In this article, I show you step-by-step calculations for company-wide FTE, part-time FTE, individual FTE, and part-time wage-to-FTE salary conversion.

What do offering employee health benefits and planning workforce capacity have in common? You need a metric called FTE, or full-time equivalent, to work out both—but many companies don’t know what this is or how to calculate it.

In just a few steps, I’ll show you how to calculate FTE for part-time employees, individual workers, and your whole company. I also cover how to calculate FTE salaries from part-time wages.

Key Takeaways

- The full-time equivalent, or FTE, represents the theoretical number of full-time staff that would deliver all your team’s work hours. This is different from your headcount, which is the actual number of employees—full-time and part-time—in your business.

- If you have over 50 FTEs, you must comply with the Affordable Care Act (ACA) regulations and offer ACA-compliant benefits to all full-time workers.

- You can calculate the FTE for your entire company, your part-time workforce, and individual employees. You need an up-to-date list of part-time and full-time employees, and their contracted or actual hours, to perform these calculations.

- Calculating the FTE for specific employees enables you to convert their part-time wages (e.g., hourly or monthly) to full-time salaries. You might do this to measure pay equity across your organization or transition part-time workers to full-time positions (or vice-versa).

What Is Full-Time Equivalent (FTE)?

Your full-time equivalent (FTE) is the hypothetical number of full-time employees who’d be working all the hours your team works.

Say you have 2 employees: a full-timer working 30 hours a week and a part-timer working 15 hours a week. If your standard full-time position requires 30 hours a week, then your part-timer contributes half as many hours as a full-time employee, so your company-wide FTE is 1.0 + 0.5 = 1.5.

Your FTE is different from your headcount. The headcount is the number of actual employees who work on either a full- or part-time basis. Meanwhile, the FTE is a theoretical number indicating how many full-time positions could deliver all team hours.

| Full-time equivalent formula FTE = Total weekly staff hours (part-time and full-time)Standard weekly full-time hours |

Did You Know?

The acronym “FTE” has 2 different meanings across HR content. In this article, for instance, I mainly talk about the FTE calculation and use the word as a unit of measurement. Meanwhile, some guidance on labor legislation may use it as a shorthand for “full-time equivalent employees” (saying things like, “businesses with 1-50 FTEs are eligible”). I’ll use the term this way, too.

Why Calculate FTE?

Knowing your FTE helps you in 2 big ways.

First, it helps you meet federal employment laws in the United States. For example, under the Affordable Care Act (ACA), companies with 50 FTEs and over are considered Applicable Large Employers (ALE) and must provide ACA-compliant benefits to full-time workers.

Also, small businesses with under 50 FTEs could qualify for the government’s Small Business Health Options Program (SHOP). The Internal Revenue System (IRS) defines full-time hours as 30 hours a week (or 130 hours a month) and above.

Second, internally, tracking your FTE helps you measure team capacity and make staffing decisions. For example, say a company that exclusively hires part-time workers needs at least 1 FTE per client throughout the year. If, in any given month, its FTE falls below 1 per client, the firm must increase employee hours or hire new staff.

Understanding the average cost of an FTE can help you budget and forecast future staffing costs. Say it’s $50,000 annually—you can better evaluate the financial impact of expanding your team.

This Might Interest You

You must stay on top of the most recent federal and state labor laws to avoid legal, financial, and reputational damages. Read our guide on how to foster workplace compliance to cover all the bases.

How To Calculate FTE in 5 Steps

Below are some step-by-step FTE calculations. I cover a few options—how to calculate FTE for all employees, part-time staff, and individual workers. I also use a real-world example to put theory into practice.

-

Define full-time hours

-

List your employees and their hours

- Employee first and last name

- Employee ID, where relevant

- Part-time or full-time employment type

- Total hours

- Period of time you’re looking at (i.e., weekly, monthly, or yearly)

- Type of hours (i.e., contracted or actual)

-

Calculate the FTE for your part-time workforce

-

Calculate the company FTE

-

Calculate the FTE for an individual

Unless you’re going with the IRS benchmark (30 hours a week), decide what number of weekly hours is the standard for a full-time position in your company. Common options include 30, 35, and 40 hours a week. The theoretical “employee” in your FTE calculation works this standard number of hours.

| Example In the company Hypothetical, a full-time employee works 40 hours per week. |

Export an up-to-date list of all your part- and full-time employees, and the number of hours they work per week, month, or year. You might be storing this information in an employee database app or Excel spreadsheet.

Pro Tip

Some companies employ staff who take extended leave and sabbaticals—or switch between full-time and part-time work. If that’s your business, double-check the accuracy of your employee data. It must include employees’ contracted or actual hours, including paid leave but excluding unpaid leave.

In your worksheet, ensure you’re tracking:

Did You Know?

Full-time employees usually work contracted hours—that is, the minimum number of hours per week they must put in, per their employment contract. They might work more, but can’t bill for them. Meanwhile, part-timers can have contracted hours or work as hourly employees. In the latter case, they usually report their hours in a timesheet, with a time tracker, or in a communication to their manager.

You must not include independent contractors (Form 1099 workers), freelancers, seasonal workers (working less than 120 days a year), or the company’s partners and business owners in your worksheet.

Example

| First name | Last name | Number of hours | Type of hours | Frequency | Employment type |

| Mel | Bea | 40 | Contracted | Weekly | Full-time |

| Kat | Blanchett | 20 | Actual | Weekly | Part-time |

| Bob | Pitt | 40 | Contracted | Weekly | Full-time |

First, let’s work out the FTE for your part-time workers only. This number tells you the contribution of part-timers to your overall FTE count. It can help you compare your workforce capacity between full-time and part-time staff.

This calculation has 2 steps:

1) Add up all hours worked by part-time employees.

2) Divide the total part-time hours by the standard full-time hours (defined in step 1).

| Example 1) In our 3-person workforce, total hours of part-time employees (per week) = 20 2) Part-time FTE = Total part-time hours / Standard full-time hours = 20 / 40 = 0.5 FTE This means that the part-time employees (there’s just one) represent 0.5 theoretical full-time employees, which means they do half the work of 1 FTE. |

Next, your company-wide FTE shows you how many total FTEs you have and tells you if you’re an Applicable Large Employer (ALE) for ACA compliance. This is the number that’s often simply referred to as “FTE.”

Here are 2 calculation methods you can use.

Method 1: Sum up the FTE for part-time workers with your full-time employee headcount. There’s no category other than full-time and part-time workers that goes into your FTE calculation, and your full-time FTE is the same as your full-time headcount.

| Example We already know that our part-time FTE = 0.5 FTE Our full-time employee headcount is 2 (namely, Mel Bea and Bob Pitt). Company FTE = Part-time FTE + Full-time employee headcount = 0.5 + 2.0 = 2.5 FTE |

Method 2: Sum up all employee hours (part-time and full-time). Then, divide this number by the standard full-time hours (defined in step 1).

| Example Summing up the hours from our employee data sheet, we get: Total hours (per week, part-time and full-time) = 40 + 20 + 40 = 100 Company FTE = Total hours / Standard full-time hours = 100 / 40 = 2.5 FTE |

As you can see, both methods produce the same FTE result: The workforce has a total of 2.5 theoretical full-time employees.

When a worker’s weekly hours are higher or lower than your standard full-time hours, you may want to calculate how many FTEs (i.e., theoretical full-time employees) they represent. For example, if someone’s count is 1.5 FTEs, they’re working one-and-a-half more hours than a full-time employee. An individual-level FTE helps you measure employee performance and convert their pay to a full-time salary.

You calculate an employee’s FTE by dividing their hours by the standard full-time hours.

| Example The only part-time employee in Hypothetical is Kat Blanchett, who works 20 hours per week. Individual FTE = Employee hours / Standard full-time hours = 20 / 40 = 0.5 FTE This means Kat represents half of a theoretical full-time employee. In this case, since they’re the only part-time employee, their individual FTE is equal to the company’s part-time FTE. |

I used a part-time work example, but you might want to know how to calculate FTE for salaried employees, too. A full-time employee is usually 1.0 FTE because they tend to be salaried and exempt under the FLSA. If you have salaried non-exempt staff, though (e.g., mechanics or live-in help), they’re eligible for overtime hours and you may want to know their FTE count. Use the same FTE calculation as in the calculation above.

How To Calculate an FTE Salary

You might calculate FTE wages for part-time employees to check whether they’re fair compared with those of full-time workers doing similar tasks. In turn, this assessment helps you achieve pay equality in your organization, decide compensation for new hires, and transition part-time workers to full-time positions (and vice versa).

Here’s how you calculate the full-time equivalent salary using a part-time wage.

First, bring your part-timer’s wage within the same timeframe as a full-time salary (which is typically annual). Here are the formulas to convert monthly, weekly, daily, and hourly wages to annual pay figures.

- Annual pay = Monthly wage x 12

- Annual pay = Weekly wage x 52

- Annual pay = Daily wage x 52 x Number of working days per week

- Annual pay = Hourly wage x 52 x Number of working hours per week

Now you have your part-timer’s annual pay, convert it to an FTE salary with this formula.

FTE salary = Part-time annual pay x (1 / Individual FTE)

| Example We’ll use Hypothetical’s employee data once again. Let’s assume Kat Blanchett, who works 20 hours a week, earns $30/hour. From previous calculations, we know their individual FTE is 0.5 FTE. Annual pay (part-time) = $30 x 52 x 20 = $31,200 FTE salary = $31,200 x (1/ 0.5) = $31,200 x 2 = $62,400 |

Pro Tip

While handy and easy to calculate, the FTE salary conversion doesn’t show you other costs of full-time and part-time positions. So, make sure you do a thorough labor cost analysis. For example, consider the additional employer taxes and company benefits attached to full-time positions if you’re transitioning part-timers to full-timers. If you’re replacing full-timers with part-timers for the same number of hours worked, consider the costs of training and managing extra people.

Track Workers’ Hours and Wages With Connecteam

A full-time equivalent, or FTE, tells you how many full-timers you’d theoretically need to work all your company hours. You need it to stay compliant with the Affordable Care Act, but you can also use it to measure workforce capacity and performance. You don’t need much to calculate FTE—just your employees’ names, hours worked, and full-time/part-time statuses.

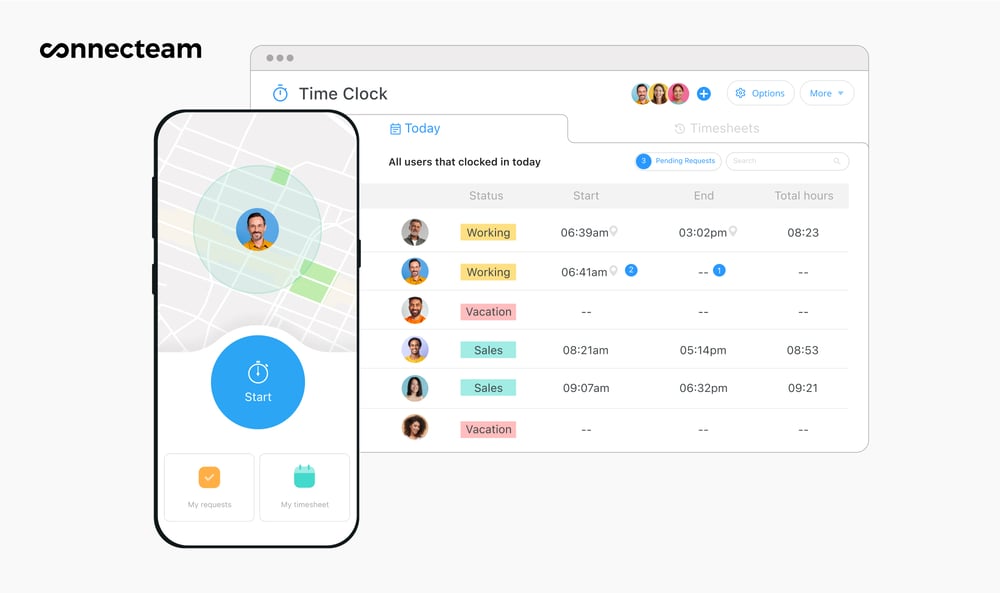

The data must be up-to-date and accurate, though. Use employee directory software like Connecteam to store details securely, have a single source of truth, and easily export customizable data sheets. As a bonus, Connecteam also lets workers track time using a 1-click time clock, ensuring your FTE calculations for part-timers and non-exempt staff include accurate hours worked.

Try Connecteam today—it’s free!

FAQs

The formula for calculating FTE is:

FTE = Total weekly staff hours (full-time and part-time) / Standard weekly full-time hours

If your team’s full-time weekly commitment is 40 hours a week, then:

Total weekly hours = FTE x Standard weekly full-time hours = 0.8 x 40 hours = 32 hours

The formula for yearly hours is:

Total annual hours = FTE x Standard weekly full-time hours x 52 = 0.8 x 40 x 52 = 0.8 x 2,080 hours = 1,664 hours

To calculate FTE in Excel, list your employee names and number of weekly hours in 2 separate columns. At the bottom of the hours column, add up all employee hours using the Excel SUM function. Then, in the cell that calculates your company FTE, divide this total hours value by your standard weekly full-time hours (e.g., 40 hours a week).

Disclaimer: The content of this article is informational only and should not be considered legal advice. Please consult an HR or legal professional and check official government guidance before making business decisions.