Business owners can get a little confused when it comes to annual compensation. What does it mean? How is it paid and how is it different from annual salary? Here is a guide breaking down exactly what annual compensation is and how you make it accurate.

For any business to thrive and grow, it’s vital to ensure that managers compensate their employees for their hard work fairly. After all, this can help attract and retain the best talent out there.

Turnover aside, there can be serious financial repercussions in the form of fines and lawsuits if employees aren’t paid the appropriate amount for their services. This can be costly for your business.

But have no fear – there are plenty of ways that you can get annual compensation right. To help clear things up, we thought it would be helpful to put together a guide for managers and other company leaders to learn about what annual compensation is and how to get it right.

What Exactly Is Annual Compensation VS. Annual Salary?

While it seems straightforward, the term annual compensation isn’t always clear-cut, especially compared to the term annual salary. Here is the main difference between the two:

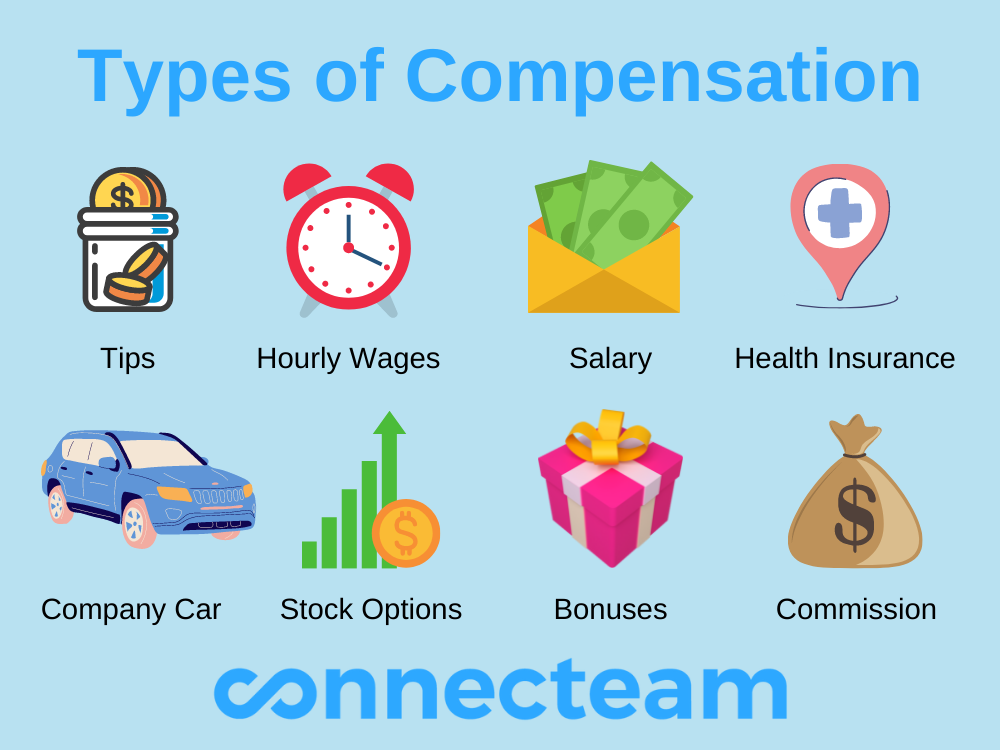

- Annual compensation – this includes any additional compensation or bonuses employees receive on top of their salary.

- Annual salary – this refers to the wages they earn in a given year. This can either be their base salary or the amount of money they’ve accumulated as an hourly worker.

Technically speaking, annual salary is a form of compensation. In a study conducted by the Bureau of Labor Statistics, salary and wages make up 70.6% of the average total compensation within private industries.

At worst, somebody’s annual salary will be equal to their annual compensation. But for companies that offer additional employee benefits, the annual compensation will be worth more than their salary and the money coming in from their paycheck.

Different Kinds Of Annual Compensation

An employee’s annual compensation will often be significantly higher than their annual salary. How much higher will depend on the bonuses that an employer offers and which ones a particular employee wants.

Annual compensation can be provided in many different forms. These include:

- The price of employer-purchased health insurance

- Stock options

- Contributions made to a retirement plan

- Help employees to pay tuition

- Subsidize the cost of daycare

- Paid vacations

- Gym memberships

- Parking discounts

The more bonuses and programs an employer offers, the higher an employee’s annual compensation will be, whereas their annual salary will be a little more straightforward.

How To Get Annual Compensation Right

Even after understanding the basics of what annual compensation and annual salary are, there is a lot to cover in terms of employee compensation, in general.

It’s important for managers to understand the following:

- Differences between full-time and part-time employees

- Issues with working overtime

- A lot of variables when it comes to offering health insurance

- Other bonuses that will contribute to an employee’s annual compensation

Overtime For Employees Who Receive Annual Compensation

Full-time employees who make an annual salary as opposed to an hourly wage don’t need to be paid if they work overtime.

These are known as exempt employees whose annual salary and other compensation cover all of the work they do for the entire year, even if they go beyond 40 hours some weeks.

At the same time, there is no change in their salary or annual compensation if during some weeks, they work fewer than 40 hours, regardless of the reason.

Track Your Employees’ Work Hours

Despite what we have previously mentioned, it’s still a good idea to have an employee time tracking system in place to track the number of hours these employees are working every week, especially if they are putting in extra hours.

Knowing how many hours a person is working compared to their workplace productivity can give a company insight into the efficiency of employees. This makes it easier to decide if this person is overburdened with work or just not being efficient enough.

Health Insurance For Employees Who Receive Annual Compensation

While it’s become common practice for employers to provide health insurance for workers, there is no official obligation to do so. However, there are tax penalties enforced by the IRS for companies that have more than 50 full-time workers but don’t provide health coverage to at least 95% of their staff.

Also, recent data suggests that nearly 90% of full-time workers are offered health insurance by their employers. That means companies that aren’t doing this for their employees are at a competitive disadvantage when it comes to recruitment.

Keep in mind that offering health insurance increases the annual compensation for employees, which makes the employer more appealing when it comes to recruitment and employee retention.

Think Carefully If You Have Less Than 50 Employees

Health insurance can be a bit more complicated for smaller businesses that have fewer than 50 full-time employees. These businesses aren’t required to provide health insurance to workers and won’t receive penalties from the IRS for not doing so.

Obviously, small businesses want to be appealing to talented workers as well, so there is an incentive to provide health coverage. But for small businesses with tight margins, it may not be feasible to offer every employee a healthcare plan.

Choose The Right Health Insurance

Naturally, there are a lot of variables when it comes to the price of health insurance. Some of these include:

- Different prices for various insurers

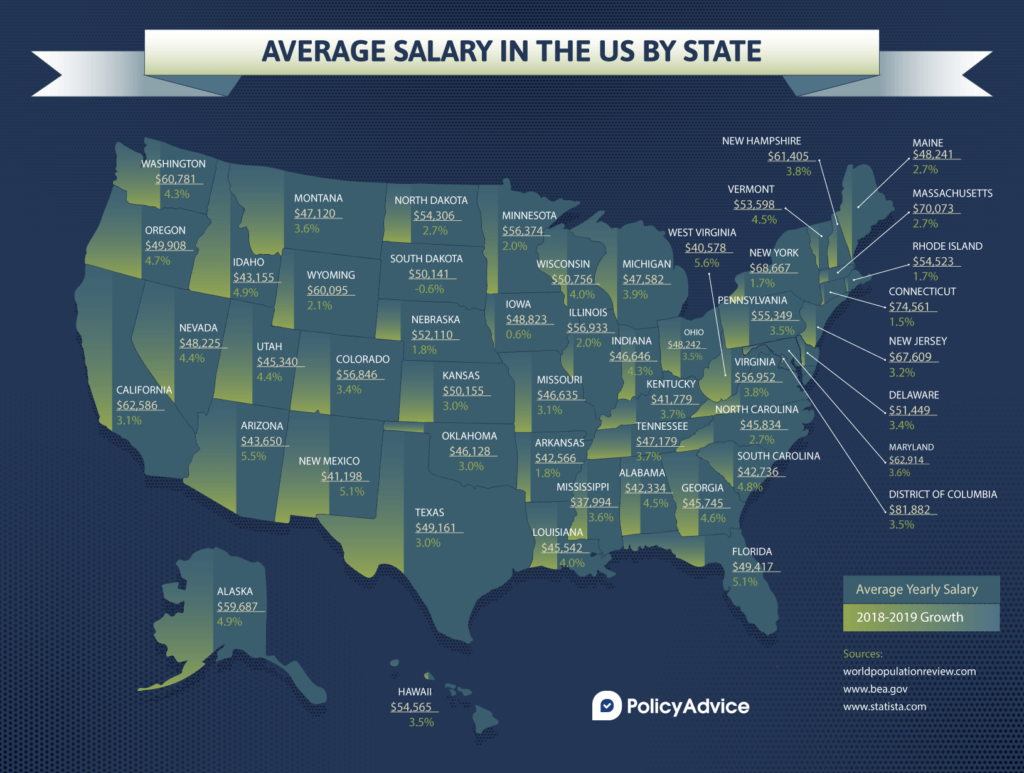

- Location and demographics of the employees

- Group plans, single coverage and family coverage

Ultimately, every company has to weigh up the options and decide whether paying for health insurance for employees is feasible financially and worth the cost.

How To Calculate The Right Annual Compensation

Unfortunately, there is no secret formula for how much every employee should earn in each pay period. However, there are some steps we recommend you take that will go a long way in calculating annual compensation accurately.

Consider All Of The Factors

Several factors must be taken into consideration when calculating annual compensation. These include:

- The demands of that particular job

- How important that position is to the company

- Overqualified and under-qualified employees

- How much employees can earn in other companies

- How much other employees make in the same company/position

Weighing up all of these factors can help give employers, at least, a rough estimate of what an employee is worth.

Conduct Performance Reviews

It’s helpful for most employers to conduct employee evaluations and performance reviews on an annual basis. This can give companies an updated perspective on how qualified an employee is for their position and whether or not they are meeting the job demands.

Having a formal and documented performance review can also come in handy if an employee ever tries to sue for wage discrimination, wrongful termination, or anything else related to their employment or compensation at a company. Remember, when in doubt, it’s always best to have all policies written and well-documented.

Annual Compensation Made Easier

Easily track time to make payroll more efficient and improve annual compensation transparency

Use The Latest Technology To Provide Annual Compensation

With so many moving parts to consider when it comes to employee compensation, doing the job manually can waste a lot of time and money. Not to mention, it can lead to human error.

Companies should implement the right software that can simplify the process as much as possible. That’s why apps like Connecteam can be the perfect solution.

Connecteam is an award-winning app designed specifically for the mobile workforce – such as remote employees and deskless workers.

Tens of thousands of companies from more than 90 industries use Connecteam’s all-in-one app to track employee work hours and ensure accurate annual compensation for employees.

- Use the online time clock to track and manage work hours, ensuring that all forms of compensation are accounted for.

- Employees can have complete transparency with managers about annual compensation, improving team communication with 1:1 chats and updates.

- Managers can send read-and-sign forms, so that employees can approve adjustments to compensation plans.

Connecteam is an all-in-one technology that makes all work processes less stressful. It gives business owners one less thing to worry about while avoiding any negative consequences related to employee compensation. Spreadsheets, pen or paper and other dated tools are no longer necessary.

The Bottom Line On Annual Compensation

So there you have it – annual compensation isn’t so complicated, after all. As a matter of fact, it’s pretty simple to get a grip of once you dissect the term a little.

The main thing you need to remember is that annual compensation refers to additional benefits and bonuses that employees receive beyond a standard salary. Whereas annual salary refers to the wages employees earn each year.

If you use the correct software solution, paying accurate annual compensation will be a walk in the park. No longer will you need to depend on dated methods such as spreadsheets and pen and paper. All it takes is one platform to meet all of your annual compensation needs. This complete guide can help you transition digitally.

With the knowledge and tools on how to make the most of annual compensation, your employees will now receive what they are entitled to.