Labor costs are often one of the biggest expenses for any business, making it essential to get accurate estimates to keep budgets on track. Our Labor Cost Calculator simplifies this process by calculating wages, payroll taxes, and extra costs like overtime, benefits, and supplies. Whether you’re looking to get a quick overview or dive into details, this calculator helps you see the full picture, so every financial decision is well-informed.

Labor Cost Calculator

How to Use Our Labor Cost Calculator

Step 1: Choose Your Mode

Start by selecting either Easy Mode or Advanced Mode based on your needs:

- Easy Mode: Perfect for straightforward calculations, Easy Mode focuses on core labor costs with fields for weekly hours, yearly hours, hourly wage, and payroll tax.

- Advanced Mode: For a comprehensive view of labor expenses, Advanced Mode allows you to enter overtime, benefits, insurance, and additional monthly costs. This is ideal if you want to capture the full scope of employee expenses.

Switching between modes will adjust the form fields to show only what’s relevant for each type of calculation.

Step 2: Enter Weekly or Yearly Hours Worked

To set your baseline, input the weekly hours worked (e.g., 40 hours per week) or yearly hours (e.g., 2,080 hours per year). If you update the weekly hours, the calculator will automatically adjust the yearly hours and vice versa, giving you flexibility based on how you track hours.

Step 3: Input Hourly Wage and Payroll Tax

Next, enter the employee’s hourly wage and the payroll tax percentage (usually 10-15% depending on your region). These inputs help calculate core labor expenses by including both wages and taxes, ensuring the estimate covers all necessary costs associated with payroll.

Step 4: Add Extra Costs (Advanced Mode Only)

In Advanced Mode, you have the option to account for additional costs that may impact your total labor expenses. Here’s a breakdown of each field:

- Overtime: Enter the overtime hours worked and select the applicable overtime rate (either 1.5x or 2x). The calculator will add these additional costs based on the overtime rate you choose.

- Benefits and Insurance: If you offer benefits or insurance, input the monthly cost of these perks. This gives a fuller picture of total employee costs, beyond just wages.

- Supplies, Bonuses, and Administrative Costs: Factor in any recurring monthly costs for supplies, yearly bonuses, and administrative overhead. Administrative overhead is typically a small percentage of overall costs but can make a significant difference in long-term budgeting.

These fields let you tailor your calculations to match the actual costs involved with each employee.

Step 5: Click Calculate and Review Your Results

Once all inputs are complete, hit the Calculate Labor Cost button. The calculator will display:

- Yearly Labor Cost: A total of all annual labor-related expenses based on your inputs.

- Monthly Employee Labor Cost: A monthly breakdown, ideal for budgeting and planning regular payroll cycles.

These results provide a clear, itemized estimate of labor expenses, helping you understand and manage your labor investment effectively.

Labor Cost Calculator

Yearly Labor Cost: $0

Monthly Employee Labor Cost: $0

How to Accurately Calculate Labor Costs: A Guide for Business Owners

Labor costs are often one of the most substantial expenses for any business, making accurate calculation crucial for profitability. From wages and taxes to benefits and overhead, understanding each component of labor costs helps you budget effectively, set prices, and make informed decisions that support long-term growth.

This guide breaks down each step to calculate labor costs thoroughly, ensuring your estimates are both accurate and reflective of real-world expenses.

Step 1: Determine Direct Labor Costs

Direct labor costs include the wages paid to employees who actively contribute to the production of a product or service. This category forms the core of your labor expenses.

Hourly Wages or Salaries

Begin by calculating the hourly wage or annual salary for each employee. Multiply hourly wages by the total hours worked annually (typically 2,080 for full-time employees) to determine yearly wages. For salaried employees, use the annual salary directly as your baseline.

Example: If an employee earns $20 per hour and works 40 hours a week, their yearly wage is:

$20 (hourly wage) x 2,080 (hours) = $41,600 per yearOvertime Pay

If employees work overtime, factor in the overtime rate (often 1.5x or 2x the standard hourly wage). To calculate overtime costs, multiply the overtime hours by the overtime wage rate.

Example: An employee working 5 overtime hours weekly at a 1.5x rate would add:

$20 x 1.5 (overtime rate) x 5 (overtime hours) x 52 (weeks) = $7,800 per yearStep 2: Include Payroll Taxes and Mandatory Benefits

Payroll taxes and mandatory benefits are essential components of total labor costs. These expenses include:

- Social Security and Medicare Taxes: Typically around 7.65% in the U.S.

- Federal and State Unemployment Taxes: Rates vary based on location and company-specific factors.

- Worker’s Compensation Insurance: Costs vary depending on industry, risk factors, and state requirements.

Estimate payroll tax by multiplying the combined tax rate by each employee’s annual salary.

Example:

$41,600 (annual wage) x 7.65% = $3,181.20 for Social Security and MedicareStep 3: Factor in Employee Benefits and Additional Perks

Benefits play an important role in attracting and retaining employees. Common benefits include health insurance, retirement contributions, paid time off, and more. Benefits costs are typically expressed as a percentage of base wages.

- Health Insurance: Calculate the employer-paid portion of health insurance costs.

- Retirement Contributions: Add any employer-matching 401(k) or retirement contributions.

- Paid Time Off (PTO): Estimate the value of PTO based on the employee’s wage and annual hours.

Example: If health insurance costs $500 per month per employee, and PTO is valued at 8% of base wages:

$500 x 12 (months) = $6,000 for health insurance

$41,600 x 8% = $3,328 for PTOTotal annual benefit cost:

$6,000 + $3,328 = $9,328 per employeeStep 4: Calculate Indirect Labor Costs

Indirect labor costs refer to expenses related to employees who support operations but aren’t directly involved in production. These costs are often harder to track but equally essential.

- Administrative Costs: Salaries for HR, accounting, and administrative staff who support operational functions.

- Facilities Costs: Allocate portions of rent, utilities, and maintenance costs to cover indirect labor.

- Software and Tools: Include costs for software (e.g., scheduling, payroll, time tracking) and tools necessary for labor management.

Example: If total facilities costs are $50,000 annually, and 20% is allocated to support staff:

$50,000 x 20% = $10,000 allocated to indirect laborStep 5: Add Overhead Expenses

Overhead expenses ensure that business functions are running smoothly. These are not tied to individual employees but affect overall labor costs. Overhead may include:

- Transportation: Fuel and maintenance costs for vehicles used in business operations.

- Office Supplies: Consumables like paper, printer ink, and cleaning supplies.

- Professional Services: Fees for services like legal consultation, accounting, and financial advice.

Assigning a percentage of these overhead costs to labor helps capture the full scope of employee-related expenses.

Example: If you allocate 15% of $100,000 in overhead costs to labor:

$100,000 x 15% = $15,000 in additional labor-related overhead costsStep 6: Set Your Profit Margin and Calculate Total Labor Cost

Setting a profit margin is essential to cover all operational costs and contribute to the business’s growth. This margin typically ranges from 10-20%, depending on your industry and competitive landscape.

To calculate your final labor cost per employee, sum up direct and indirect labor costs, benefits, taxes, and overhead, then add your profit margin.

Example:

Total Labor Cost: $41,600 (wages) + $3,181.20 (taxes) + $9,328 (benefits) + $10,000 (indirect costs) + $15,000 (overhead)

= $79,109.20 per year

Adding 15% Profit Margin:

$79,109.20 x 1.15 = $90,975.58 total cost per employeePractical Example of Labor Cost Calculation

Here’s a sample calculation for a hypothetical employee to bring all these steps together:

- Wages: $20 hourly rate x 2,080 hours = $41,600

- Overtime: $20 x 1.5 x 100 hours (assumed annually) = $3,000

- Payroll Taxes: $41,600 x 7.65% = $3,181.20

- Health Insurance: $500 per month x 12 = $6,000

- PTO: $41,600 x 8% = $3,328

- Indirect Costs: $10,000

- Overhead Allocation: $15,000

Total Cost Without Profit Margin:

$41,600 + $3,000 + $3,181.20 + $6,000 + $3,328 + $10,000 + $15,000 = $82,109.20Adding 15% Profit Margin:

$82,109.20 x 1.15 = $94,425.58 per yearCalculating labor costs accurately is crucial, but staying on top of time tracking, payroll, and scheduling can become overwhelming without the right tools. Connecteam offers a comprehensive solution to simplify every step of workforce management:

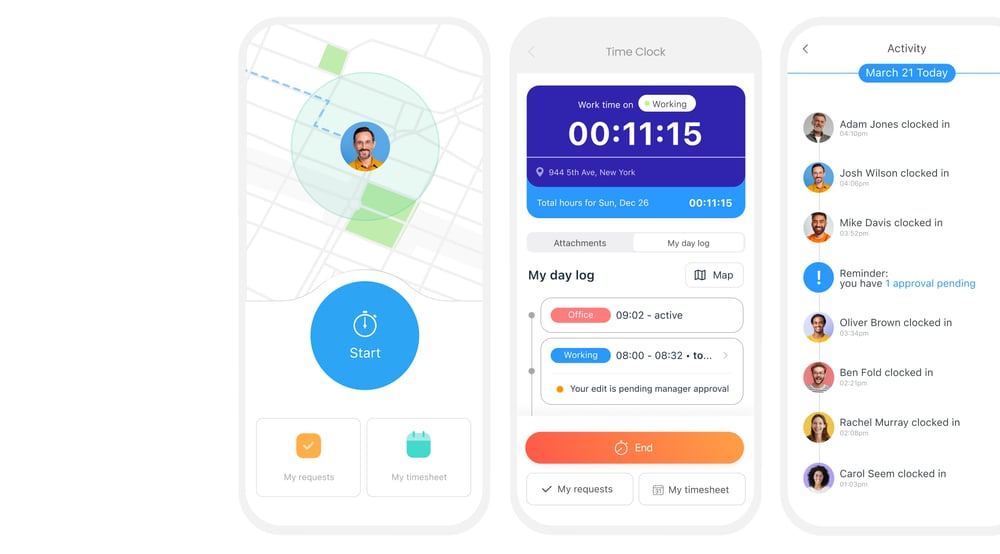

Accurate Time Tracking: Track hours worked, overtime, and breaks in real time with Connecteam’s easy-to-use time clock. Employees can clock in and out directly from their mobile devices, ensuring every minute is captured and reported accurately.

Streamlined Payroll: Save time on payroll with automatic timesheet exports, minimizing the risk of human error and ensuring accurate pay calculations. Connecteam integrates with major payroll systems, making it easy to sync data for seamless payroll processing.

Employee Scheduling: Plan shifts and manage team schedules effortlessly with Connecteam’s scheduler. Assign shifts, make adjustments on the fly, and notify employees instantly of any changes, helping you control labor costs by avoiding scheduling conflicts or overstaffing.

Job and Project Tracking: Get insight into where labor hours are being spent with Connecteam’s job and project tracking. Assign tasks to specific projects, monitor time allocation, and assess productivity to make informed decisions that keep your labor costs aligned with project budgets.

Communication: Keep your team aligned and engaged with Connecteam’s built-in communication tools. Easily share updates, task instructions, and essential resources, ensuring every team member has the information they need to work efficiently. Effective communication reduces misunderstandings and helps maintain productivity, ultimately controlling labor costs.

Connecteam empowers business owners to manage labor costs effectively, reduce administrative burden, and improve workforce productivity – all from a single platform.

Ready to take control of your labor expenses?

FAQs

Our Labor Cost Calculator is a tool for business owners and managers to estimate total labor costs, covering wages, payroll taxes, benefits, and more. It’s designed to help you get a clear view of labor expenses so you can budget confidently.

Business owners, managers, and HR professionals who want a straightforward way to calculate labor expenses for their teams or projects. It’s helpful for anyone looking to manage costs effectively and improve budgeting.

A thorough labor cost calculation includes several key factors: hourly wages, payroll taxes, overtime, employee benefits (like insurance and paid time off), supplies related to the job, and any additional administrative costs. All of these contribute to the overall cost of employing someone, beyond just their base pay.

Labor costs directly influence how you price your services or products. Underestimating labor expenses can lead to profit loss, while accurately accounting for these costs ensures you’re setting prices that cover expenses and support healthy profit margins. Clear visibility into labor costs helps you remain competitive and financially sustainable.

Direct labor costs are wages paid to employees who directly contribute to producing a product or delivering a service. Indirect labor costs include expenses for support staff or functions that help maintain operations (like administrative roles or HR). Both are important for a complete view of labor expenses.