There are many federal labor laws, and their application can be complex. This article gives you an overview of key laws covering topics such as discrimination, hours, wages, workplace safety, and taxes to help you understand your obligations as an employer.

The framework of federal laws in the United States is vast and complex. The Department of Labor alone enforces over 180 laws—and this is just the tip of the iceberg. While it may feel overwhelming, you must understand your responsibilities as an employer in the US. Otherwise, you put your organization at risk of non-compliance and potentially severe penalties.

To help you out, we take a look at some of the main pieces of federal legislation that apply to private employers in the US. Below, we describe these laws’ key provisions and include recommendations for further reading. Let’s dive in!

Key Takeaways

- There are hundreds of federal labor laws in the US. These laws address issues such as wages, hours, discrimination, workplace safety, taxes, and health insurance.

- Key laws include the Fair Labor Standards Act, the Occupational Safety and Health Act, and Title VII of the Civil Rights Act.

- Some apply to all employers, while others apply only to employers with a certain number of employees or in a specific industry.

- It’s essential to understand which federal laws apply to your business to ensure compliance and reduce the risk of penalties and other legal issues.

Understanding Federal Labor Laws

There are various federal laws addressing different aspects of employment, including discrimination, wages and hours, compensation, paid or unpaid leave, and employee privacy. This article looks at federal laws that apply generally to private employers in the US. Other federal laws apply to specific industries such as mining, transportation, and construction.

In addition to the federal level, labor laws exist at the state and municipal levels. Multiple—and conflicting—rules can apply to you as an employer. Typically, in these situations, the most generous law applies to the employee. For example, the current federal minimum wage is $7.25 an hour. Many states set a higher minimum wage. Where they do, the higher state minimum wage applies.

Federal Laws for All Employers

Consumer Credit Protection Act (CCPA)

The CCPA includes provisions on wage garnishments limiting how much of an employee’s pay per week. It also prohibits employers from terminating employees based on a wage garnishment related to 1 debt.

Employee Polygraph Protection Act (EPPA)

Under the EPPA, employers generally can’t require job applicants or employees to undergo lie detector tests. Polygraph tests are allowed in limited circumstances, and the EPPA sets out how these tests must be conducted. Employers are prohibited from disclosing information obtained during a polygraph test.

The Department of Labor’s (DOL) Wage and Hour Division administers the EPPA.

Employee Retirement Income Security Act (ERISA)

The ERISA applies when a private employer voluntarily establishes a pension or welfare benefit plan for employees. It sets out employers’ fiduciary duties and disclosure and reporting requirements. Some ERISA provisions—for example, reporting requirements—apply only to employers with 100 or more employees.

The Employee Benefits Security Administration (EBSA) enforces the ERISA.

Equal Pay Act (EPA)

The EPA prohibits wage discrimination based on sex. Men and women who perform substantially equal jobs must receive equal pay. Pay covers all forms of compensation, including wages, bonuses, benefits, and allowances.

Employees can make an EPA complaint to the Equal Employment Opportunity Commission.

📚This Might Interest You:

Read our article to learn more about gender equality in the workplace.

Fair Credit Reporting Act (FCRA)

Some employers may rely on background checks—also called consumer reports—to make employment decisions. If they do, they must comply with the provisions of the FCRA.

Employers must notify job applicants and employees of their intended reliance on consumer reports and get written permission from the applicant or employee. The FCRA also requires employers to certify with the consumer report provider that they’ve followed these steps.

Fair Labor Standards Act (FLSA)

A critical federal law, the FLSA sets out employee rights and employer responsibilities around wages and hours—including the federal minimum wage and overtime rate of 1.5 times an employee’s regular pay rate. It also includes child labor laws that address the minimum age for employment and age-based restrictions on hours and types of work.

The FLSA applies to non-exempt employees only. Want to know more about this topic? We explain the difference between FLSA non-exempt and exempt employees.

📚This Might Interest You:

Curious about the minimum working age across the U.S.? Explore our comprehensive guide to ensure compliance and stay informed about youth employment regulations.

👉 Check it out here: Minimum Working Age by State

A recent amendment to the FLSA means that covered employees are entitled to reasonable breaks to express milk for their child until 1 year after the child’s birth. Employers must give employees a private place to pump that isn’t a bathroom. However, employers with under 50 employees don’t need to provide such a place if doing so would cause undue hardship.

The DOL’s Wage and Hour Division enforces the FLSA.

Federal Insurance Contribution Act (FICA)

Under the FICA, employers must withhold payroll taxes from employees’ paychecks to send to the IRS. These taxes are used to fund Social Security and Medicare. The FICA sets out applicable tax rates and the wage base limit—i.e., the maximum wage subject to social security tax.

Federal Unemployment Tax Act (FUTA)

Administered by the Internal Revenue Service, the FUTA law requires most employers to pay taxes to fund unemployment benefits.

Employers must pay unemployment taxes if they paid wages of $1,500 or more in a quarter or had at least 1 employee anytime during any 20 weeks in a calendar year. The FUTA sets out the applicable unemployment tax rates.

Health Insurance Portability and Accountability Act (HIPAA)

The HIPAA protects sensitive patient health information. It applies to employers in limited circumstances, typically when an employer has a self-insured health plan. Employers with a self-insured health plan that stores or sends an employee’s sensitive patient health information must file it separately from other employee records.

Immigration and Nationality Act (INA)

The INA establishes employment eligibility and verification processes and prevents discrimination against non-citizens.

Employers generally can’t discriminate against someone based on their citizenship status when making an employment decision. They must verify employees’ employment authorization but can’t ask for extra or different documents to do this based on citizenship.

Under the INA, employers are also prohibited from retaliating against an employee for making a complaint.

The Department of Justice Civil Rights Division’s Immigrant and Employee Rights Section enforces the INA.

Jury Systems Improvement Act

In the US, the Jury Systems Improvement Act prohibits employers from terminating, harassing, or discriminating against employees based on their federal jury duty service attendance.

National Labor Relations Act (NLRA)

Enforced by the National Labor Relations Board, the NLRA regulates the relationships between private employers, unions, and employees. It protects employees’ right to join or form a union and to engage or not engage in protected union activities.

The NRLA doesn’t apply to specific industries, including the agriculture and airline sectors.

Occupational Safety and Health (OSH) Act

Under the OSH Act, employers must provide employees with a workplace free from serious hazards.

The Occupational Safety and Health Administration (OSHA) administers and investigates complaints under the OSH Act. The act sets out rules and guidelines for workplace health and safety conditions, including the requirement to display an OSHA poster in a prominent place.

Additionally, the act addresses employee rights. It protects their right to a safe work environment, access specific records, and file a complaint with OSHA for a workplace inspection.

The OSH Act also explains the reporting obligations for employees and employers when a workplace illness or accident occurs. Additional health standards are required for employers in certain industries, such as the construction, agriculture, and maritime sectors.

🧠 Did You Know?

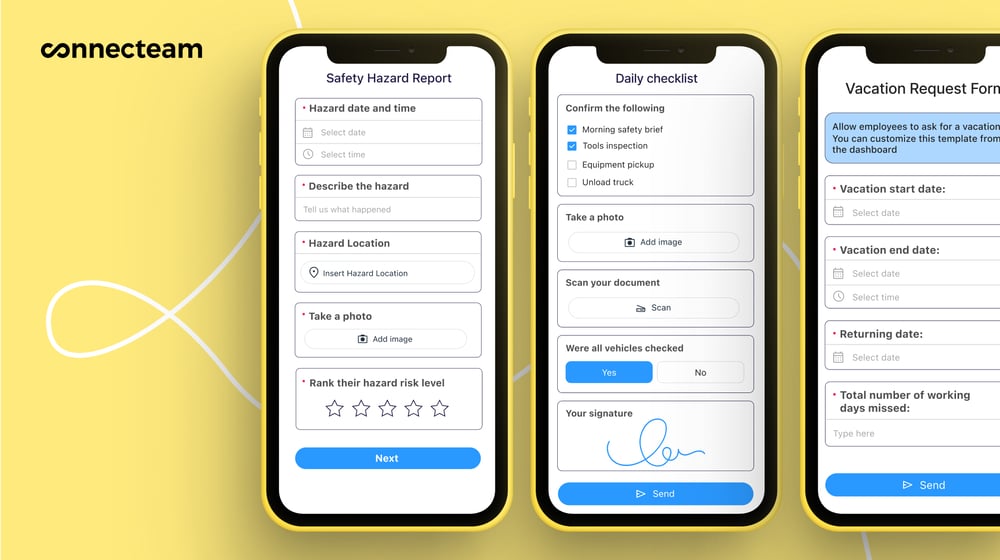

Connecteam can help you manage your compliance obligations easily using smart forms and checklists, advanced employee training capabilities, and the easiest way to manage and organize employee documents.

Uniformed Services Employment and Reemployment Rights Act (USERRA)

The USERRA prohibits employers from discriminating against employees who are current or former armed service members. Armed service employees include members of the Armed Forces, Reserves, National Guard, and other Uniformed Services.

Employers must re-reinstate returned armed service employees and continue to provide health insurance to them while they are on leave. The USERRA also sets out the complaints process, administered by the DOL’s Veterans’ Employment and Training Service.

Federal Laws for Employers With 15 or More Employees

Americans With Disabilities Act (ADA)

The ADA ensures equal employment opportunities for people with disabilities. It prohibits employers with 15 or more employees from discriminating against employees with disabilities concerning hiring, firing, or conditions of employment.

Employers must provide reasonable accommodations for employees with disabilities. The protections don’t extend to individuals who can’t perform the essential duties of their job despite all reasonable accommodations.

The Equal Employment Opportunity Commission (EEOC) handles ADA-related complaints.

Genetic Information Nondiscrimination Act (GINA)

Title II of the GINA prohibits employers with 15 or more employees from discriminating against employees based on their genetic information, such as the employee’s or a family member’s genetic tests or medical history.

This prohibition applies to all stages of the employment process—including hiring, termination, and conditions of employment. Employers can’t require job applicants’ genetic information as a condition of employment.

However, there are limited circumstances where employers can access genetic information about job applicants or employees.

The EEOC enforces the GINA.

Pregnancy Discrimination Act (PDA)

The PDA is an amendment to Title VII of the Civil Rights Act that expands the definition of sex discrimination to include pregnancy discrimination.

It outlines that employers can’t discriminate against employees based on:

- Pregnancy (current or past).

- Potential pregnancy.

- The decision to have or not have an abortion.

- Birth control usage.

- Complications arising from pregnancy or childbirth.

The EEOC administers the PDA.

Pregnant Workers Fairness Act (PWFA)

Under the PWFA, employers must make reasonable accommodations for employee limitations related to pregnancy, childbirth, or a related medical complication so employees can do their assigned work. Employers don’t have to make accommodations where doing so would cause undue hardship.

The EEOC also administers the PWFA.

Title VII of the Civil Rights Act

Under Title VII of the Civil Rights Act, employers can’t discriminate against employees based on their:

- Race.

- Color.

- Religion.

- National origin.

- Sex, including gender, pregnancy, sexual orientation, and gender identity.

This protection applies to all employment decisions, including hiring, termination, and conditions of employment.

Title VII also prohibits policies designed to appear neutral but actually discriminate against someone based on a protected characteristic.

Employees subject to discrimination can file a complaint with the EEOC. Employers can’t retaliate against employees who raise a discrimination complaint.

Federal Laws for Employers With 20 or More Employees

Age Discrimination in Employment Act (ADEA)

The ADEA protects job applicants and employees 40 years or older from employment discrimination. This protection applies to decisions during all stages of the employment process, including hiring, firing, promotion, and conditions of employment.

An employer may be exempt from this if there’s a bona fide occupational qualification—a rare instance where a person’s age is essential to carrying out a specific job function.

The EEOC hears complaints under the ADEA.

Older Workers Benefit Protection Act (OWBPA)

The OWBPA is an amendment to the Age Discrimination in Employment Act. It requires employers to offer workers aged 40 years or older benefits equal to those provided to younger employees. It also governs employee waivers of their right to sue for age discrimination, requiring them to be made knowingly and voluntarily.

Consolidated Omnibus Budget Reconciliation Act (COBRA)

The COBRA extends healthcare benefits for employees who have lost them due to voluntary or involuntary job loss, reduced hours, death, divorce, or other qualifying events.

Depending on the circumstances, the act can extend coverage by 18 or 36 months. It also explains how employees can elect COBRA coverage.

The Employee Benefits Security Administration (EBSA) administers the reporting requirements under COBRA.

Federal Laws for Employers With 50 or More Employees

Affordable Care Act (ACA)

Also called Obamacare, the ACA expands health insurance coverage. It applies to

employers with 50 or more full-time employees and requires employers to make affordable health insurance benefits available to certain employees.

Family and Medical Leave Act (FMLA)

Under the FMLA, eligible employees can take up to 12 weeks of unpaid leave in 12 months for:

- Their own or a family member’s serious illness or injury.

- The birth or adoption of a child.

- Situations relating to a family member’s active military service.

Unpaid leave can be extended to up to 26 weeks when the leave relates to a family member who’s injured or becomes ill during active military service.

Employees are eligible for FMLA leave if they’ve worked for the employer for at least 12 months and 1,250 hours.

The DOL’s Wage and Hour Division enforces the FMLA.

Federal Laws for Employers With Over 100 Employees

Worker Adjustment and Retraining Notification Act (WARN Act)

The WARN Act applies to businesses with 100 or more employees. It requires employers to provide affected employees with at least 60 days written notice of a planned plant closure or mass layoff.

Further Federal Employment Law Resources

This article is a brief overview of the key labor laws at a federal level. For more information about them, you can visit the websites of the Department of Labor and the Equal Employment Opportunity Commission. These are the 2 agencies responsible for enforcing most labor laws.

The DOL’s website provides 2 lists of resources for employers:

- Employment Laws: Overview and Resources for Employers

- Resources for Employers, under the Wage and Hour Division (WHD)

The EEOC’s website also has information for employers about discrimination laws, including a small business resource center.

📚 This Might Interest You:

Understanding your obligations as an employer is just one step in the compliance process. You also need to educate your employees about their rights and responsibilities. Using technology is a great way to do this. To learn more, check out our article on how mobile training solutions are changing compliance training.

Conclusion

Federal labor laws are complicated and change often. Plus, they interact with state and local laws in various ways depending on location. For these reasons, speaking with a lawyer is essential to get advice relevant to your circumstances.

By fully understanding your obligations under the laws discussed in this article—and any others that may apply to your business—you can ensure you treat your employees lawfully. This will help you reduce the risk of non-compliance and associated penalties and keep your business in good standing.

FAQs

What are the most common federal employment laws?

There’s a variety of federal work laws in the US. Key laws that apply to most employers include the Fair Labor Standards Act, the Occupational Safety and Health Act, Title VII of the Civil Rights Act, and the Family and Medical Leave Act.

Which federal agency enforces workplace laws and regulations?

The federal agency responsible for the enforcement of a specific employment law varies. For example, the Department of Labor administers laws such as the Fair Labor Standards Act, and the Equal Employment Opportunity Commission enforces employment discrimination laws like Title VII of the Civil Rights Act.

Disclaimer

The information on this website about federal work laws in the United States is intended to be a summary for informational purposes only. However, laws and regulations regularly change and may vary depending on individual circumstances. While we have made every effort to ensure the information provided is up-to-date and reliable, we cannot guarantee its completeness, accuracy, or applicability to your specific situation. Therefore, we strongly recommend that readers seek guidance from their legal department or a qualified attorney to ensure compliance with applicable laws and regulations. Please note that we cannot be held liable for any actions taken or not taken based on the information presented on this website.