The right payroll software can transform managing payroll from a daunting and time-consuming task into a quick and easy one. I’ve lined up my picks of the best payroll software on the market so you can find one for your business.

Managing payroll can be a daunting task for small business owners. With so much on your plate, it’s easy to make mistakes or miss payments—leading to upset employees and worse.

But, the right payroll software can prevent this.

I’ve rounded up 5 best payroll software for small businesses so you can make an informed choice.

Our Top Picks

-

Good for global teams

-

Good for same-day direct deposits

-

Good for multiple payment options

Why trust us?

Our team of unbiased software reviewers follows strict editorial guidelines, and our methodology is clear and open to everyone.

See our complete methodology

17

Tools considered

10

Tools reviewed

5

Best tools chosen

How I Chose the Best Payroll Software

Here are the key functions and features I looked for while researching the best payroll software on the market:

Important core features

- Employee data management: Securely store all important employee data, such as personal information, wages, payment preferences, and bank account details.

- Digital timesheets: Use a built-in time clock or sync with a time tracking solution to automatically convert employee hours—including breaks and overtime—into accurate timesheets that you can review, edit, and use for payroll.

- Automatic tax calculations, filings, and compliance: Ensure your software auto-calculates and deducts local taxes and benefits and handles local, state, and federal filings to help you stay compliant and avoid tax penalties.

- Customizable payment options: Choose your preferred payment structure and pay employees through direct deposit, check, or pay cards.

- Security features—like data encryption, secure data storage, and user access controls—keep confidential pay and personnel data private.

I looked for usability features, like:

- Scalability so it can grow with your company and meet future needs without you having to switch solutions.

- Employee self-service tools that let workers access their own records, tax documents, and pay stubs and update their personal information.

- A mobile app that can be used easily by admins and employees on the move.

Finally, I looked for these additional features:

- Backup and disaster recovery to protect your payroll data in case of unforeseen events.

- Reporting and analytics on payroll expenses, tax liabilities, and individual employee payments to aid better decision-making.

- Document storage with enough space to store all employee documents safely and securely.

- Integration capabilities with other systems, such as time tracking, scheduling, project management, benefits, and accounting software.

The 5 Best Payroll Software for Small Businesses of 2025

-

Gusto — Good for global teams

Gusto is a full-service HR management and payroll software solution.

Why I chose Gusto: It has a wide range of features, including payroll tools, and comes at an affordable price for small businesses and startups. Gusto offers US and international payment support.

Here are Gusto’s core features.

Employee management

Gusto’s People tab lets you add and manage team members—including their personal information, employment types, team and manager names, tax and compliance docs, and compensation data.

I like this because it’s a central hub for calculating payroll accurately based on employment type—such as W2 employee or 1099 contractor—and location. The best part? Employees can use self-service tools to update this information themselves, add their expenses, and download their pay stubs.

Time tracking and timesheets

Employees can clock in and out of their shifts with their mobile devices or a shared kiosk. Alternatively, Gusto lets employees and managers make manual entries. Time entries—including breaks and overtime—are used to generate payroll reports you can view and adjust before approving for payroll.

Payroll and taxes

You can easily run payroll for salaried employees and contractors as often as you need to each month—or set up auto-payroll. Gusto also lets you automatically file payroll taxes, manage healthcare and other employee benefits (which are automatically deducted from payroll), perform next-day, 2-day, and 4-day direct deposits, and more.

What impressed me most? Gusto automatically calculates payment and tax amounts for you and your employees based on the latest tax laws. When you run payroll, it withholds the required amounts from employees’ paychecks, files the relevant tax reports, and pays the IRS on your behalf.

This makes it a good pick for small business owners and entrepreneurs looking to automate their payroll processes.

That said, it doesn’t offer smart shift scheduling, task management, overtime alerts, and internal communication tools. Fortunately, it integrates with systems that do, including Connecteam—an all-in-one work management platform.

Why Connecteam Complements Gusto

Gusto handles payroll, but if you need to schedule shifts, track time more effectively, or communicate with your team in real time, Connecteam fills those gaps. The two platforms integrate seamlessly, allowing you to sync timesheets for payroll processing while managing everything else—like scheduling, compliance checklists, and internal messaging—in one place.

This makes Connecteam + Gusto a powerful combination for small businesses that want to streamline both workforce management and payroll without juggling multiple disconnected tools.

📚 This Might Interest You:

Check out our list of the best Gusto time tracker apps for seamless integration between your time tracking and payroll software.

What users say about Gusto

Easy to use platform, bountiful features, INCREDIBLE customer support.

Some features are hard for beginners to understand.

Key Features

- Payroll management

- Benefits administration

- Employee data management

- Time tracking and timesheets

Pros

- Employee self-service tools

- Automatic tax and benefits deductions

Cons

- No overtime alerts

- Limited work management features

Pricing

Starts at $40/month + $6/person/month Trial: No Free Plan: No

-

QuickBooks Online — Good for same-day direct deposits

QuickBooks Online, part of the Intuit suite of products, is an accounting and payroll software that aims to provide small to medium-sized businesses with smarter business tools.

Why I chose QuickBooks Online: It offers all the essential features needed to run payroll services and integrates with other Intuit products like QuickBooks Time, Turbo Tax, and more for a complete offering.

Let’s explore QuickBooks Online’s key features.

Team and document management

With QuickBooks Online, you can add and manage your team members’ personal details, wages, and more. Employees can upload requested documents, and you can also share documents—like their I-9s—and request e-signatures from within the app. I appreciate the employee self-service tools, which let them access their pay stubs, W2s, and more from the app.

Benefits administration

QuickBooks Online has tie-ups with top benefits providers, like Next and Guideline—so you can offer your employees health, vision, dental, life, and retirement benefits. I find this handy: You can make the necessary deductions automatically through QuickBooks payroll, eliminating manual effort and mistakes.

Integration with QuickBooks Time

QuickBooks Time, which integrates with QuickBooks Online, lets employees clock in and out of their shifts or add time manually. Time entries—including rest breaks, overtime, and expenses—are used to generate digital timesheets. Review, edit, and approve these from within the QuickBooks Online platform to get payroll-ready.

Payroll

You can run payroll manually each pay cycle or set up auto-payroll. I appreciate the peace of mind that comes with timely, automatic payments. QuickBooks Online also allows for same-day direct deposits for domestic employees, which is so useful for urgent payments or reimbursements.

Further, QuickBooks Online auto-calculates and deducts relevant local, state, and federal taxes and does tax filings for you. I appreciate the platform’s tax guarantee. QuickBooks covers up to $25,000 if you receive tax penalties due to mistakes on the company’s end.

Overall, QuickBooks Online impressed me—but I wish it offered comprehensive project management tools. That said, QuickBooks integrates with third-party software like Connecteam, which offers these and more.

How Connecteam Complements QuickBooks Online

For businesses that need more than just payroll, Connecteam integrates seamlessly with QuickBooks Online, bridging the gap with smart shift scheduling, task automation, real-time communication, and mobile-first time tracking. This allows managers to sync timesheets directly with payroll while keeping their teams connected and operations running smoothly.

Pairing QuickBooks Online with Connecteam gives small businesses a complete solution—handling payroll, finances, and workforce management in one streamlined workflow.

What users say about QuickBooks Online

I use for invoicing, payroll, 401k inegration and everything is just easier than when I used different suppliers for each.

The learning curve can be steep for new users, especially those unfamiliar with accounting software.

Key Features

- Team management

- Benefits administration

- Time tracking with QuickBooks Time

- Payroll management

Pros

- Tax coverage guarantee of $25,000

- Auto-payroll

Cons

- Steep learning curve

- Limited project management tools

Pricing

Starts at $17.5/month Trial: Yes — 30-day Free Plan: No

-

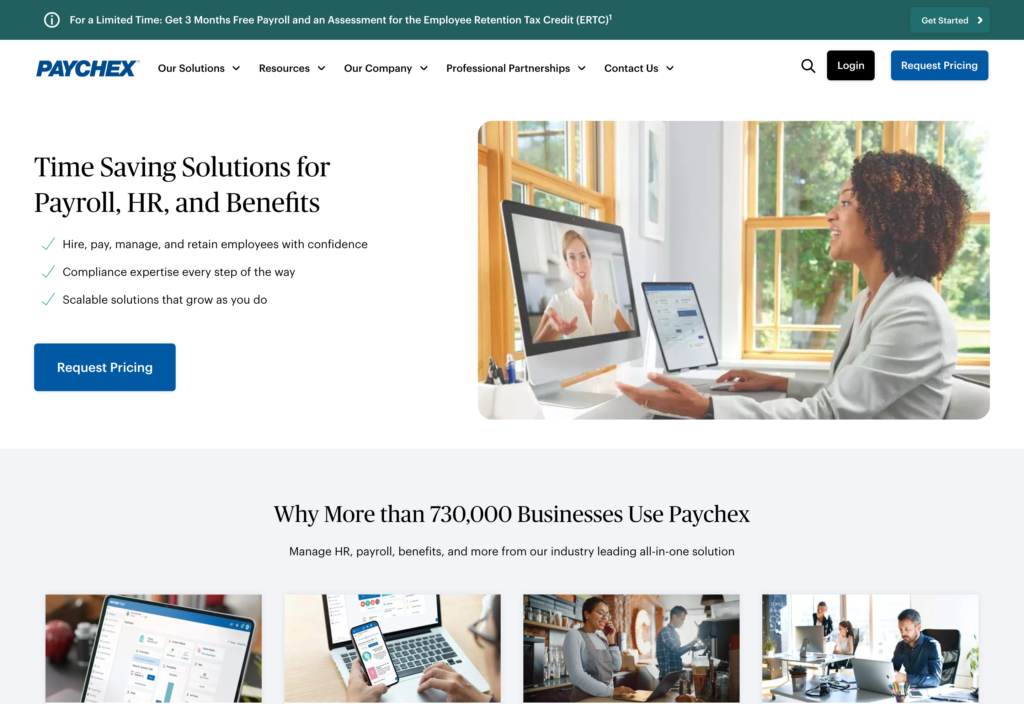

Paychex Flex — Good for multiple payment options

Paychex is an online HR management and payroll system for businesses of any size.

Why I chose Paychex: Paychex offers time tracking and payroll management tools, plus a mobile app. Despite its slightly outdated interface, I think it offers some great HR and payroll features.

Time tracking and scheduling

Paychex offers time tracking and scheduling features as an add-on using Paychex Flex Time. You can create and assign schedules, and employees can clock in and out of work using biometric verification and add entries manually.

The benefit of using this add-on? It’ll give you ready timesheets that automatically sync with Paychex’s payroll tool. The downside is the additional cost, which isn’t transparently listed on Paychex’s website.

Payroll processing

I was impressed with Paychex’s payroll processing. It uses timesheets to calculate wages, expenses, and overtime for accurate payroll reports.

Paychex Taxpay, a built-in feature, automatically calculates the necessary local, state, and federal taxes and deducts them automatically at the time of payroll. Paychex also withholds garnished wages: amounts that legally go towards paying off employees’ debts (like child support).

You can use different payment methods, including direct deposit, pay cards, paper checks, online tip sharing, and on-demand access to earned wages.

Integrations

Paychex offers various direct integrations. For benefits administration, you must integrate your account with Flock. Additional tools like an in-app chat, task management, and employee surveys are available through Paychex’s integration with Connecteam.

Why Connecteam Complements Paychex

While Paychex handles payroll and tax compliance, Connecteam offers smart scheduling, time tracking, real-time communication, and task automation—helping businesses keep their teams organized and productive. The two platforms integrate seamlessly, allowing managers to sync timesheets for payroll processing while managing employee schedules, tasks, and internal communication in one place.

For businesses that need a full-service workforce management solution alongside payroll, the Paychex + Connecteam integration provides the best of both worlds.

📚 This Might Interest You:

Check out our list of the best Paychex time tracker apps for seamless integration between your time tracking and payroll software.

What users say about Paychex

My small business has been a Paychex client ever since…2005, and choosing them as our payroll provider has been one of my best business decisions.

Clunky interface. Disjointed customer service.

Key Features

- Time tracking through Paychex Flex Time

- Payroll processing

- Automatic tax calculations and deductions

- Employee database

Pros

- Supports wage garnishments

- Offers multiple payment options

Cons

- Relies heavily on third-party integrations

- Dated interface

Pricing

Contact vendor for price Trial: No Free Plan: No

-

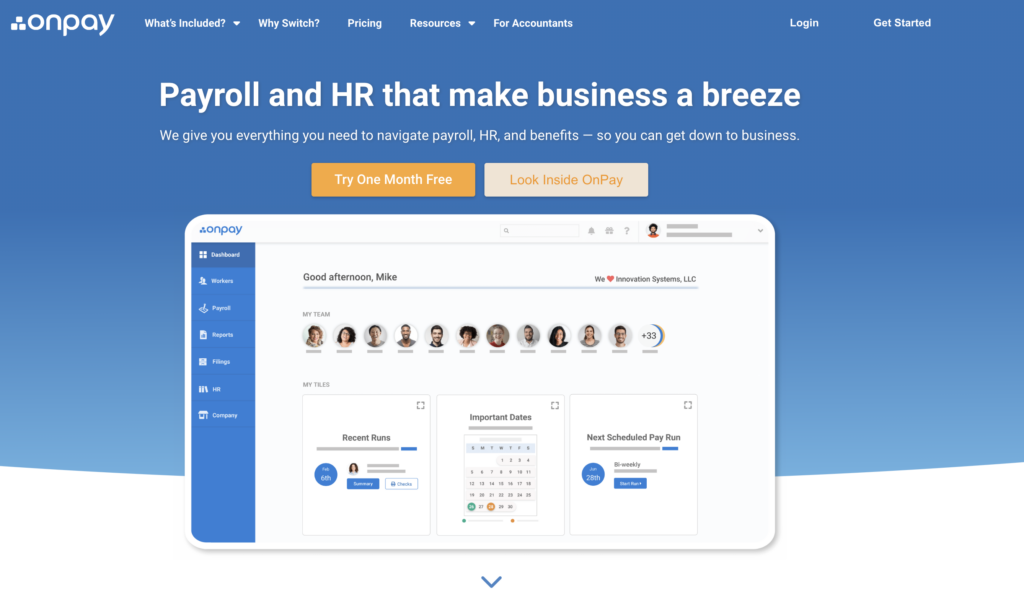

OnPay — Good for ease-of-use

Available on

- Web

OnPay is an HR management, payroll, and employee benefits platform.

Why I chose OnPay: OnPay is really user-friendly and has a straightforward pay plan—so you know exactly what to expect as you scale.

Let’s dive into OnPay’s key payroll features.

Payroll

You can set up payroll to run automatically at regular intervals, ensuring employees are paid on time consistently. OnPay also handles all aspects of payroll taxes, including calculations, withholding, and making tax payments on behalf of your company.

I really appreciated OnPay’s tax guarantee, which ensures that the OnPay team will work with the appropriate tax agency and pay all tax penalties resulting from the company’s errors.

OnPay offers multiple payment options, such as direct deposits, paper checks, and pay cards. It also supports wage garnishments.

HR and employee management

OnPay offers various tools for automated onboarding and collecting and e-signing employee documents. There’s also an employee self-service portal that lets workers manage their pay stubs, tax documents, and other personal information.

Benefits

OnPay offers in-house brokers to help you offer employee benefits—from retirement plans to medical, dental, and vision. I like platforms that offer benefits and payroll: There’s no manual work in deducting benefits.

My main disappointment with OnPay is the lack of built-in time-tracking tools for boosting payroll accuracy. While it integrates with a few time tracking software, integrations are limited. Plus, there are no project management integrations, and OnPay doesn’t offer its own project management tools.

What users say about OnPay

I’ve been accustomed to more complex systems such as PayChex and Paylocity, and this interface is refreshingly simple which is great for our current application.

The support staff is smart and helpful, but I could only access to her for 30 min blocks every few days when her calendar permitted.

Key Features

- Payroll processing

- Benefits administration

- HR and employee management

- Employee self-service tools

Pros

- In-house benefits advisors

- Easy-to-use interface

Cons

- No built-in time clock

- Limited integrations

Pricing

Starts at $40/month + $6/user Trial: No Free Plan: No

-

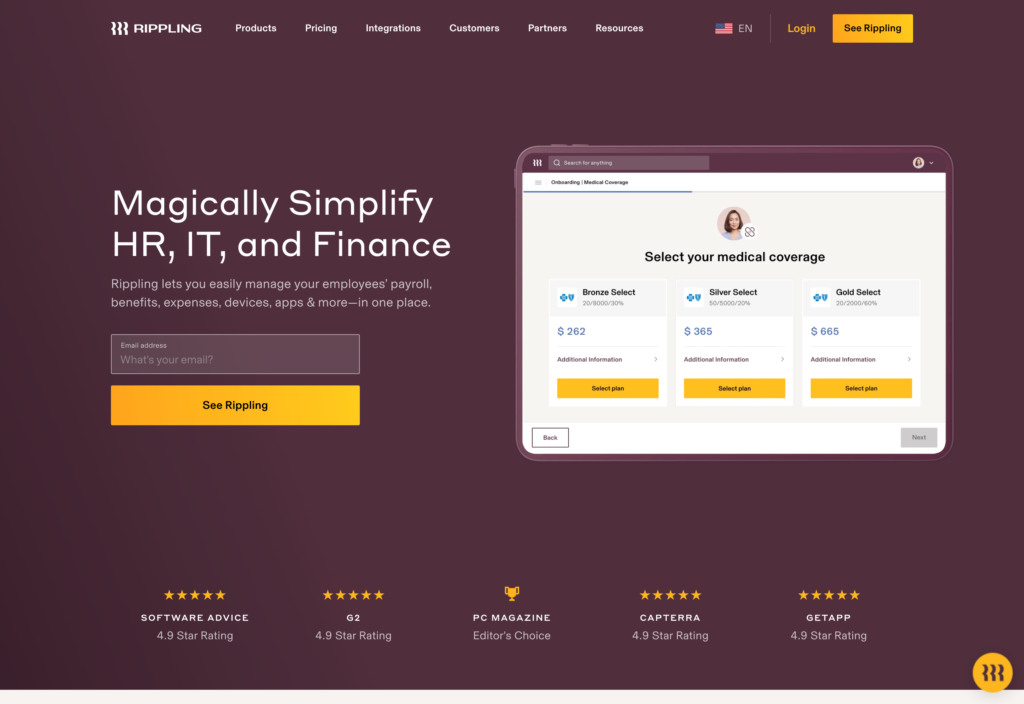

Rippling — Good for large-scale enterprises

Rippling is a full-service payroll software that aims to make payroll processing instant and reliable.

Why I chose Rippling: While the platform offers an extensive suite of work management tools suited to large businesses, smaller companies can also benefit from its key features.

Time tracking and scheduling

Rippling offers a digital time clock that lets employees clock in and out of work with a timer or through manual entries. And unlike some payroll solutions, Rippling also offers employee scheduling.

Payroll processing, taxes, and benefits

Rippling converts time entries into ready timesheets you can adjust and approve for payroll. The built-in payroll solution lets you choose from various pay types to suit your company’s specific needs—for example, wages, bonuses, or tips on an ad-hoc or recurring basis. I like that it lets you choose the pay frequency that works best for your organization.

Moreover, Rippling doesn’t just support US payments but also lets you pay employees abroad.

Once you run payroll, Rippling automatically pays employees’ compensation and deducts benefits, taxes, and other withholdings as required—even for international payroll—so you don’t have to worry about varied compliance rules for different locations.

Additionally, Rippling’s has its own benefits administration feature, which makes payroll easier.

Other HR and project management tools

Rippling offers various team management features, such as training, automated workflows, and custom reporting.

However, it’s unclear the complete offering costs. Also, I’m disappointed by the difficulty users have getting demos of the software and the fact that only admins can contact customer support.

What users say about Rippling

As an employee, Rippling is a very easy app to use. The interface is simple, and easy to understand and work around.

Unless you are using Rippling’s full suite of products (Payroll, Benefits, HRIS, etc.), there are some roadblocks that do not make it easy to integrate with external systems.

Key Features

- Time tracking

- Scheduling

- Payroll and benefits management

- HR tools

Pros

- Supports international payroll

- Sufficient integration options

Cons

- No transparent pricing

- No in-app chat

Pricing

Starts at $8/user/month Trial: Yes Free Plan: No

Compare the Best Payroll Software for Small Businesses

| Topic |

|

|

|

|

|

|---|---|---|---|---|---|

| Reviews |

4.6

|

4.3

|

4.2

|

4.8

|

4.9

|

| Pricing |

Starts at $40/month + $6/person/month

|

Starts at $17.5/month

|

Contact vendor for price

|

Starts at $40/month + $6/user

|

Starts at $8/user/month

|

| Free Trial |

no

|

yes

30-day

|

no

|

no

|

yes

|

| Free Plan |

no

|

no

|

no

|

no

|

no

|

| Use cases |

Good for global teams

|

Good for same-day direct deposits

|

Good for multiple payment options

|

Good for ease-of-use

|

Good for large-scale enterprises

|

| Available on |

Web

|

What is Small Business Payroll Software?

Small business payroll software helps small businesses manage and process employee salaries, bonuses, and expenses efficiently. It automates calculations for deductions, taxes, and net pay, ensuring compliance with relevant tax laws and regulations.

The best software also includes features for tracking employee hours, managing benefits, and managing employee data.

How Does Payroll Software Work?

Software for small business payroll uses cloud technology and automation tools to streamline the entire payroll process.

A manager can create an account for their company and link the company’s bank account for payroll. They can then create employee profiles and enter details about wages, contract types, pay frequencies, and employee locations so the software can accurately calculate pay and deduct taxes in line with local tax laws.

The best small business payroll solutions have built-in time clocks or integrate with time tracking platforms. Employees can clock in and out of shifts—and managers can view, edit, and approve timesheets before running payroll either manually or automatically (depending on the platform).

To get set up, employees enter their personal details and bank account information. Once payroll runs, they can log in anytime to track their wages, view or download pay stubs, and check deductions—ensuring everything looks accurate.

Benefits of Payroll Processing Software

So, what benefits can you expect with payroll for small business software? Here are some.

Saves time and reduces errors

Payroll software automates calculating employees’ pay amounts. This saves you the hassle of doing it manually while preventing miscalculations, Excel formula errors, and other costly mistakes. The software also allows employees to access their pay stubs and tax documents online, reducing administrative queries.

Keeps you compliant

Keeping up with tax laws and regulations isn’t easy. Good payroll software updates you on any noteworthy changes and automatically calculates, deducts, and files taxes as required. Using payroll management software also helps maintain detailed records of payroll transactions for audit and reporting purposes.

Boosts employee satisfaction

Untimely or erroneous payments tick off employees. Payroll solutions prevent this while giving employees a transparent overview of everything—from payment histories and pay stubs to tax documents. Employees can also choose how they want to receive their pay.

Enhances security

Payroll data is confidential and sensitive. Secure payroll solutions ensure this data is stored securely and accessible only to those with permission.

Improves reporting and decision-making

Payroll software often generates detailed reports on labor costs, payroll expenses, and more—and lets you view these by location, team, project, etc. This provides you with valuable insights for financial analysis and business planning.

How Much Does Small Business Payroll Software Cost?

The cost of small business payroll software varies per provider and often depends on the size of your business, the number of users, and the features you need.

OnPay has a straightforward pricing plan at a $40/month flat fee and $6/month for every additional user. This is the same as Gusto’s starting plan, but Gusto offers more features in its more expensive packages.

When choosing the best payroll software for your business, make sure that if your chosen solution doesn’t offer a full range of work management tools, it integrates with a platform that does.

Connecteam, for instance, offers time tracking, scheduling, task management, HR management, internal communications, and much more. It offers a completely free plan for small businesses with up to 10 employees, and paid plans start at just $29/month for the first 30 users.

Picking a payroll platform that integrates with Connecteam means you can manage your entire business seamlessly from one system without breaking the bank.

>> Get started with Connecteam today for free! <<

FAQs

Yes, small businesses benefit significantly from payroll software because it streamlines the payroll process, ensuring accuracy and compliance with tax laws. It also saves you time and reduces the likelihood of errors, which is crucial for maintaining efficient operations in any business environment.

The best payroll software really depends on your needs and your budget. Connecteam is a great option because it’s affordable for small businesses and easy to use. The app totals up everyone’s hours and owed wages, and then you can export it to a payroll processing software for easy and accurate payments.

Not all payroll software is easy to use, but some companies will provide a demo so you can see how the software works. After a demo, you’ll have a better understanding of whether it will be easy for you and your team to use.

The Bottom Line on Payroll Software for Small Businesses

Without payroll software, it’s difficult to pay your workers or comply with tax laws properly. So, it’s no wonder there’s such a broad selection of payroll management and automation solutions out there.

Be sure to choose one that streamlines payroll processes, ensures accurate payments, and integrates with work management solutions like Connecteam.