Getting a business license is essential when starting your venture. It’s not just paperwork; it’s your key to operating legally.

This guide breaks down what you need to know about business licensing and how to get a business license for your business.

We’ll help you understand the process clearly, making it easier to get your business up and running smoothly.

What Is a Business License?

A business license is a permit or license required to legally operate a business and provide services in a specific location.

It is an essential document that ensures businesses are compliant with government regulations and registered for tax purposes.

The purpose and requirements for obtaining a business license may vary depending on federal, state, county, and municipal agencies.

Do You Need a Business License?

Not all businesses require a business license, but it is important to determine whether your business activities necessitate one.

The need for a license depends on various factors, including the type of business you operate and its location.

Business licenses are issued by different government entities at different levels, such as federal, state, county, and municipal agencies.

Types of Business Licenses

There are different types of business licenses that may be required, depending on the nature of your business. Some examples include:

- General business licenses: These licenses allow businesses to operate in a specific state or locality. They are often required for businesses engaged in general commercial activities.

- Industry-specific licenses: These licenses are required for professions or industries that have specific regulations and requirements. Examples include licenses for salons, electrical work, childcare, medicine, and law.

- Federal licenses: Certain businesses involved in regulated industries, such as alcohol and firearms sales, and aviation, may require additional federal licenses.

Obtaining the necessary licenses for your business is crucial to ensure compliance and avoid any legal issues.

Understanding the specific requirements for your industry and location is important in determining the type of licenses you need to operate your business legally.

How To Get a Business License

-

Form Your Business Entity

Before applying for a business license, you need to form your business entity. This involves choosing a legal structure for your business, such as a sole proprietorship, partnership, LLC, or corporation.

The chosen legal structure will determine the process and requirements for obtaining a business license.

If you are a sole proprietor or in a partnership, you may operate under your own or your partners’ names.

However, you may also choose to register a Doing Business As (DBA) name.

On the other hand, if you have an LLC or a corporation, you must register your business name with the appropriate state agency before applying for a business license.

Common business legal structures for small businesses include:

- Sole Proprietorship: This is the simplest form of business structure, where the business is owned and operated by a single individual. There’s no distinction between the owner and the business for legal and tax purposes. It’s easy to set up but offers no personal liability protection.

- Partnership: This structure is used when a business is owned by two or more people. Partnerships can be general or limited. In a general partnership, all partners share in the profits, liabilities, and management of the business. In a limited partnership, there are both general and limited partners, where the latter typically don’t participate in the day-to-day operations and have limited liability.

- Limited Liability Company (LLC): An LLC combines the liability protection of a corporation with the tax benefits and flexibility of a partnership. Owners of an LLC are called members, and the LLC can be owned by one or more individuals or entities. This structure provides personal liability protection for its members but is more complex to set up than a sole proprietorship or partnership.

- Corporation (C Corp): This is a more complex business structure with an independent legal identity separate from its owners (shareholders). It offers the strongest personal liability protection but comes with more regulations, higher administrative fees, and more complex tax and legal requirements. Profits are subject to corporate tax, and dividends paid to shareholders are taxed again at the personal level.

- S Corporation (S Corp): An S Corp is similar to a C Corp but with some key differences in taxation. It allows profits (and some losses) to be passed directly to owners’ personal income without ever being subject to corporate tax rates. Not all states tax S corps equally, and there are certain restrictions on the number and type of shareholders they can have.

- Cooperative: This is a business owned and operated for the benefit of those using its services. Members of a cooperative share in the profits and decision-making processes of the business. Cooperatives are more common in certain industries like agriculture, retail, and housing.

The best choice for you depends on the specific circumstances and goals of your business and its owners.

Be sure to speak to a legal or financial advisor to fully understand the advantages and disadvantages for each structure.

Apply for an Employer Tax Identification Number (TIN)

Once you have formed your business entity, the next step is to apply for an Employer Tax Identification Number (TIN).

This number, also known as an Employer Identification Number (EIN), is required for tax purposes and is issued by the Internal Revenue Service (IRS).

You can apply for an EIN online through the IRS website, and it is a straightforward process that usually only takes a few minutes to complete.

Having an EIN is necessary if you have employees, plan to open a business bank account, or if your business entity is not a sole proprietorship.

Determine Which Licenses You Need

Before applying for a business license, it is important to determine which licenses you need for your specific business activities.

The licensing requirements can vary depending on the nature of your business, the industry you operate in, and your location.

Research the federal, state, county, and municipal agencies that regulate your industry to identify the licenses and permits you need to legally operate your business.

This step ensures that you are compliant with all applicable laws and regulations.

Did You Know?

Specific business activities, like selling alcohol or providing childcare, may require additional industry-specific licenses. It’s important to research thoroughly to ensure you’re fully compliant with all licensing requirements.

Apply for a Business License

Once you have determined the licenses you need, it is time to apply for a business license.

The process for applying for a business license may vary depending on your location and the type of license you require.

You will need to complete a business license application and provide any necessary supporting documents.

These documents may include your EIN, proof of insurance, a copy of your business entity formation documents, and any industry-specific certifications or permits.

Submit your application and pay any required fees.

Be prepared to wait for processing time, as the duration can vary depending on the issuing authority.

Renew Your Business License

After obtaining your initial business license, it is important to stay compliant by renewing your license as required.

Business license renewals typically occur annually or biennially, depending on your location.

Be sure to keep track of your renewal date and submit your renewal application and fees on time to avoid any penalties or disruptions to your business operations.

Renewing your business license ensures that you maintain your legal authority to operate within your jurisdiction.

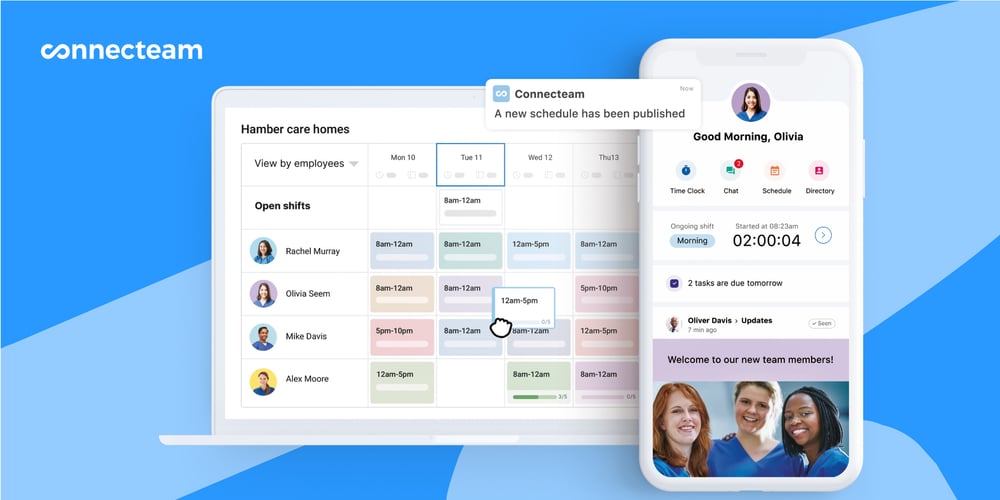

Manage Your Small Business With Connecteam

Connecteam’s all-in-one small business management app with everything you need to manage your non-desk team and daily operations, even while on the go.

Connecteam is an excellent choice for your small business for the following reasons:

- Shift Scheduling: A user-friendly employee scheduling app with drag-and-drop functionality, providing visibility into employee availability, vacations, and certifications. It helps prevent overtime scheduling and allows employees to trade shifts via the app.

- GPS Time Clock: A mobile employee time clock app for precise work hour tracking, enhanced with geofencing for on-site reminders and GPS tracking for real-time employee location monitoring.

- Team Collaboration: Features like one-on-one and team messaging, an announcement feed for sharing updates, and task management tools with custom digital forms, checklists, and deadline reminders.

- HR Tools: A secure cloud-based employee document management system for HR, capable of storing employee files, tracking certifications and tax form expirations, and offering surveys and quizzes to gauge company culture and employee satisfaction.

Did You Know?

We created Connecteam to help small business owners like yourself. To give you the best possible start into your business venture, we made our employee management software 100% for small businesses.

Get started with Connecteam for free today!

FAQs

The cost of a business license can vary depending on the location and type of business you have. Some licenses have a flat fee, while others are based on factors such as gross receipts or number of employees. It’s best to check with your local government or licensing agency to determine the specific cost for your business.

Yes, an LLC (Limited Liability Company) can and must obtain a business license. While forming an LLC provides liability protection for the owners, it does not exempt the business from licensing requirements. You will still need to research and comply with the licensing requirements that apply to your specific industry and location.

The licensing requirements for a business license can vary depending on your industry and location. Common requirements may include providing proof of insurance, submitting an application with necessary documentation, passing inspections, and paying the required fees. It’s important to thoroughly research the specific requirements applicable to your business to ensure compliance.

The process for applying for a business license typically involves filling out an application form provided by your local government or licensing agency. The form may require information about your business, such as your business structure, location, and employer identification number. You may also need to provide supporting documents, such as proof of insurance or professional qualifications. Once you have completed the application, you will need to submit it along with any required fees.

The renewal period for business licenses can vary depending on your location. Some licenses may need to be renewed annually, while others may have longer renewal periods. It’s important to keep track of the expiration date of your business license and renew it before it expires to avoid any disruptions in your operations. Check with your local government or licensing agency for the specific renewal requirements and deadlines applicable to your business.