Working extra hours? Make sure you’re getting paid what you’ve earned. Our California Overtime Calculator helps you quickly estimate your overtime and double-time pay based on California labor laws. Just enter your hourly rate and daily hours worked, and see your total pay instantly — including a detailed breakdown of regular, overtime, and double-time hours.

Free California Overtime Wage Calculator

How to Use the California Overtime Calculator

Understanding how your overtime pay is calculated can be tricky — especially with California’s unique labor laws. This calculator helps you figure out exactly how much you’ve earned in regular pay, overtime, and double time, all based on your daily work hours. Here’s how to use it step by step:

1. Enter Your Regular Hourly Rate

Start by typing in your hourly wage under “Regular Hourly Rate.”

This is your base pay before overtime or double-time rates apply. For example, if you earn $20 per hour, enter 20.

2. Select Your Pay Period

Choose whether you’re calculating for a weekly or bi-weekly pay period.

This helps the calculator apply the correct rules for weekly overtime (anything over 40 hours in a week).

3. Enter Your Daily Working Hours

You’ll see boxes for each day of the week — from Monday to Sunday.

Enter the number of hours you worked each day.

- You can include partial hours (e.g., 8.5 for eight and a half hours).

- Leave any day you didn’t work blank or set it to 0.

The calculator uses your daily hours to determine where regular time ends and where overtime or double time begins:

- Over 8 hours/day: paid at 1.5x (overtime).

- Over 12 hours/day: paid at 2x (double time).

4. Review the 7th-Day Rule (if applicable)

If you’ve worked seven days in a row, California law requires:

- 1.5x pay for the first 8 hours on the 7th consecutive day.

- 2x pay for any hours beyond 8 on that day.

The calculator automatically applies this rule based on your inputs.

5. Click “Calculate Overtime Pay”

Once you’ve entered your info, hit the Calculate Overtime Pay button.

You’ll instantly see:

- Your total pay (regular + overtime + double time).

- A detailed breakdown of hours worked in each category.

- A day-by-day summary showing how your pay adds up.

6. Review the Breakdown

Scroll down to see a full breakdown by pay type:

- Regular Hours: All hours up to 8 per day.

- Overtime Hours: Hours between 8–12 per day or over 40 per week.

- Double Time Hours: Any hours beyond 12 per day or over 8 on the 7th day.

Each section lists the total hours, pay, and which days those hours were worked.

7. Reset and Try Again

Need to make changes? Click the Reset button to clear all fields and start over. You can test different scenarios — like adjusting your hourly rate or working different schedules — to see how your overtime pay changes.

Calculate your overtime pay according to California labor laws

Your Overtime Pay

Weekly Overtime: 1.5x pay for hours over 40 in a week

7th Day: 1.5x pay for first 8 hours, 2x pay for hours over 8

This calculator provides estimates. Consult with HR for official calculations.

How to Calculate and Understand Overtime Pay in California

California has some of the most detailed overtime laws in the U.S., designed to protect employees who work long hours. Understanding these rules is key for both workers and employers — it ensures fair pay, prevents disputes, and keeps your business compliant.

This step-by-step guide will show you how to calculate overtime correctly — with a real-world example at the end showing exactly how it all works when run through the California Overtime Calculator.

Step 1: Start with the Regular Hourly Rate

Your regular hourly rate is your base pay before any overtime or double-time multipliers are applied.

Let’s say Shawn works at [Dasdf] Pizza and earns $20 per hour.

Here’s what his overtime rates will look like:

- Regular pay: $20/hour

- Overtime (1.5x): $30/hour

- Double time (2x): $40/hour

Step 2: Understand Daily Overtime Rules

In California, overtime is calculated on a daily basis, not just weekly. The key thresholds are:

- Regular Time: Up to 8 hours per day

- Overtime (1.5x): Hours 8–12 per day

- Double Time (2x): Hours over 12 per day

So if Shawn works a 10-hour day, he earns:

- 8 hours × $20 = $160 (regular)

- 2 hours × $30 = $60 (overtime)

Total for that day: $220

Step 3: Apply Weekly Overtime Rules

California also requires overtime pay for any hours worked over 40 in a week, even if no single day exceeds 8 hours.

This ensures workers get paid fairly for consistent long weeks.

Step 4: The 7th Consecutive Day Rule

If an employee works seven days in a row, California law adds extra protection:

- First 8 hours = 1.5x pay

- Hours over 8 = 2x pay

This encourages rest days and prevents overworking.

Step 5: Run the Numbers — Example

Let’s see how this works with a real example.

Meet Shawn, a pizza cook at [Dasdf] Pizza, who worked the following hours last week:

| Day | Hours Worked |

|---|---|

| Monday | 8 |

| Tuesday | 10 |

| Wednesday | 9 |

| Thursday | 8 |

| Friday | 11 |

| Saturday | 6 |

| Sunday | 0 |

Total hours: 52

Let’s break this down using the California Overtime Calculator logic:

🔹 Monday (8h)

All 8 hours are regular.

Pay: 8 × $20 = $160

🔹 Tuesday (10h)

8 regular + 2 overtime

Pay: (8 × $20) + (2 × $30) = $220

🔹 Wednesday (9h)

8 regular + 1 overtime

Pay: (8 × $20) + (1 × $30) = $190

🔹 Thursday (8h)

All 8 regular

Pay: 8 × $20 = $160

🔹 Friday (11h)

8 regular + 3 overtime

Pay: (8 × $20) + (3 × $30) = $250

🔹 Saturday (6h)

All 6 regular

Pay: 6 × $20 = $120

🔹 Sunday (0h)

No hours worked

Step 6: Review the Totals

| Category | Hours | Rate | Total Pay |

|---|---|---|---|

| Regular Hours | 46 | $20 | $920 |

| Overtime Hours | 6 | $30 | $180 |

| Double Time | 0 | — | $0 |

| Total Weekly Pay | 52 | — | $1,100 |

✅ Final Total: $1,100

Step 7: What the Calculator Would Show

When entered into the California Overtime Calculator, Shawn’s results would appear like this:

Your Overtime Pay: $1,100 Total

- Regular Hours: 46h = $920

- Overtime Hours: 6h @ 1.5x = $180

- Double Time Hours: 0h = $0

Breakdown by Day:

- Monday: 8h regular

- Tuesday: 8h regular, 2h overtime

- Wednesday: 8h regular, 1h overtime

- Thursday: 8h regular

- Friday: 8h regular, 3h overtime

- Saturday: 6h regular

- Sunday: 0h

This matches California’s labor law overtime structure perfectly — fair, transparent, and easy to verify.

Step 8: Why This Matters

Understanding how overtime is calculated helps employees like Shawn confirm they’re being paid correctly and gives managers confidence that payroll is compliant with California law.

It also prevents disputes, supports accurate budgeting, and promotes trust between workers and employers.

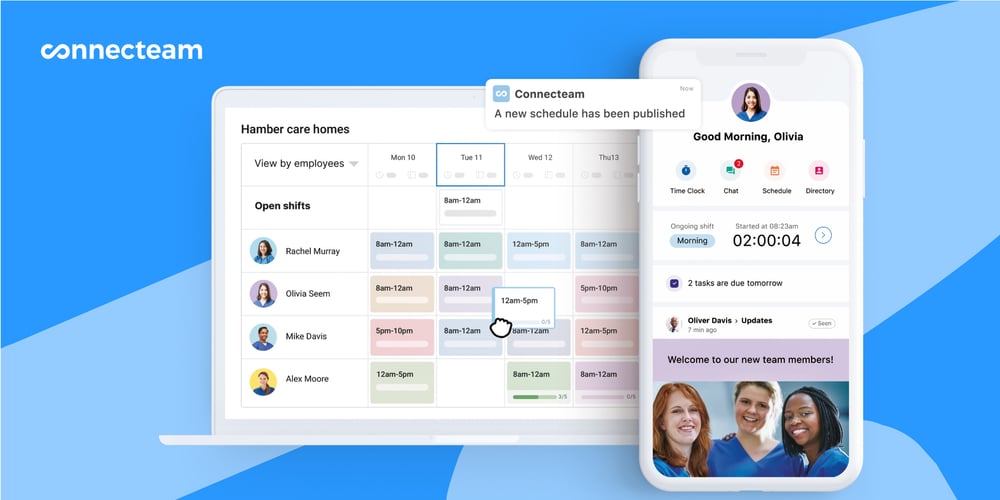

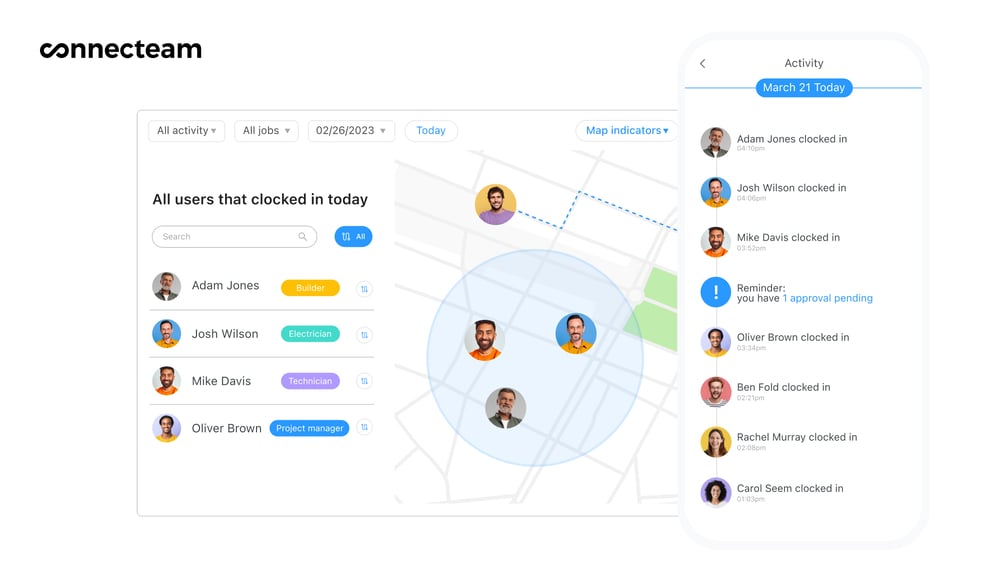

Simplify Overtime Tracking with Connecteam

Manually tracking hours and overtime can quickly become complicated — especially when managing multiple employees. Connecteam makes it easy.

Here’s how Connecteam helps California businesses stay on top of their overtime compliance:

- Automatic Overtime Calculations: The system applies California-specific daily and weekly overtime rules automatically.

- Accurate Time Tracking: GPS-enabled clock-ins ensure every shift is recorded precisely.

- Smart Scheduling: Prevent unnecessary overtime with real-time insights into employee availability.

- Payroll Integration: Send accurate data straight to payroll to save hours on admin work.

- Mobile Access: Employees can clock in and out, view hours, and track overtime from their phones.

With Connecteam, businesses can reduce payroll errors, improve compliance, and give employees the transparency they deserve.

Try the California Overtime Calculator above to see how your hours add up — and discover how Connecteam can make managing schedules, time, and overtime effortless.

Use Connecteam to Efficiently Run Your Business

Running a successful cleaning business requires more than just skilled cleaners; you need efficient processes and seamless communication to keep everything running smoothly.

This is where Connecteam comes in.

Connecteam’s all-in-one platform is designed specifically for managing deskless teams, making it an ideal choice for cleaning service providers. Here’s how Connecteam can streamline your operations and boost productivity:

What Connecteam Offers for Business Owners

Simplified Staff Management: Easily assign tasks, monitor progress, and manage schedules from one place. Connecteam’s mobile-friendly interface lets your team access everything they need, right from their phones.

Intuitive Scheduling Tool: With Connecteam’s scheduler, you can easily create and manage work schedules, assign shifts, and make adjustments on the fly. This helps prevent scheduling conflicts and ensures your cleaners are in the right place at the right time.

Effortless Communication: Keep your team informed with instant updates, chat features, and group messages. Connecteam’s communication tools make it easy to send job details, safety guidelines, or updates directly to your team, fostering better coordination.

Accurate Time Tracking: Connecteam’s GPS-enabled time tracking ensures you know exactly where your team is working and for how long. This feature helps you streamline payroll, reduce errors, and manage labor costs effectively.

Training and Onboarding Tools: Standardize your training and onboarding with Connecteam’s training features, helping new team members get up to speed quickly and maintaining service consistency across your cleaning business.

With Connecteam, you have everything you need to manage your cleaning business operations efficiently and professionally. From simplifying scheduling to enhancing team communication, Connecteam lets you focus on what matters most: providing outstanding service to your clients.

Ready to take your cleaning business to the next level?

FAQs

Overtime in California starts after 8 hours in a single workday or 40 hours in a workweek.

- Any hours between 8 and 12 in a day are paid at 1.5x your regular rate.

- Any hours beyond 12 in a day are paid at 2x your regular rate.

Additionally, if you work seven consecutive days in a workweek, the first 8 hours on the 7th day are paid at 1.5x, and hours over 8 are paid at 2x.

It depends. In California, salaried employees are not automatically exempt from overtime.

If you’re a non-exempt salaried employee (for example, if your role doesn’t meet the executive, administrative, or professional exemption test), your salary can still be converted into an hourly rate for overtime calculations.

Exempt employees—typically managers, certain professionals, and higher-paid roles—do not receive overtime.

Double time (2x pay) applies in two main cases:

- When you work more than 12 hours in one day.

- When you work more than 8 hours on the seventh consecutive day in the same workweek.

This rule ensures employees who work long or consecutive shifts are fairly compensated for the extra time.

Not necessarily. In California, weekend work alone doesn’t trigger overtime.

Overtime is based on total hours worked, not the day of the week.

For example, if you work Saturday but stay under 8 hours that day and under 40 total hours for the week, you’re still paid at your regular rate.

Generally, private-sector employers in California cannot replace overtime pay with compensatory time off (“comp time”).

All overtime hours must be paid out in the same pay period they were earned. Public-sector employers (like government agencies) are sometimes allowed to offer comp time under specific agreements, but private businesses must pay cash overtime.