Knowing how much each employee really costs helps you budget smarter, set prices accurately, and make better staffing decisions.

Hiring someone costs more than just their salary. Benefits, taxes, tools, and training can all add up fast.

So, what’s the real cost of an employee?

In this article, we break down how to calculate employee costs, provide a free calculator, and cover hidden costs many businesses miss.

Key Takeaways

- Calculating how much an employee costs starts with salary but also takes into account factors like benefits, payroll taxes, and more.

- It’s important to understand the cost per worker to improve budgeting, price estimates, and employee evaluations.

- The true employer cost for an employee is between 1.25 and 1.4 times the worker’s base salary.

- There are many factors that can affect the total employee cost, like benefits, role type, company size, and more.

- Employers can save on the cost per employee by streamlining their operations.

Why You Should Calculate Employee Costs

Calculating the true cost of an employee is essential for smart business decisions. It gives you a clearer picture of what each hire really means for your budget. An employee’s cost isn’t just their salary, but also benefits, training, tools, and other day-to-day resources.

This insight can help you plan more strategically. When you know what each role costs, it’s easier to decide whether full-time, part-time, or contract work makes the most sense.

You can spot opportunities to cut costs or scale more efficiently. And, it can help you evaluate employee performance by comparing their output or impact.

It also plays a key role in pricing. By factoring labor into your cost structure, you can price your products or services in a way that supports profitability, without guesswork.

What Impacts Employee Costs?

Employee costs are shaped by many factors, some of which are internal to your company, while others are driven by market or industry conditions. Understanding these factors is key to calculating true cost and making smarter staffing decisions.

Taxes

Employers must pay taxes based on employee wages, including Social Security, Medicare, and state unemployment taxes. These vary by location and are paid to federal and state governments.

Check the IRS website for federal tax rates and your state’s tax office for local requirements.

Did You Know?

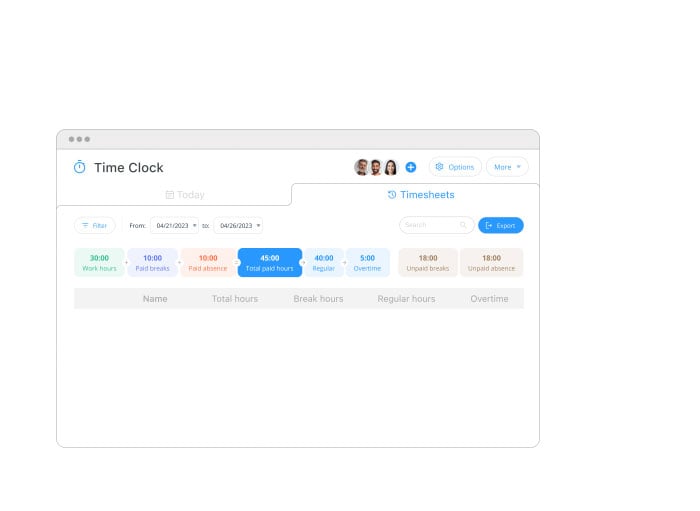

Connecteam makes it easy to track time, manage payroll, and control staffing costs. With automated timesheets and integrations with Quickbooks, Gusto, Xero, and Paychex, you can ensure your team gets paid accurately without the hassle.

Start using Connecteam for free today!

Employee benefits

Benefits like health insurance, retirement plans, PTO, and other perks significantly add to total cost. To calculate average benefit cost per employee:

Total benefits cost ÷ Total number of employees = Per-employee benefit cost

Keep in mind these are ongoing expenses that usually renew annually.

Location

Where your employees work can affect salaries, benefits, and legal obligations. For example, living costs in Los Angeles are nearly 30% higher than in Denver, meaning you may need to offer more competitive compensation in some regions.

This Might Interest You

Learn how to adjust salary bands across locations with our guide to geographic pay differentials.

Market conditions

The hiring market changes over time. In tight labor markets, it’s more likely you’ll need to offer higher pay or stronger benefits to attract talent. In more competitive job markets for employers, costs may decrease.

Industry

Expectations around pay and perks vary widely by industry. Some industries offer full employer-paid insurance and perks like gym memberships, while others offer minimal extras. Industry norms will shape what your compensation package looks like.

Role type

More senior or specialized roles typically come with higher pay and benefit expectations. These positions also require longer, more resource-intensive hiring processes. Roles with overtime eligibility (hourly or hybrid positions) can also lead to higher costs, especially without proper time tracking or oversight.

Connecteam is the #1 Employee Management App

Stay on top of payroll, scheduling, communication, and more all while on the go.

Company size

Larger companies often benefit from spreading costs like software, IT, and admin support across more employees. This can lower the per-employee cost compared to smaller businesses.

Pro Tip

Opt for a software solution with affordable, scalable plans. Connecteam’s pricing starts with a 100% free plan for businesses with up to 10 employees and includes additional plans to support organizations of all sizes.

Recruitment

Hiring a new employee comes with internal and external costs. Internally, that includes the time your HR team and hiring managers spend reviewing resumes and conducting interviews. Externally, it could include job ads, recruiter fees, background checks, and referral bonuses.

These expenses can add up quickly, especially if you’re hiring often or for hard-to-fill roles.

Pro Tip

Using the right digital platform, you can significantly reduce onboarding and training costs.

Connecteam’s training tools make onboarding faster and more affordable. You can create custom training courses, assign them by role, and track progress, all in one app.

Get started with Connecteam today!

Overhead

These are general business expenses that support employees indirectly. They include:

- Rent and utilities

- Office supplies and/or uniforms

- Equipment

- Business software (HR, payroll, communications)

Turnover

High turnover increases total employee costs. It probably means you’re constantly paying for recruiting, onboarding, and lost productivity.

How to Calculate the True Cost of an Employee

A widely used formula from MIT senior lecturer Joseph Hadzima estimates that the true cost of an employee is 1.25 to 1.4 times their base salary. This range accounts for payroll taxes and standard benefits.

To estimate an employee’s cost, multiply their base salary by 1.25 and 1.4:

- Base salary × 1.25 = Employee cost

- Base salary × 1.4 = Employee cost

For example, if a new hire earns $45,000:

- $45,000 × 1.25 = $56,250

- $45,000 × 1.4 = $63,000

Their total cost likely falls between those two numbers.

This formula also works for hourly employees. If someone earns $20/hour:

- $20 × 1.25 = $25/hour

- $20 × 1.4 = $28/hour

This gives you a quick, reliable range. Just keep in mind that it doesn’t include other expenses like recruiting, training, equipment, or office space.

Employee cost calculator

Use our free Employee Cost Calculator in “Advanced” mode to simplify the process by calculating salary, payroll taxes, and extra costs like overtime, benefits, and supplies:

Employee Cost Calculator

Basic Details

Additional Costs

Yearly Labor Cost: $0

Monthly Employee Labor Cost: $0

The Bottom Line

The true cost of an employee goes beyond salary. From benefits and taxes to training, location, and turnover, it all adds up. Understanding these costs helps you budget smarter, price your services right, and make better hiring decisions.

With tools like Connecteam, you can track hours, manage payroll, and control staffing costs more easily, so you always know where your money’s going.

Connecteam also offers a Small Business Plan, which is completely free for up to 10 users.

FAQs

What is the real cost of having an employee?

In most cases, the real cost of an employee is 1.25 to 1.4 times their base salary. This accounts for payroll taxes, benefits, training, tools, and overhead. For example, a $50,000 salary could mean a total cost of $62,500 to $70,000 once all expenses are factored in.

Is it cheaper to keep an employee or hire a new one?

Keeping an employee is almost always more cost-effective. Replacing someone means paying for recruiting, onboarding, and the time it takes for them to reach full productivity — all of which can cost thousands of dollars and disrupt operations.

How to calculate the value of an employee?

To measure value, compare their total cost to their measurable output. This could include revenue generated, productivity metrics, or cost savings. Also consider non-quantifiable contributions like leadership, teamwork, innovation, and customer satisfaction.

What percentage should an employee cost?

For most U.S. companies, payroll makes up 15% to 30% of gross revenue. The percentage varies by industry, location, and business model. Highly labor-intensive industries like hospitality or construction may be at the higher end, while capital-heavy industries may be lower.

How much does it cost to replace an employee?

According to the Society for Human Resource Management (SHRM) the average cost per hire is about $4,700. However, when you factor in lost productivity and the time managers spend hiring and training, the real cost can reach three to four times the position’s salary — especially for specialized or senior roles.