Mileage tracker apps help you log every eligible mile for IRS deductions and reimbursements without the guesswork of pen and paper.

Whether you’re managing a team in the field or driving for work yourself, logging mileage accurately is essential. A good mileage tracker app automates the process, ensures IRS compliance, and saves you time.

In this guide, I reviewed and compared the 5 best mileage tracker apps for businesses and freelancers:

These tools all offer GPS tracking, trip classification, and report generation, but each one comes with trade-offs. Keep reading to find the one that fits your needs best.

Our Top Picks

-

1

Best for Mileage Tracking With All-in-One Field Management

-

2

Best Standalone App for Business Mileage and Expenses

-

3

Best for Multi-Vehicle, Multi-Driver Businesses

Why trust us?

Our team of unbiased software reviewers follows strict editorial guidelines, and our methodology is clear and open to everyone.

See our complete methodology

What to Look For in a Mileage Tracker App

I focused on features that help businesses track mileage accurately, without chasing down logs, second-guessing reports, or juggling disconnected tools.

Here’s what I looked for:

Core must-haves

- Accurate mileage logging: I only picked apps that support manual, semi-automatic, or fully automatic tracking modes, with logs that hold up under IRS scrutiny.

- GPS tracking: The app must show real routes, locations, and timestamps to verify every trip.

- Trip classification: Whether it’s a swipe or a smart rule, I looked for apps that separate business miles from personal ones with zero confusion.

- IRS-compliant reports: You need clean, exportable mileage reports with all required fields such as date, time, distance, purpose, and destination.

Ease of use

- Mobile-friendly design: Drivers need to log mileage on the go. If the mobile app felt clunky or limited, it didn’t make the list.

- Simple setup: No one should need a user manual to start tracking trips. I prioritized apps with short learning curves and clean interfaces.

Features that give top apps an edge

- Custom reminders: Whether it’s nudging employees to submit logs or verify a trip, smart alerts save a ton of admin time.

- Built-in safeguards: Features like odometer photo capture, GPS breadcrumbs, and shift-based tracking reduce fraud and boost accuracy.

- Payroll and accounting integrations: I gave extra points to apps that connect with tools like QuickBooks, ADP, and Gusto to streamline reimbursement and reporting.

5 Best Mileage Tracker Apps

-

Connecteam — Best for Mileage Tracking With All-in-One Field Management

Connecteam is the best all-in-one software for companies that want to track mileage, schedule employees, track time, and manage tasks.

Why I chose Connecteam: Connecteam isn’t just a mileage tracker—it’s a complete field operations platform that captures mileage in the context of your employees’ shifts, tasks, and locations. Instead of duct-taping mileage logs to standalone tools or spreadsheets, Connecteam lets you track, verify, and manage mileage right inside the same app you use for scheduling, time tracking, and task management.

Let’s explore Connecteam’s mileage tracking advantages:

Custom digital mileage log forms

Connecteam mileage log form automates mileage tracking, ensuring employees are capturing the relevant details for compliance. Remember that the IRS requires each mileage log to show the distance traveled, total mileage, date and time, and destination for each trip.

By default, the mileage form requires employees to enter odometer start/end, total mileage, destination, and signature. What really impresses me is that employees must capture a photo of the odometer rather than uploading a pre-captured image. As a result, you can rest assured that employees use real odometer readings to calculate business mileage.

Moreover, I really appreciate the conditional form function. With this tool, you can configure Connecteam to automatically record the employee’s location when they capture the odometer end image or type in the destination. This prevents employees from falsifying mileage figures and helps verify the trip’s destination for compliance with IRS requirements.

You can also set Connecteam to remind employees to submit an IRS-compliant mileage log at the end of the shift. Prompt reminders eliminate the need to constantly chase down employees for mileage logs. You can also require employees to sign mileage logs to authenticate their claims.

GPS-stamped breadcrumbs to verify route

Besides the customizable mileage form, you can use the shift attachment feature to record employee mileage. With this feature, Connecteam prompts employees to add the distance covered when they tap the clock-out button.

Requiring employees to enter mileage covered at the end of the shift has two benefits. One, it makes it easy for field employees to remember to record their mileage.

Second, it simplifies trip classification. Remember that the IRS requires businesses to reimburse employees for work-related trips only. Serving up this option at the end of the shift ensures employees record business mileage only.

Connecteam also captures a GPS stamp for each punch. Even better, the app’s GPS breadcrumb technology picks up employees location at random points in the journey. While this doesn’t calculate mileage per se, it helps verify where your employees have traveled to while clocked in. Hence, it becomes easier to determine if the documented logs are accurate.

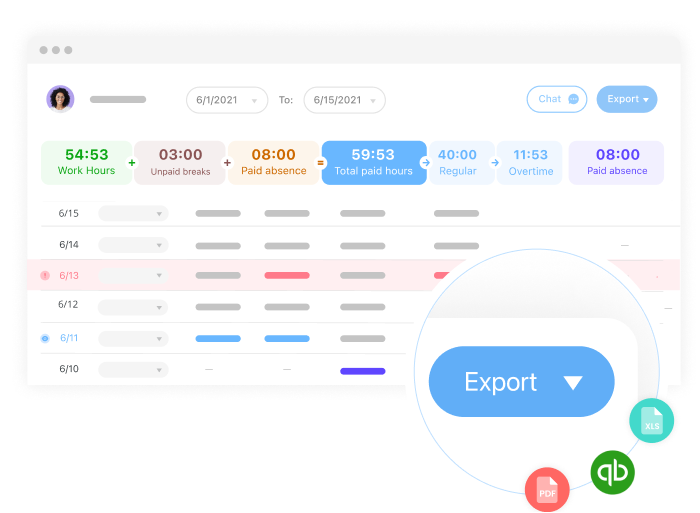

Easy-to-generate mileage reports

The be-all and end-all of mileage tracking is IRS compliance and reimbursement. Besides ensuring your mileage logs are accurate, Connecteam makes the data easily accessible. You can generate timesheets or shift reports to get a detailed view of employee mileage logs.

One thing I liked is that each mileage report is tied to a specific shift or job. This makes it easy to amend erroneous logs so that you can reimburse employees accurately. Moreover, the reports show all the relevant information you’d need to prove the authenticity of your tax deductions.

Other helpful features:

- Employee scheduling: Connecteam’s auto-scheduler helps you schedule employees for full-shift coverage in minutes. You can also leverage shift templates, shift copying, shift swaps, and drag-and-drop functions to streamline the process.

- Time tracking: Utilize geofencing to ensure employees clock in or out only when they arrive at designated work sites. You can also configure geofence triggers to notify you when an employee leaves a job site.

- Mobile-first employee training: Create mobile-friendly courses to enable frontline and field employees to learn at their own pace, anytime, anywhere.

- Integrations: Connecteam integrates seamlessly with popular payroll and accounting software like QuickBooks Online, ADP, Xero, and Gusto.

- Easy-to-use mobile apps: Connecteam lets employee’s user Android or iOS mobile app for tracking mileage. The app are readily available on Google Play or Apple’s App Store.

Connecteam also offers a free for life plan – Try Connecteam here!

0Key Features

- Time Tracking

- Shift Attachments

- Forms and Reports

- Geotracking/ GPS Capabilities

- Training Software

Pros

- Extremely Customizable

- User-Friendly

- Keeps mileage details organized per shift

- Real-time notifications

Cons

- Needs internet or wifi access to work

Pricing

Free-for-life plan availablePremium plans start at $29/month for 30 users

14-day free trial, no credit card required

Start your free trial -

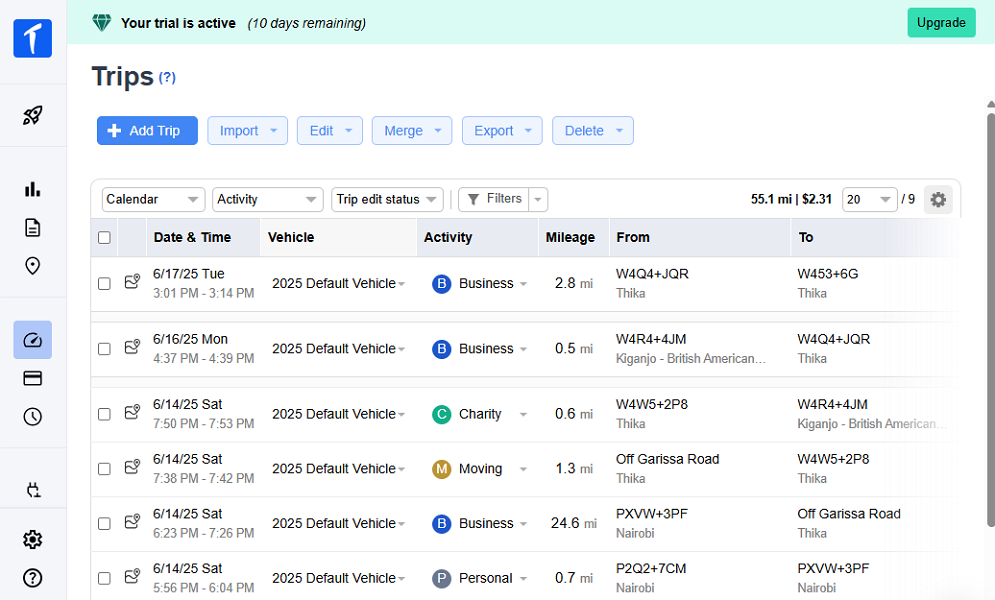

Everlance — Best Standalone App for Business Mileage and Expenses

Available on

- Web

- iOS

- Android

Everlance doesn’t let employees classify trips on the web app. Everlance is a mileage and expense tracking app for self-employed drivers and small businesses looking to simplify reimbursements and tax deductions.

Why I chose Everlance: Everlance stood out to me because it supports both automatic and semi-automatic mileage tracking. This makes it ideal for tracking mileage for cents-per-mile (CPM) or fixed and variable rate (FAVR) reimbursement methods. However, its mobile app doesn’t work with an internet connection, a dealbreaker for drivers in poorly connected areas.

Let’s explore how Everlance mileage tracker app works:

Automatic and manual mileage tracking

You can choose between semi-automatic tracking and automatic drive detection modes. With the former, you’ve to tap a button to start or end your trip. It’s tedious, especially when you make multiple trips during the day. However, it’s recommended for privacy-conscious users as it gives them the autonomy to start and end trips at will.

I was impressed by the automatic drive detection mode during my testing. I didn’t need to lift a finger to track my mileage. Instead, Everlance detected motion and started logging mileage automatically once the vehicle exceeded a predefined speed threshold. My only minor grievance is that Everlance doesn’t let you stipulate the minimum tracking speed threshold.

Another issue is that while Everlance provides the route for every trip — with the start and stop locations — it doesn’t support breadcrumbs. For this reason, it might not be helpful if you want to monitor the driver’s behavior during the trip. Moreover, the automatic tracker presents privacy concerns as it automatically tracks a driver movement even outside working hours.

Everlance Work hours

Besides instigating privacy issues, automatic drive detection creates another problem: manual trip classification. Employees must manually separate business trips from personal trips at the end of the work day. While trip classification is as easy as swiping the trip card to the right or left, it consumes vital hours that could be expended on other meaningful tasks.

To mitigate this issue, Everlance allows you to stipulate work hours when you upgrade to the Business plan. Work hours don’t aid time tracking or scheduling in any way: they are purely meant to automate trip classification. The software classifies mileage logged during the work hours as business, saving you the manual hassle.

What users say about Everlance:

It’s real easy to use to keep track of how many miles you’ve driven.

I wouldn’t recommend it. It has too many glitches and I can get something free with way better dependability.

Key Features

- Mobile receipt upload

- Expense tracking

- Time & expense tracking

- Reimbursement management

Pros

- Auto-detects movement and stand-stills

- Easy and simple to use

Cons

- Not cost-friendly

- Mistakenly marks personal trips as business trips often

Pricing

Starts at $10/user/month Trial: Yes — 60-day Free Plan: Yes

-

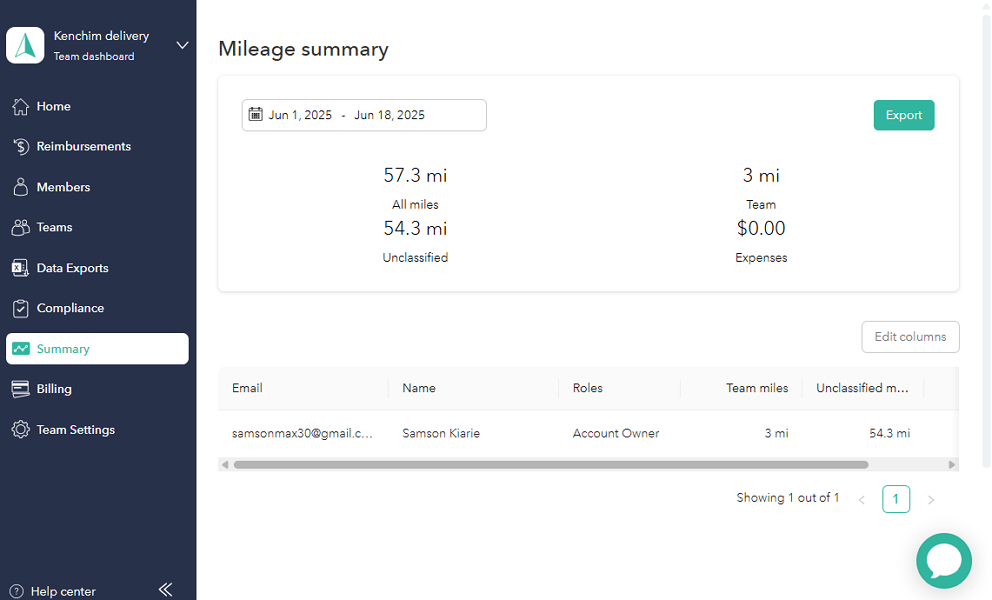

Triplog — Best for Multi-Vehicle, Multi-Driver Businesses

Available on

- Web

- iOS

- Android

Employees can classify trips on the web and mobile app with ease. Triplog is a feature-rich mileage tracking app for small and mid-sized businesses that need to create and enforce mileage tracking policies.

Why I chose TripLog: Triplog’s main advantage is its array of mileage tracking modes, which makes it suitable for different use cases. It also offers other essential features such as scheduling and time tracking, but they’re stripped down to the very basics. I also liked its expense tracking module, which lets you link bank accounts to reconcile business expenses automatically.

Let’s explore TripLog’s key features:

Multiple mileage tracking modes

TripLog supports six mileage tracking methods, namely: semi-automatic, MagicTrip, iBeacon, Drive, car bluetooth, and Plug-N-Go. MagicTrip is only a fancy name for an automatic mileage tracker, which leverages drive detection technology to log miles. It’s not different from other automatic mileage trackers, but it lets you adjust the minimum speed threshold to your liking.

TripLog Beacon (iBeacon) is a unique USB device that connects to the mobile app via Bluetooth technology. Unlike the standard automatic mileage tracker, the iBeacon logs miles when the driver is in the designated car. TripLog Drive is also a plug-and-go device designed specifically for offline mileage tracking, and like iBeacon, it requires additional hardware.

However, iBeacon and Drive may require a hefty initial investment, especially for companies with a large fleet. Another issue is that employees have to classify trips manually, mainly if you are on the Team plan. But if you’re on the Enterprise plan (TripLog’s most-expensive plan) you can set default work hours to classify business trips automatically.

Mileage tracking rates and policies

TripLog also allows you to create and enforce mileage tracking policies. For instance, you can set it to automatically deduct employees’ commuting miles, which are not tax-deductible or subject to reimbursement. It also lets you stipulate a daily mileage cap to ensure employees are mindful of the distance they cover to save on travel costs.

Another feature I liked was the driving safety tracking. It allows you to set a custom speed limit to get alerts about rapid acceleration, overspeeding, hard braking, and phone calls during driving. The alerts help curb unsafe driving habits to improve fuel economy and reduce vehicle wear and tear.

TripLog also lets US-based businesses apply the standard mileage rates for business, moving, medical, and charity mileage with the click of a button. If you’re outside the U.S. you can configure custom rates to adhere to requirements in your region. All in all, setting mileage rates enables the app to calculate employee reimbursement accurately based on trip categorization.

What users say about TripLog:

I love the automatic tracking that recognizes my previous locations! It’s so helpful.

Triplog Drive USB is absolutely useless, and does not track your mileage

Key Features

- Route planning

- Monitors fuel consumption

- GPS Capabilities

- Maintenance management

Pros

- Detailed reports

- Accurate tracking

Cons

- Complicated set-up and onboarding

- Reviews report poor customer-support

Pricing

Starts at $4.99/user/month Trial: Yes — 15-day Free Plan: Yes

-

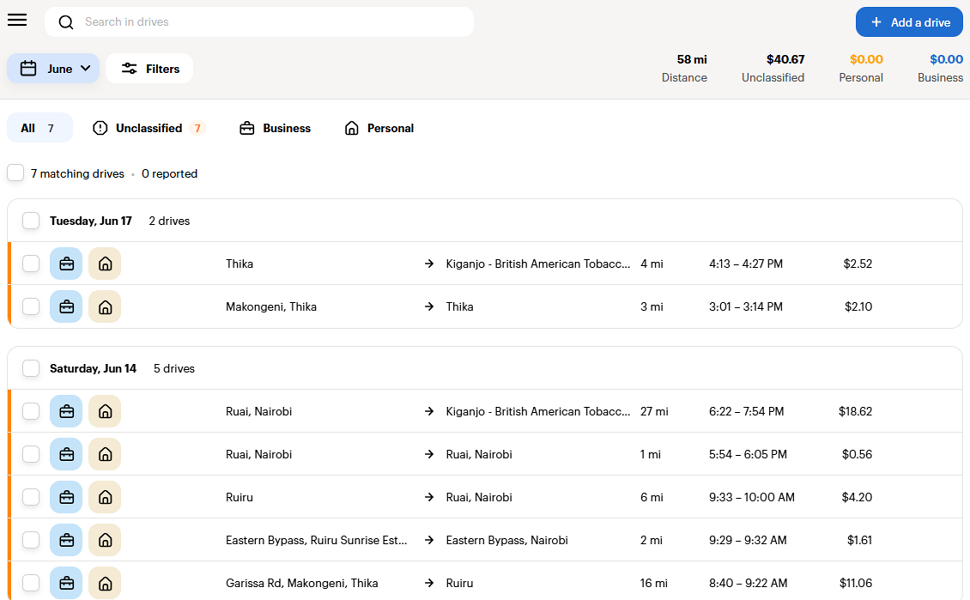

MileIQ — Best for Set-and-Forget Automatic Tracking

Available on

- Web

- iOS

- Android

MileaIQ doesn’t let you classify trips by business sub-categories. MileIQ is another easy-to-use mileage tracker app designed specifically for freelancers and small business owners in the U.S., Canada, and the U.K.

Why I chose MileIQ: MileIQ sets itself apart with a user-friendly interface that makes it easy to track mileage and categorize trips. However, it does have a few drawbacks such as the lack of an offline mode and a tendency to miss shorter and low-speed trips.

Lets dive into the details of MileIQ’s capabilities:

Automatic mileage tracker

Unlike TripLog and Everlance, MileIQ doesn’t have a semi-automatic mileage tracking option. Instead, the app utilizes automatic drive detection to track miles. While the automatic tracker eliminates the need to constantly tap the start/end button, it comes with a few quirks.

I noticed that the drive detection mode is set up differently. Instead of triggering the tracker when you hit a minimum speed threshold, it starts logging miles when you travel at least half a mile. Without a minimum tracking speed cap, MileIQ might over-report mileage, something I experienced firsthand during my testing.

Actually, MileIQ logged more miles than the rest of the apps. This suggests that the app doesn’t filter out short, slow movements, such as trips made on foot or in traffic jams. Moreover, MileIQ doesn’t support offline tracking, and is ideal only for users in well-connected areas.

Trip classification

Classifying trips is an effortless task. On the mobile app, it takes a simple swipe to the right or left to classify trips as business or personal, respectively. On the other hand, it takes a couple of clicks to classify trips on the web app. Alternatively, you can set work hours to auto-classify trips.

My only gripe is that U.S. businesses can’t apply the standard mileage rate for charity, moving, and medical trips. This is because MileIQ classifies charity, medical, and moving trips as personal by default, which is erroneous. These trip categories are tax deductible and subject to reimbursement per IRS regulations.

What users say about MileIQ:

MIleIQ has made our IRS mileage reporting and reimbursing a breeze to get done quickly and accurately.

Missing several trips every day. I’ve used this for 17 months.

Key Features

- Smart categorization

- Location setup

- Auto mileage tracking

- Expense reimbursements

Pros

- Intuitive-to-use

- Cost-friendly

Cons

- Drains the battery quickly on smartphones

- Tracks continuously until the app is closed

Pricing

Starts at $50/driver/year Trial: Yes Free Plan: Yes

-

Hurdlr — Best for Freelancers Who Also Track Income and Taxes

Available on

- Web

- iOS

- Android

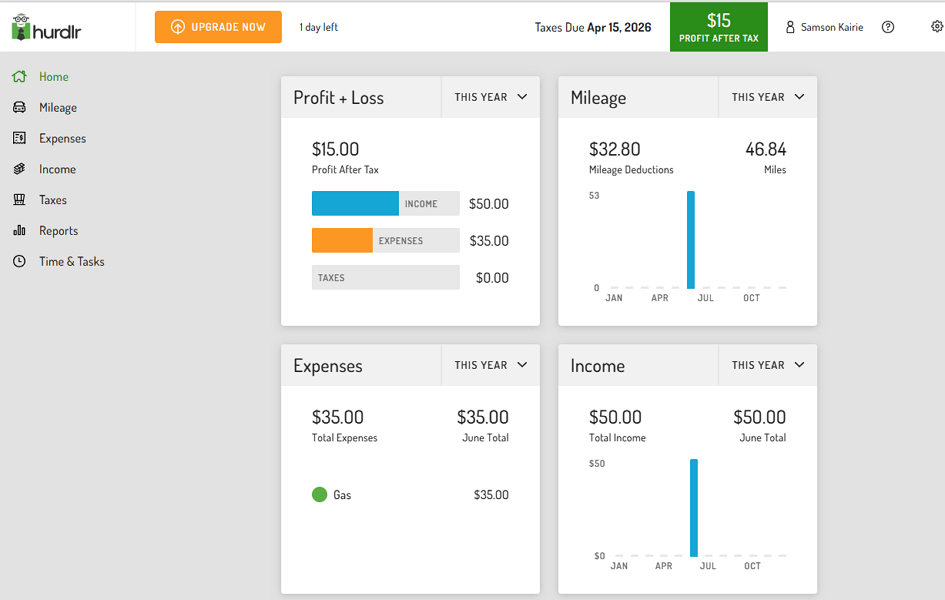

Hurdlr dashboard displays a summary of your mileage, expenses, and income. Hurdlr is a free mileage tracking app for rideshare and freelance drivers in the United States and Canada.

Why I chose Hurdlr: While Hurdlr can track mileage, it can go a lot further and help you track expenses, tax deductions, time, and income streams in real-time. Its broad capabilities make it ideal for DoorDash, Lyft, Uber, and other gig drivers. However, Hurdlr has no offline mode and it presents a steep learning curve for first-time users.

Mileage tracking modes

Hurdlr supports manual, semi-automatic, and automatic mileage tracking modes. The automatic mode starts tracking when the vehicle reaches 10mph. I find this tracking speed threshold quite high and ineffective for ride-hailing drivers, for valid reasons.

If you’re a rideshare driver, you spend a lot of time below 10mph creeping through pickup and drop-off zones and navigating residential areas. As a result, Hurdlr might miss a lot of legitimate deductible mileage, leading to underreported trips. Thankfully, I didn’t encounter this issue, mainly because I was driving well above the 10 mph limit.

The best tracking method for rideshare drivers is the bluetooth mode. With this option, Hurdlr logs mileage when your phone connects to a pre-selected Bluetooth device within the vehicle and stops when it disconnects. This helps sidestep the manual hassle, while ensuring no deductible mileage is omitted.

Income stream tracking

Beyond mileage tracking, Hurdlr makes it easy to track your income and expenses. You can track your income either manually or automatically. With the latter, you only need to link your bank accounts or credit cards so that your transactions pull into Hurdlr automatically.

What I liked is that Hurdlr helps track all deposits and withdrawals from a centralized dashboard. This way, you can see where your money is coming from or going, without having to log into the bank portal. However, the streamlined transactions dashboard is available only to Hurdlr Pro subscribers.

What users say about Hurdlr:

Very simple to use and great if you are a contractor or direct seller

Great for small businesses with no accounting knowledge; horrible for advanced needs

Key Features

- Trackable corporate cards

- Scan/upload receipts

- Time tracking

- Out-of-pocket compensation management

Pros

- User-friendly

- Accurately details expense tracking

Cons

- Needs manual fixing often

- Lacks invoicing from the phone

Pricing

Starts at $10/user/month Trial: Yes — 7-day Free Plan: Yes

Compare the Best Mileage Tracker Apps

| Topic |

Start for free

Start for free

|

|

|

|

|

|---|---|---|---|---|---|

| Reviews |

4.8

|

4.5

|

4.1

|

4.5

|

4.1

|

| Pricing |

Starts at just $29/month for the first 30 users

|

Starts at $10/user/month

|

Starts at $4.99/user/month

|

Starts at $50/driver/year

|

Starts at $10/user/month

|

| Free Trial |

yes

14-day

|

yes

60-day

|

yes

15-day

|

yes

|

yes

7-day

|

| Free Plan |

yes

Free Up to 10 users

|

yes

|

yes

|

yes

|

yes

|

| Use cases |

Best for Mileage Tracking With All-in-One Field Management

|

Best Standalone App for Business Mileage and Expenses

|

Best for Multi-Vehicle, Multi-Driver Businesses

|

Best for Set-and-Forget Automatic Tracking

|

Best for Freelancers Who Also Track Income and Taxes

|

| Available on |

Web, iOS, Android

|

Web, iOS, Android

|

Web, iOS, Android

|

Web, iOS, Android

|

What Is a Mileage Tracker App?

A mileage tracker app is a software application designed to help users track distance traveled, expenses, clock in and out times, and where they’re located. Mileage apps use GPS technology to automatically track the user’s location and calculate how far they’ve traveled, eliminating the need for manual tracking.

Users can usually categorize their trips and expenses as either business or personal, and the app keeps track of these details in a secure, cloud-based dashboard. Some apps include additional features, too, like scheduling and payroll.

How Do Mileage Tracker Apps Work?

A mileage tracking app uses GPS technology on a driver’s phone to measure their driving distances and converts the information into reports for financial purposes, such as tax deductions and reimbursements.

Some apps require users to start and stop the mileage tracker for each journey, while others actually run in the background, tracking mileage automatically even when users are not on their phones. Connecteam does not track your staff’s location when they are off the clock!

What Are the Benefits of a Mileage Tracker App?

Here are five key reasons why using a mileage tracker app can benefit your business in the long run:

Saves time and money

One of the main benefits of a mileage tracker app is that it can save you time and money in the long run. If you’re able to track fuel costs and mileage over a long period of time, you’ll have clearer oversight and be better prepared for scheduled vehicle maintenance.

Streamline your payroll and accounting processes

Digitally tracking your mileage on an app that integrates with your payroll software means your accounting processes will be much smoother. There’s no need to conduct manual data entry of mileage or expense reports because the software automatically inputs the information for you.

Always be aware of your drivers’ locations

Mileage tracker apps come with GPS technology, so you’re always aware of your drivers’ locations at all times. That way, you can better communicate and coordinate with them and rest assured that they are where they say they are.

It’s always accessible

As opposed to using a large, inconvenient laptop or tracking mileage manually, employees can easily use a mileage app on their mobile phones.

Enures tax compliance

To claim mileage deductions and save on taxes, you need to keep detailed records. With a mileage tracker app, you can digitally upload documents, photos, and receipts into the software, and it will keep track of everything for you.

How Much Do Mileage Tracker Apps Cost?

There usually isn’t a drastic difference in pricing between mileage tracker apps. With that said the most expensive solutions tend to start at approximately $10 per user/month, while the cheapest are usually half the price.

Pricier options such as QuickBooks Time cost $10 per user/month with a base monthly fee of $40. While cheaper solutions like Triplog cost $4.99 per user/month. It’s also worth mentioning that for some solutions, customers may need to contact a sales representative for pricing information.

However, with Connecteam, you can access a suite of powerful employee management and mileage tracking tools at a fraction of the cost. Paid plans start at just $29 per month for up to 30 users. What’s more, small businesses with up to 10 users can access the app completely free of cost.

FAQs

Connecteam is the best mileage-tracking app for employees. It’s an all-in-one solution that will cover mileage tracking and all other areas of employee management right from your phone.

Most mileage tracker apps allow users to keep records of work travel in order to deduct business mileage easily. This takes the pressure off the user, providing automated reports in the process. When mileage has been deducted on tax returns, the IRS requires accurate business mile reports. Mileage tracker apps ensure that you keep track of destinations, dates, and reasons for each trip.

There are free mileage tracker apps on the market, but most have some limitations. However, many of these apps do offer free trials, allowing users to test them out before purchasing.

Connecteam is the only mileage tracker app that offers a 100% free small business plan for up to 10 users. Users have access to all of the app’s robust employee management features, including a time clock, advanced scheduling capabilities, a knowledge center, and more.

See more about Connecteam’s pricing here.

The Bottom Line on the Best Mileage Tracker Apps

As you can see, there are numerous mileage tracker apps that are bound to make invoicing and payment for transportation reimbursement much more straightforward.

Features like a GPS time clock, breadcrumb technology, mileage reimbursement forms, and training resources on how to track mileage efficiently are all features you should look for in an app. Fortunately, Connecteam has all of these features and more, and even offers a free plan for businesses with up to the 10 users.