Payroll software is a key business tool that helps businesses automate payroll processes. It can boost efficiency, reduce payroll errors, and improve compliance.

Getting your team paid shouldn’t feel like a full-time job. But if you’re chasing timesheets, calculating overtime, and trying to stay compliant with ever-changing award rates, it quickly can.

For small Aussie businesses—especially those with shift workers or teams out in the field—the right payroll software can save serious time, reduce errors, and keep you compliant.

Here are 6 top tools to help you run payroll with confidence.

Our Top Picks

-

1

Best all-in-one payroll software

-

2

Good for small teams

-

3

Good for Australian businesses that want reliable payroll via accounting software integration

Why trust us?

Our team of unbiased software reviewers follows strict editorial guidelines, and our methodology is clear and open to everyone.

See our complete methodology

What to Look for in Payroll Software for Small Businesses

Here are the key features I looked out for in standout payroll solutions:

Must-have features

- Digital timesheets. Built-in time clocks or integration with time-tracking software ensures timesheets for payroll are current and accurate.

- Security features. Pay and other sensitive data should be protected with encryption, user controls, passwords, and secure data storage.

- Payroll processing and tax management: The software should accurately process payments and manage deductions for taxes and benefits

- Compliance management. Good payroll software should help ensure compliance with Australia’s award rates and national and territory-specific tax regulations—by automatically updating to reflect tax changes and updates to employment law or enabling you to easily customise your settings. Ideally, it should offer single touch payroll (STP) reporting to streamline processes.

- Customisable pay types. Flexibility in payment options makes it easy to pay employees via their preferred method—direct deposit or cheques. It should also handle different rates of pay, like bonuses, overtime, or commission structures.

- Employee self-service portal. The tool should enable workers to view their pay stubs, tax forms, and benefits information online—and they should be able to update their personal details and banking information.

I also made sure the software is:

- Affordable and scalable. The software should be reasonably priced and grow proportionally with the size of your business.

- Easy to use. There shouldn’t be steep learning curves that cause unnecessary stress and delays.

- Mobile accessible. Responsive design or a dedicated mobile app ensures that employees and payroll administrators can access their information and perform necessary tasks from anywhere.

Finally, I checked for features that make payroll software great:

- 24/7 support. Instant access to support prevents hold-ups to payroll processing.

- Integrations with other tools. The option to integrate with a range of tools—from scheduling to time off management tools—means smoother workflows, less data entry, and fewer errors.

The 6 Best Payroll Software for Small Businessess

-

Sage Payroll — Best all-in-one payroll software

Available on

- Web

- iOS

- Android

Sage Payroll is an online payroll service that includes various payroll management functions, from budget management to bulk reporting to overtime processing.

Why I chose Sage Payroll: I like how Sage Payroll combines all the crucial components of payroll management into one easy-to-use platform and offers a range of integration options with other well-known systems.

Automatic payroll processing

I appreciate that Sage Payroll reduces admin: You can automatically run payroll based on the data stored in the system, ensuring everyone is paid accurately and on time. Simply check your team’s worked hours (which you can track through Sage), make sure there aren’t any discrepancies, and let Sage do the rest.

Sage Payroll is also STP compliant, meaning it automatically reports your payroll info directly to the ATO every pay run. It handles PAYG (Pay As You Go) withholding and superannuation contributions—and even takes care of leave entitlements in line with the Fair Work Act. Plus, it’s updated regularly to stay compliant with changes to modern award rates and other legislation.

With the self-service tools, employees can access their payslips, update their details, and track leave balances without needing to chase down HR or payroll.

One big issue? Tons of users have issues accessing the app and their payslips.

Time off management

Sage Payroll’s time off management allows employees to track and request any paid time off. This includes annual leave, sick pay, parent pay, and any other types of leave you might offer. I appreciate how this means that any leave taken is accurately reflected in payroll calculations, eliminating discrepancies and manual adjustments.

Built-in communication tools

Sage Payroll’s built-in communication tools make it easy to keep your team up to date on payroll topics and more. You can easily share business updates and send reminders to your employees. Employees can also add comments to posts, encouraging 2-way communication and helping you identify any issues in your workplace.

That said, I wish Sage Payroll offered a dedicated in-app chat. While the ability to comment on posts is great, direct messages are often more efficient for quick back-and-forth conversations—especially concerning sensitive payroll-related information.

First-class integration options

Sage Payroll offers integrations with a range of high-quality business software, including accounting software like Gusto and operations tools like Zapier or Clarity Connect.

What users say about Sage Payroll

Excellent. Couldn’t work without it.

Read user review here.

The software is good. Except for small things like deleting cycles or companies. BUT the accounts department are shocking.

Read user review here.

Key Features

- Automated payroll runs

- Time-tracking and timesheets

- Time off management

- Australian compliance features

Pros

- Free-to-use knowledge base

- Employee self-service tools

Cons

- Issues opening the app and accessing payslips

- Limited customer support

Pricing

Starts at $8/month Trial: Yes Free Plan: No

-

Gusto — Good for small teams

Gusto is a popular and comprehensive cloud payroll tool suited for small and growing businesses.

Why I chose Gusto: I like its seamless payroll functionalities. I particularly appreciate the clean, clear look of its timesheets, which were accessible to me when I used a screen reader.

Here are a few of its features:

Payroll processing and reporting

You can easily run your payroll from the data collected on employees’ timesheets. All you must do is check them, manually adjust them (if necessary), and send them for processing. You can even set payroll processing to AutoPilot—Gusto’s automated payroll feature that ensures employees get paid on time without you needing to lift a finger.

You can run payroll as many times as necessary per month at no extra charge. I really appreciate this, as some businesses have employees on different pay cycles or must process off-cycle payments for things like bonuses or reimbursements. Not having to worry about extra fees for additional payroll runs is a big win.

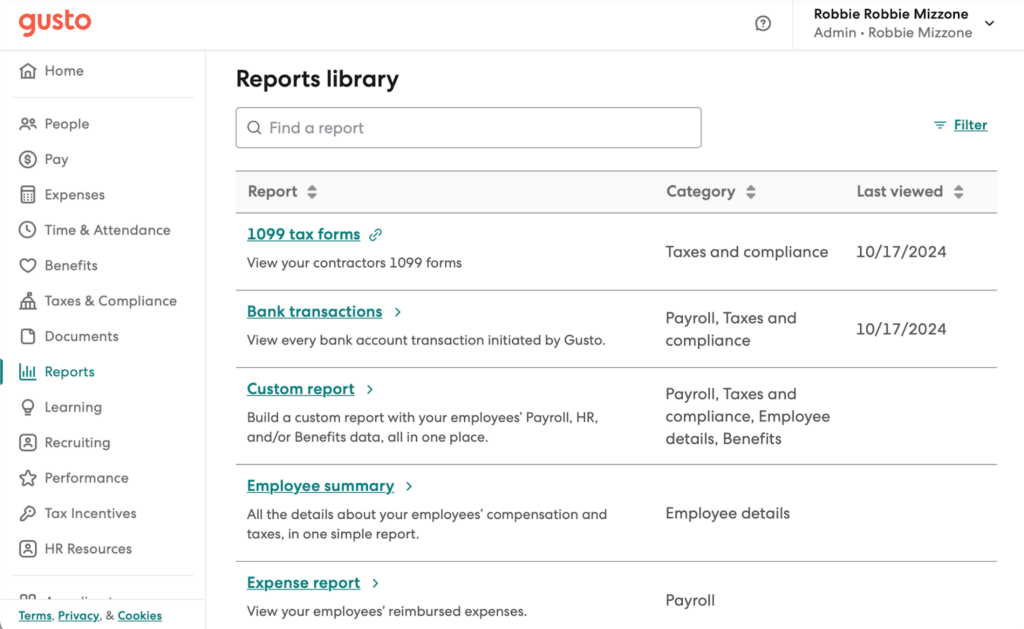

Gusto also lets you quickly download tax documents, bank transactions, and expense reports—and create custom reports as necessary. This gives you complete oversight of your finances.

The “Reports library” lists available payroll reports. Time tracker

Gusto offers a built-in time tracker through the mobile app. Employees can clock in and out with the touch of a button, and Gusto shows summaries of hours worked during specific days and pay periods. Once an employee has clocked out, they can quickly submit their hours to their timesheet, which can be fed straight into the payroll system.

I like how if an employee forgets to clock in, managers and supervisors can submit worked hours on an employee’s behalf. This is much easier than chasing down an employee to manually change their hours. Employees can also backdate shifts if necessary.

Gusto also integrates with stronger time-tracking solutions. I’m especially fond of the Connecteam integration. Its GPS time-tracking tools are perfect for small businesses with mobile or field-based teams—like tradies, security firms, or cleaning crews—where verifying clock-ins by location helps reduce timesheet fraud and payroll errors..

A major drawback of Gusto? It doesn’t offer break or overtime reminders, meaning employees could breach overtime or labour laws if they aren’t diligent about clocking out on time.

Built-in security

Gusto’s mobile app offers advanced security features like data encryption, 2-factor authentication, and system backups in case of disaster. It’s fully compliant with the Australian Privacy Act of 1988 and updates its SOC reports annually.

What users say about Gusto

Seamless, easy to use, one of my favorite tools. Transparents, saves employee documents, shows if handbooks are read etc. Really great!

Read user review here.

Significant issues handling state tax filings and communication.

Read user review here.

Key Features

- Mobile app

- Built-in time clock

- Payroll reporting

- Performance tracking

Pros

- Free plan

- Handy FAQ section

Cons

- Limited security options

- No 24/7 helpline

Pricing

Starts at $40/month + $6/person/month Trial: No Free Plan: No

-

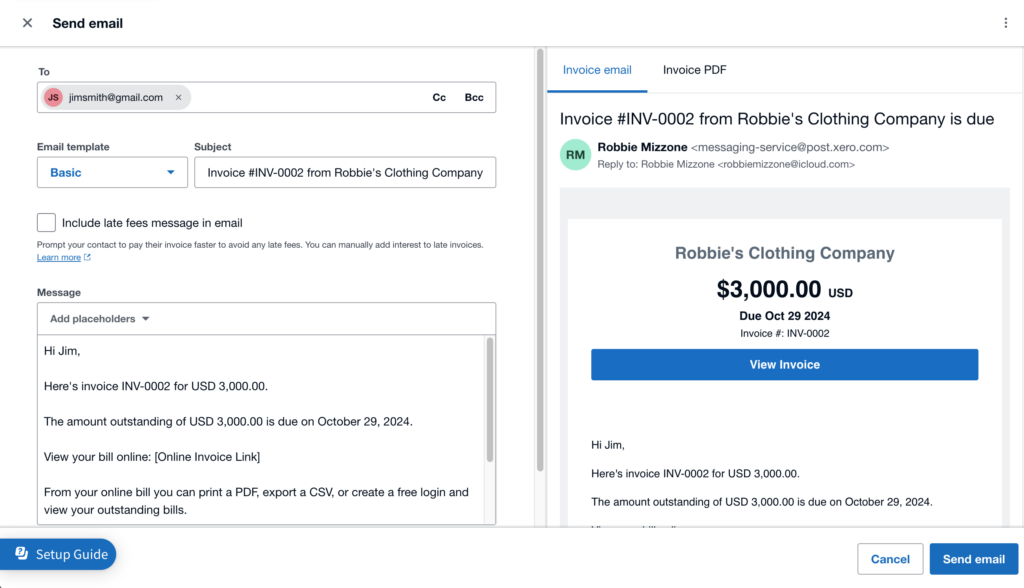

Xero — Good for Australian businesses that want reliable payroll via accounting software integration

Xero isn’t a payroll platform in the strictest sense—but it’s still a great choice for Australian businesses that want to manage payroll as part of a broader accounting solution. Instead of offering built-in payroll, Xero integrates seamlessly with payroll platforms like Gusto, allowing you to automate pay runs, calculate superannuation and taxes, and handle leave balances—while keeping everything synced with your general ledger and financial reports.

Why I chose Xero: I value its advanced general ledger controls, easy invoicing, and how well it connects to payroll software. It’s a practical option if you want to centralize accounting and payroll without juggling multiple disconnected tools.

Here are some of its other core features:

Simple, Compliant Payroll for Aussie Teams

Xero includes built-in payroll features designed specifically for Australian businesses. It can calculate PAYG withholding, superannuation, and leave entitlements automatically, helping you stay compliant with local tax and labor laws. You can also set up a custom payroll calendar and apply special rates—like penalty rates for public holidays—directly within the platform.

Your team can use the Xero Me app to view payslips, submit timesheets, and request leave, streamlining admin for both employees and managers. I found this self-service feature especially helpful for reducing back-and-forth and improving accuracy.

However, Xero doesn’t include employee time tracking or scheduling—so to run payroll efficiently, you’ll need to connect it with other tools.

That’s why I especially appreciate how well Xero works with Connecteam—you can track employee hours, manage rosters, and handle team communication all in one place, with timesheet data syncing directly into Xero for smooth payroll processing.

Expense and invoice tracking

Xero’s accounts and invoice tracking is a standout feature for businesses that need to keep a close eye on cash flow. You can automate recurring invoices, set payment reminders, and even match payments to bank transactions, making it easier to manage your accounts receivable.

Send client invoicing emails directly from Xero. Additionally, Xero allows businesses to scan and upload receipts, ensuring expenses are properly recorded and reducing manual data entry. I really appreciate this feature, especially when your team is working off-site or traveling for work.

Mobile app

Xero’s handy mobile app means you can keep up with your accounting on the go, issuing statements, tracking expenses, and managing invoices wherever you are. This is great for managers who need constant oversight of spending or must upload receipts from multiple sites.

It also offers 2-factor authentication, regular security audits, and biometric identification.

What users say about Xero

I recently had an excellent experience using Xero, both in terms of its functionality and the support provided by their team.

Read user review here.

Horrible invoicing…This new version is costing business so much time.

Read user review here.

Key Features

- Send and receive payments

- Create and store invoices

- Manage payroll directly

- Track current projects

Pros

- 30-day free trial

- Easy-to-use mobile app

Cons

- No employee scheduling tools

- No in-app chat

Pricing

Stats at $25/month Trial: Yes — 30-day Free Plan: No

-

QuickBooks Online — Good for those new to payroll

QuickBooks Online is another accountancy software with added HR management tools for those needing an easy-to-use payroll system.

Why I chose QuickBooks Online: I appreciate its tax calculation guarantee. This is invaluable to those just getting started with payroll calculations and will help businesses avoid costly tax mistakes. Automated payroll processing also saves time, making it easier to manage employee wages without extensive payroll expertise.

Straightforward payroll

QuickBooks Online integrates with QuickBooks Time to combine time-tracking and payroll processing, making payroll processes quick and streamlined.

Your team can track worked hours by clocking in and out through the mobile app and submitting their hours to their manager, who can then approve them—all through the app. I like how streamlined the process is for deskless workers.

The system uses the time data to create digital timesheets and payslips, which QuickBooks Online automatically processes for payroll. This means fewer manual calculations and a lower risk of errors, which is a huge plus for small businesses that don’t have dedicated payroll teams.

One downside? QuickBooks Time’s overtime tracker doesn’t always work.

Luckily, the Connecteam-QuickBooks integration adds powerful overtime tracking—something QuickBooks Time lacks—plus scheduling, task management, and mobile communication tools. It’s ideal for compliance-heavy industries like healthcare or transport.

HR support

For those new to management, QuickBooks Online offers dedicated HR support to help you manage your team. QuickBooks Online has teamed up with Mineral Inc., giving you access to a range of professional HR advisors, each with specific expertise and industry knowledge to guide you through complex HR issues. It’s great for when you have a quick question or just need a little backup.

Complete security for inexperienced managers

I adore the 100% accurate tax calculation guarantee. If the QuickBooks team calculates your tax obligations incorrectly, they’ll deal with the ATO on your behalf and pay up to $25,000 to cover the cost of the penalty.

What users say about Quickbooks Online

Friendly agents who listen to the query and then clearly explain the resolution.

Read user review here.

My experience with QuickBooks has been nothing short of a nightmare.

Read user review here.

Key Features

- Automatic tax calculations

- time-tracking

- Access to HR advisors

- Mobile app

Pros

- 100% accuracy guarantee

- Dedicated HR support

Cons

- Reports of poor customer service

- No free plan

Pricing

Starts at $38/user/month Trial: Yes — 30-day Free Plan: No

-

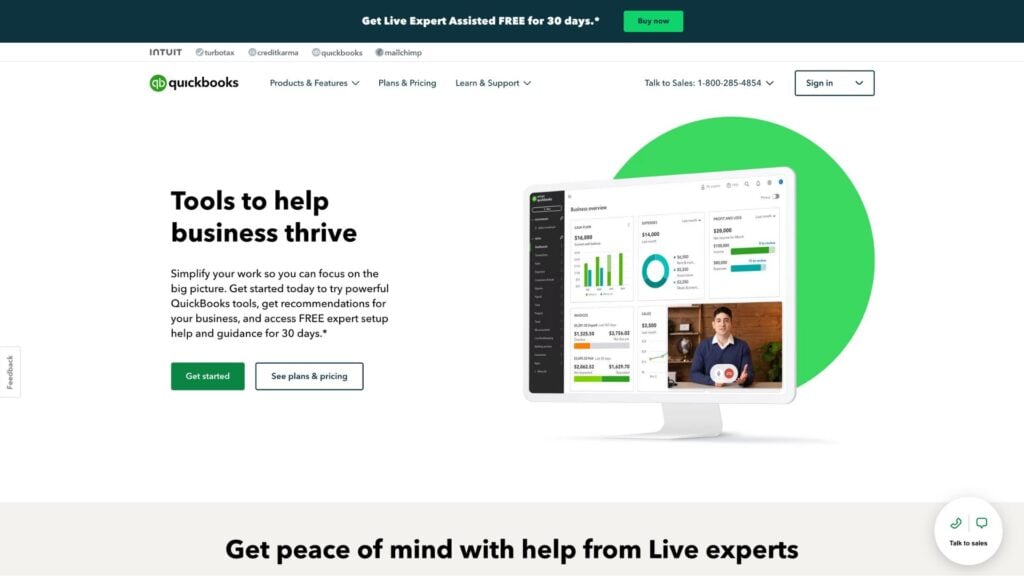

KeyPay — Good for those who struggle with compliance

Available on

- Web

- iOS

- Android

- Windows

- Mac

KeyPay is an all-in-one, cloud-based payroll software focused on improving compliance and saving manager time.

Why I chose KeyPay: I picked KeyPay for its handy automation features—once it’s set up, it pretty much runs itself.

Automated compliance

KeyPay automatically manages your tax, pension, and leave calculations, so you don’t have to worry about keeping up with ever-changing regulations. It’s a real time saver, especially for those brand new to payroll calculations.

What’s more, KeyPay can auto-enroll employees with your chosen payroll provider when they become eligible. That means there’s no need to manually set each new starter up with their pension.

However, the lack of transparent pricing might be a bit frustrating if you’re trying to compare options upfront.

Automated pay runs

KeyPay lets you set up automated pay runs, so once you’ve configured your payroll settings, it processes salaries without manual input. This feature is especially useful for businesses with consistent pay structures, reducing the risk of errors and saving valuable admin time.

I appreciate that KeyPay offers a warning and notification system as part of this automation. You can choose which errors you want to be notified of—for example, if an employee hasn’t received any pay, if there are pending leave requests, if bank account details are missing, etc.—so you’re always in the loop if something needs your attention.

Schedule management

KeyPay’s schedule management tools allow you to create schedule templates, copy pre-built schedules, and build schedules by budget or headcount. You can quickly compare schedules to hours worked to ensure no one is clocking out before they’re supposed to, and you can easily notify employees of schedule changes by email, text, or push notification.

Unfortunately, there’s no time clock tool with KeyPay. However, managers and employees can enter their start and end times on KeyPay’s separate mobile app, WorkZone. They can also enter break times and overtime hours directly through the app. I wish there was a better method of time-tracking, as this method relies on employee honesty and diligence—and could lead to inaccuracies in recorded hours.

That said, I like the warning notification system, which highlights when employees have hit their maximum working hours, have missed a break, or are scheduled for a shift that conflicts with their leave. It’s a great way to catch issues before they become problems.

What users say about KeyPay

Great payroll solution. Compliances are always up to date, making it a hassle free option for payroll needs.

Read user review here.

The most important aspect to me was the ability to set up the payroll to accrue and pay annual leave correctly as per the NZ Holidays Act. I was unable to get my one employee set up to my satisfaction.

Read user review here.

Key Features

- Self-service employee portal

- Automatic scheduling

- Employee autopay

- Reporting tools

Pros

- Award-winning tool

- Multiple integration options

Cons

- No pricing structure on website

- No in-app chat

Pricing

Contact vendor for price Trial: No Free Plan: No

-

MYOB — Good for growing businesses

MYOB is a scalable, mobile-first accounting tool intended for growing businesses.

Why I chose MYOB: I like MYOB for its mobile-first approach to payroll and invoicing.

Here are some of its features:

Timesheet management

MYOB offers a range of timesheet management tools that employees and managers can access from their phones. For example, a built-in time clock allows employees to clock in and out from anywhere. Plus, managers can see when an employee has clocked in and out, ensuring there are no discrepancies in hours worked.

What’s more, employees can view their schedules, timesheets, current banking details, and payroll history directly from the app, giving them full transparency and making it easier for them to stay on top of their hours and payments. It cuts down on back-and-forth emails and helps everyone stay on the same page.

Single touch payroll

MYOB’s STP reporting means you can generate full payroll reports with all hours paid, tax obligations, and superannuation details in one go. It syncs directly with the ATO so everything is compliant and submitted on time.

Employees can also DIY their onboarding through the app, inputting their personal details like addresses, dates of birth, and bank details. This reduces admin for your HR team and puts employees back in control of their data. MYOB also integrates with employee communication tools. I really like the Connecteam integration because it fills in MYOB’s gaps by adding all-in-one team management features like mobile scheduling, real-time communication (in-app chat, updates feed), GPS time tracking, and a self-service help desk.

Account management

MYOB allows managers to send invoices, track cash flow, manage payroll budgets, and handle tax calculations all in one place. This can be done via the web kiosk or mobile app.

Vendors can also pay invoices directly into the company account using the “pay now” button, preventing the need for manual transfers.

What users say about MYOB

The report section of MYOB is very easy and familiar. By clicking on any report we can see detailed report, also we can customise as per requirement.

Read user review here.

Read user review here.

Key Features

- Timesheets

- Expense reporting

- Cash flow management

- Payroll

Pros

- Free trial

- Mobile first approach

Cons

- No free plan

- No FAQ section

Pricing

Starts at $34/month + $2 per user Trial: Yes Free Plan: No

Compare the Best Payroll Software for Small Businessess

| Topic |

|

|

|

|

|

|

|---|---|---|---|---|---|---|

| Reviews |

4.8

|

4.6

|

4.4

|

4.3

|

4.4

|

3.8

|

| Pricing |

Starts at $8/month

|

Starts at $40/month + $6/person/month

|

Stats at $25/month

|

Starts at $38/user/month

|

Contact vendor for price

|

Starts at $34/month + $2 per user

|

| Free Trial |

yes

|

no

|

yes

30-day

|

yes

30-day

|

no

|

yes

|

| Free Plan |

no

|

no

|

no

|

no

|

no

|

no

|

| Use cases |

Best all-in-one payroll software

|

Good for small teams

|

Good for Australian businesses that want reliable payroll via accounting software integration

|

Good for those new to payroll

|

Good for those who struggle with compliance

|

Good for growing businesses

|

| Available on |

Web, iOS, Android

|

Web, iOS, Android, Windows, Mac

|

What Is Payroll Software for Small Businesses?

Payroll software helps you pay employee wages and manage employee details. Good payroll software also includes tools to help you manage timesheets, track payroll spending, and handle tax compliance. The best payroll software for Australian businesses will offer features or support that help users to comply with Australian modern award and tax laws.

This payroll software is designed to be simple, affordable, and scalable. Tools that offer a free-to-use plan or free trial are especially great for small businesses, allowing you to try before you buy and ensure the tool meets your needs before committing.

How Does Payroll Software for Businesses in Australia Work?

Payroll software works by calculating how much pay is owed to your employees through their wage data and timesheets, which are pre-created, generated in the app, or uploaded from third-party software. The software removes any deductions or taxes that must be applied (like superannuation contributions) from computed wages. It then sends your employees’ pay to their bank accounts (or uses other methods), ensuring your team receives the correct amount on paydays.

Most payroll software also offers digital payslips so employees can easily access their payment details without extra paperwork.

In addition, payroll software integrates with your accounting software to make tracking payroll expenses seamless and ensure everything balances correctly at the end of the month.

The Benefits of Payroll Software for Small Businesses

There are several benefits to using payroll software for small businesses.

Saves time

There’s no need to manually create timesheets, calculate salaries, manage deductions, and report all this to the ATO. Instead, this software helps automate these processes, freeing you up to complete more important tasks.

Reduces errors

Manual payroll processing increases the risks of making miscalculations, missing deductions, or even paying employees the wrong amount. With payroll software, calculations are done automatically, ensuring greater accuracy and fewer costly mistakes. This also keeps employees happy.

Ensures compliance

Payroll compliance in Australia isn’t optional. Failing to correctly apply modern award rates, miscalculating overtime, or missing Single Touch Payroll (STP) deadlines can result in fines from the Fair Work Ombudsman or the ATO. Good payroll software reduces these risks by keeping your settings aligned with current laws.

Improves record keeping

Payroll software improves record-keeping by storing a backup of all payroll-related data in a secure, easily accessible format. This eliminates the need for manual filing and ensures you have up-to-date records for audits.

Enhances security

Features like two-factor authentication (2FA), biometric login, password protection, and encryption ensure that sensitive payroll data is kept secure. You can also restrict access to authorised personnel only, protecting your employees’ personal information from unauthorised access or breaches.

Increased efficiency

Payroll software processes your payroll automatically, meaning you can use your time more efficiently and focus on other crucial business tasks.

How Much Does Payroll Software in Australia Cost?

Payroll software can cost anywhere between $2 for 1 user and $49 per month for multiple users. There are usually additional costs for extra users. Some tools offer free trials, introductory prices, or free-to-use plans, which are invaluable for small businesses or those just getting started or hoping to scale.

FAQs

You can manage payroll yourself for free. However, it’s time-consuming and leaves your business open to errors and compliance risks. Choosing an affordable payroll solution can save you money and time.

You don’t need an accountant to do payroll. All you need is good payroll software and a basic understanding of payroll obligations.

The Bottom Line On Payroll Software for Small Businesses

Small businesses in Australia benefit from using payroll software to improve compliance, free up administration time, and reduce the risk of errors.

Of the best payroll software in Australia, I like Sage for its STP reporting, Gusto for its security features, and Xero for its invoice tracking. QuickBooks is another great option with strong integrations. And I appreciate KeyPay and MYOB for their compliance features.

The best choice will depend on your needs—but my advice is to pick a solution with good integrations. For example, Gusto, Xero, and QuickBooks all integrate with Connecteam, my favourite workforce management platform for mobile teams.

If your team works off-site, in shifts, or across multiple job sites, consider pairing your payroll system with a workforce management tool like Connecteam. From GPS-tracked time clocks to mobile scheduling and team chat, it helps keep everything in sync—saving time and ensuring your payroll is accurate, every time.