Construction payroll is complex, but the right software can help. I compare 5 top construction payroll software to help you find the best.

Managing payroll in the construction industry is daunting due to the sector’s diverse workforce, fluctuating work hours, and regulations.

Challenges can lead to inaccuracies in payroll processing, increased administrative burden, and legal issues.

In this article, I compare the 5 best payroll software for construction companies to streamline payroll, enhance accuracy, and ensure compliance.

Our Top Picks

-

1

Good for contractors

-

2

Good for tax filing and tax credits

-

3

Good for accounting and bookkeeping

Why trust us?

Our team of unbiased software reviewers follows strict editorial guidelines, and our methodology is clear and open to everyone.

See our complete methodology

How I Chose the Best Payroll Software for Construction Companies

I looked for some key features when choosing the top construction payroll software.

Must-have features:

- Time tracking: Accurately captures employee hours across projects, jobs, and tasks, ideally incorporating GPS tracking for precise location-based time recording.

- Job costing and reporting: Provides detailed reports on labor costs by project, allowing for effective budget and project cost management.

- Benefits administration: Enables management of employee benefits, such as health insurance and retirement plans.

- Tax and compliance reporting: Generates precise federal, state, and local tax reports, along with required compliance reports.

I also made sure the software has:

- User-friendly interface to ensure easy use and adoption for employees with varying technical experience.

- Affordable pricing that aligns with your budget without compromising critical functionalities.

Finally, I checked for features that make construction payroll software great:

- Multi-state payroll processing: Supports operations across various states with their own labor and tax regulations.

- Tax filing: Automates the calculation, withholding, and reporting of payroll taxes, minimizing the risk of errors and penalties.

- Ability to handle multiple employee types: Supports compliant payroll for full-time, part-time, contract, and unionized construction workers.

- Employee self-service portals: Lets employees view their pay stubs, tax forms, and benefits.

- Advanced reporting and analytics: Enables you to track trends, optimize labor allocation, and identify cost-saving opportunities.

The 5 Best Construction Company Payroll Software

-

Gusto — Good for contractors

Gusto is a cloud-based platform offering a suite of tools for payroll, benefits, and human resource management, tailored to meet the needs of small and medium-sized businesses.

Why I Chose Gusto: Gusto is one of the best payroll software for small construction companies, providing tailored solutions that tackle the sector-specific challenges of managing a fluctuating workforce.

Tax compliance across states

A feature I found particularly helpful is Gusto’s automated tax processing and filings. This functionality is a lifesaver for construction companies that operate across multiple states. It ensures compliance with the diverse tax laws and regulations in different jurisdictions.

Time tracking and integration

Another standout feature is the time tracking integrations. These allow you to import hours worked from various time-tracking platforms—including Connecteam—directly into the payroll system.

Gusto’s time clock kiosk app transforms any connected device into a centralized station for clocking in and out, equipped with PIN-operated sign-in to eliminate time theft.

Workers’ compensation and compliance

Gusto provides workers’ compensation administration, a critical aspect in this high-risk industry. The platform simplifies obtaining and managing workers’ compensation insurance, ensuring that companies comply with regulations.

Another helpful feature Gusto offers is certified payroll reports. If your construction company works on government-funded projects, you’re legally required to produce weekly certified payroll reports. This feature is essential for ensuring compliance with regulations like the Davis-Bacon Act, which mandates that workers on public works projects are paid prevailing wages.

Job costing and workforce management

Gusto’s comprehensive job and workforce costing capabilities enable you to break down costs by project, task, or employee accurately. This transparency in job costing is instrumental in making precise project bids and managing budgets effectively.

Gusto integrations

Despite its comprehensive features, Gusto has limited advanced features for accurate time tracking, including GPS tracking and geofencing.

Luckily, Gusto integrates with various software that can make up for these shortcomings. These include accounting software like QuickBooks and Xero, time and attendance systems like QuickBooks Time and Connecteam, and HR platforms such as BambooHR. It also integrates with other essential business tools, including Slack and Google Workspace.

📚 This Might Interest You:

Check out our list of the best Gusto time tracker apps for seamless integration between your construction time tracking and payroll software.

What users say about Gusto

One of the best features is that we don’t have to worry about calculating and paying our payroll taxes…you plugin in the time cards and hit submit and it’s done.

Read full review.There should be a way to have a salary that doesn’t change when the hours are changed. The other downside is that if there is an error, you have to void the entire payroll.

Read full review.Key Features

- Automated tax processing and filings

- Time tracking integrations

- Workers' compensation administration

- Certified payroll reports

Pros

- Simplified multi-state payroll processing

- Enhanced compliance

Cons

- Lacks advanced workforce management features

- Interface can be overwhelming for first-time users

Pricing

Starts at $40/month + $6/person/month Trial: No Free Plan: No

-

Paychex Flex — Good for tax filing and tax credits

Paychex Flex is a cloud-based payroll and human resources management solution designed to streamline and simplify business processes for small to medium-sized businesses.

Why I chose Paychex Flex: With features like tax compliance, time tracking, benefits administration, and workers’ compensation, Paychex Flex is one of the best payroll software for small construction companies.

Tax management and credits

The software’s robust tax filing capabilities appealed to me. It ensures accurate calculation, withholding, and submission of federal, state, and local payroll taxes, significantly reducing the administrative burden on businesses.

Furthermore, Paychex Flex offers specialized support for navigating tax credits, such as the Work Opportunity Tax Credit (WOTC) and the Employee Retention Tax Credit (ERTC). If you’re hiring for your construction company, WOTC can help you save on taxes when you hire individuals facing employment challenges who’d fit well into your construction roles. And, if you’ve kept your team on the payroll through tough times—like the COVID-19 pandemic—the ERTC offers you tax relief to offset payroll costs.

Timekeeping and attendance management

Paychex Flex’s time and attendance system integrates seamlessly with payroll processing. This system enables employees to clock in and out through multiple channels, including mobile devices and web applications.

Unfortunately, advanced time and attendance management features like geofencing are available only with higher pricing, which can get expensive.

Benefits and workers’ compensation administration

Paychex Flex also offers benefits administration, such as health insurance, retirement plans, and more. Plus, it includes a comprehensive approach to managing workers’ compensation insurance. The platform simplifies obtaining, managing, and adjusting policies, which is crucial for protecting businesses and their employees against the financial impacts of workplace injuries.

Paychex Flex offers many other features, including compliance tools and detailed reporting capabilities that allow businesses to analyze labor costs by project, task, or employee.

Paychex Flex integrations

Paychex flex integrates with accounting software like QuickBooks and Xero, time and attendance systems like Connecteam, HR platforms like BambooHR and Gusto, and other essential business tools such as Salesforce for CRM and Slack for team communication.

📚 This Might Interest You:

Check out our list of the best Paychex time tracker apps for seamless integration between your construction time tracking and payroll software.

What users say about Paychex Flex

Paychex is great in helping run reports for my certified payroll projects.

Read full review.When trying to sync with our accounting software it can take anywhere from a week to a month to get the issue resolved.

Read full review.Key Features

- Advanced tax filing and credits (WOTC, ERTC)

- Time tracking

- Benefits administration

- Workers' compensation management

Pros

- Integration with accounting and business systems

- Enhanced compliance

Cons

- Costly add-ons

- Complex interface

Pricing

Contact vendor for price Trial: No Free Plan: No

-

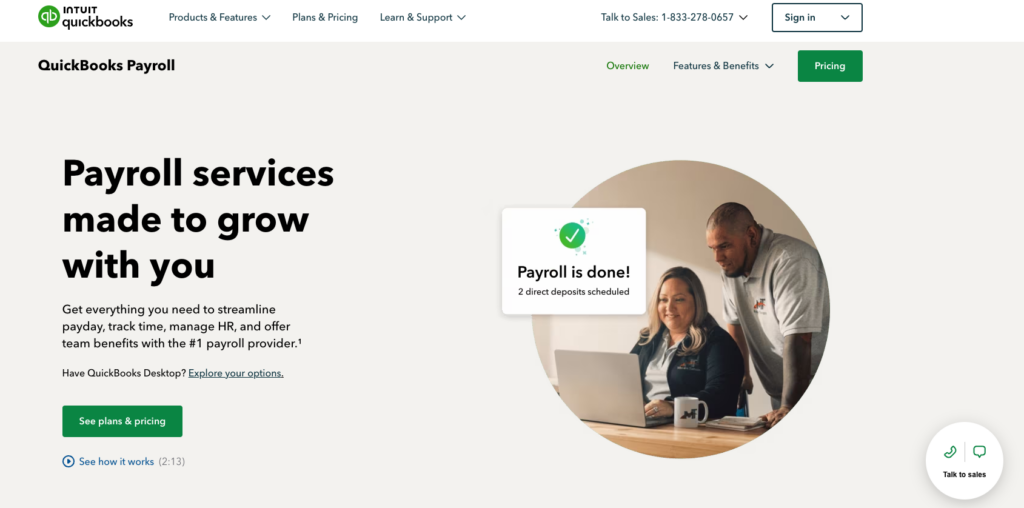

QuickBooks Payroll — Good for accounting and bookkeeping

QuickBooks Payroll is a comprehensive payroll solution developed by Intuit.

Why I chose QuickBooks Payroll: It’s designed to integrate with QuickBooks accounting software, making it an ideal choice for small to medium-sized construction companies.

Automated payroll processing and labor costing

QuickBooks Payroll offers automated tax calculations and filings, direct deposit, and the ability to run payroll on any device, enhancing flexibility for businesses with employees across multiple job sites.

It also supports managing subcontractor payments and provides detailed labor costing, enabling you to track expenses against specific projects or tasks accurately. I find this very helpful.

Integrated time tracking and compliance

Unfortunately, QuickBooks offers only basic time-tracking and employee management features. You can’t manage employee availability or use biometric verification for clock-ins, for example.

However, you can integrate QuickBooks Payroll with QuickBooks Time or third-party solutions like Connecteam to gain robust time tracking capabilities.

Plus, QuickBooks Payroll facilitates compliance with construction industry standards, including generating certified payroll reports required for government contracts.

QuickBooks Payroll integrations

QuickBooks Payroll integrates seamlessly with various essential business tools, including accounting platforms like QuickBooks Online, time tracking and workforce management solutions like Connecteam, and project management apps such as Asana and Trello.

What users say about QuickBooks Payroll

Once you learn how to use it and custom your reports, it saves time and the data from years back can be accessed.

Customer service transfers you around many times because no one owns the issues with payroll with contractors.

Key Features

- Automated tax calculations and filings

- Direct deposit

- Integration with QuickBooks accounting

- Subcontractor payments management

Pros

- Simplified tax compliance

- Multi-channel support

Cons

- Complexity increases with added features

- Limited customization

Pricing

Starts at $75/month + $6/user/month Trial: Yes — 30-day Free Plan: No

-

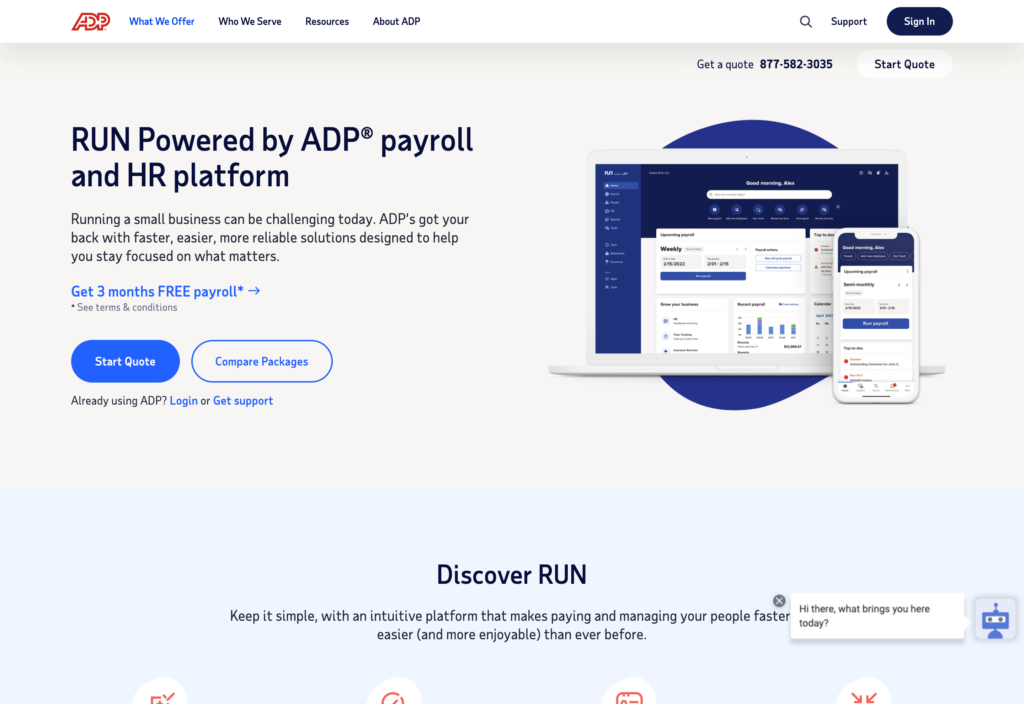

RUN Powered by ADP®

RUN Powered by ADP® — Good for global payroll

Available on

- Web

- iOS

- Android

RUN Powered by ADP® (RUN) is a dynamic payroll and HR solution engineered by ADP, renowned for its outsourcing services and payroll solutions tailored for small to medium-sized businesses.

Why I chose RUN Powered by ADP®: RUN offers various tools to streamline construction payroll, including global payroll.

Flexible payroll management and reporting

RUN efficiently manages diverse employment types, including full-time, part-time, and subcontractor roles. It also offers detailed reporting for accurate labor cost allocation, improving budget control and financial oversight.

Unfortunately, time tracking and benefits administration features cost extra.

Global payroll capabilities and employee portal

If your construction business operates in different countries, RUN offers robust global payroll capabilities. It handles payroll across North America, Europe, Asia, and the Middle East, enabling you to pay employees in their local currency and streamline international payroll administration.

Additionally, it supports certified payroll reports for government contracts and provides employees secure online access to paystubs, W-2s, and essential information.

RUN integrations

The platform integrates with hundreds of third-party tools, including HR systems like Zoho People and Workday, accounting software like QuickBooks and Xero, and time and attendance solutions like PayClock and Time Doctor. It also integrates with benefits administration tools like Namely and Zenefits.

What users say about RUN Powered by ADP

Easy navigation, great features, easy to do one time changes, personalized messages. Great reports on a single payroll, quarter or custom date ranges.

Not quite as compatible as I thought it would be with Time&Attendance.

Key Features

- Payroll management

- Certified payroll reporting

- Tax filing and reporting

- Labor costing

Pros

- Detailed reporting capabilities

- Compliance with industry-specific regulations

Cons

- It can be expensive for small businesses

- Interface may be complex for new users

Pricing

Contact vendor for price Trial: Yes Free Plan: No

-

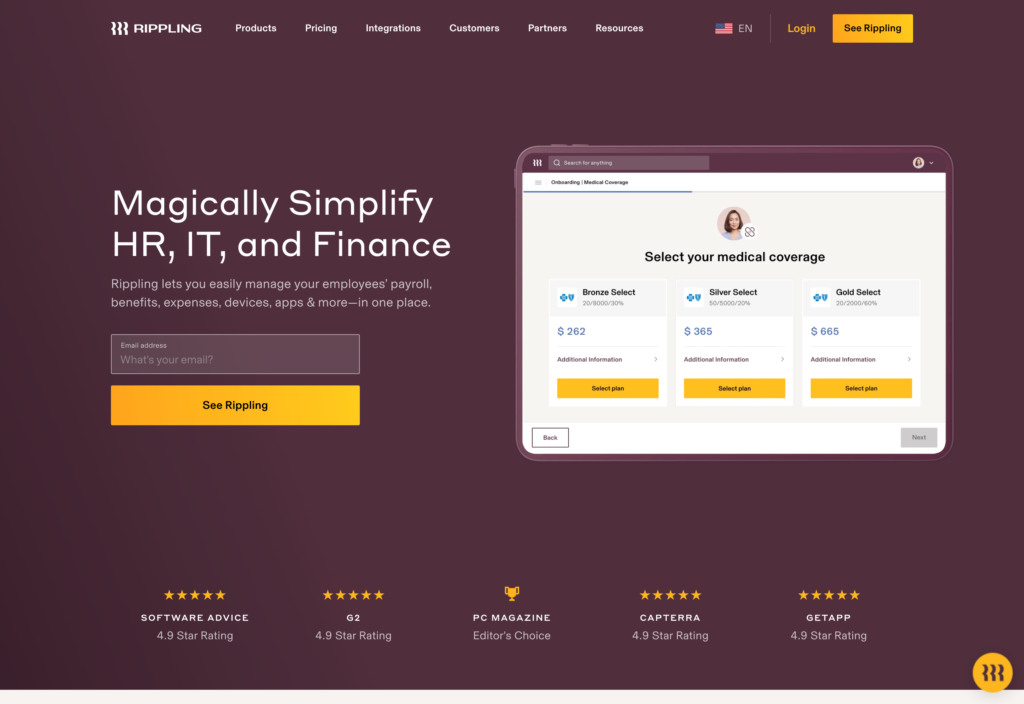

Rippling — Good for extensive integrations

Rippling is a cloud-based platform that streamlines HR and IT operations, offering integrated solutions for payroll, benefits, employee management, and more.

Why I chose Rippling: This construction company payroll software offers a holistic suite of services, including payroll, benefits administration, and HR management.

Worker management and global payroll support

Rippling excels in managing both W-2 employees and 1099 contractors within a unified system, streamlining the onboarding, payment, and management processes for construction businesses. Its global payroll support is also notable, enabling companies to efficiently manage international workers with compliant tax calculations and filings across multiple countries.

Financial management and compliance

Rippling also offers detailed labor cost tracking and reporting, enabling precise budget management and project financial analysis. Furthermore, the platform helps businesses adhere to regulations with its compliance tools.

Rippling integrations

I noticed that Rippling offers very basic time tracking and benefits administration capabilities and lacks advanced features, which is a drawback.

Fortunately, Rippling offers 500+ integrations, including time tracking apps like Clockify, accounting systems like QuickBooks and Xero, and benefits administration tools like Zenefits and ADP.

What users say about Rippling

From Onboarding and Benefits elections and enrollments to payroll and timekeeping – Rippling is the powerhouse that keeps us going!

The initial setup and onboarding was a bit time consuming. Would have paid more money to have someone guide us through and help set up our account with us.

Key Features

- Integrated management for W-2 employees and 1099 contractors

- Labor cost tracking and reporting

- Compliance tools

- Certified payroll reporting

Pros

- Extensive integrations with third-party applications (500+)

- Scalable

Cons

- May have a steeper learning curve for new users

- Is expensive for small businesses

Pricing

Starts at $8/user/month Trial: Yes Free Plan: No

Compare the 5 Best Construction Company Payroll Software

| Topic |

|

|

|

RUN Powered by ADP® |

|

|---|---|---|---|---|---|

| Reviews |

4.6

|

4.2

|

4.7

|

4.5

|

4.9

|

| Pricing |

Starts at $40/month + $6/person/month

|

Contact vendor for price

|

Starts at $75/month + $6/user/month

|

Contact vendor for price

|

Starts at $8/user/month

|

| Free Trial |

no

|

no

|

yes

30-day

|

yes

|

yes

|

| Free Plan |

no

|

no

|

no

|

no

|

no

|

| Use cases |

Good for contractors

|

Good for tax filing and tax credits

|

Good for accounting and bookkeeping

|

Good for global payroll

|

Good for extensive integrations

|

| Available on |

Web, iOS, Android

|

What Is Construction Payroll Software?

Construction payroll software is specialized software designed to manage and process payroll for businesses within the construction industry. It addresses the unique payroll needs and challenges faced by construction companies.

These challenges include handling multiple job sites, complying with various tax laws and regulations specific to construction work, and managing a diverse workforce that includes full-time, part-time, contract, and unionized workers.

How Does Construction Company Payroll Software Work?

Construction payroll software automates and streamlines payroll processes in the construction industry. It reduces manual errors by integrating payroll calculations with time tracking.

The software offers managers a robust platform for overseeing payroll operations, from employee time approval to compliance reporting. It facilitates real-time monitoring of labor costs and streamlines administrative tasks associated with time tracking and paying employees.

Employees use the software to clock in and out, track work hours, and access pay rates information. Managers use the system to review and approve timesheets with ease before using them to process payroll.

This system fosters a more efficient workplace by enabling managers and employees to focus on their core tasks with the confidence that payroll and compliance are handled effectively.

The Benefits of Construction Payroll Software

The best payroll software for construction companies provides the following benefits.

Streamlined operations

Construction payroll software automates payroll processes, reducing manual errors and ensuring timely employee payments. This efficiency frees management to focus on core project activities, enhancing overall operational productivity.

Compliance assurance

Construction payroll software stays current on legal requirements. It mitigates risks by automatically updating tax deductions and ensuring accurate pay based on regulatory requirements, including union requirements for unionized construction workers and certified payroll requirements for government projects.

Cost control

The software offers real-time labor cost tracking and job costing insights, aiding in precise budget management and profitability. Accurate financial forecasting and control over project expenses lead to better decision-making and competitive pricing strategies.

Transparency and trust

Providing employees access to paystubs and tax information promotes transparency, builds trust, and reduces conflicts. This level of openness is key to improving employee relations and retention in the competitive construction industry.

How Much Does Construction Payroll Software Cost?

Construction payroll software pricing varies based on features, operation scale, and user numbers. Most software offers a monthly subscription, which is often tiered based on the number of users and desired features. Expect ranges like $30-$75/user/month for established software like ADP and Paychex. Specialized solutions like Rippling often fall within the $50-$100/user/month range.

FAQs

The best payroll software depends on your business needs, but popular options include Gusto, QuickBooks Payroll, ADP Run, and Paychex Flex, known for their comprehensive features, ease of use, and scalability.

HR payroll software helps businesses manage their employee paychecks and tax forms. It automates tasks like calculating salaries, withholding taxes, and generating paychecks. It can also help track time and attendance, manage benefits, and comply with labor laws.

No, Excel is not a payroll software. It’s a spreadsheet program used for various data management tasks. These can include payroll calculations, but Excel lacks the automation, tax compliance, and integration features of dedicated payroll software.

We collected a list of the best free construction software and also a list of the best construction training software for your company and employees.

The Bottom Line On Construction Payroll Software

Managing payroll in the construction sector requires precision and efficiency due to its unique demands and regulatory requirements. Without the right tools, accurately tracking your workers’ hours, complying with laws, and paying your workforce can be challenging.

The market offers various platforms designed to address these challenges. When selecting a payroll management system, opting for a solution that simplifies the payroll process and ensures precision and compliance is crucial.