The cost of labor can be one of the largest expenses you’ll have to factor into your budget, depending on your business. What’s more, there are many things to keep in mind when determining a fair wage.

Providing competitive salaries without giving up your bottom line is a delicate balancing act, but one that is possible.

No matter what kind of business you run, if you have employees, you need to pay them for their time. The process of determining how to calculate labor cost can be intimidating — but it doesn’t have to be scary!

That’s where this helpful guide comes in. Learn about what goes into the cost of labor, step-by-step instructions on how to calculate it, and how to make sure it doesn’t eat away at your budget.

What is Labor Cost?

Labor cost is the total amount paid to employees over a given period of time, including wages, benefits, and payroll taxes. All businesses are out to make money, but you need employees to help you get there — and you need to pay them.

A big part of employee management — whether you work in HR or own your own business — is determining everything that goes into the annual cost of labor. Remember that in some industries, it’ll be your biggest spend.

Additionally, with wages steadily increasing, it’s important that you be conscious of the benefits you should be providing your employees with on top of their hourly rate.

It goes well beyond the cost per hour. You should also include the following in your labor cost calculations:

- Taxes

- Benefits

- Overtime

- Training costs/onboarding

- Bonuses

- General payroll costs

Let’s take a closer look at a few.

Taxes

Payroll taxes are a piece of the cost of labor puzzle. These taxes include the 7.65% FICA fee that covers Social Security and Medicare, respectively, as well as the lesser-known 6% FUTA tax that pays for federal unemployment.

You also can’t forget about state unemployment taxes, and local unemployment taxes too.

It’s also important to note that payroll taxes need to be added on top of gross pay — that’s what employees earn before benefits, taxes, and any other payroll deductions.

Benefits

Benefits can include standard health, dental, disability, and life insurance, as well as retirement plans, paid time off (PTO), and vacation and sick days.

These extras are extremely important when it comes to making your employees feel valued and can help to increase job retention and decrease employee turnover. A Pew Research study found that 43% of respondents said that they quit a job because it didn’t offer good benefits.

Retirement plans are also something to consider. The most common retirement plans offered by US-based businesses are employee-funded plans, like a 401(k).

What’s the Difference Between Direct and Indirect Labor Costs?

Now that you know all that goes into calculating real labor cost, it’s essential to understand the difference between direct and indirect labor costs.

Direct labor cost is the total compensation that you give your employees — including any benefits and taxes — and the cost of materials that you need to provide them, like desks, computers, and anything else they may need to do their jobs.

Indirect labor costs are also known as “overhead costs.” They comprise any maintenance of the materials that your team needs, operating costs, rent and utilities for office space, and training. Indirect labor costs are often industry-specific.

For example, businesses that require a fleet of vehicles that need upkeep will naturally have more indirect overhead costs than an office-based business.

You can easily calculate direct labor costs by adding up your employees’ wages, benefits, and the cost of materials they need. Then, you need to calculate any indirect costs associated with your business.

Track direct and indirect costs separately so that you know exactly what goes into your operational costs. And while knowing this information will help you better understand how much it costs to compensate your employees, it’ll also help you price your goods and services.

You can look at what your direct labor costs are and then come up with pricing that gives you a competitive edge over your competitors.

Calculating indirect costs will help you plan for the future, come up with a strategy to scale, and ensure that you have enough money set aside in your budget for operating costs.

As a note, the average cost of labor is usually between 20–35% of your gross sales depending on your industry. Keeping that in mind, you’ll be able to price your product and services in a way that makes sense for your business goals.

Step-by-Step Guide to Calculate Labor Cost

Now that you better understand everything that goes into the cost of labor, it’s time to learn how to calculate labor cost per hour for your business. There are several formulas to use to figure it out — all you’ll need are some very specific numbers.

Below you’ll discover exactly how to calculate labor cost for a specific employee, including hourly cost and overtime costs. To make things easier to understand, let’s call her Patricia.

She is a office manager at a small field service company in Virginia, and she makes the average hourly rate for her position, which clocks in at about $35 per hour, well beyond minimum wage.

You’ll begin by calculating her gross pay, benefits, and taxes, as well as determining how many hours she actually worked. Then you’ll take into account any other expenses so that you can calculate labor cost for one year in order to figure out the true cost of labor for Patricia.

💡 Pro Tip: Need help calculating your labor costs quickly? Try our free employee labor cost calculator to simplify the process and get accurate estimates in minutes.

Pro Tip

There is an easier way to manage your labor cost. Save BIG on labor costs with Connecteam’s Digital Time Clock and take complete control of your business.

✅ Record work hours with 100% accuracy and eliminate costly payroll errors

✅ Set up limitations to manage overtime

✅ Automatically calculate break times, absences, overtime, and PTO

Get started with Connecteam for free today

Step 1: Figure out gross wages

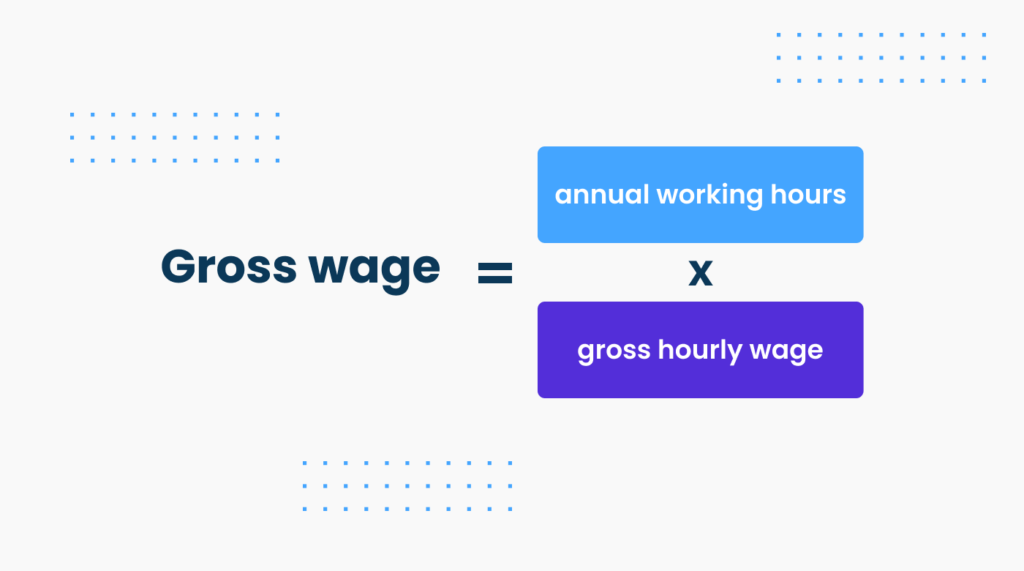

Gross wages can be calculated by figuring out how many hours Patricia worked and her gross hourly wage. The formula is very straightforward.

Full-time employees are expected to work 40 hours per week over 52 weeks per year, which is 2,080 working hours per year. If Patricia earns $35 per hour, her gross year wage would be $72,800.

As you can see from this example, it’s no wonder that the cost of labor is one of the biggest expenses for business owners depending on the industry. While you of course want to pay your people fairly, it’s important to be realistic about how much you can actually afford to pay them.

In this example, just one employee costs more than $70k. If your yearly gross sales aren’t very high, you may need to rethink your business model if you want to continue to pay your people well.

It’s important to note here that gross wages don’t include benefits, overtime, or payroll taxes. You’ll learn how to factor in those expenses in Step 3.

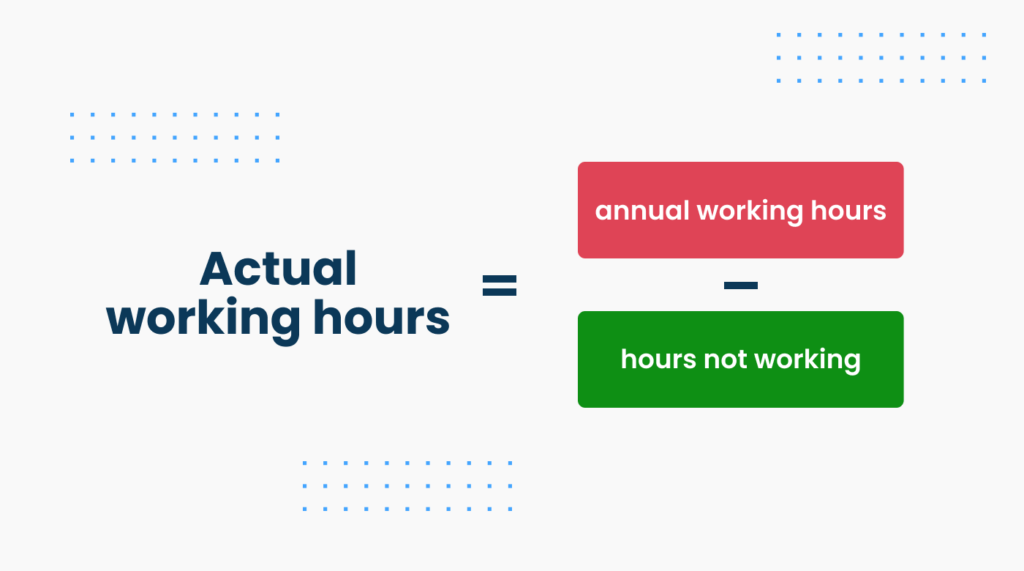

Step 2: Determine the actual number of hours worked

There may be 2,080 workable hours per year for a full-time employee, but the reality is that people need breaks and vacations and they sometimes get sick. Patrica loves her job, but that doesn’t mean that she wants to work 40 hours a week, all 52 weeks of the year.

To determine the actual hours that Patricia works, let’s assume that she had 21 days of paid time off. If there are 8 hours in a workday, that means that she had 168 hours off. Use these numbers in a new formula to calculate how many hours Patricia worked.

Using the formula above with Patricia’s actual working hours means that she worked 1,912 hours. Although she wasn’t clocking in her time, she did decide to use her vacation time.

At her company, every employee gets the standard 14 days off as a part of their vacation policy. She used seven of her PTO days so that she could take a full three-week vacation.

As a reminder, employers are not required to offer PTO as a part of their employee benefits package. That said, it’s attractive to prospective employees, and a solid PTO program can encourage team members to stick around for the long haul. It’s something to keep in mind!

Step 3: Take into account any additional expenses

It’s time to take into account all of those other expenses that were touched on above. Benefits should be added on top of gross pay in order to calculate the total labor cost for a given employee. You’ll add these costs into another formula to get that final figure.

So, what kinds of benefits does Patricia enjoy as a graphic designer at a tech company?

- Health insurance

- Life insurance

- Disability insurance

- An employee-funded retirement plan with employer matching

- Free lunch at the company cafeteria

- A laptop and tablet

- Quarterly opportunities for continued education

To give you a better idea of how much benefits like these can affect hourly wages, the United States Department of Labor released a study in 2021 that showed that the average private industry worker earned $38.07 per hour.

The average hourly wage came in at $26.86, or 70.5% of the total. The remaining $11.22 went into benefits.

The cost of benefits isn’t the only expense to keep in mind. You also need to include overtime and bonuses to come up with the true cost of labor.

Qualtrics released a study that found that 57% of employees want to work extra shifts as a way to combat inflation. That means it’s becoming more important than ever to include it in your total labor cost formula.

Let’s say that Patricia worked a few 50-hour weeks over the course of the year. Overtime hours are often higher than the standard hourly wage — some companies offer time and a half, while others offer double.

Remember: weekends and public holidays are also often subject to higher employee wages.

Patricia really knocked it out of the park on a few projects over the year, and so she was awarded a bonus for her efforts. You need to add her overtime hours as well as her bonus into your calculations to determine the full cost of labor.

Lastly, don’t forget about those ever-important payroll taxes! FICA comes directly out of Patricia’s weekly paycheck, and the tech company is required to pay FUCA. And, because they’re located in New York City, they also need to pay state unemployment taxes to New York.

While all of these benefits may seem excessive, your employees will appreciate you a lot more if you offer them. The fact is, a happy employee is a more productive employee, and a productive employee is invaluable.

Step 4: Calculate the total labor cost per year

You know Patricia’s gross wage, the actual hours she worked, and all of the other expenses that go into her pay. Now it’s time to determine her total labor cost per year with another formula.

The total labor cost formula is quite simple. Let’s take a look at how much Patricia costs her company per year, based on her gross wages and other expenses.

If you remember, she clocked in a total of 2,080 hours over the course of the year and she earns $35 per hour, meaning that she earned $72,800. She did take some vacation time as well as PTO, but she was paid for those hours.

Now let’s break down those expenses and add in some real-life figures to help you understand.

- Social Security: 6.2% of $72,800 = $4,513.60

- Medicare: 1.45% of $72,800 = $1,055.60

- New York state unemployment tax: 4.1% on the first $7,000 = $287

- FUTA tax: 0.6% of the first $7,000 = $42

- Health insurance: $4,000

- Overtime: $1,000

- Other benefits: $1,500

Based on these numbers, the extra expenses that you must add to Patricia’s base salary of $72,800 come out to $8,402.20. The actual labor cost to keep Patricia on the team at the tech company is $81,202.20.

The total labor cost formula is very easy to use as long as you have access to all of the numbers you need. Again, consult the finance department or speak to your bookkeeper or accountant if you have any questions or start to feel lost. That’s what they’re there for!

What About Labor Cost Percentage?

While we’re on the topic of labor cost, you also need to be aware of your business’ labor cost percentage.

Knowing it will allow you to dig even deeper into the cost of labor for your business. It’ll help you determine if the cost of labor is too high — which can negatively affect your profits.

Labor cost percentage compares your labor costs with your gross sales and knowing these figures is essential for your budget, growth, and planning.

To calculate yours, first, you need to know your annual gross revenue. You should be able to find this information on your company’s income sheet which you can grab from someone in the finance department.

Then, determine your business’ total labor costs (as indicated in the step-by-step instructions above) and use this helpful formula to calculate your labor cost percentage:

(Total Labor Cost / Gross Sales) x 100 = Labor Cost Percentage

This percentage typically ranges depending on which industry you’re in. If you sell a product, yours will likely fall within the 25–30% mentioned above. Restaurant labor costs are typically a bit higher as it’s a service-based business.

The type of work that you do as well as what you offer for hourly wages will directly affect your labor cost percentage.The formula above can be used to figure out your annual labor cost percentage.

You may also want to look at other periods of time such as weeks, months, or quarters instead of years, especially if you’ve recently experienced higher gross profits or have increased your employees’ wages.

You can use the same formula, but you’ll need to look at your company’s interim sales reports to get the correct numbers to plug into it.

While you may be tempted to cut costs wherever you can, if you’re unhappy with your labor cost percentage, it’s important to tread carefully. If you reduce your hourly wages or salaries, you run the risk of losing essential employees or poor quality of work.

It’s a balancing act that you must master if you want your business to succeed and keep your team members happy.

Calculate Labor Cost Today

Now you know how to calculate labor cost for your business. As you discovered, the cost of labor goes above and beyond hourly wages and takes into account many other factors, like benefits, taxes, and other essential expenses.

When you use data to calculate just how much it’s costing you to pay your employees, you’ll be better positioned to provide fair and competitive compensation without negatively impacting your bottom line.

HR professionals may be tasked with calculating labor costs as a part of their MO — use the formulas above to do it and you can’t go wrong!

Knowing the cost of labor is key to proper employee management. Stay on top of your businesses’ labor cost with the most advanced time tracking and time sheet creation tool on the market.

Get started with Connecteam for free now and keep your labor cost in check.