Due to weather risks, a skilled labor shortage, and strict state licensing, starting a construction business in Florida may be challenging.

However, if you’ve got proper knowledge of local laws, plan well financially, know how to navigate the licensing requirements, and understand the market, you can find success.

To help you learn how to start a construction company in Florida, I’ve created a detailed step-by-step guide that covers everything you need to know to get your idea off the ground.

Key Takeaways

- Forming and registering your business is a crucial first step that provides legal protection, safeguards your brand, and establishes your company’s legitimacy.

- The licensing requirements are strict in Florida, and there are many different categories and types of licenses to be aware of, each with important eligibility requirements.

- Comply with all necessary permitting, zoning, and labor laws to ensure your business can continue to operate legitimately and to avoid fines or penalties.

Starting a Construction Business in Florida: A Step-by-Step Guide

Here are the steps involved when starting a construction business in Florida.

-

Understand the Florida markets

-

Form and register your business in Florida

- Sole Proprietorship: A straightforward single-owner structure with no formal filing requirements. The owner is personally responsible and liable for all debts and other obligations.

- Partnership: Shared ownership where 2 or more people own a business together. There are 2 types in Florida: a General Partnership (all partners have equal share of responsibility and management authority) and a Limited Partnership (some partners maintain full responsibility, while others hold only limited responsibility). Profits and losses are passed through to the partners’ personal tax returns.

- Corporation: A completely separate legal entity from all owners that offers strong liability protection. Owners/shareholders aren’t generally responsible for the obligations of the company, and these organizations can raise capital easily by selling stock in the company.

- Limited Liability Company (LLC): A flexible hybrid structure that blends the liability protection of a corporation with the “pass-through” tax model of Sole Proprietorships and Partnerships.

-

Meet Florida construction licensing requirements

- A General Contractor license in Florida has a very broad scope and lets you work on any project of any size and type of construction, outside of some specialized trades, such as HVAC and plumbing.

- A Building Contractor license lets you work on any commercial or residential building construction, as long as the building is under 3 stories.

- A Residential Contractor license lets you work on 1-family, 2-family, and 3-family residences, as long as they’re no larger than 2 stories.

- Be at least 18 years old.

- Have a FICO credit score of at least 666.

- Provide electronic fingerprints to undergo a background check.

- Certified Contractor: $105 if you’re applying between September 1st of an odd year through April 30th of an even year, and $205 if you’re applying between May 1st of an even year through August 31st of an odd year.

- Registered Contractor: $205 if you’re applying between September 1st of an even year through April 30th of an odd year, and $305 if you’re applying between May 1st of an odd year through August 31st of an even year.

-

Insure your business

-

Consider local permitting and zoning laws

-

Ensure compliance with Florida labor laws

-

Plan financially

-

Develop connections and compete for contracts

Before you start a construction business and learn how to get a contractor’s license in Florida, it’s crucial to understand the market. The construction industry in Florida has experienced massive growth recently. According to the Federal Reserve Economic Data database, construction GDP in Florida has risen from $64 billion in Q1 2020 to over $101 billion in Q1 2025.

Construction work in Florida is spread across multiple key sectors like residential development, commercial real estate, and public works like roads, bridges, and public buildings. While there’s demand for various types of construction work, hurricane-resistant construction is especially sought after thanks to the unpredictable weather.

The rapid population growth in the state is one of the biggest drivers of the demand for new construction. According to the Pew Research Center, Florida was the fastest-growing state from 2023 to 2024, with a 2.04% population growth rate.

The state sees plenty of tourism, which leads to more opportunities for building hotels and restaurants, upgrading transportation networks, and creating other tourism-related facilities.

Understanding these trends can help you pick a sector that aligns with your skills and resources.

However, it’s also important to consider the challenges of operating in Florida, including weather risks, strict licensing requirements, and a skilled construction labor shortage.

This process begins by choosing your business structure, and your options include:

Florida doesn’t have a state income tax, so there are no taxes to operate Sole Proprietorships, LLCs, and Partnerships in most cases. However, the state has a 5.5% corporate tax rate for corporations.

If you opt to go with an LLC or a Corporation, you must formally register your business with the Florida Division of Corporations. This means filing Articles of Organization for an LLC, or Articles of Incorporation for a Corporation.

If you’re operating the business under anything other than your legal name, you must file a fictitious name registration with the state. This goes for all business structures.

This Might Interest You

Struggling to come up with a name to help your construction business stand out? Check out our list of construction company name ideas for inspiration.

Next, you’ll have to get an employer identification number (EIN) from the IRS before conducting business. It’s used to identify your business, apply for licenses, file taxes, and perform other business activities.

Finally, you should open a business bank account to keep business and personal finances separate.

Each business must operate under the license of a certified contractor who takes responsibility for all construction work. So it’s important to know the requirements for how to become a contractor in Florida.

Types of contractor licenses

First, be aware of the 2 different Florida contractor license types: a Certified Contractor license and a Registered Contractor License. A Certified Contractor can work anywhere in Florida, while a Registered Contractor is licensed only in a specific city or county and can do work there only.

This is different from how some other states handle licensing. For example, there’s no statewide licensing requirement to think about when starting a construction business in Texas.

Local business licenses

Most counties and cities require a business license, known as a local business tax receipt. Check with the local authorities in your area to understand your specific requirements.

License categories

In addition to the 2 types mentioned above, there are 3 main categories/classifications of contractor licenses in Florida:

However, there are other licenses you may need, depending on the type of construction business you’re starting. The Florida Department of Business and Professional Regulation (DBPR) has a useful resource that provides you with links to the licenses that different types of contractors may need.

Eligibility requirements

There are several requirements you must satisfy to be eligible for licensing. You must:

There are also Florida general contractor license experience requirements to keep in mind. You’ll need 4 years of field experience in the category of license you’re trying to obtain, and 1 year has to be supervisory. However, you can substitute up to 3 years of college credit hours or military service in place of field experience.

You’ll need to participate in 14 hours of continued education for each renewal of your license, too, and this renewal takes place every 2 years.

Application process

The last part of the process to get a Florida contractor license is to send an application to the DBPR. There’s an application fee, which is:

You’ll also have to complete a Business & Finance exam, plus a trade knowledge exam that’s specific to the type of contractor you’re trying to become.

Once you meet all the requirements, you can submit your application. The Florida Construction Industry Licensing Board of the DBPR ultimately decides which applications are approved and which are denied.

You should also insure your business to protect yourself from financial losses and other unexpected events. General and building contractors need $300,000 of liability insurance and $50,000 of property damage insurance, while all other categories need $100,000 and $25,000, respectively.

You may also need commercial auto insurance for any work vehicle and workers’ compensation insurance if you’ve got 1 or more employees.

Some projects or bids may require a surety bond: a guarantee that your business will accomplish the work it was contracted to do. It also protects the project owner from financial loss if your company fails to meet its obligations.

The exact cost of your coverage depends on company size, license type, the provider you choose, and the scope of your work.

If you desire personalized service and a deeper understanding of local regulations, risks, and challenges, you may choose a Florida-based provider. But a national insurer may provide access to a larger network or wider coverage options, or you want to expand beyond Florida.

This Might Interest You

Check out our complete guide on construction insurance to learn more about how to protect your business.

You should always secure the proper building permits before starting a project and know any zoning restrictions for both commercial and residential property. These dictate which activities may take place on a property and inform what sizes buildings may be and where they can be located. The exact restrictions vary widely from city to city.

To learn about the permits, laws, and restrictions in your area, visit the .gov site for your city or county.

Along with zoning restrictions, several other regulations may be different in one city or county than another. For example, Aventura only allows construction noise until 6:00 p.m., while Hillsborough County doesn’t have any noise standards in place until 8:30 p.m., and construction may continue even later than that if it doesn’t get too loud.

Also, before you complete a project, don’t forget the inspection requirements. For example, in Tampa, a final building inspection has several requirements. For instance, all life safety systems (such as fire alarms and smoke detectors) must be in the proper places and functional.

If you hire a team at your company, you should know the Florida labor laws. Here are just a few:

Wage and hour laws

The minimum wage in Florida is currently $13/hour, but it’s increasing to $14/hour on September 30th, 2025, and again to $15 per hour on September 30th, 2026. While there’s no state income tax in Florida, the state requires employers to register for Reemployment tax with the Florida Department of Revenue. This is an unemployment tax that goes into the Unemployment Compensation Trust Fund.

Florida doesn’t have its own overtime law, so it follows the federal Fair Labor Standards Act (FLSA) rules. These require that non-exempt employees be paid at least 1.5 times their hourly rate for hours worked over 40 hours in a given week.

Did You Know?

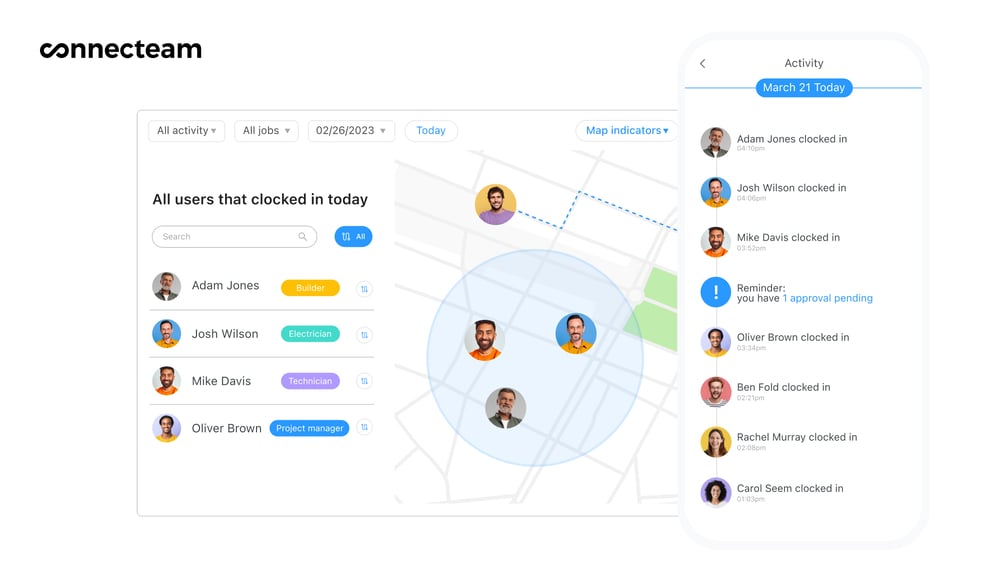

The employee time clock feature on Connecteam lets you track employee hours, manage absences and attendance, set break and pay rules, and ensure employees are paid properly.

Workplace safety laws

Employers in Florida are required to follow Occupational Safety and Health Administration (OSHA) standards. As a result, employers need to provide a safe place to work, proper safety equipment, training, and have safety programs and procedures in place.

In addition to the federal rules, the Florida Building Code (FBC) also establishes standards for building safety and sanitation. It’s based on national codes, but is adjusted to fit the specific needs of the state, such as the higher risk of natural disasters.

Pro Tip

Use a free compliance solution like Connecteam to provide employees with safety training, store compliance-related standard operating procedures, have workers fill out hazard reports and safety checklists, and more.

Hiring requirements

There are hiring requirements to keep in mind, such as verifying a new hire’s ability to work in the US with Form I-9 (or E-Verify if you’ve got more than 25 employees) and reporting new hires to the Department of Revenue.

However, the rules may be different if you work with independent contractors as opposed to employees. For example, if you work with independent contractors only, you won’t have to use E-Verify and won’t use Form W-2 to report worker earnings. Instead, you should report payments to the contractor with Form 1099-NEC.

This Might Interest You

Worried about hiring a great team amidst the construction labor shortage? Learn tips for hiring construction workers.

Here’s how to make a financial plan.

Funding options

First, where will you get the funds to operate your business? Some options include paying out of pocket, finding private investors, using SBA loans, securing lines of credit, and getting grants and incentives. Some of these include USDA Rural Business Development Grants, Prospera grants, and The Amber Grant.

You may need to seek funding before completing some steps above, but be aware you won’t be able to apply for some grants and loans until you’ve set up your business completely.

Tax considerations

While Florida is very tax-friendly for workers and employers alike, there are some considerations to make. For example, corporations must pay the 5.5% corporate income tax. Also, don’t forget about the sales tax obligations for any construction materials.

As you grow and scale your construction business, be sure to leverage construction associations such as Associated Builders and Contractors (ABC) Florida and the Florida Home Builders Association. These associations are valuable for networking, training, support, and accessing useful resources. They’re also great resources for identifying, connecting with, and potentially hiring skilled labor.

Also, take time to network with potential clients, suppliers, vendors, and other contractors, as it can help to provide new opportunities and boost credibility.

Don’t shy away from competing for contracts via MyFloridaMarketPlace either, as this can help you land lucrative projects and give you access to a broader range of jobs.

This Might Interest You

Discover even more tips on how to successfully run your construction business.

How Much Does It Cost to Start a Construction Business in Florida?

The cost of starting a construction company ranges from a few thousand dollars to $500,000. Exact costs depend on the size of your operation, the type of equipment you need, how many people you hire, and where you operate.

Registering a corporation in Florida costs a minimum of $70, while registering an LLC costs at least $125. The licensing costs vary depending on the license, but generally include the previously-mentioned application fees, an examination fee of around $135 for each part of the exam, and around $30 to $50+ for fingerprinting and background checks.

Labor costs depend on how many people you hire, and the type of workers you bring on. The annual wages of construction workers in Florida include:

- $43,840 for construction laborers.

- $60,570 for construction equipment operators.

- $115,550 for construction managers.

- $38,290 for construction helpers.

According to insurance companies, construction companies pay between $75 and $220 for general liability insurance, $250 to $500 for workers’ compensation insurance, and $175 to $350 for commercial auto insurance.

The bonding requirements vary, but most construction companies in Florida need to post a bond between $5,000 and $20,000, and the cost for these bonds is generally between 1 and 10% of the total amount.

Equipment and tools may cost anywhere from $1,000 for a few basic starter tools to up to hundreds of thousands of dollars if you need heavy machinery or a large number of tools and equipment.

That said, according to Adam Ross, HVAC Contractor and Owner of Aircon Repair, be prepared to spend more than you think on starting your business.

Specifically, he says to “Put together a budget that you think is reasonable. And then 10x your expenses and think about what that would mean. Everything is going to cost much more than you expect.”

Tips for Starting a Construction Business in Florida

Some important tips to keep in mind when starting a construction company in Florida include:

- Scheduling your exams early, as, according to Ross, it can take up to 6 months to find the availability to take the exam.

- Taking the exams seriously and studying hard, as Ross says they’re “notoriously difficult” and have low passing rates.

- Writing a business plan, as it helps you outline your company vision, your values, the services you offer, the customers you’ll target, and the key performance indicators (KPIs) that you’ll track. It serves as a blueprint or roadmap to your success.

- Using a construction management tool to easily create schedules, manage employee documentation, track time, and communicate with workers from anywhere.

FAQs

The costs of getting a contractor’s license in Florida vary by license type but typically cover the application fee, about $135 per exam section, and $30–$50+ for fingerprinting and background checks.

The penalty for unlicensed contracting in Florida is outlined in Florida Statutes Section 489.127. It’s normally charged as a first-degree misdemeanor, with a penalty of up to 1 year in prison. However, if you’ve previously been found guilty of unlicensed contracting and are charged with it again, it’s a third-degree felony, with a penalty as high as 5 years in prison.

There’s no single easiest contractor’s license to get, as most require years of experience and passing an exam. However, becoming a residential contractor or another contractor with a limited scope of work may be easier than becoming a general contractor or another type of contractor with a broader scope of work.

Disclaimer

This guide is provided for general informational purposes only and does not constitute legal, tax, or professional advice. Construction licensing, labor laws, permitting requirements, and tax rules in Florida are subject to change and may vary by city, county, or project type. Compliance obligations also depend on the specific facts and circumstances of your business. Before taking action, consult with a qualified attorney, accountant, or the appropriate state or local authority to ensure you meet all legal and regulatory requirements.