A major shift in federal law could leave millions of American workers without healthcare, and small businesses will feel the fallout.

A new federal law is reshaping Medicaid eligibility, and the impact on small businesses could be massive.

When coverage is tied to paperwork and strict monthly requirements, even a simple reporting mistake can mean missed shifts, last-minute call-outs, or surprise resignations.

In this guide, we’ll walk you through what’s changing, what your team needs to stay covered, and how Connecteam can help you protect your people and your bottom line.

Key Takeaways

- Medicaid work requirements become federal law by 2027, with rollout starting in 2025.

- Most adults must report 80 hours of work, training, or education each month to stay covered.

- Reporting mistakes, not lack of work, are the top reason people lose Medicaid.

- Small businesses could face more call-outs, stress, and turnover as coverage lapses.

- Connecteam helps teams track hours, export timesheets, and stay compliant with less hassle.

What Are the New Medicaid Work Requirements Under the 2025 Law?

On July 4, 2025, the One Big Beautiful Bill Act (H.R. 1) was signed into law, introducing the most sweeping Medicaid reform in decades. By 2027, most low-income adults across the U.S. will be required to work, study, or volunteer at least 80 hours per month—and prove it—to keep their coverage.

But for many, the hardest part isn’t meeting the 80-hour threshold. It’s tracking, verifying, and submitting that proof correctly each month. The process is often confusing, time-consuming, and easy to get wrong.

What exactly is required?

Under Section 71119 of the “Big Beautiful Bill,” many adults on Medicaid now have to meet monthly activity requirements to stay covered, or even apply. Here’s what that means:

To stay eligible, a person must do at least 80 hours a month of one (or a mix) of the following:

- Paid work

- Community service

- Job training or a work program

- School or education (at least half-time)

- Any combination of the above that adds up to 80 hours

- Or earn the equivalent of 80 hours at minimum wage, either calculated monthly or averaged over six months for seasonal workers

There are also specific reporting requirements tied to eligibility, including:

- New applicants must prove they’ve met the requirement for 1 to 3 months in a row before applying (states determine the exact timeframe).

- Current enrollees must show they’ve met the requirement for at least one month between eligibility checks.

- States must verify compliance during those eligibility checks and can choose to verify more frequently.

What’s really important to know is that states can’t opt out of these new requirements. While states can offer short-term exemptions for people dealing with extreme, temporary issues (e.g., hospitalization), all states must enforce work and reporting mandates under federal law.

Who’s exempt from Medicaid work requirements?

Not everyone has to meet the new requirements. Some people qualify for Medicaid work requirement exemptions, but the exact rules vary by state. In general, the following groups are usually excluded:

- Pregnant people

- People with disabilities

- Full-time students

- Primary caregivers for children or dependent adults

- People with serious illness

- In some states, people experiencing homelessness or domestic violence

However, even if someone qualifies for an exemption, they usually still need to prove it. That means that they need to fill out forms, submit documentation, and stay on top of deadlines. Missing just one of these steps could still mean losing coverage.

Why reporting matters

It might sound simple enough, but what trips most people up is reporting their required hours, not completing them.

Let’s break it down: An employee who relies on Medicaid needs to log into a state-run portal, track their time, get their time verified by an employer, upload the proper documentation, and do all this within a limited time frame. If you’re working an hourly job, taking care of family members, and have limited access to a computer, sometimes that’s just not doable.

Did You Know?

In June 2018, Arkansas became the first state to enforce a Medicaid work requirement. In the first seven months, over 18,000 people lost coverage. Even though they were working, they didn’t file or document their hours correctly.

Even minor reporting mistakes can lead to a loss of Medicaid coverage. Regardless of if you’re working, studying, or volunteering, if you don’t submit your hours correctly, the system could count it as noncompliance.

As more states prepare to meet the federal deadline of December 31, 2026, and roll out Medicaid reporting rules, the risk of losing coverage will increase. With strict monthly requirements and more paperwork, an estimated 5.2 million Americans could lose coverage simply due to reporting errors, according to the Congressional Budget Office.

How Work Requirements for Medicaid Could Impact Your Business

The Congressional Budget Office estimates that 11–12 million Americans could lose Medicaid or ACA coverage by 2034 under the One Big Beautiful Bill Act. Many of them are hourly and frontline workers, meaning small businesses may face real consequences, ranging from higher absenteeism to unexpected turnover.

Even if the Medicaid changes don’t affect you directly, they could impact your team and your bottom line. When employees lose coverage, it often leads to missed shifts, increased stress, and even surprise resignations.

Here’s how:

More missed shifts and absenteeism

When an employee loses Medicaid, they might skip doctor visits, avoid filling prescriptions, or go without needed care. That can lead to more last-minute call-outs and longer recovery times, and a serious spike in your absenteeism rate. Not to mention, this can disrupt schedules and put added pressure on the rest of your team.

Higher stress, lower productivity

Worrying about losing healthcare can add a lot of pressure to your team’s day-to-day life. If your employees are navigating coverage issues, chances are they’re also dealing with paperwork, medical expenses, and the stress that comes with it. This can pull focus away from work, resulting in more mistakes, reduced productivity, or burnout.

Unexpected turnover

For your hourly workers, losing Medicaid coverage might mean they leave to take up a job with benefits. That leaves you with roles to fill, a hiring process, and time spent onboarding new hires.

Increased admin burden

If your employees are stressed about Medicaid paperwork, you might be the only resource they have. This could lead to time spent reviewing government requirements, sifting through timesheets, or writing letters to verify their work hours. Small teams might not have the resources to help and keep business as usual.

Vulnerable employees hit the hardest

Your workers who are part-time, hourly, seasonal, or entry-level are most likely to need Medicaid. They’re also the least likely to know how to navigate new Medicaid work requirements. Plus, they’re usually the ones that keep your business running and you can’t afford to lose.

Simplify Medicaid Reporting with Connecteam

Most employees lose Medicaid coverage because they’re missing the right paperwork to prove that they’re working. When you need to report hours, track activities, and meet monthly deadlines, the right tool can make a huge difference.

Connecteam helps everyone stay on top of Medicaid work requirements and improve daily operations. Here’s how:

Automatically track and log work hours

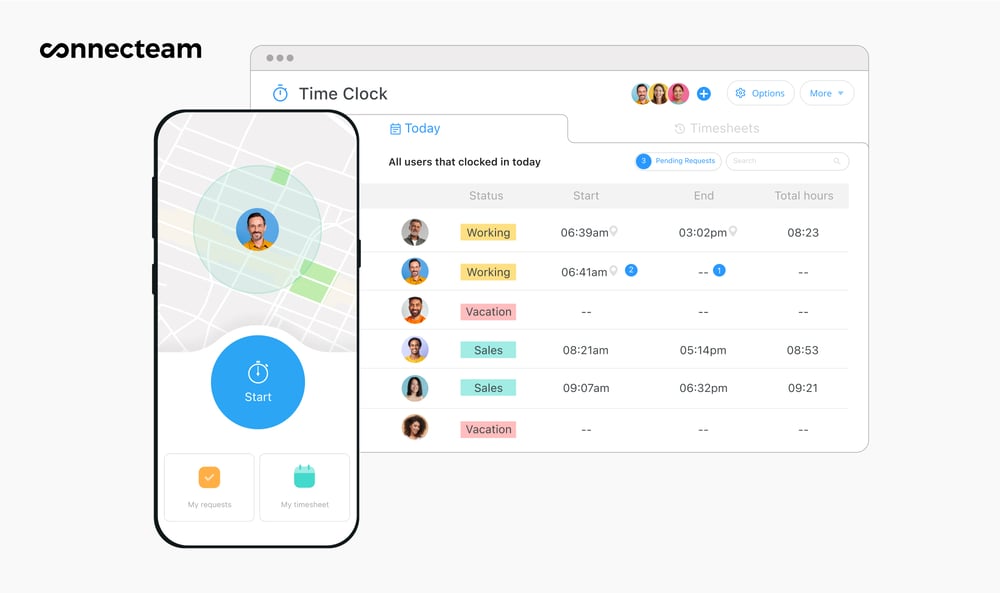

Connecteam’s employee time clock lets employees clock in and out from anywhere, directly from their phones. Hours are logged instantly into clear, accurate records. Employers can track attendance in real-time, reduce payroll errors, and keep operations running smoothly.

Scheduling made smarter

Connecteam makes shift scheduling fast and flexible. The employee scheduler lets managers create and adjust schedules in minutes. Employees receive instant notifications when there’s a change, so they never miss a shift. Plus, every shift is logged and tracked, so you always know who’s working when.

Export timesheets for payroll and recordkeeping

Connecteam automatically tracks work hours and organizes them into detailed timesheets you can review and export in seconds. There’s no guesswork or manual entry. Just clean, accurate records whenever you need them. You can easily download timesheets for payroll or export them directly to your payroll provider.

Real-time reminders and in-app messaging

Connecteam’s online team chat lets you message employees instantly with quick reminders, updates, or announcements. You can also set up automatic notifications for upcoming shifts, timesheet submissions, or other important tasks. Organize your communication and keep the work chat in the work app.

Connecteam’s Small Business Plan is completely free for up to 10 users. It’s designed to give small teams the tools they need to succeed. Access time tracking, scheduling, task management, and more from one single app.

What You Can Do Right Now as an Employer

The new Medicaid work requirements in 2025 are already affecting employee coverage, and they could impact your business. Here are a few ways you can support your team and keep your operations on track:

Let your team know

Many employees probably don’t know about the new requirements. A simple heads up can really help. Educate your team about the new requirement, what counts toward the 80 hours, what needs to be reported, and when.

Emphasize that even small errors, like submitting hours late or missing documents, can lead to loss of coverage.

Make reporting easier

Tools like Connecteam make it easier for employees to track their hours and stay on top of monthly reporting. A good system keeps things organized and helps prevent coverage loss caused by missed steps or reporting issues.

Look for state-specific updates

States must implement these changes by January 1, 2027. While some are still in planning phases, others, like Georgia, Arkansas, and Indiana, have already rolled out new rules. Check your state’s Medicaid website for updates that could affect your staff.

Keep communication open

Make sure your team knows it’s okay to ask questions. Even though health insurance is personal, when it affects work, it becomes a business matter, too. Staying informed and supportive can help keep your employees productive and protected.

The Bottom Line

As Medicaid work requirements for 2025 roll out, they bring new challenges for both employees and employers. Since coverage is now linked to monthly work and reporting, even small mistakes can lead to serious consequences, including missed shifts, added stress, or staff turnover.

The best thing you can do to stay ahead is be proactive. Don’t just wait for the work requirements to come into effect. Instead, prepare your team by talking to them, keep up with state-specific changes, and use the right tools to make tracking and reporting easier.

With the right systems in place, you can help employees keep their coverage and avoid unexpected disruptions to your business.

Start using Connecteam today to help your team stay compliant, stay healthy, and stay on the job.

FAQs

Am I responsible for verifying employees’ work hours for Medicaid?

No, but employees may ask you for documentation. A clear time tracking and recordkeeping system helps you respond quickly without additional admin burden.

How can I protect my team from losing Medicaid coverage?

Educate them about the requirements, ensure hours are accurately tracked, and offer to verify hours if asked.

What if someone loses Medicaid and quits?

Turnover risk increases when employees lose healthcare access. Using tools like Connecteam can help prevent this by streamlining hour tracking and avoiding coverage gaps.

What states require work for Medicaid?

In 2025, Georgia, Arkansas, and Indiana have all approved or implemented Medicaid work requirements. More states will likely follow due to federal guidelines.

How much can I make and still keep my Medicaid?

It varies by state, but adults usually qualify with incomes up to 138% of the federal poverty level, or around ~$21,000 annually for a single person in 2025.

Can I have Medicaid without a job?

Yes, if you meet other eligibility requirements. Depending on your state, many groups can qualify without employment, including: children, pregnant people, people with disabilities, and low-income adults.

Do you need to be employed for Medicaid?

Not always. Some states require work or approved activities, like education, volunteering, or training, for some adults. Many people still qualify without being employed due to exemptions or income eligibility.

What happens if you make too much money while on Medicaid?

You may lose eligibility. In some instances, you could be transitioned to a different program, such as a subsidized plan through the health insurance marketplace.