Many would-be cleaning business owners in Canada are so nervous about navigating business licensing, marketing, and employee management that they never start their business. If that’s you, don’t worry. We can help.

Starting a cleaning service may be easier than you think. It mostly takes planning, effort, and some business know-how.

Whether you’re targeting homes, offices, or specialised cleaning contracts, this guide will walk you through each step, from choosing your niche to registering for grants.

Key Takeaways

- Demand for cleaning services varies significantly by province, with more industrial clients in the north and a strong eco-luxury niche in cities like Vancouver and Toronto.

- Every business in Canada must register with provincial authorities.

- If you’re launching a specialised cleaning service for industrial, healthcare, or construction clients, expect higher upfront costs and the need to follow health and safety codes.

How To Open a Cleaning Company in Canada: A Step-by-Step Guide

To start your cleaning business, follow these 7 steps.

Decide which cleaning services you want to offer

Deciding the type of cleaning services you want to offer is key. It will determine what kind of licensing and insurance you need, and it’s an important step in planning your expenses.

Popular types of cleaning services include:

- Commercial: If you live near a city, you can target offices, retail locations, and even industrial sites. Because they need to maintain hygiene standards in order to stay open, commercial clients tend to be reliable spenders, even during recessions.

- Residential: House cleaning is an attractive option for business owners wanting to limit their upfront investment in tools and equipment. Though some residential clients may be sensitive to economic downturns, wealthier families will likely maintain their demand through the economy’s ups and downs.

- Windows: For commercial clients, window cleaning involves a bit of skill and risk, which makes it more profitable than other types of cleaning services.

- Carpet and upholstery: By investing in steam cleaning tools, you can deep-clean carpets and upholstery for residential and commercial clients.

- Move-in/move-out cleaning: This type of cleaning involves preparing properties for new residents. It involves minimal initial investment.

- Post-construction cleaning: Construction companies are commercial cleaning clients that produce tons of waste. That means lots of business for anyone willing to remove debris, dust, and materials. However, cleaners must follow municipal or provincial rules to properly dispose of waste.

Research your market

Each Canadian province and city is different. When you decide which type of cleaning company to start, think about the needs of your local market.

Every city and province has different needs and challenges. For example:

- Toronto has more high-end customers, with high demand for specialised services like luxury condo cleaning and post-renovation cleanup. Customers tend to focus more on speed and quality than price, so you can charge more.

- Vancouver and the surrounding area are known for their focus on eco-friendliness, so using low-waste products and chemical-free soaps is often a must. Labour in Vancouver is costly, but if you market yourself as a green and eco-friendly provider, you can charge more to cover those costs.

- Calgary has an unstable economy that rises and falls with the energy industry. Labour costs are usually lower, and there are fewer regulations. But you’ll need a plan for when oil prices drop and demand slows down.

Estimate your costs

Before you register your company, you should get a good idea of how much it will cost to set up the business, including buying equipment. This way, you’ll know whether you have the money to continue with confidence. Costs will vary quite a bit from region to region.

In most cleaning businesses, labour is your biggest ongoing cost, followed by expenses like supplies, equipment, and transportation.

Many new owners who plan to hire employees underestimate how much money is needed to cover payroll before client payments arrive. You should have enough money saved to pay 2 to 3 months of wages, even without any income.

Also, will you or your employees use your personal cars, or do you need dedicated transport for equipment and waste removal? Consider fuel costs, plus the costs for vehicles (if necessary).

Even though they will be your smallest expenses, you must also consider the costs for cleaning supplies and tools, plus the costs for registering your business and getting insured.

Want to dive into specific costs? Jump down to the section on how much it costs to start a cleaning business.

Register your business

Every business in Canada must be registered to operate, but registration rules and processes vary by province. Head to your local government website or contact a clerk to find the right paperwork and obtain a business license for your company.

| Province / Territory | Register your business with… |

| Alberta | Alberta Corporate Registry |

| British Columbia | BC Registry Services |

| Manitoba | Companies Office |

| New Brunswick | Corporate Affairs Registry |

| Newfoundland & Labrador | Registry of Companies |

| Nova Scotia | Registry of Joint Stock Companies (RJSC) |

| Ontario | Ontario Business Registry |

| Prince Edward Island | PEI Corporate Registry |

| Québec | Registraire des entreprises Québec |

| Saskatchewan | Saskatchewan eTax Services |

| Yukon | Business Corporations – Yukon |

| Northwest Territories | Corporate Registries |

| Nunavut | Legal Registries Division |

As part of this process, you must choose the business structure that best fits your cleaning company. In Canada, there are 4 popular business structures:

- Sole proprietorship: The business is owned by one person. As owner, you have full control over the business, but you’re also personally responsible for any debts or legal issues.

- Partnership: The business has two or more owners who split both control and legal responsibility.

- Corporation: The business is a separate legal entity with limited liability. This means that owners aren’t personally responsible for business debts, but this structure has more complicated tax and employment rules.

- Co-operative: The company is a type of corporation owned by the employees, in which everyone gets one vote in business decisions.

You should also be aware of business number (BN) registration rules. If you set up a corporation or need a Canada Revenue Agency (CRA) account for GST/HST, payroll, or corporate income taxes, you’ll need to register for a BN. Follow this guide on how to register.

Get insured

After registering your business, you should figure out what kind of insurance you need.

Workers’ compensation insurance is required for almost every cleaning business in Canada. Here’s a brief overview of the requirements from relevant provincial authorities:

- Ontario (WSIB): Mandatory for anyone employing cleaning staff or doing physical work. Even many independent operators must register. Clients and municipalities typically require a valid WSIB clearance.

- British Columbia (WorkSafeBC): Mandatory for all employers. Solo cleaners are expected to register if they serve multiple clients.

- Alberta (WCB-Alberta): Mandatory for most industries, including janitorial. Registration required within 15 days of hiring.

- Saskatchewan (WCB): Mandatory for nearly all sectors, cleaning services included.

- Manitoba (WCB): Mandatory for cleaning and maintenance businesses. Only genuine 1-person, low-risk operations can seek exemption.

- Québec (CNESST): Mandatory for virtually all employers, including domestic service providers.

- New Brunswick (WorkSafeNB): Mandatory for employers with 1+ workers.

- Nova Scotia (WCB NS): Mandatory for cleaning services. Very limited opt-outs for small family or self-employed setups, but coverage is still expected by most clients.

- Prince Edward Island (WCB PEI): Mandatory as soon as an employee is hired.

- Newfoundland & Labrador (Workplace NL): Mandatory for all employers.

- Yukon (YWSCB): Mandatory if you employ anyone, even part-time.

- Northwest Territories and Nunavut (WSCC): Mandatory registration for all businesses with workers.

Pro Tip

Use a compliance solution like Connecteam to provide workers with safety training, teach standard operating procedures, and create safety checklists, all of which can reduce workplace incidents and potential workers’ compensation claims.

In addition to workers’ compensation insurance, commercial cleaning services should get commercial liability insurance. This protects the business from lawsuits or third-party claims of injury or property damage. Most policies provide $2–5 million in coverage.

Your business might also benefit from other types of insurance or bonds. Some clients might even require these. Learn more in our guide on cleaning business insurance.

Get to know relevant employment law

If you hire workers, you must comply with Canadian employment law. Key laws include:

- Occupational health and safety laws, both at the federal and provincial levels. These are especially important for specialty cleaners focused on hazardous work in healthcare institutions or on construction sites.

- Provincial employment laws setting minimum wages, maximum hourly limits, overtime rules (including pay rules), vacation mandates, and more, like this law in B.C.

- The federal Human Rights Act and provincial variants setting anti-discrimination laws.

- In Quebec, language laws require medium and large businesses to operate mainly in French (including when communicating with employees).

Did You Know?

With Connecteam, you can track and manage workers’ hours and pay, store anti-discrimination policies, and so much more. This can help you and your team comply with various employment laws. Learn more.

Start building local awareness of your business

These steps cover the basics of beginning to market your cleaning business:

- Create a simple, user-friendly website where customers can learn more about your offerings and see that your company is legitimate. Popular web builders like Wix and WordPress are simple to use and offer affordable starter plans and templates for cleaning business websites.

- If you’re targeting commercial clients, try posting to local business groups on social media. Similarly, if you’d like to offer residential cleaning services, group pages for neighbourhoods, cities, and regions are a great way to be seen at relatively low cost. You might try Nextdoor. Since launching in Canada in 2019, it’s become a valuable marketing tool for small businesses, with 1 in 3 Greater Toronto Area households using it.

- Make business profiles on sites like Google and Yelp to start earning reviews. A Google Business Profile will help you to rank in local search results, too!

- As you start earning reviews on sites like Yelp and Google, respond to both positive and negative feedback so potential customers see your commitment to their satisfaction.

Finally, don’t discount the power of word of mouth. Urge your connections, including friends and family, to spread the word. Consider offering discounts so you can build up a customer base and get referrals.

Register for grants

Some cleaning businesses might qualify for certain grants and funding programs, though it’s often difficult to get accepted, and no grants are made specifically for the cleaning industry. In Canada, you often must fit your business into existing grant themes (such as green tech, digital adoption, regional development). To qualify, you’ll need to show how your cleaning business contributes to one of those priorities. For example, your desire to invest in eco-friendly equipment might align with green tech grant programs.

Many grants are issued by regional or city governments. For example, in Ontario, the Starter Company Plus program allows new entrepreneurs to apply for training, mentorship, and grants. Similarly, in Alberta, there are provincial small business support schemes that aren’t cleaning-specific but accessible to entrepreneurs. Each grant has its own application process, but most involve writing a detailed proposal outlining how you satisfy the conditions.

Nationally, the Zensurance Small Business Grant (a competition for a CAD 10,000 grant) is open to small businesses in various fields.

How Much Does It Cost To Start a Cleaning Company in Canada?

The cost of starting a cleaning company in Canada varies.

First, there are costs associated with registering and insuring your business. These vary based on your province, the types of insurance you purchase, and more. For instance, registering a business in Ontario costs at least $60. Basic liability insurance might cost $450/year (prices go up for more advanced coverage).

Then, there’s the cost of wages. You must pay your workers at least the minimum wage. Here’s a breakdown of minimum wages by province:

| Province / Territory | Minimum Wage |

| Alberta | $15.00/hour |

| British Columbia | $17.85/hour |

| Manitoba | $16.00/hour |

| New Brunswick | $15.65/hour |

| Newfoundland & Labrador | $16.00/hour |

| Northwest Territories | $16.95/hour |

| Nova Scotia | $16.50/hour |

| Nunavut | $19.75/hour |

| Ontario | $17.60/hour |

| Prince Edward Island | $16.50/hour |

| Québec | $16.10/hour |

| Saskatchewan | $15.35/hour |

| Yukon | $17.94/hour |

* Minimum wage rates were last checked in November 2025.

There are also transport costs for fuel and vehicles. A used commercial van or truck, if you need one, can range from $20,000 to $45,000, and custom shelving and signage can add a few thousand dollars on top of that. Gas prices change often, so check out this source on fuel prices by province to understand costs.

After that, there are costs for supplies and tools. These can vary significantly based on the type of service you’re providing.

For instance, simple residential cleaning services don’t need to go far beyond everyday items like mops, buckets, gloves, and vacuum cleaners, which can cost less than $1,000.

But equipment costs can run high if you’re running a commercial cleaning service, especially if you clean sensitive sites like medical facilities. For instance, HEPA commercial vacuums cost $800–$2,000 per unit, and floor scrubbers range from $2,000 for a walking model to $15,000 for a model you ride on. Add air quality monitors, P100 respiratory filters, and dehumidifiers, and your equipment costs will be in the low tens of thousands.

How overall costs might look for different types of cleaning businesses

- If you’re launching a residential cleaning business, the bar to entry is low. A sole proprietor can get started with a used vehicle, basic supplies, and liability insurance for $3,000–$10,000. That covers registration fees, cleaning products, tools, uniforms, business insurance, and minimal marketing. Your largest expense will likely be transportation.

- A commercial cleaning company costs more to establish because contracts require scale, insurance, and compliance. Expect $25,000–$75,000 in upfront costs to cover incorporation, WSIB or provincial workers’ comp registration, commercial liability insurance, payroll float, and industrial-grade equipment such as floor scrubbers, vacuums, and chemical dispensers.

- Niche cleaning companies (e.g., construction waste removal, hazardous material cleanup, or medical-facility sanitation) require more money and certification. Startup costs can run $50,000–$150,000+, mostly because of specialised equipment (HEPA vacuums, containment systems, disinfectant foggers), training, and higher insurance premiums.

Running Your Cleaning Company Day-to-Day

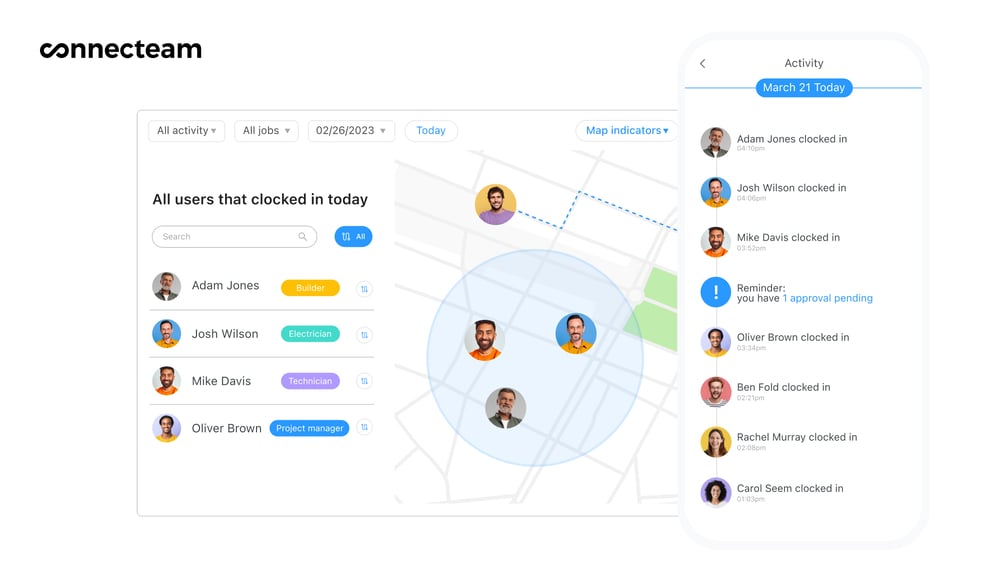

Once your cleaning company is up and running, you’ll need tools to stay organised as your team and client list grow. A good cleaning services app can help you manage schedules, track hours, communicate with workers, and make sure every job gets done on time.

With Connecteam, you can manage everything in one place. It lets you assign jobs, track work hours and overtime, share cleaning checklists, collect proof of work with photos, and even create short safety lessons or onboarding guides for employees. You can also keep everyone connected through in-app chat and updates.

Best of all, Connecteam is free for small teams with up to 10 users, making it perfect for new cleaning business owners who want to grow without big upfront costs.

Pro Tip

Starting small? Even if you’re working alone or with one helper, using an app early helps you stay professional, build habits, and prepare for growth.

FAQs

You must register your business provincially and obtain a local business license. Some municipalities require additional permits for commercial or janitorial services.

Register your business, secure insurance, buy industrial equipment, and train your team. Build contracts with offices or property managers and ensure coverage under your province’s workers’ compensation system.

Start with referrals, local ads, and social media posts in local groups. Replying to online reviews is a good way to build trust and credibility.

Connecteam is the leading cleaning services app that can help with scheduling, task tracking, employee training, and more. It’s free for small teams of up to 10 users.

Startup costs vary by size and focus. A solo residential cleaner might spend $3,000–$10,000, while commercial cleaners can expect $25,000–$75,000 or more for equipment and insurance. Niche services can run from $50,000 to $150,000 or more.

Using an all-in-one cleaning business app like Connecteam is the easiest way to manage your team and daily tasks. It helps you schedule jobs, track time, train employees, and stay compliant with payroll and safety rules, all from your phone.

Connecteam is one of the best apps for cleaning company management and scheduling. It lets you assign jobs, track hours, and communicate with staff all in one place. It’s simple to use and free for small teams.

Disclaimer

The information in this guide is for general educational purposes only and does not constitute legal, financial, or professional advice. While we’ve made every effort to ensure accuracy, laws and regulations change frequently and may vary by province, territory, or municipality. Before starting your cleaning business, consult the appropriate provincial or federal authorities or another qualified legal or business professional to confirm your specific compliance requirements.