Before you start taking on customers for your cleaning business, it’s important to have insurance that protects you against financial losses from accidents and theft.

Without insurance, your business may be on the hook for thousands of dollars in damages if something goes wrong on a job. Having the right policy could be the difference between carrying on after an accident and having to close up shop.

In this guide, we’ll cover everything you need to know about cleaning business insurance. We’ll explain common types of bonds and insurance policies, look at their costs, and guide you through the process of getting your cleaning business insured today.

Key Takeaways

- Insurance is crucial to protect your business against accidents, property damage, or job site injuries. Every cleaning business should have insurance, and some types of policies may be required by law.

- Types of insurance to consider for your cleaning business include general liability insurance, property insurance, workers’ compensation insurance, and professional liability insurance. Your business may also need a surety or janitorial bond.

- Cleaning business insurance typically costs $320-$675 per month. Costs vary based on the size of your business, the value of your property, and the types of cleaning jobs you take on.

Do You Need Insurance for Your Cleaning Business?

Insurance is essential for every cleaning business, regardless of size or the types of jobs you take on. It protects you from financial risk related to on-the-job accidents, including injuries to your employees and damage to customers’ property. Good coverage can also protect you from theft or damage to your business’s property while not on a job, such as if your office burns down.

“Insurance is a must,” said Tim Walters, owner of Triple H Cleaning Services. “It safeguards your company against accidents, liability, or even potential fraud.”

There are three key reasons why your business needs insurance.

Protection from financial losses

Financial losses from simple accidents can be surprisingly large. For example, if a client slips and falls because your team left the floor wet, you could be responsible for tens of thousands of dollars in legal and medical bills. Insurance can pay these costs for you, saving your business from financial ruin.

Legal requirements

You may also be legally required to have certain types of insurance for your cleaning business. For example, if you have employees, you’ll need a workers’ compensation insurance policy. If your business has vehicles, you’ll have to have commercial auto insurance.

Customer trust

Most customers will only work with licensed and insured cleaning businesses. Insurance creates trust and shows that your business is professional, responsible, and prepared for unexpected problems. It gives clients peace of mind knowing that any damage or accidents will be covered.

Being insured and bonded also helps you win better, higher-paying contracts. Most commercial or higher-end customers won’t consider hiring uninsured or unbonded cleaning businesses. If you can’t show that you have insurance to cover the costs of potential damage to a customer’s property, you’re going to have a hard time finding work.

This Might Interest You

Haven’t launched your cleaning business yet? Check out our guide on how to start a cleaning business.

Types of Bonds and Insurance for Cleaning Businesses

There are many different types of insurance policies that your cleaning business might need. We’ll explain the most common ones and what they offer.

General liability insurance: $40–$85 per month

General liability insurance covers damage to a client’s property, injuries to people not employed by your business, and problems caused by advertising, like defamation or copyright infringement. It protects your business from the financial risks of lawsuits and claims.

This type of insurance is crucial because accidents happen, no matter how careful your team is. For instance, if a cleaner accidentally breaks a window or a client trips over a vacuum cord and gets injured, general liability insurance can cover the costs.

The amount of liability insurance you need depends on the size of your business and what kind of cleaning jobs you take on. If you mostly do small jobs with just 1 or 2 employees, $500,000 in coverage may be enough. On the other hand, if you work on large homes or commercial properties and have several employees on each job site, you’ll need at least $1-2 million in liability coverage.

Commercial property insurance: $20–$60 per month

While liability insurance covers damage to a customer’s property, it doesn’t cover damage to or theft of your own tools, vehicles, or facilities. For that, you need commercial property insurance.

If a fire destroys your warehouse or thieves steal your high-end cleaning equipment, commercial property insurance helps you replace these essential assets. It covers losses from fire, theft, vandalism, and natural disasters.

You can figure out how much coverage you need from a commercial property insurance policy by adding up the replacement cost of all your business’s equipment and assets. It’s a good idea to add a bit more to this figure since it’s hard to account for everything your business owns.

Workers’ compensation insurance: $100–$200 per month

Cleaning jobs can be physically demanding and expose workers to hazardous chemicals or environments. Workers’ compensation insurance provides benefits for employees who suffer work-related injuries or illnesses. It covers medical care, rehabilitation, and a portion of lost wages during recovery periods.

Importantly, workers’ compensation insurance is legally required in most states for any business that has employees. Progressive Insurance has a state-by-state guide to workers’ compensation insurance rules to help you figure out how much coverage you need.

Commercial auto insurance: $150–$300 per month

If your business has vehicles, you’re required by law to insure them. At a minimum, your policy must include bodily injury liability and property damage liability coverages. Check your state’s auto insurance requirements for the minimum coverage limits.

It’s worth considering purchasing more than the minimum coverage, especially if your business’s vehicles are valuable. Types of additional coverage to consider include:

- Collision coverage: Pays for damage to your vehicle in an accident.

- Comprehensive coverage: Covers damage to your vehicle that isn’t related to a collision, such as hail damage or theft.

- Personal injury protection: Pays for medical expenses if you or your passengers are injured in an accident.

Types of Bonds for Cleaning Businesses

Bonds are an important part of running a cleaning business. They add an extra layer of protection for your clients and show that your company can be trusted. Having a bond gives clients confidence in your work and can help you win better contracts.

What’s the difference between bonding and insurance?

Bonds are different from insurance, but they’re no less important. A bond involves 3 parties: your business, your client, and the bonding company. If insurance protects you, then a bond protects your client. It guarantees that you’ll complete the contracted jobs as agreed, or your client will receive compensation.

Importantly, if your bonding company pays out a claim, you’ll have to pay back the covered amount. For instance, if your bonding company pays out $2,000 to your customer, you must repay your bonding company $2,000. Your bond agreement should explain how long you have to repay the debt, whether you can set up a payment plan, and whether any interest charges or fees apply.

Does a cleaning business need to be bonded?

Cleaning companies don’t have to be bonded by law, but it’s still a good idea. Higher-end private clients and almost all commercial clients expect it, and many won’t hire unbonded cleaning companies.

Being bonded shows that your company is trustworthy and that clients will be repaid if something goes wrong. This can help you win better, higher-paying contracts. And you can only advertise your business as “bonded and insured” if you have an active bond and valid insurance.

What kind of bond does your cleaning business need?

There are two types of bonds used by cleaning businesses. The right one depends on the types of cleaning jobs you take on.

Janitorial bonds: $8-$20 per month

A janitorial bond is a kind of fidelity bond that protects your clients if one of your employees steals something while cleaning up to a set limit (usually $5,000-$50,000). You usually need a janitorial bond if you clean homes or small offices.

Surety bonds: $12-$40 per month

A surety bond guarantees that you’ll fulfill your contractual obligations. If you don’t, the bonding company will compensate your client up to an agreed amount. You will then have to repay the bonding company. Surety bonds are usually needed if you want to clean commercial properties, like larger offices, government buildings, healthcare facilities, and more.

Optional Insurance for Enhanced Protection

There are a few additional types of insurance that are fully optional, but offer additional protections for your business, no matter what goes wrong.

Professional liability insurance: $50–$100 per month

Also known as errors and omissions (E&O) insurance, professional liability insurance defends you against claims of negligence, missed deadlines, or unsatisfactory work. If a client claims your cleaning service didn’t meet agreed-upon standards and caused them financial loss, professional liability insurance can cover claim costs and legal expenses.

Professional liability insurance is much more expensive than a surety bond, but you don’t have to repay claims. So, it’s a good alternative if you don’t want to be responsible for large, unexpected expenses.

Umbrella insurance: $20–$80 per month

Umbrella insurance is a type of policy that kicks in to give additional coverage when your other insurance policies reach their limits. It’s worth considering if your business cleans high-value properties or if your insurance policies have relatively low coverage limits.

For example, say a client’s house burns down and your business is found liable. Your general liability insurance policy will only pay up to your coverage limit, which may not be enough to cover the damages. Umbrella insurance can cover the rest.

Standard umbrella policies offer up to $1 million in supplemental coverage, but larger policies are available if you work on very high-value properties.

Business owner’s policy: $50–$125 per month

A business owner’s policy is an all-in-one insurance policy that combines common types of coverage. It usually includes general liability and commercial property insurance and can be more cost-effective than buying policies individually. This is especially useful when starting your cleaning business.

Note: All price estimates in this article are based on our team’s market research.

How Much Does Cleaning Business Insurance Cost?

With all these different policies to purchase, you’re probably wondering how much insurance for a cleaning business costs. The answer depends on a variety of factors, including:

- Business size and kinds of cleaning: Larger businesses or those providing high-risk services, such as high-rise window washing, may face higher premiums due to increased exposure to potential claims.

- Location: Working in areas with higher crime rates or natural disaster risks can increase insurance costs.

- Claims history: A history of claims can indicate a higher risk to insurers and bonding companies, leading to higher premiums.

- Coverage limits and deductibles: Higher coverage limits and lower deductibles can provide more protection but will increase your costs.

Here are estimates for how much key types of insurance for a cleaning business cost:

- General liability insurance: $40–$85 per month.

- Commercial property insurance: $20–$60 per month.

- Workers’ compensation insurance: $100–$200 per month.

- Commercial auto insurance: $150–$300 per month.

- Surety bonds: $12-$40 per month.

- Janitorial bonds: $8–$20 per month.

In total, you’re looking at around $320–$675 per month, or $3,840–$8,100 per year. Be sure to factor this into your budget when calculating the cost of starting a cleaning company.

Did You Know?

By using an all-in-one management tool like Connecteam, your cleaning company can potentially lower insurance premiums by enhancing safety protocols and minimizing the risk of accidents and claims.

Try Connecteam for free today.

How To Get Your Cleaning Business Bonded and Insured

Securing the right bonding and insurance for a cleaning business is crucial for protection and building client trust. Here’s how you can do this.

Step 1: Understand your needs

Begin by assessing the risks you face with your cleaning business to select the necessary insurance policies and bonds.

For instance, if your team specializes in high-end residential cleaning, you may need more comprehensive liability insurance to cover potential damage to expensive property. Likewise, if your cleaners enter homes or businesses where theft could be a concern, a janitorial bond is essential.

Pro Tip

Consult with a lawyer or insurance broker to determine the specific types of insurance and bonds your business needs. They can also help you understand complex insurance terms.

Step 2: Compare quotes and providers

Next, research and compare offerings from insurance companies and bonding agencies to find the best coverage. You can look at their websites, use insurance comparison sites like NetQuote, contact insurance brokers, or look up customer reviews.

Companies specializing in insuring cleaning services often have policies that can cover all of your needs. For example, an insurer may offer a package deal that combines general liability and commercial property insurance at a rate that’s lower than the combined rates for separate purchases.

Don’t rush into choosing the first provider you find. Get quotes from several insurance and bonding companies. When comparing prices, consider the coverage limits, deductibles, and exclusions. Also, consider the provider’s reputation for customer service and claim handling.

Pro Tip

“Most states offer online resources and application portals designed to help new business owners navigate the licensing and registration process,” said Pristine Beers, owner of White Lilac Cleaning. If you’re interested in surety bonds, check out the Small Business Administration’s surety bond agency directory or the Bureau of the Fiscal Service’s list of certified companies to find providers.

Step 3: Understand terms

Carefully review each policy and bond’s terms. For instance, make sure that your general liability insurance will cover common hazards like slips and falls. Understanding the fine print can prevent surprises when making a claim.

Choosing the right coverage limits

Coverage limits are the maximum amount your insurance company will pay for a claim. For example, if your general liability insurance has a $1 million limit, the insurer will cover up to $1 million in damages.

Policies with higher limits will pay out more in case of a serious accident, but will also cost more each month.

Understanding insurance deductibles

A deductible is the amount you pay first, before the insurance will cover the rest of the claim. For example, with a $500 deductible, you pay the first $500 in damages, and the insurance company pays the rest.

Policies with lower deductibles mean that you will pay less if something goes wrong, but your monthly payment will be higher. Higher deductibles mean that your monthly payment will be lower, but you’ll pay more for each claim.

Watch for common exclusions

Exclusions are situations that your insurance policy doesn’t cover. Every insurance policy has exclusions. Common exclusions for cleaning businesses are:

- Intentional damage

- Normal wear and tear

- Damage from using the wrong chemicals

Always read the exclusions list to know what’s covered and what risks you’ll be responsible for on your own.

Note: These rules apply mainly to general liability insurance, but coverage limits, deductibles, and exclusions can also apply to other policies like commercial property and professional liability insurance.

Step 4: Apply for policies and wait to be approved

To apply, contact insurers directly or use their online application systems. You’ll need to provide your cleaning company name and detailed information about your operations to secure terms that best fit your business model. Make sure to be accurate with these details. If you give incorrect information or don’t choose enough coverage, your business may not be fully protected. In the worst case, the insurance company can deny your claim completely.

Your application will be assessed based on the risks involved in your business, your past insurance history, and other factors. Be prepared for companies to offer higher premiums, specific exclusions, or even decline your applications. If your application is declined, ask why. Use the answers to make changes to avoid future denials, and reapply for insurance elsewhere.

Pro Tip

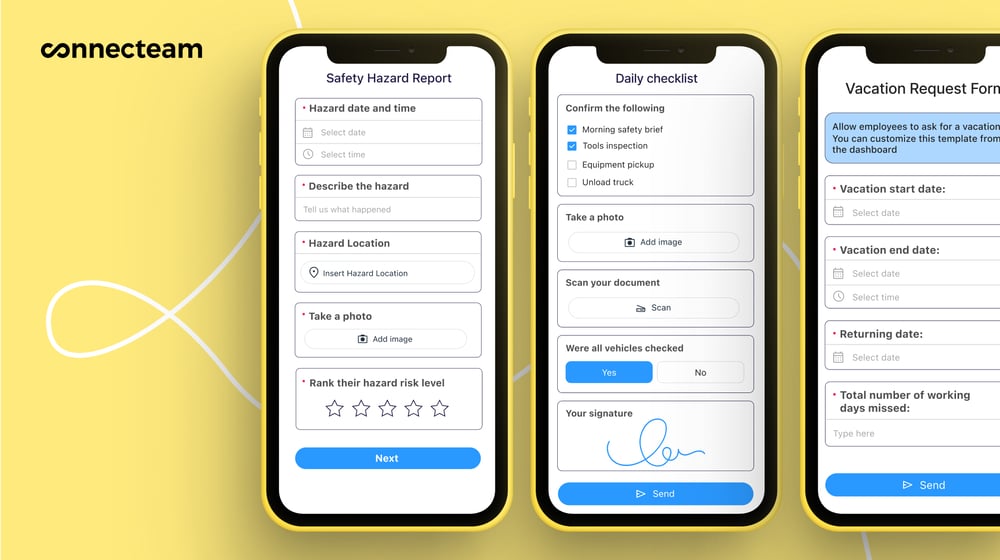

Consider using cleaning business software or janitorial management software to manage and document your team’s tasks and schedules. This is especially helpful when applying for insurance and bonds, as it allows you to accurately report your operational procedures and risk management practices.

Step 5: Finalize and maintain your coverage

Once you’ve chosen your policies and bonds, fill out the necessary paperwork and make the initial payments. Paperwork will include your formal policy agreements and any other documents the provider may need.

Keep your documents organized for easy reference. As your business grows, review your coverage at least once a year to see if it still fits. For example, if you expand into commercial cleaning, you may need to adjust your insurance to cover larger spaces and specialized equipment.

Also, make sure that you get a certificate of insurance as proof of your coverage once you’re approved. You can show it to clients, landlords, or partners who may want to see it.

Pro Tip

Software like Connecteam can help you manage insurance documents and alert you before policies expire. It can also let employees access policy documents in the field, so they’re always ready to address client questions about your coverage.

Try Connecteam for free today.

Secure Your Future With Cleaning Business Insurance

Securing the right insurance and bonds for your cleaning business is essential for protecting your operations, building client trust, and ensuring financial stability.

While costs and requirements may vary, the peace of mind that comes with full coverage is invaluable.

You can also manage risks more effectively by using the right technology to improve your business operations. Using a cleaning app like Connecteam, you can make your daily tasks safer and more efficient, which may help you qualify for lower insurance and bond costs.

Join Connecteam – The Best Cleaning Services App

Try for free todayYes, you must have insurance when starting a cleaning business. Certain types of insurance, like workers’ compensation and commercial auto policies, are required by law. General liability insurance and bonding are essential for demonstrating that your business is professional and building trust with customers.

Insurance costs for a small cleaning business will vary depending on how many employees you have, what kind of equipment your business owns, and what types of cleaning jobs you take on. You should expect to pay around $320-$675 per month.

Most residential cleaners need general liability insurance and a janitorial bond.

If you have employees, you’ll also need workers’ compensation insurance.

If you drive for work, you must have commercial auto insurance.

Yes. Even if you work alone, you need general liability insurance to protect yourself from accidental damage or injuries.

You do not need workers’ compensation unless you hire employees.

Bonds and insurance policies are both essential to run a cleaning business. Bonds protect your customers from damages, while insurance policies protect your business. Many clients will only work with cleaning businesses that are bonded and insured, so plan to get both types of policies.

To stay compliant, you need to:

- Keep employee training up to date

- Maintain safety records

- Store certificates

- Prove your operational procedures

Connecteam offers features for training, document storage, checklists, and scheduling, making it easier to stay compliant without extra paperwork.

Apps like Connecteam let you give employees instant access to cleaning checklists, rules, and step-by-step tasks, helping reduce mistakes that lead to injuries or property damage.

Disclaimer

This article is for general informational and educational purposes only. It is not intended as and does not constitute business, financial, or professional advice, and should not be relied upon as such. Market conditions and business outcomes can vary widely. Before pursuing new services or business strategies, consult with a qualified business advisor for tailored advice based on your business’s circumstances. Connecteam accepts no responsibility for consequences arising from actions taken or not taken based on the information present in this article.