to pay a premium for the flexibility and convenience that per diem work offers.

In some cases, per diem employees may also be eligible for premium pay or overtime, depending on the specific job and hours worked.

As-Needed or Temporary Basis

Per diem workers, often considered as part time employees, are typically hired on an as-needed or temporary basis, allowing them to work when and where their services are required.

This provides a level of flexibility for both the employee and employer, as there are no long-term commitments or guaranteed hours involved. In this arrangement, diem employees work as needed, ensuring that their skills are utilized effectively in various diem jobs.

However, this also means that per diem employees may experience inconsistent work schedules and a lack of job security, which may not be suitable for everyone.

How Many Hours Can a Per Diem Employee Work?

There isn’t a specific limit to the number of hours a per diem employee can work. The number of hours they work is largely dependent on the company’s policies.

Per diem employees can take on the roles of both full-time and part-time workers and can work a variety of shift lengths and schedules.

Per Diem Work vs. Independent Contractor

While per diem work and independent contractor arrangements may seem similar, there are key differences between the two. Per diem employees are considered employees, with taxes withheld from their paychecks and subject to minimum wage and overtime laws.

Independent contractors, on the other hand, receive payment for services rendered and are responsible for managing their own taxes and expenses. Additionally, independent contractors typically do not receive the same worker benefits and protections as per diem or traditional employees.

Distinctions between Per Diem Employees and Independent Contractors

A crucial distinction between per diem employees and independent contractors lies in their compensation, benefits, and worker protections.

Per diem employees receive W-2 income, with taxes automatically withheld from their paychecks, and are eligible for minimum wage and overtime pay.

Independent contractors:

- Are issued Form 1099-NEC

- Their compensation is not subject to FICA taxes

- Are not eligible for the same worker benefits and protections as employees, such as health insurance or paid time off.

Pro Tip

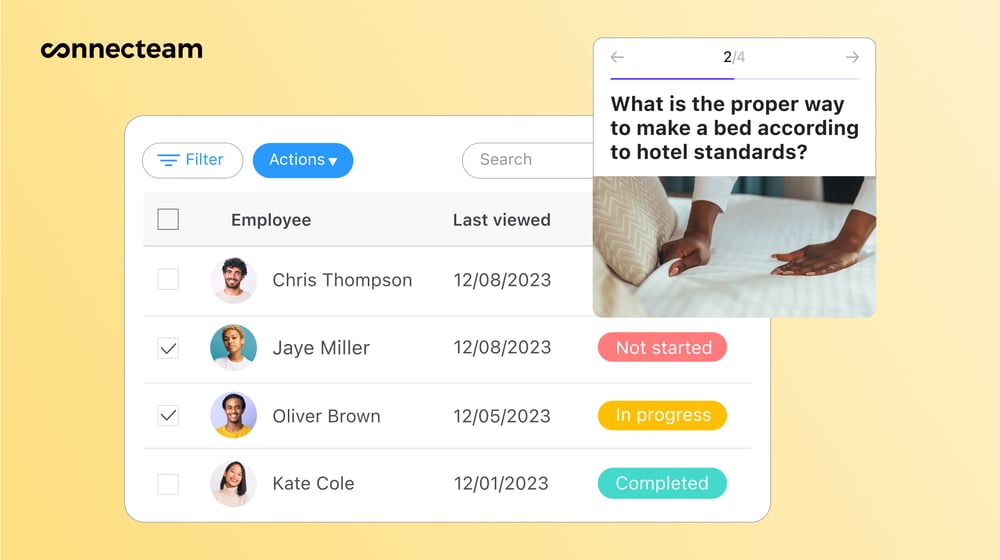

Onboard per diem employees seamlessly with Connecteam. Efficiently onboard and train your staff, ensuring they receive the knowledge and benefits they deserve.

Get started with Connecteam for free today!

Pros and Cons of Per Diem Work

Per diem work offers a unique blend of advantages and challenges for both employees and employers. While it provides flexibility, higher pay rates, and reduced commitment, it also lacks stability, benefits, and clear worker protections.

This section will further analyze the pros and cons of per diem work, scrutinizing the implications for all parties involved.

Benefits of Per Diem Work

For employees, per diem work can offer flexibility in schedule, allowing them to work when and where they choose. The higher pay rates associated with per diem work can also result in greater earning potential.

Employers benefit from the reduced commitment and the ability to bring in specialized talent on an as-needed basis. Additionally, per diem work can simplify expense tracking and reimbursement processes, providing clear spending boundaries for both parties.

Challenges of Per Diem Work

Per diem work is not without its drawbacks. For employees, the lack of stability and limited benefits can pose challenges, especially for long-term financial planning and security.

Employers may face higher labor costs, as per diem rates are often higher than those for traditional employees. Additionally, per diem employees may be subject to potential tax implications, as reimbursements for travel expenses can be considered taxable income under certain circumstances.

Per Diem and Business Travel Expenses

Per diem allowances are commonly used to cover business travel expenses for employees. They simplify the reimbursement process and provide clear spending guidelines.

Per diem allowances can include costs for:

- Lodging

- Meals

- Transportation

- Incidentals

Reimbursement for Travel Costs

Per diem allowances, also known as per diem payments, help cover travel-related diem expenses for employees while they are on business trips.

By providing a fixed daily rate, companies can streamline the reimbursement process and ensure that employees are adequately compensated for their out-of-pocket costs.

This system eliminates the need for employees to submit complicated expense reports and reduces the potential for overspending or fraudulent claims.

Did You Know?

Make managing travel expenses a breeze with Connecteam. Our dedicated employee management software eliminates the need for complicated expense reports and ensures your employees are fairly compensated.

Get started with Connecteam for free today!

Coverage of Meals, Accommodations, and Incidentals

Per diem allowances typically cover expenses related to meals, lodging, and incidental expenses, such as fees and gratuities for services. The specific amount of the per diem allowance can vary based on the employer’s policies and the destination of the business trip.

By providing employees with a clear daily allowance, companies can ensure that spending remains within established boundaries and simplify the expense-tracking process.

Different Types of Per Diem

Per diem rates can vary depending on the context, whether it is government, corporate, or international.

By understanding the various rate structures, employees and employers can make informed decisions when it comes to per diem work and travel expenses.

Government Per Diem

The U.S. General Services Administration (GSA) sets per diem rates for federal employees and other businesses that follow federal reimbursement guidelines. These rates are established annually, taking into account factors such as location, cost of living, and industry standards.

Government per diem rates are typically used as a benchmark for other organizations when determining their own per diem allowances, as they provide a standardized and widely recognized system.

Corporate Per Diem

Corporate per diem allowances are determined by individual companies and may be higher or lower than federal rates. These allowances are designed to cover travel expenses for employees on business trips and can vary depending on the company’s policies and travel destination.

Many companies use the GSA’s per diem rates as a starting point, adjusting them as needed to reflect their specific needs and budgetary constraints.

International Per Diem

International per diem rates are adjusted for employees traveling outside the United States, accounting for cost differences in other countries. These rates are typically established by government agencies, such as the U.S. Department of State, and are based on factors such as location, cost of living, and exchange rates.

By using international per diem rates, companies can ensure that their employees are adequately compensated and reimbursed for expenses incurred while traveling abroad.

Per Diem Pay Calculation

Calculating per diem pay is a simple process. All you need to do is multiply the per diem rate by the number of days worked.

The employer usually determines the per diem rate per day in advance. Employees then receive payment for the days they work.

The calculation for per diem allowance works in the same way. Let’s look at a practical example:

Suppose your employee goes on a two-day business trip with a per diem meal expense allowance of $60. The total per diem would be calculated as follows:

Per diem meal expense allowance: 2 x $60 = $120

Factors Considered in Determining Per Diem Rates

When determining per diem rates, factors such as location, cost of living, and industry standards are taken into account. For example, the U.S. General Services Administration (GSA) sets federal per diem rates based on these factors, while the IRS per diem rates are based on the “high-low” method.

Companies may also choose to establish their own rates, which may be higher or lower than federal or IRS rates, depending on their specific needs and budgetary constraints.

Methods Employers Use to Calculate Per Diem Pay

To calculate per diem pay, employers may rely on various methods, including:

- GSA federal standards, which provide a widely recognized benchmark for per diem rates

- The high-low method, which establishes a high and low per diem rate for each location based on the cost of living

- Company-specific rates

Companies may also choose to develop their own per diem rates, adjusting them as needed to reflect their specific needs and budgetary constraints.

Did You Know?

The IRS published its own per diem rates, the so-called “high-low” rates, in IRS Notice 2021-52. This system takes cost of living into account when calculating per diem rates. Most employers, however, stick to the GSA rates.

Is Per Diem Taxable?

Per diem reimbursements for travel expenses are generally not subject to income tax, but there are exceptions. It’s crucial to note a few important points. As previously mentioned, if your company’s maximum per diem rates for reimbursing travel-related expenses surpass the GSA’s, the excess amount is taxable income.

This needs to be reported on the employee’s W2 form.

For example, if the GSA’s maximum per diem rate is $135, but your company’s rate is $160, the $25 difference is considered taxable income for the employee.

In fact, per diem payments are taxable if any of the following conditions are met:

- The payment exceeds the federal per diem rate

- The employer did not receive an expense report from the employee (it must be submitted to the employer within 60 days after the trip ends)

- The expense report lacks necessary information (the date, time, location, amount, and business purpose for the expenses)

- The employer provided the employee with a flat amount and did not request an expense report.

If none of the above conditions apply, the per diem payment is not taxable.

Conclusion

Per diem work represents a unique and flexible employment option that provides both employees and employers with a range of benefits.

From the daily compensation structure to the streamlined expense tracking process, per diem work offers an attractive alternative to traditional hourly or salaried positions.

As the modern work landscape undergoes continuous transformation, it becomes crucial for both individuals and businesses to grasp the nuances of per diem work and identify how it can cater to their needs most effectively.

Frequently Asked Questions

What does per diem mean for job?

Per diem work is employment on an as-needed basis that is paid daily, rather than per shift, hour, or annually. It includes a single daily allowance for employees traveling for work which usually covers their lodging, meals, and incidentals. Companies generally set per diem stipends according to national guidelines so that anything below the limits is considered non-taxable by the IRS.

What does $100 a day per diem mean?

Per diem refers to a set daily allowance paid to employees when traveling for business purposes. In this case, $100 per day is allocated to cover for accommodation, food, fees and other related expenses. This payment eliminates the need for manual tracking and paperwork of such payments.

Is per diem pay good?

Per diem payments can be a great way to cover travel expenses without the hassle of paperwork, making it a beneficial option for both companies and employees. Plus, they are tax deductible for businesses and not considered income for an employee.

What is the main difference between per diem work and independent contractor work?

Per diem work involves employees receiving a fixed daily rate or allowance to cover travel expenses, while independent contractors are self-employed and receive payment for services rendered, making them the main difference between the two.

Are per diem employees eligible for the same benefits as full-time employees?

Per diem employees are not typically eligible for the same benefits as full-time employees, such as health insurance or paid time off.