Use our fixed assets audit checklist template as a starting point to customize yours to fit your company.

Fixed Assets Audit Checklist

Make work flow with Connecteam’s digital forms & checklists

- Easily create digital forms and checklists for any task your team needs to complete on the job

- Boost accountability by having employees add a signature, image, or location stamp

- Save time by choosing from a variety of ready-made templates

- Instantly receive your team’s submissions and share reports within your organization

- Use AI to convert PDFs, Excel files, or images into digital forms in seconds—no manual work needed

Fixed Assets Audit Checklist

A Fixed Assets Audit is a crucial process for organizations to verify the existence, condition, and value of their tangible assets.

This comprehensive checklist provides a structured framework for conducting a thorough fixed assets audit, ensuring accurate financial reporting and effective asset management.

Fixed Assets Audit Checklist

Audit Details:

[ ] Audit Date: __________

[ ] Audit Team Members: __________

[ ] Location(s) of Assets: __________

Asset Identification:

[ ] Verify each asset’s unique identification number or tag.

[ ] Ensure tags are legible and in good condition.

[ ] Confirm asset descriptions match records.

[ ] Check for discrepancies in asset names, models, or serial numbers.

[ ] Verify the asset’s location is accurately documented.

[ ] Cross-reference with location records.

Physical Verification:

[ ] Physically locate and inspect each asset.

[ ] Ensure assets are physically present.

[ ] Check for any unauthorized asset removal.

[ ] Verify asset condition.

[ ] Assess whether assets are in working condition.

[ ] Note any damage, wear, or signs of obsolescence.

[ ] Record asset serial numbers and other relevant details.

Asset Documentation:

[ ] Review asset records and documentation for accuracy and completeness.

[ ] Ensure all asset-related documents are up-to-date.

[ ] Confirm acquisition dates and costs match records.

[ ] Verify that purchase invoices match recorded values.

[ ] Check for depreciation calculations and adjustments.

[ ] Ensure depreciation methods and rates align with accounting standards.

Asset Valuation:

[ ] Calculate the current value of assets based on their condition and depreciation.

[ ] Confirm valuation methods align with accounting standards.

[ ] Ensure compliance with applicable financial reporting regulations.

[ ] Assess the need for impairment testing, if applicable.

[ ] Perform impairment tests for assets with potential value diminishment.

Ownership and Responsibility:

[ ] Verify asset ownership and responsible departments or individuals.

[ ] Cross-reference asset records with departmental assignments.

[ ] Ensure asset transfers and disposals are properly documented.

[ ] Review transfer requests, approvals, and documentation.

[ ] Confirm asset insurance coverage is up-to-date.

[ ] Ensure assets are adequately insured based on their value and importance.

Asset Tagging and Labeling:

[ ] Check that assets are appropriately tagged or labeled for easy identification.

[ ] Ensure tags or labels are securely attached.

[ ] Confirm that labeling includes necessary information.

[ ] Include asset number, description, acquisition date, and location.

Asset Movements and Transfers:

[ ] Review records of asset movements or transfers.

[ ] Verify proper approvals and documentation for asset relocations.

[ ] Confirm that transfer forms are complete and accurate.

Disposal and Retirements:

[ ] Confirm that assets marked for disposal or retirement have been properly processed.

[ ] Review disposal documentation, including sales records or donation confirmations.

[ ] Ensure assets are retired in compliance with organizational policies and legal requirements.

Depreciation and Amortization:

[ ] Review depreciation and amortization schedules for accuracy.

[ ] Cross-check calculations against asset records.

[ ] Confirm that appropriate methods and rates are applied.

[ ] Ensure compliance with accounting standards.

Impairment Assessment:

[ ] Assess the need for impairment testing based on asset values and usage.

[ ] Evaluate potential indicators of impairment, such as changes in market conditions.

[ ] Document any impairment losses and related adjustments.

[ ] Calculate and record impairment losses in accordance with accounting rules.

Audit Findings and Recommendations:

[ ] Summarize audit findings, including discrepancies, errors, or areas of concern.

[ ] Provide detailed recommendations for corrective actions or improvements.

[ ] Specify responsible individuals or departments for implementing recommendations.

Signatures:

[ ] Lead Auditor: __________ Date: __________

[ ] Audit Team Member: __________ Date: __________

[ ] Reviewed by (if applicable): __________ Date: __________

The Fixed Assets Audit Checklist is a comprehensive tool for organizations to maintain accurate records and effectively manage their tangible assets.

By conducting regular audits using this detailed checklist, you can systematically verify asset details, condition, and valuation.

This comprehensive approach contributes to improved financial reporting accuracy, compliance with regulations, and effective asset management, ultimately supporting the organization’s financial health and sustainability.

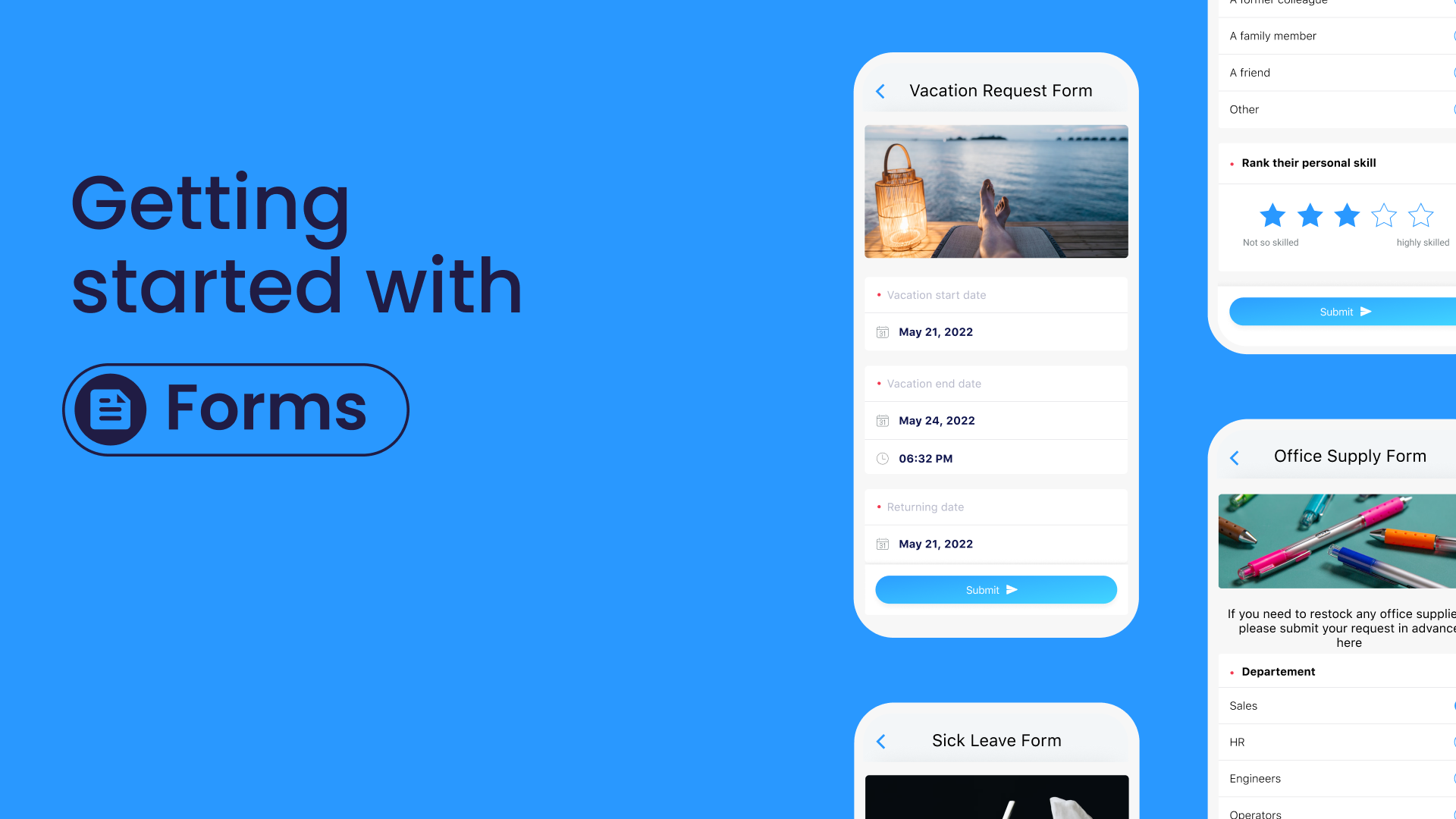

Choose Connecteam, the #1 Choice for Asset Management

Connecteam is the ultimate tool that can significantly enhance your performance, streamlining your tasks and boosting productivity.

With our user-friendly mobile app, you can easily create and access forms, ensuring every asset is accounted for.

Keep track of all of your equipment, and should something ever be lost or damaged, have your staff document it all right within the app, complete with photos and notes.

With the tap of a button, they can send damage reports off to their managers to request repairs or replacements.

Plus, our smart scheduling and task management capabilities help you optimize work plans, ensuring timely inspections and minimizing delays.

Experience a game-changing solution tailored to your company’s needs!

Get started with Connecteam for free today and enjoy seamless checklists, instant reporting, and efficient collaboration with your team.

Watch the video below to see it in action:

Ready to boost your efficiency with our pre-made templates?