Jump to

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account. Direct deposit is the standard method most businesses use for paying employees.

It’s critical to get proper authorization to use an employee’s bank details for payroll before sending money. Otherwise, your business could find itself in legal trouble.

A direct deposit authorization form also covers all the bank account details that you need to know where to send a payment. These details can be entered directly into your payroll software, streamlining the process of paying your employees.

What is Direct Deposit and Why Use It?

Direct deposit is a method of sending money electronically to an individual’s bank account. For businesses, direct deposit replaces the time-consuming process of printing a check and then having an employee visit their bank to deposit that check.

Most employees today expect direct deposit as a payment option, so your business may be losing out on talent if you don’t offer it. It’s also highly efficient. Most payroll software platforms are set up to process direct deposit payments and can do so with just a few clicks.

Most employers ask employees to fill out an employee direct deposit enrollment form shortly after they are hired, as part of the employee onboarding process. If an authorization expires after a certain amount of time, it’s important to have an employee fill out a new form before the old one expires.

If your business is offering direct deposit for the first time, you should ask all employees to fill out direct deposit forms.

💡 Pro Tip:

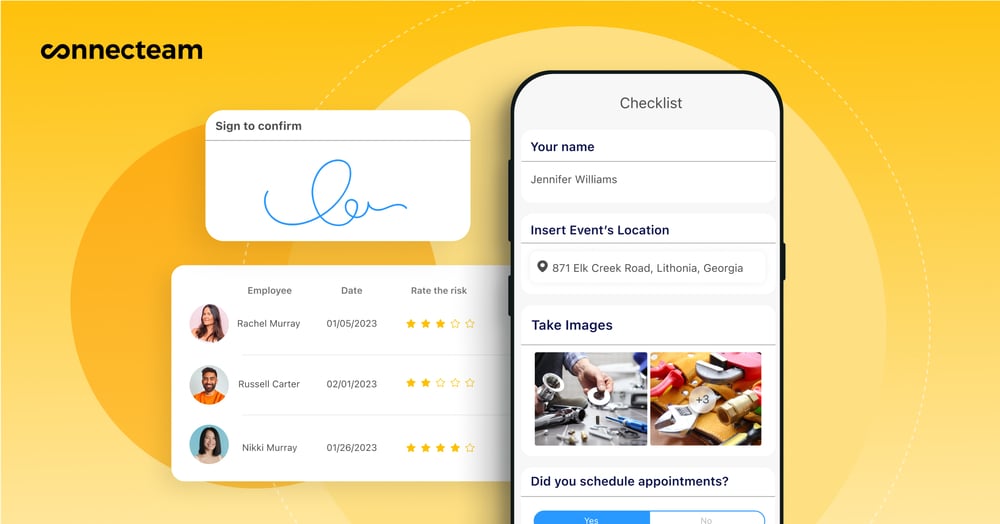

Using digital direct deposit forms makes life much much easier, especially if you have remote or field workers. With Connecteam, you can upload, store, and share direct deposit forms right in the app so employees can access them, fill them out, and send them back directly from their mobile devices.

Get started with Connecteam for free today!

What to Include on a Direct Deposit Authorization Form

A direct deposit authorization form can be relatively simple. To ensure you always collect all necessary information, you should create a direct deposit form template. Here’s the information you should ask for on your form:

- Company details: Include your business’s name, address, and contact information. This affirms that an employee is knowingly authorizing your business to use their bank details for payments.

- Employee contact details: Ask for your employee’s full name, address, and contact details.

- Bank name: The name of the bank where the employee’s account is registered.

- Account number: The unique number of the employee’s bank account. This can also be found on a check from that account.

- Routing number: The nine-digit number that identifies the bank. This is available online or can be found on a check from the employee’s account.

- Account type: Employees should indicate whether the account they are using is a checking or savings account.

- Authorization: A statement indicating that the employee authorizes your business to use their provided bank details for the purpose of depositing payments into their account. This statement should begin with “I hereby authorize” and include a timeframe for the authorization.

- Signature: The employee should sign and date the authorization form.

It’s also a good idea to give employees the option of splitting up their paycheck among multiple bank accounts. In this case, you can simply provide multiple account information sections on your form. For each account, the employee should select the percentage of each deposit that should go into that account. Make sure the percentages add up to 100.

You’re not required to verify the bank information that an employee provides, but doing so can prevent a headache later if there’s a mistake. You can ask for a voided check for each account, which will show the bank name, account number, and routing number or a bank verification letter for direct deposit.

Once completed, an employee’s direct deposit authorization form should be stored in the confidential portion of their employee file. The form contains sensitive financial information that must be kept secure.

How to Set Up Direct Deposit for Your Employees

Setting up direct deposit for employees involves a few key steps. Here’s a general outline of the process:

- Choose a payroll service provider: If your business doesn’t already have one, select a payroll service provider that offers direct deposit. This could be a bank, a dedicated payroll company, or a software service. Many payroll providers are also direct deposit companies.

- Gather employee information: Collect banking details from your employees, including their bank name, account number, and routing number. You’ll also need their authorization to deposit money into their accounts, typically obtained through a signed direct deposit form.

- Set up employee accounts in your payroll system: Enter the employee’s banking and personal information into your payroll system. This step is crucial for ensuring that the funds go to the correct account.

- Obtain bank information: Get the necessary information from your bank or payroll service provider to set up direct deposit. This may include setting up a new account specifically for payroll purposes.

- Test the direct deposit setup: Before fully implementing, conduct a test run to ensure that the deposits are going through correctly. This might involve a small deposit to each employee’s account to verify that the system is working.

- Schedule the deposits: Set up the timing for regular deposits according to your payroll schedule, whether it’s weekly, bi-weekly, or monthly.

- Inform your employees: Communicate with your employees about the start date of direct deposit and any changes to the payroll process. Ensure they know when to expect their first direct deposit.

- Maintain records and compliance: Keep accurate records of all transactions and ensure your direct deposit process complies with state and federal regulations.

- Regularly update information: Make sure to update employee banking information as needed, for instance, if an employee changes banks or accounts.

- Review and audit: Periodically review the system for accuracy and efficiency, and conduct audits to ensure compliance and security.

Paying Employees Without Direct Deposit

Many employees opt into direct deposit payments and the Electronic Fund Transfer Act allows employers to make direct deposit mandatory for employees. However, for employees who don’t want to use direct deposit, there are ways to offer alternative payments.

- Physical checks: Most payroll software platforms enable you to print out physical checks. You can also write checks by hand and give them to employees to cash.

- Cash: Paying employees with cash is allowed and can offer a way to avoid bank transfer fees. However, it’s important to keep excellent records when paying employees in cash. The IRS looks closely at businesses that use cash for payroll.

- Digital wallets: You can also send cash to a digital wallet like PayPal, Venmo, or Apple Pay. However, this can be a hassle since employees need to sign up for these services and there may be fees for some transfers.

- Prepaid cards: Your business can load an employee’s paycheck onto a prepaid card, which they can then use like a debit card. Note that some prepaid cards charge high fees, both when loading the cards with money and when employees make transactions using the cards.

The Best Technology to Facilitate Direct Deposit

Connecteam

Connecteam’s all-in-one payroll management software provides business owners and managers with all the tools they need to pay employees accurately and on time.

Store your company’s direct deposit authorization form directly in the app with Connecteam’s forms and checklist feature so new employees can fill it out and send it back instantly.

Employees can clock in and out of work from the mobile time clock and all tracked hours are automatically organized on digital timesheets. Then, you can review and edit total daily work hours, the number of hours worked during a payroll period, overtime, breaks, and time off.

When ready, you can export your timesheets to Excel, your payroll service, or one of Connecteam’s payroll software integrations, like Quickbooks or Gusto. Employee paychecks will be deposited directly into their accounts on time.

Gusto

Gusto payroll software streamlines payroll processes with automated tax calculations, direct deposit, and compliance tracking. Its intuitive interface allows easy employee onboarding, benefits management, and time tracking. Gusto ensures accurate, efficient payroll management while minimizing errors and ensuring legal adherence.

Sage

Sage payroll software offers comprehensive features for efficient payroll management. It automates tax calculations, facilitates direct deposits, and ensures compliance with changing regulations. Employee self-service tools, time tracking, and leave management enhance productivity.

Conclusion

Direct deposit authorization forms are simple, but important forms that enable you to pay employees by direct deposit.

The completed form collects the bank details required to make payments and authorizes your business to handle that sensitive account information.

Most payroll software platforms support direct deposit, making payments to your employees simple and fast.