Affordable online accounting software with efficiency-enhancing features and easy invoicing.

Verdict: 8/10

Xero is an online accounting software solution designed for businesses of all sizes and industries, though certain project management features make it especially suited to service-based contracting businesses with multiple clients and jobs.

I found Xero impressive due to its advanced general ledger controls and easy invoicing and billing, which can be handled directly from the software. It’s also significantly cheaper than competitors. Plus, its deep integration with Gusto means you can use it for easy payroll.

While Xero excels in financial management, it has some limitations. Its customer support is limited to a single, email-based channel, and parts of its interface feel outdated. For businesses seeking employee management features like time tracking or communication, Xero’s integration with Connecteam offers a powerful solution. Connecteam streamlines time tracking and workforce communication, bridging the gap and enhancing Xero’s capabilities.

Key Features:

- General ledger control: Manage overall company transactions.

- Project time tracking: Track time spent on individual projects/jobs.

- Invoicing & bill pay: Send invoices and pay bills directly from Xero.

- Contacts: Keep an organized list of suppliers and customers.

- Payroll integration: Seamlessly connect with Gusto for easy payroll processing.

Pros

- Advanced, functional general ledger

- Streamlined invoicing and bill pay

- Low-cost plans

- Excellent mobile app

Cons

- Interface feels dated

- Not HIPAA-compliant

- Limited customer service channels

- No built-in employee time tracking

Xero Pricing

| Plan | Early | Growing | Established |

| Price and users | $15/month Unlimited users | $42/month Unlimited users | $78/month Unlimited users |

| Features | • Send quotes and 20 invoices per month • Enter 5 bills per month • Reconcile bank transactions • Capture bills and receipts with Hubdoc • Short-term cash flow and business snapshot • W-9 + 1099 management • Sales tax management | Everything in Early • Unlimited invoices • Unlimited bill entry • Bulk reconcile transactions • Inventory Plus (optional add-on not available under the Early plan) | Everything in Growing • Use multiple currencies • Track projects • Claim expenses • Analytics Plus (optional add-on not available under the Early or Growing plans) |

Xero’s pricing structure is straightforward, with 3 plan sizes and no limit to how many users can access the software.

The Early plan is the cheapest option, containing most core accounting features—but limiting users to 20 invoices and 5 bills per month. The Growing and Established plans are geared toward larger organizations, with unlimited invoices and bills, plus extra add-ons like Inventory Plus and Analytics Plus.

After some digging, I found that Xero doesn’t offer the typical discounted, annual subscription—the company charges on a monthly basis only. A free 30-day trial is available for all 3 plans, in addition to a 95% discount for the first 3 months.

I found Xero’s pricing to be really cheap compared with most of its competitors, especially for businesses with multiple accountants.

For example, QuickBooks’ Plus plan—the mid-range option—is more than double the cost of Xero’s Growing plan, and FreshBooks costs even more since it charges an extra $11 per month for each additional user.

| Team size | Xero (Growing) | QuickBooks (Plus) | FreshBooks (Premium) |

|---|---|---|---|

| View pricing | View pricing | View pricing | |

| 1 Users | $55/mo | $115/mo | $65/mo |

| 3 Users | $55/mo | $115/mo | $87/mo |

| 5 Users | $55/mo | $115/mo | $109/mo |

| 10 Users | $55/mo | $350/mo (Advanced Plan + 5 users at $15/user) | $164/mo |

Verdict: 9/10

Xero Usability & Interface

I found Xero’s interface to be only reasonably satisfactory—both in terms of look and navigation. In general, accounting software has a steep learning curve because of the complexity of its functions—but even still, Xero’s software leaves something to be desired.

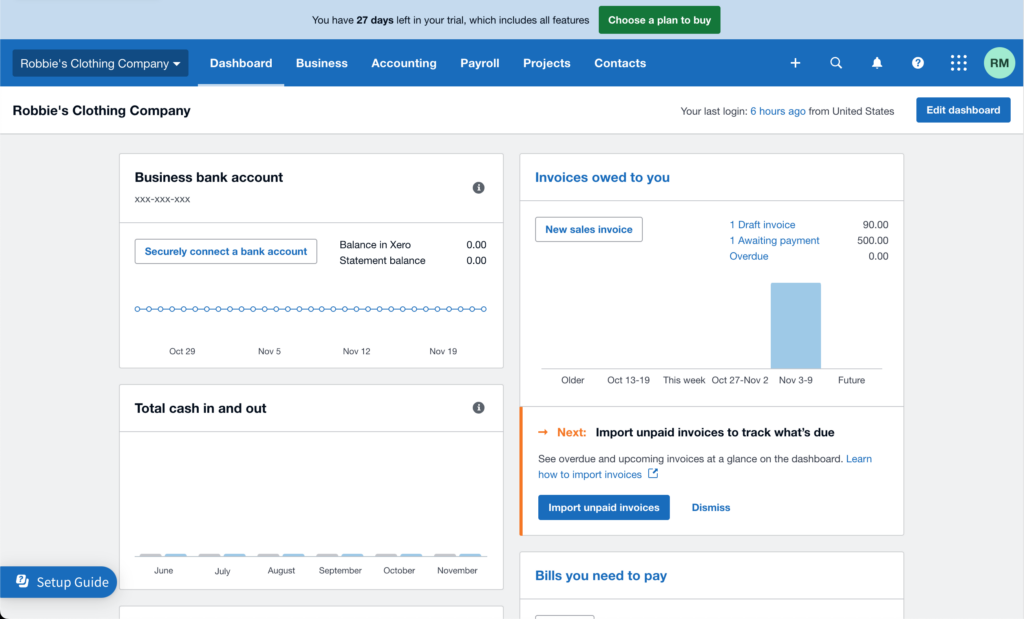

The main dashboard is well designed, with the main menu bar running across the top. The color theme is blue and white, and fonts are simple.

Upon logging in to Xero, you’ll be presented with some snapshots of your business’s financial health, such as your bank balance, owed invoices, cash in and cash out, upcoming bills, and more. This is really helpful for getting some immediate insights into your business’s financial performance.

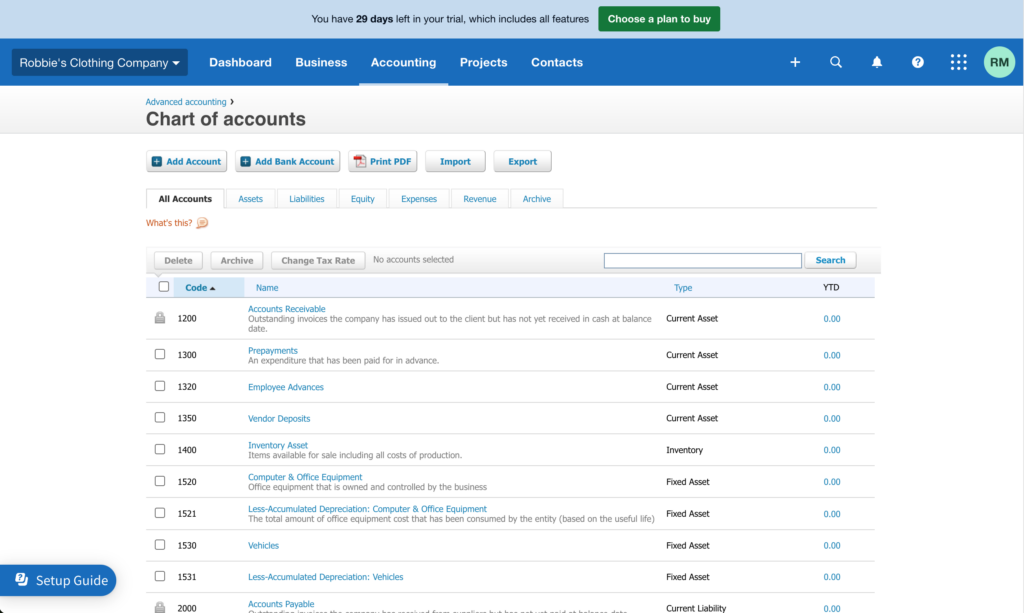

However, I was somewhat disappointed when I clicked onto the “Chart of accounts” page.

This page felt very dated—it looked totally different than Xero’s other pages. The chart of accounts is essentially your business’s central accounting hub, where you can view assets, liabilities, and equity, as well as add and code new accounts. It’s a page accountants must frequently access, which is why I was disappointed to see it looking so neglected.

Xero’s overall navigation is relatively intuitive—I found that buttons and access to sub-menus were generally located where I expected them to be. That said, I did have to Google answers for some pretty straightforward tasks—for example, integrating with Gusto and finding the customer support portal—which I’ll discuss more in later sections.

Xero prioritizes accessibility for users that may have disabilities. The company claims to “substantially” conform to WCAG (Web Content Accessibility Guidelines) by conducting audits of the software with accessibility tools like VoiceOver, TalkBack, NVDA, and JAWS.

Verdict: 6/10

Mobile app

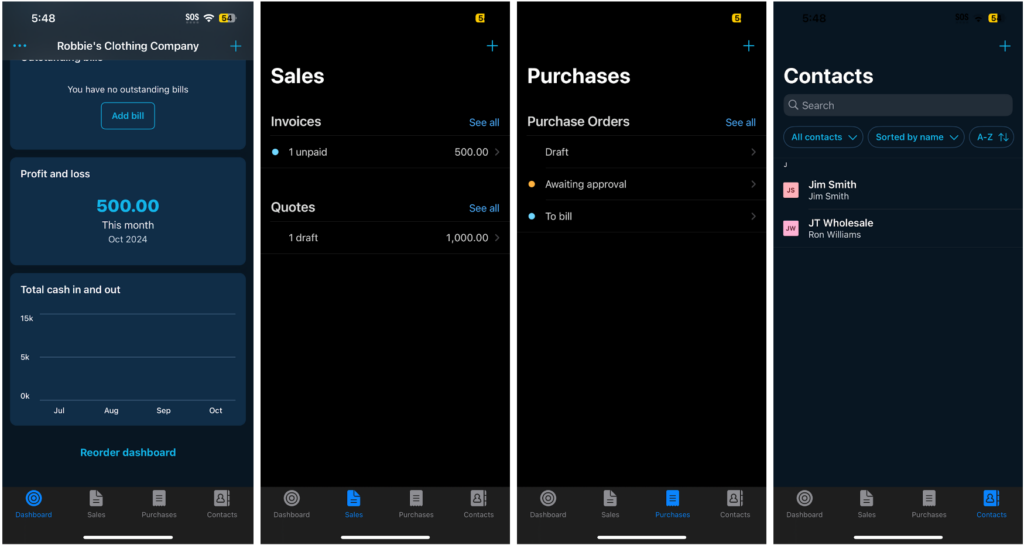

The Xero Accounting app is a simplified version of Xero’s online software available for iOS and Android devices.

I used the iOS version and found it has many of the website’s actionable features—such as the ability to create and pay invoices—with essentially none of the deep accounting features (like the ability to view and edit the chart of accounts or run reports). This reduced functionality is to be expected with most mobile accounting apps, including FreshBooks’ and QuickBooks’ mobile apps.

In terms of usability, the app works wonderfully. The menu, located on the bottom of the screen, contains 4 categories:

- Dashboard provides a quick access menu where you can add bills, see the current month’s profit and loss, and more.

- Sales lets you view your company’s revenue and even create new invoices, edit existing ones, or attach files.

- Purchases shows a summary of company bills and purchase orders, with the ability to create new purchase orders and edit existing ones.

- Contacts gives you a list of your current contacts and lets you create, edit, and delete contacts.

It’s also worth mentioning that while Xero Accounting is Xero’s primary mobile app, there are 3 others, each with its own purpose:

- Xero Verify: An authenticator app that ensures smooth, secure 2-factor authentication.

- Xero Projects: An app for quoting, tracking, and invoicing on a project-by-project basis.

- Xero Me: An employee expense management app that lets employees track mileage, quickly upload photos of company receipts for easy reimbursements, and more. It also functions as a payroll app where employees can view payslips, request leave, and submit timesheets.

While having separate apps can be nice for staying organized, I feel this can make things unnecessarily complicated—though I understand the need for a separate employee self-service app.

Verdict: 9/10

| Actions | Admin | |

|---|---|---|

| Website | Mobile App | |

| Invoicing & Bill Pay | ||

| Online invoicing | ✅ | ✅ |

| Send invoices & quotes | ✅ | ✅ |

| Void invoices | ✅ | ✅ |

| Track unpaid invoices | ✅ | ✅ |

| Accept payments | ✅ | ❌ |

| Claim expenses | ✅ | ✅ |

| Pay bills | ✅ | ✅ |

| Record expenses | ✅ | ✅ |

| Place purchase orders | ✅ | ✅ |

| Banking & Reconciliation | ||

| Connect to bank | ✅ | ✅ |

| Reconcile bank accounts | ✅ | ✅ |

| Filter bank statement | ✅ | ✅ |

| Sort & search transactions | ✅ | ✅ |

| Reporting & Financials | ||

| View reports | ✅ | ✅ |

| Run reports | ✅ | ❌ |

| View sales tax | ✅ | ❌ |

| View inventory | ✅ | ❌ |

| Run payroll with Gusto | ✅ | ❌ |

| View accounting dashboard | ✅ | ✅ |

| Management & Communication | ||

| Track projects | ✅ | ❌ |

| Integrate apps | ✅ | ❌ |

| Manage contacts | ✅ | ✅ |

| Manage customer & supplier info | ✅ | ✅ |

| Store & access files | ✅ | ✅ |

Xero Core Functionalities

General ledger control

The general ledger is the full record of your company’s financial transactions, organized by accounts. I found Xero’s general ledger system to be highly functional and effective.

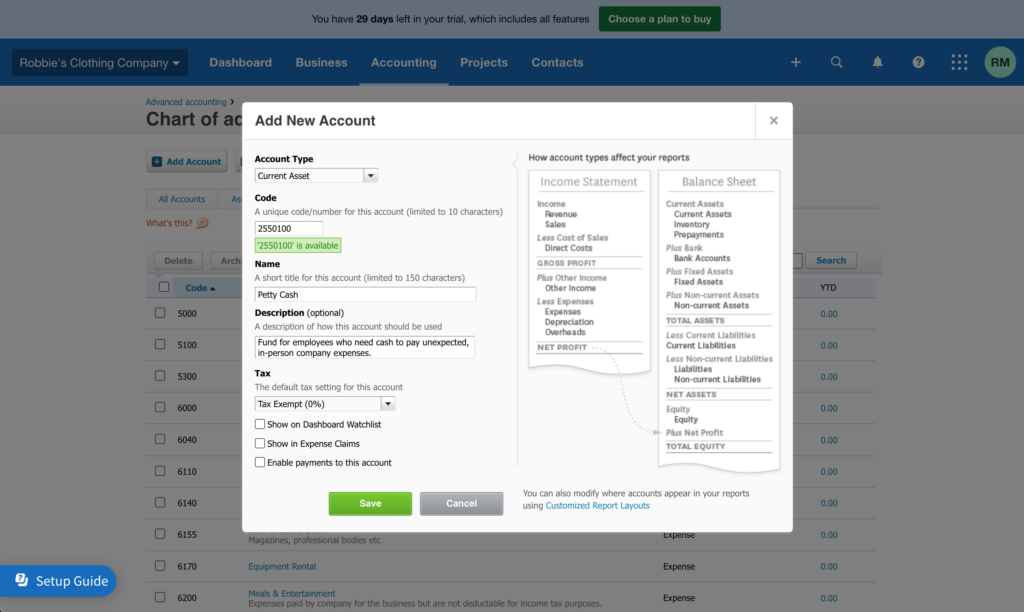

I appreciate how easy it is to add new general ledger accounts and bank accounts. During the first few months of setting up your company in accounting software, you’ll do this a lot.

When you click “Add Account” from the chart of accounts page, Xero simply opens a customization pop-up window right in the current page—no waiting or loading. For businesses that need to add hundreds or even thousands of new accounts, this is a really productive feature.

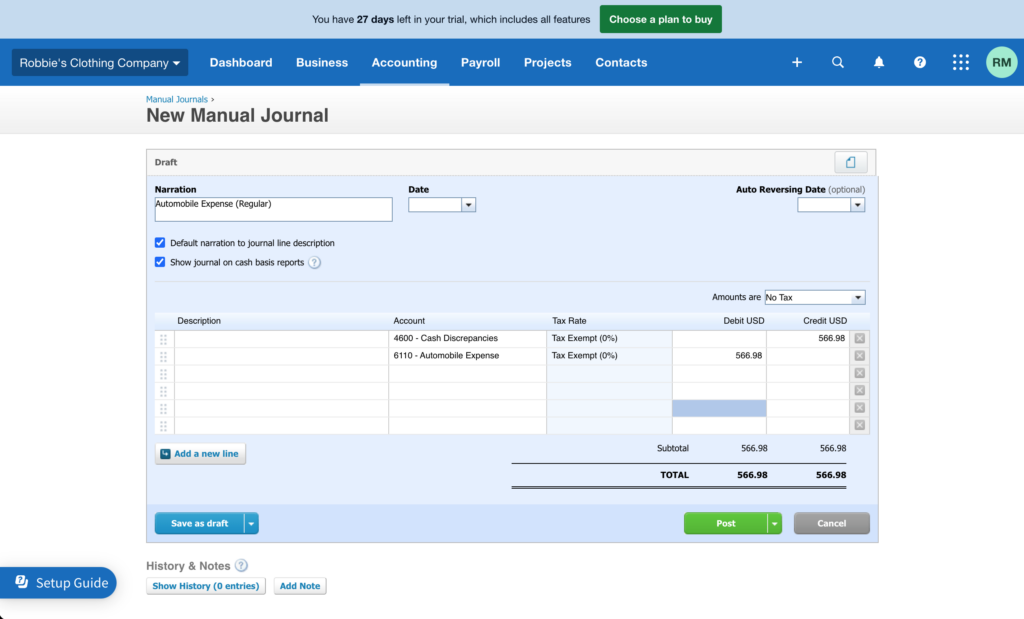

When it comes to creating journal entries, I found Xero offers many of the same advanced features found in enterprise-level accounting software like SAP or BlackLine. These include the abilities to choose between tax exclusive or tax inclusive amounts, specify auto-reversing dates for accrual entries, and upload supporting files alongside your entries for audit purposes.

Verdict: 9/10

Invoicing & bill pay

Xero’s system for receiving and making payments greatly streamlines user input and cuts out unnecessary steps.

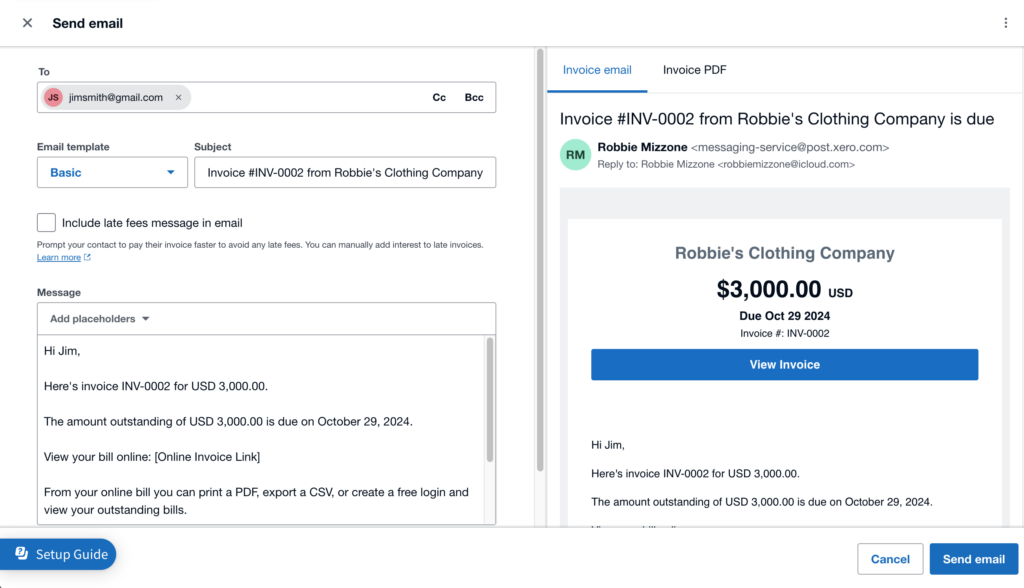

For example, when you’re finished creating a new invoice, you can click “Approve & email.” Instead of saving the invoice as a PDF, Xero lets you compose and send the email directly from the software. This eliminates the need for switching between platforms.

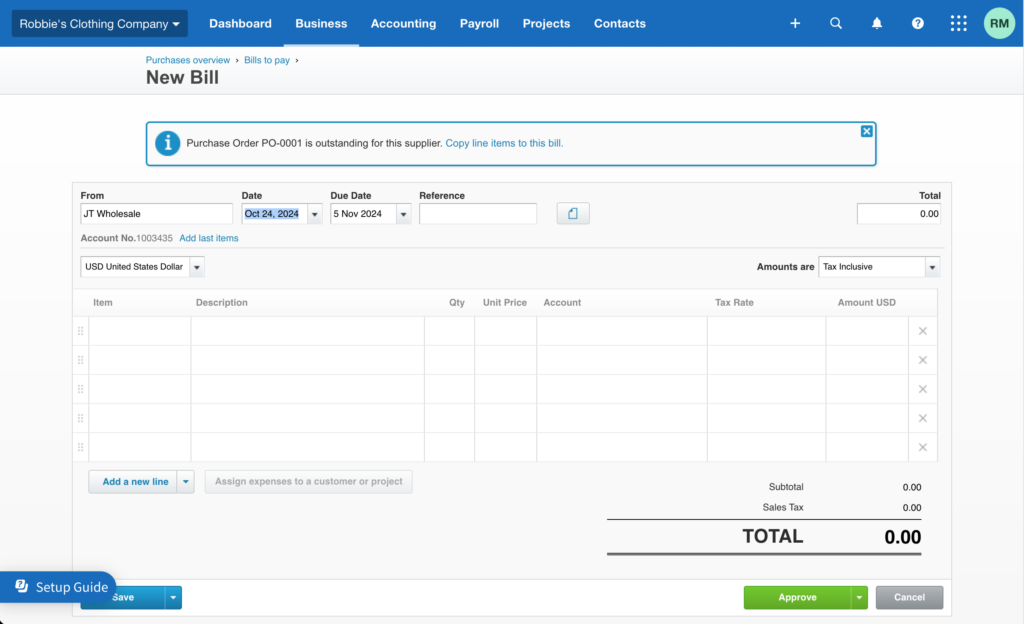

I found another feature really helpful as I was editing a bill. Let’s say you’re coding in a new bill to a client, and you already have multiple unpaid bills outstanding to that client (it happens). As you’re creating that new bill, Xero will alert you with a pop-up—and with a single click, you can have the amounts from all the other outstanding bills automatically roll into the new one. This is great for consolidating payments and avoiding missing any outstanding balances.

Verdict: 9/10

Time tracking

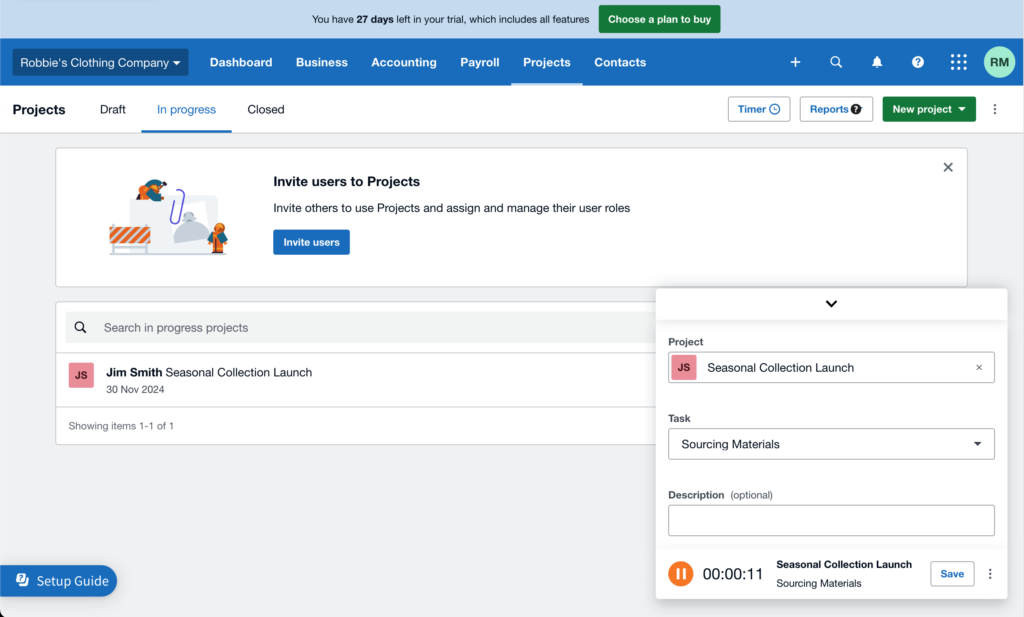

Xero doesn’t offer built-in employee time tracking as part of its software. It does have project time tracking to help businesses understand how time is being spent on various tasks and ensure projects stay on budget and on schedule. Once you’ve tracked the time spent on a project, you can automatically generate invoices based on that tracked time, making the process much more efficient.

Xero makes it really easy to track project time with a built-in timer accessible from the projects dashboard. You can start the timer if you want to track in real time—or manually input time entries at your convenience. I found it really helpful to have both these tracking methods available.

Since Xero’s time tracking monitors overall company time allocated to specific projects only, it won’t generate payroll-ready timesheets. To track employee time for payroll purposes, you can use Connecteam, the best time-tracking software that integrates with Xero.

Alternatively, payroll employees can use Xero Me (which is also available as a web application) for manually entering time data into timesheets they then submit for approval. You can also do this on behalf of your employees through your web browser. Unfortunately, I think these solutions are time-consuming and prone to errors (or even time theft).

Verdict: 6/10

Payroll

Xero doesn’t have its own payroll functionality, so if you have employees to pay, you must integrate Xero with the payroll provider Gusto.

This Might Interest You

Read our full Gusto review to learn if it’s the right payroll solution for your business.

I was confused during the integration process. Xero had me start the process from its software, but as I followed the instructions and created a Gusto account, I wound up on Gusto’s dashboard with no further instructions on how to actually connect the apps. I figured out through trial and error that the connection must be made from the Gusto side. This took just 5 minutes to figure out—but Xero could definitely provide some better instructions here.

Once the apps are integrated, the connection is seamless. You run payroll directly from Gusto, and the transactions automatically show up in Xero. You can reconcile the payments and keep your financial records current with minimal manual data entry.

I appreciate that you can set up single sign-on to access Gusto using your Xero login credentials—and receive payroll alerts in Xero.

Verdict: 7/10

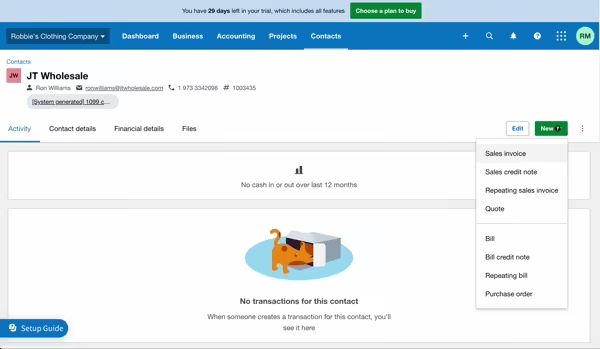

Contacts & communication

The “Contacts” section centralizes key information for customers and suppliers.

For each contact, you can review recent activity, add banking information for easily sending and receiving payments, and even upload files to keep related documents organized and accessible. I found that all these features greatly streamline communication, letting you manage client relationships almost exclusively from Xero’s software.

Contacts are classified as customers or suppliers. Xero automatically chooses the category for you, depending on whether you send the contact an invoice (customer) or pay them a bill (supplier), which I think is neat.

Successful accounting and payroll involve managing relationships with both external contacts and internal team members. So, I was disappointed to find Xero provides no way to communicate directly with members of your own organization or create contacts for them, the way you can with software like QuickBooks Messenger.

Verdict: 9/10

Xero Security Features

Xero provides strong security for your data, though I feel it falls short in 1 key area.

First off, Xero offers 2-factor authentication, which has become a standard, extra layer of protection for online accounts. It does this through an authenticator app—either a third-party’s or Xero Verify, Xero’s own authenticator app.

Xero fully complies with the ISO/IEC 27001:2013 standard, a globally recognized security framework. The company regularly undergoes SOC 2 security assurance audits, which are independently conducted security checks of its cloud-based accounting systems. Xero also complies with the PCI DSS v3.2 standard—which is crucial for businesses that process card payments.

Unfortunately, Xero isn’t HIPAA compliant even though it has a webpage marketing its software to healthcare businesses. This is worth noting if you work in healthcare, since using accounting software to process patient-related financial transactions could expose sensitive information and lead to HIPAA violations.

That said, Xero encrypts all client data, both when it’s stored and as it’s being transferred. Hackers can still access your data if you make a mistake—which is why I was impressed that Xero provides a dedicated email, [email protected], where you can report potential security threats as soon as they occur.

While Xero’s full online software doesn’t support biometric verification, the mobile Xero Accounting app offers it, allowing you to use fingerprint or facial recognition for secure log-ins.

Verdict: 7/10

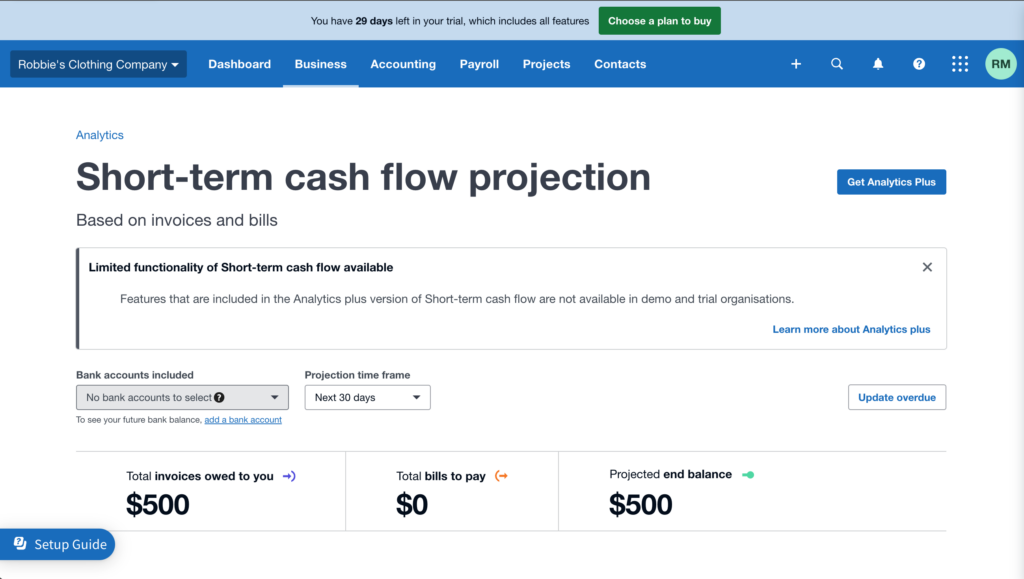

Xero Reporting & Analytics

I found Xero’s reporting and analytics features to be both comprehensive and easy to navigate.

Xero offers over 50 accounting reports, categorized into the following sections:

- Financial performance: Summarizes the overall health of a business.

- Financial statements: Summarizes assets, liabilities, revenue, and cash flow.

- Payables and receivables: Tracks money owed to and by the business.

- Projects: Monitors financial activity related to specific projects.

- Reconciliations: Matches internal records with external statements.

- Taxes and balances: Displays tax liabilities and outstanding balances.

- Transactions: Lists all individual financial transactions.

You can also view a Payroll Summary Activity report and download past payroll data.

I really love how the reports don’t just show a static list of numbers—they can be directly interacted with and customized. You can customize the time frame for the report, choosing options like “This month,” “Last month,” “This quarter,” and more—or input a fully custom date range. Once you have the report to your liking, you can save it with a custom name for easy future use.

You can navigate to specific figures within your reports—such as “Merchandise sales” or “Building Expenses” numbers—and with a single click, Xero will take you to a full account summary, allowing you to identify exactly where those numbers came from and review all related sub-transactions.

You can also export these reports as PDF and Excel files—or open them directly within Google Sheets.

Finally, Xero provides a special analytics report, “Short-term cash flow,” which uses past financial data to provide intelligent insights into your business’s future financial health, such as giving you a predicted cash balance as a specified date.

Unfortunately, this report is available only with the Analytics Plus add-on under the Established plan.

While these intelligent insights are undoubtedly helpful, competitors like Zoho Books offer AI assistants that can respond to text queries with answers and predictions tailored to even more specific scenarios.

Verdict: 9/10

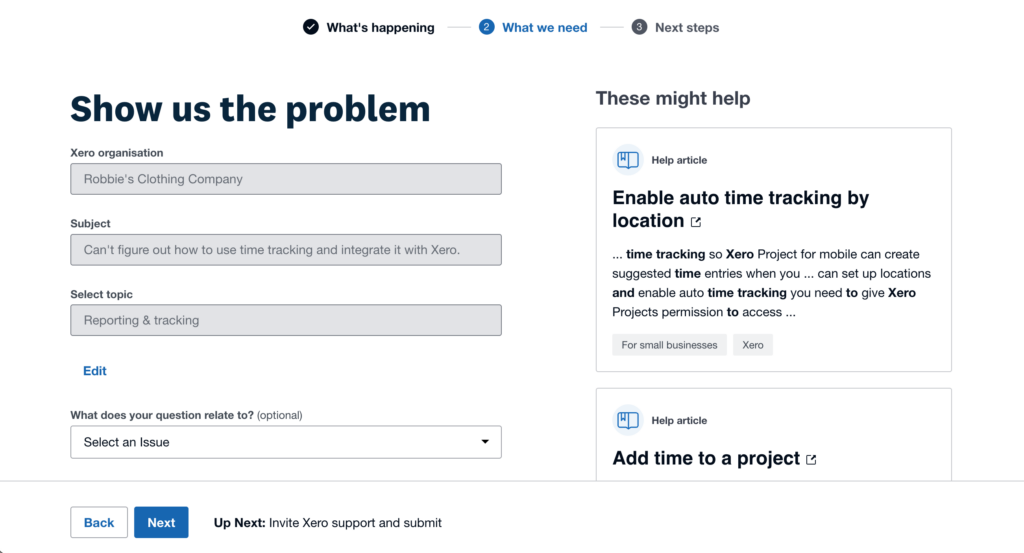

Xero Customer Support

Xero provides customer support via the email contact form on its website. There’s no phone support. The contact form is available 24/7, but you’re not guaranteed a response within a certain timeframe.

I had difficulty locating this customer support portal. There’s no support button anywhere within the main interface, and I had to Google “How to contact Xero customer support.” A forum post revealed the customer support portal is accessible only from the bottom of Xero’s pre-written help articles—which I found strange.

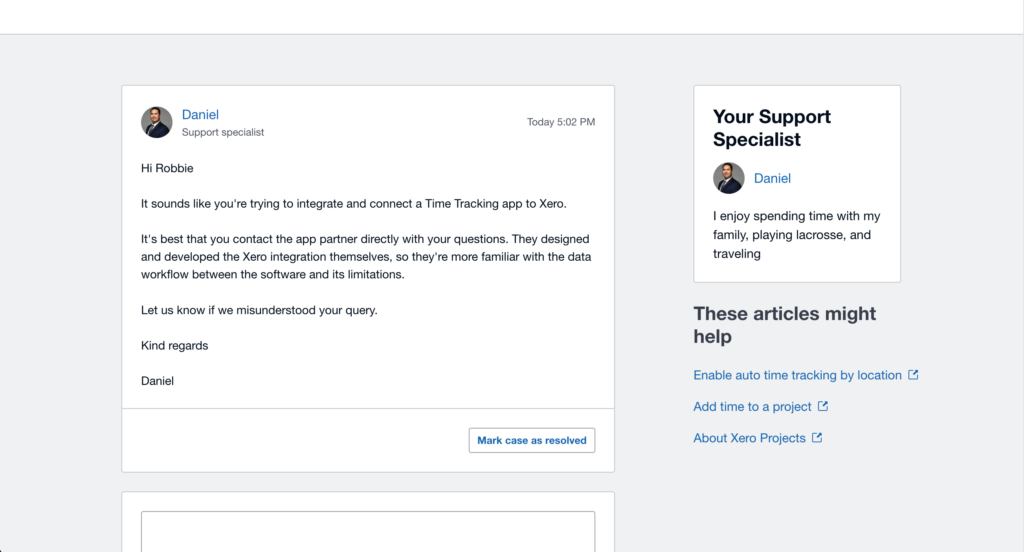

Once I found the contact center, I submitted a query at 4:54 pm and received a helpful reply by 5:02 pm.

While this response time is excellent, I wish Xero hosted these conversations in a live chat environment with easier back-and-forth messaging.

Speaking of chats, I did receive a text message from a Xero support rep stating she’d be my point of contact throughout the setup process. This message came 2 days after I registered for my free trial. While this type of support is undoubtedly a good look, I can’t imagine why Xero wouldn’t advertise text message support—I had no idea this was offered until I received the text.

I also received an email from this same support rep, who sent me a link to her calendar and encouraged me to “schedule some time to meet and get familiar with the Xero ecosystem.”

Verdict: 7/10

What are Xero’s Review Ratings from Review Sites?

(As of April 2025)

Capterra: 4.4/5

G2: 4.3/5

Software Advice: 4.4/5

TrustRadius: 8.2/10

GetApp: 4.4/5

Google Play Store: 3/5

Apple App Store: 4.6/5

Xero App Review

I think Xero is an affordable online accounting software that can work well for businesses of all sizes. I was pleasantly surprised by the advanced general ledger features and user-friendly invoicing and project management functions.

However, it has limited customer service and an outdated interface in some areas. And businesses looking for employee management features—like full-featured time tracking—won’t find these with Xero.

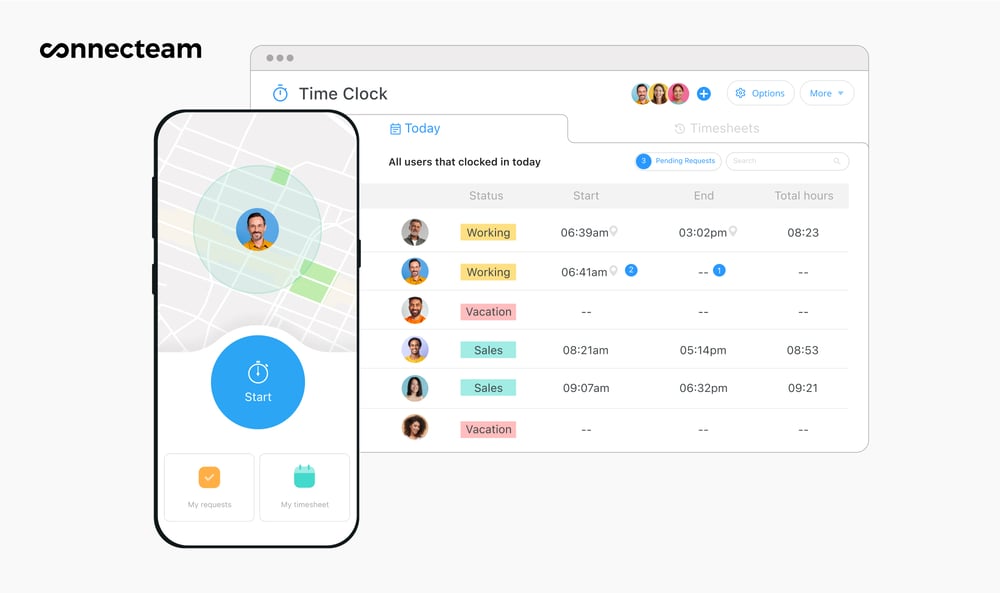

Connecteam: The Best Xero Integration for Time Tracking & Communication

If Xero doesn’t have all the functionality you need, consider Connecteam.

Like Xero, Connecteam features project-specific time tracking for managing multiple clients and jobs and for invoicing. But unlike Xero, Connecteam offers employee time tracking that’s even more comprehensive than what Gusto offers. It compiles time data into payroll-ready timesheets that reduce manual entry and make payroll processing much simpler.

Time can be tracked via Connecteam’s dedicated time clock app for employees—which comes with the ability to track overtime, breaks, employee locations, and more.

I also really love the team communication system where you can send messages, share updates, and collaborate with your team in real time. This is especially useful for keeping everyone informed on project progress.

Connecteam does more, too. It offers leave management, task management, scheduling, training, and so much more.

And Connecteam integrates seamlessly with Xero. That’s why I recommend using Xero for your core accounting needs and pairing it with Connecteam for stronger employee and project management.

There’s a free-forever plan for small businesses, and paid plans start at just $29 per month.

Get started with Connecteam for free today!

FAQs

Yes, Xero offers a 30-day free trial for its 3 plans.

Xero isn’t HIPAA-compliant, which means it shouldn’t be used to handle transactions involving patient health information.