Whether you are a contractor, do subcontracting, or own a large or small construction business, insurance protects you from financial liability when things go wrong.

The construction industry comes with inherent risks, and you must protect your business against financial losses when things go wrong. One of the best ways to do this is by getting the right insurance.

However, the complexities of insurance for construction businesses can be daunting. With various types of insurance available, knowing whether you have the right one for your needs is difficult. But failing to take out the right insurance can result in devastating financial losses to your business if an incident occurs.

This article demystifies construction insurance for you. We look at how it works and the types of insurance available. Plus, we discuss the general costs involved and where you can get information tailored to your situation.

Key Takeaways

- Due to the nature of the industry, construction businesses face various risks, such as defective work, workplace injuries, or environmental hazards. These can result in significant financial losses.

- Business insurance for construction companies provides financial protection against these risks.

- Different types of construction insurance are available, including general liability, workers’ compensation, tools and equipment, and inland marine insurance.

- The right business insurance for your construction company depends on various factors, so getting several quotes or speaking to an insurance broker is important when deciding.

- Consider using Connecteam to help manage your construction workforce and reduce your business’s risks.

What Is Construction Business Insurance?

Construction insurance is an umbrella term for various types of insurance that protect business owners, property owners, and contractors involved in construction projects from the industry-specific financial risks they face.

Various risks may arise during the course of a construction project, including:

- Structural defects or flaws.

- Injuries to employees, subcontractors, and third parties.

- Project delays.

- Motor vehicle accidents.

- Damage or theft of equipment and materials.

- Environmental hazards.

Suppose an incident occurs during or as a result of a construction project, resulting in property damage, injury, or legal action. Costs could be high and potentially devastate a business financially. Insurance for construction businesses protects against these risks by covering some or all the costs.

Construction businesses and contractors typically need to take out several types of insurance to cover their activities. Some construction or contractor insurance policies are required by law or under the terms of a construction contract.

🧠 Did You Know?

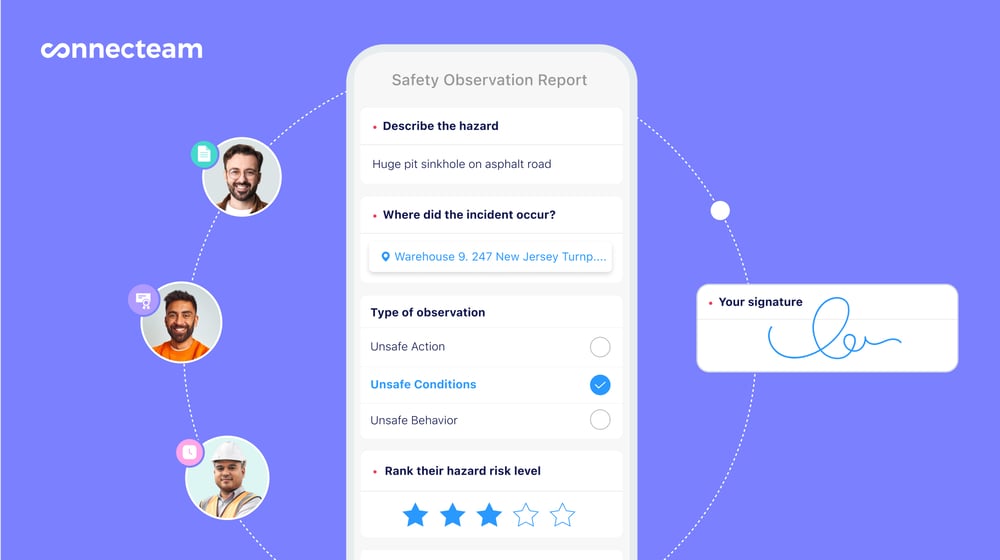

Running a construction business requires reliable employment management software to help reduce the risk of accidents. Use the Connecteam construction app to track your employees’ hours, store safety checklists, and complete real-time incident reports from one app.

11 Types of Construction Business Insurance

These are some common types of insurance construction companies and contractors take out. This list is not exhaustive, and other types of insurance may be relevant to your business, particularly if you work in a specialized sector or specialty.

General liability insurance

General liability insurance for construction businesses covers common claims by third parties, such as property damage or bodily injury. It’s also called commercial general liability or contractor general liability insurance.

This type of insurance typically covers the cost of property repair or replacement and medical bills. For example, if a contractor working on a roof drops a tool and smashes the window of a neighboring building, general liability insurance would typically cover the cost of replacing the windowpane.

General liability insurance is required by law in some states. Regardless, most construction businesses take it out given the nature of the risks to their business.

📚 This Might Interest You:

Getting the right insurance is one step to running a successful construction business. Learn more expert tips for running a construction business.

Workers’ compensation insurance

There’s a high risk of workplace injuries and illnesses in the construction industry—like falls, back injuries, and dust-related asthma. If a worker is injured, falls ill, or dies, workers’ compensation insurance covers related costs, including medical bills, lost wages, temporary and permanent disabilities, and death benefits.

For example, say an employee painting a ceiling falls off a ladder, spraining their wrist badly. They must have their wrist x-rayed, and the doctor advises them to take 2 weeks off work. Workers’ compensation insurance likely covers their medical bills and lost wages during their time off.

This type of insurance is mandatory in all states except Texas.

🧠 Did You Know?

One of the best ways to reduce the risk of workplace accidents is employee training. Connecteam can help you design, deliver, and track training programs through an employee training app. Plus, our app works on any device—so your team can complete their training from anywhere.

Builder’s risk or course of construction insurance

Builder’s risk insurance—also called course of construction insurance—protects you from financial losses resulting from damage to a building or structure before completion.

For example, if a severe storm hits your construction site, causing damage to partially built structures or stored materials, builder’s risk insurance typically covers the costs of repairs and replacements.

The policy will specify what type of damage it covers. Most builder’s risk policies cover a minimum of weather, fire, and vandalism. You can often add extra protection for other events, like floods.

Professional liability or errors and omissions (E&O) insurance

Professional liability or errors and omissions (E&O) insurance covers your business if a construction client alleges you made a mistake or left something out while completing the project. This insurance applies to scenarios where there are issues with the quality of work or you can’t meet timeframes.

Professional liability insurance for construction businesses typically pays for costs arising from lawsuits, such as court fees, lawyers’ fees, and legal settlements.

Say you run a construction project management business and, due to a lack of supervision, the project is significantly delayed and costs increase. If the client sues you for negligent management, professional liability insurance usually covers the cost of defending the claim and any damages the court orders you to pay.

📚 This Might Interest You:

Check out our guide to the best construction project management software. With options catering to both large and small businesses, you’ll find a solution to manage your construction projects efficiently and within budget.

Commercial auto insurance

Commercial auto insurance covers company-owned or work vehicles if they’re in accidents, stolen, or vandalized. Commercial auto insurance may cover the cost of medical bills, property damage, and legal expenses arising from an accident.

Say your company owns a truck used to transport material and tools to worksites and it’s involved in an accident with a car, causing damage to both vehicles and injuries to the driver of the car. Commercial auto insurance likely covers repairs of the damage, medical costs for the passenger, and any legal claims arising from the accident.

This type of insurance is mandatory in most states.

Tool and equipment insurance

This type of insurance covers the cost of replacing or repairing stolen, lost, or damaged tools and equipment. For example, if an employee accidentally reverses over a drill left on the ground, breaking it, tool and equipment insurance likely covers the cost of replacing it.

Each policy outlines the specific type of property it covers. Tool and equipment insurance typically covers smaller, movable property like hand and power tools. There are other types of insurance, such as inland marine insurance, for larger pieces of equipment.

🧠 Did You Know?

Connecteam is handy for keeping track of your tools and equipment. Use it to create digital forms like maintenance checklists and work orders. Plus, chat with employees using team instant messaging when equipment issues arise.

Inland marine insurance

Inland marine insurance protects against financial losses due to damage to tools, equipment, and materials that are somewhere other than a job site, such as in transit or at a storage facility.

This insurance category generally includes items like tools, mobile equipment, and leased equipment.

For example, if a fire occurs due to an electrical fault in the warehouse where you store building materials, inland marine insurance may cover the cost of replacing the damaged materials.

Pollution or environmental liability insurance

This type of insurance covers the cost of injury or property damage caused by a business’s accidental pollution or hazardous waste. It typically applies to issues arising both during construction and after project completion.

Depending on the policy terms, pollution insurance may cover medical, clean-up, property damage, and legal costs. For example, say your business accidentally spills a large amount of solvent during a project. In that case, this insurance may cover the costs of cleaning up the spill and dealing with any legal claims arising from it.

Businesses that regularly handle hazardous waste or materials should consider taking out this insurance.

Subcontractor default insurance

If you engage subcontractors, this insurance offers financial protection in scenarios where subcontractors fail to perform their obligations—for example, when they miss deadlines or deliver poor-quality work.

For example, say one of your main subcontractors files for bankruptcy during a construction project. This insurance typically covers the financial losses you sustain, including those relating to completing unfinished work and project delays.

This insurance is especially relevant if you manage many subcontractors since more can potentially go wrong.

Wrap insurance

Wrap insurance is a policy that combines or “wraps up” liability coverages for specific construction projects. Wrap insurance typically includes general liability insurance and workers’ compensation insurance as a minimum and covers all parties on a project, including owners, general contractors, and subcontractors.

Owners can purchase this under an owner-controlled insurance program (OCIP), or contractors can purchase it under a contractor-controlled insurance program (CCIP).

Bonds

Surety bonds

Surety bonds are an alternative to business insurance in the construction industry.

A surety bond is a contract that guarantees a construction business or contractor will perform its duties and complete the project. If they don’t, the company providing the bond—usually an insurance company—covers the other party’s costs, and the construction business or contractor reimburses the insurance company.

A key difference between surety bonds and insurance is that while insurance protects the policyholder, surety bonds protect the property owner or construction client.

For example, say a client engages your construction business to build a new office tower, and a contract term requires a guarantee the project will be done by a specific date and according to relevant regulations. You enlist a surety (such as an insurance company) to provide a bond on the terms required by the client. The surety covers the client’s costs if you fail to complete the contract on time.

Surety bonds may be required under the terms of a construction contract or by law. Construction businesses may also use a combination of both surety bonds and insurance to fully cover their activities.

Other bond types

Other types of bonds are relevant to the construction industry depending on what you must guarantee. For example:

- Contractor license bonds guarantee contractors will follow licensing rules.

- Bid bonds guarantee contractors can financially support a project if they win a bid.

- Performance bonds are an alternative to subcontractor default insurance.

- Payment bonds guarantee contractors can pay subcontractors and suppliers.

How Much Does Construction Insurance Cost?

The cost of construction insurance varies greatly depending on factors like:

- The different types of insurance your business needs.

- The level of insurance coverage you require.

- Where your business or job sites are based.

- The nature of your work.

- How much equipment you own and its value.

- The number of employees you have.

- Your business’s annual revenue.

- The size of the project.

- Your credit history.

- Your insurance claim history.

As a general guide, according to the Fortune 500 insurance company, The Hartford:

- General liability insurance for construction businesses costs an average of $805-$1,057/year.

- The average cost of commercial auto insurance is $6,884/year.

- Professional liability insurance costs around $300/month.

- The average price of workers’ compensation insurance is $81/month.

💡 Pro Tip:

When researching the best insurance policies for your construction business, contact insurance companies directly for guidance and quotes. Alternatively, consider using an insurance broker to act as an intermediary and do the research for you.

When considering insurance for your construction business, compare policy features. Policies have different coverage limits, meaning they cover losses up to a certain amount only. Premiums (the monthly or annual cost of coverage) also vary. The portion of costs you’re responsible for under a policy—called the deductible—is another consideration to keep in mind.

📚 This Might Interest You:

Insurance can be expensive, but construction software doesn’t have to be. Learn more in our guide on the 6 best free construction company software.

How Connecteam Helps Construction Businesses

Whether you’re an individual contractor or own a small construction business, insurance is essential to shielding your business from financial liability when incidents occur. With various types of construction insurance available, you should research before choosing a combination of policies or speak to an insurance broker. While the costs of business insurance policies add up, they can protect you from significant financial losses.

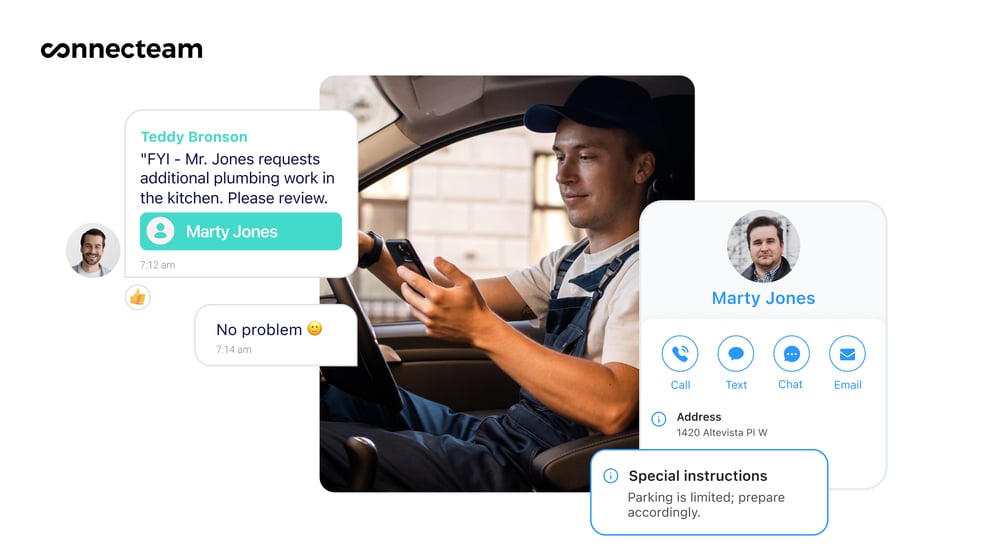

Another way to minimize your construction business’s risks is to find reliable construction company software. Connecteam is ideal for the construction industry, offering a host of features to support safety and compliance, including accurate time tracking, compliance checklists, and real-time communication.

FAQs

What is the best insurance for small construction businesses?

At a minimum, small construction business insurance should typically include general liability, workers’ compensation, commercial auto, and builder’s risk insurance. However, each business’s insurance needs are unique, and you should seek expert advice when choosing insurance to ensure your business is fully covered.

What is a COI for a project?

A COI, or certificate of insurance, is a document confirming a contractor or construction business has adequate insurance as required by law or a construction contract. Owners, general contractors, and government agencies may ask to see a COI before or during a project.

Disclaimer

The information on this website about construction business insurance in the United States is intended as a general summary for informational purposes only. Insurance laws and regulations are subject to change and can vary based on individual business circumstances and specific insurance policies. While we strive to provide current and reliable information, we cannot guarantee its completeness, accuracy, or suitability for your particular insurance needs. We strongly recommend consulting with an insurance professional or a legal advisor to ensure your construction business is adequately covered and complies with all relevant insurance laws and regulations. Please be aware that we cannot be held liable for any decisions made or actions taken based on the information provided on this website.