The right payroll software can transform managing payroll from a daunting and time-consuming task into a quick and easy one. I’ve lined up my top picks of the best payroll software on the market so you can find the best one for your business.

Managing payroll can be a daunting task for small business owners, but with the right payroll software, it doesn’t have to be.

Whether you’re a budding startup or a well-established small business, I’ve rounded up 12 of the best payroll software for small businesses on the market to simplify your payroll management and give you more time to focus on what matters most – growing your business and taking care of your team.

If you don’t have the time to read through our research, jump down to our quick comparison table.

Our Top Picks

-

Best all-in-one payroll software for small businesses

-

Good for automating payroll processes

-

Good for automating recurring payroll

Why trust us?

Our team of unbiased software reviewers follows strict editorial guidelines, and our methodology is clear and open to everyone.

See our complete methodology

45

Tools considered

31

Tools reviewed

12

Best tools

chosen

How I Chose the Best Payroll Software

Here are the key functions and features I looked for while doing research on the best payroll software on the market:

Important core features:

- Employee data management: You should be able to securely store all important employee data and create employee profiles.

- Document storage: Payroll software should come with enough space to store all employee documents safely and securely.

- Automatic timesheets: The payroll software should automatically calculate employee hours onto timesheets. You should also be able to edit them as needed.

- Export timesheets to payroll: You should easily be able to export timesheets to accounting software to easily pay your employees on time.

I looked for usability features like:

- Scalability and customization: Look for software that can grow with your company to meet future growth needs. You should also be able to customize earnings, deductions, and other payroll items to match your company’s unique pay structure.

- Integration with other software: Consider the software’s ability to integrate with other systems, such as payroll or recruitment software.

- Employee self service: I looked for software in that employees could access on their own so they can update their personal information and access documents such as W-2s and tax forms.

Other key product features I looked for include:

- Compliance with tax and industry regulations: I checked if the software could handle local, state, and federal tax calculations accurately and keep up with tax law changes.

- Backup and disaster recovery: The software should have robust backup and disaster recovery measures in place to protect your payroll data in case of unforeseen events.

- Security: Payroll data contains sensitive information, so security is paramount. I verified that the software offers encryption, secure data storage, and user access controls.

The 12 Best Payroll Software for Small Businesses of 2023

-

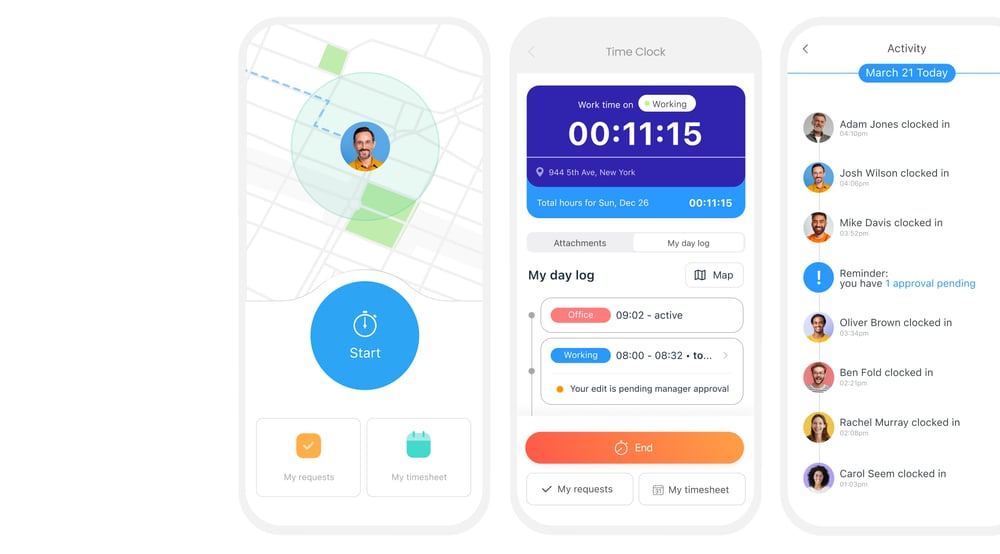

Connecteam — Best all-in-one payroll software for small businesses

Connecteam is my top pick of payroll software because it’s easy to set up and use, and is incredibly affordable for small businesses.

Why I chose Connecteam: Connecteam is all-in-one payroll management software that provides business owners and managers with all the tools they need to prepare 100% accurate timesheets for payroll.

Let’s take a look at some of the key features:

GPS time clock accurately tracks employee hours

With Connecteam’s GPS-enabled employee time clock, employees can clock in and out of work right from their phones. The app also automatically tracks their locations the entire time they’re on the clock so you can make sure no one is clocked in while they aren’t actually working.

The time clock also allows you to create digital geofences around worksites so workers can only clock in and out while they’re on the job.

PTO, overtime, and absence management

Handle all things related to time off management right from your phone. Accurately track employee time off requests, paid and unpaid absences, and overtime. You can also input everyone’s individual allotted vacation days and PTO policies, and the app automatically keeps track. It will also alert you if an employee goes into overtime.

Automated timesheets makes processing payroll a breeze

All employee hours are automatically organized onto digital timesheets for payroll. Here, you can easily see and review all logged data, such as total daily work hours, the number of hours worked during a payroll period, overtime, breaks, and time off. The system also flags any irregularities so you can easily spot and correct potentially costly payroll errors.

In addition, you can apply different pay rates per employee or job and automatically calculate work hours, breaks, and overtime.

Employee self service makes it easy for employees to review their timesheets, request changes, and send in approval before you process timesheets for payroll, all from their mobile devices.

Simplified payroll processing

When ready, you can simply export timesheets directly to your payroll software or use one of Connecteam’s payroll integrations: Gusto, QuickBooks Online, Paychex and Xero. This allows you to skip the entire manual process, saving you valuable time and effort.

Easily manage all employee data and documents

Connecteam’s company employee directory allows you to store all important employee data right in the app. Keep phone numbers, email addresses, preferred contact methods, food allergies, ID numbers, and more all in one place.

The directory is also completely customizable so you can create as many information fields as you need and safely store all pertinent employee details.

In addition, keep any and all important staff documents, like hiring forms and tax documents, digitally stored in the app. You can also set user permissions to ensure that only authorized individuals can view certain documents.

Connecteam also comes with all the tools you need to effectively manage your team on the go. Online team chat, employee task tracking, employee scheduling, and more.Connecteam’s paid plan starts at just $29 per month for up to 30 users, and small businesses with fewer than 10 users can access the app completely free.

Key Features

Timesheet errors/irregularities highlights

Pros

Intuitive and easy to use

All-in-one solution

Great customer support

Budget-friendly

Cons

Needs internet or wifi access to work

Pricing

Free-for-life plan availablePremium plans start at $29/month for 30 users

14-day free trial, no credit card required

Start your free trial -

Gusto — Good fora automating payroll processes

Gusto’s full-service payroll software aims to help small businesses take care of their teams.

Why I chose Gusto: You can easily run payroll for salaried employees and contractors as often as you need each month. It also allows you to automatically file payroll taxes, manage healthcare and other employee benefits, perform next-day, 2-day, and 4-day direct deposits, and more.

Gusto is a good pick for small business owners and entrepreneurs looking to automate their payroll processes to minimize administrative hires and instead direct their resources toward the business’s mission.

Learn more about GustoKey Features

- Benefits management

- Check printing

- Direct Deposit

- Electronic forms

Pros

- Easy to use

- Feature-rich

Cons

- Poor customer support

- Limited reporting options

Pricing

Starts at $40/month + $6/person/month Trial: No Free Plan: No

-

RUN by ADP — Good for automating recurring payroll

Available on

- Web

- iOS

- Android

RUN by ADP is a payroll system for small businesses that aims to handle the “nitty-gritty” of processing payroll, so you can instead focus on running your business.

Why I chose RUN by ADP: It offers step-by-step screens, guidance, and tips for managing payroll and allows you to set up automations for recurring payroll. It includes multiple payment options, including direct deposit and ADPCheck.

RUN also includes add-ons for benefits administration and tax form filing for additional fees.

This software is specifically designed for businesses with up to 50 employees. It can still be a good fit if you expect to grow beyond that, as it allows you to migrate to ADP’s enterprise platform.

Learn more about RUN by ADPKey Features

- Check printing

- Compensation management

- Direct deposit

- Payroll reporting

Pros

- Good customizability

- Easy to use

Cons

- Limited data import capabilities

- Hard to set up

Pricing

Contact vendor for price Trial: Yes Free Plan: No

-

QuickBooks Time — Good for automating state and federal tax filings

QuickBooks Time is a great accounting software solution that aims to provide small- to medium-sized businesses with smarter business tools.

Why I chose QuickBook Time: This payroll software system offers the essential features needed to run payroll services, including wage garnishments, health insurance, and other benefits administration, and automated state and federal tax filings. Managers can also set QuickBooks payroll to run automatically so that they can focus on the bigger picture.

Learn more about QuickBooks TimeKey Features

- Automatic billing

- Billing and invoicing

- Expense tracking

- Payroll management

Pros

- Feature-rich

- Easy to use

Cons

- Learning curve

- Poor customer support

Pricing

Starts at $20/month + $10/user/month Trial: Yes — 30-day Free Plan: No

-

Paychex Flex — Good for new-hire reporting to government agencies

Available on

- Web

- iOS

- Android

- Windows

- Mac

Paychex Flex is a payroll system for small businesses that aims to make handling complex HR, payroll, and benefits simple for business owners.

Why I chose Paychex Flex: With this payroll system for small businesses, you can process payroll for your employees and contractors online or submit payroll by phone to a payroll specialist. It does not include benefits administration offered by some competitors.

You can use different payment methods, including direct deposit, pay cards, paper checks, online tip sharing, and on-demand access to earned wages.

Learn more about Paychex FlexKey Features

- Check printing

- Compensation management

- Direct deposit

- Employee database

Pros

- Easy to use

- Good customizability

Cons

- Limited capabilities

- Hard to implement

Pricing

Contact vendor for price Trial: No Free Plan: No

-

Sage Payroll — Good for accessing payslips online

Available on

- Web

- iOS

- Android

Sage’s payroll software for small businesses aims to simplify your payroll process and grant access to accurate reports for quicker decision-making.

Why I chose Sage: You can process weekly, bi-weekly, and monthly payrolls. Payslips are accessible online for you and your employees to view or look back on. It also includes tools to manage workplace pension schemes and to help ensure you comply with legislation.

One of its main strengths is security – your payroll information in the cloud is fully encrypted, and user access permissions can be customized to ensure data security and integrity.

Learn more about Sage PayrollKey Features

- ACA reporting

- Benefits management

- Check printing

- Compensation management

Pros

- Easy to use

- Easy to integrate

Cons

- Unintuitive user interface

- Poor customer service

Pricing

Starts at $8/month Trial: Yes Free Plan: No

-

SurePayroll — Good for: running payroll from your mobile phone

Available on

- Web

- iOS

- Android

SurePayroll’s small business payroll system aims to help simplify and saves time on important back-office operations.

Why I chose SurePayroll: It was the first software-as-a-service payroll company that expanded its services into a total online payroll and tax filing software. These include services for workers’ compensation, 401(k) plans, and health insurance.

SurePayroll’s services are specifically designed for small and micro business owners who don’t need a wide variety of HR support tools.

Learn more about SurePayrollKey Features

- Benefits management

- Check printing

- Compensation management

- Wage garnishment

Pros

- Easy to use

- Feature-rich

Cons

- Limited reporting customizability

- Poor customer service

Pricing

Starts at $19/month + $4/user/month Trial: Yes Free Plan: No

-

Wagepoint — Good for automating payroll taxes

Available on

- Web

Wagepoint’s payroll software, created just for small businesses, aims to make it easy to pay everyone and stay on top of your payroll taxes.

Why I chose Wagepoint: With this online payroll software, you can automatically calculate incomes, deductions, and paid time off. It can also automate payroll taxes to ensure compliance.

You can then pay your employees and contractors using direct deposits. Everyone can then access their paystubs online.

Learn more about WagepointKey Features

- Direct deposit

- Tax compliance

- W-2 preparation

- Wage garnishment

Pros

- Easy to use

- Good customer support

Cons

- Limited reporting capabilities

- Insufficient customizability

Pricing

Contact vendor for price Trial: No Free Plan: No

-

Paycor — Good for ensuring compliance

PayCor is a payroll app for small businesses that aims to make the entire payroll process simple and seamless and make mistakes easy to catch.

Why I chose PayCor: This payroll and tax service software allows you to pay employees from wherever you are. The software constantly updates, making it easy to comply with local, state, and federal laws.

PayCor guides you through the payroll process and allows you to make real-time calculations. This way, you can see exactly what’s being debited before you run payroll. You can also set up automations to process payroll on a specific day and time without having to be at a computer.

Learn more about PaycorKey Features

- 401(k) tracking

- Benefits management

- Compensation management

- COBRA administration

Pros

- Intuitive user experience

- Easy to implement

Cons

- Limited reporting options

- Poor customer service

Pricing

Contact vendor for price Trial: No Free Plan: No

-

Bamboo HR — Good for managing payroll reports

Available on

- Web

- iOS

- Android

BambooHR is another great payroll system for small businesses.

Why I chose BambooHR: BambooHR provides an easy, 3-step solution to payroll. It saves employee information like wages, hours, bank account numbers, employee benefits, deductions, or withholdings and automatically does the payroll process for you.

Additionally, the software has an employee portal so employees can access their payroll information, like paystubs and direct deposit accounts, at any time. It also provides over 100 exportable payroll reports.

Learn more about Bamboo HRKey Features

- Compensation management

- Benefits management

- Direct deposit

- Retirement plan management

Pros

- Easy to implement

- Good customer support

Cons

- Unintuitive user experience

- Features need refinement

Pricing

Contact vendor for price Trial: Yes Free Plan: No

-

Rippling — Good for syncing HR data

Rippling is a full-service payroll software for small businesses that aims to make processing payroll instant and reliable.

Why I chose Rippling: The payroll software syncs all of your business’s HR data with payroll allowing you to skip manual calculations and data entry. It also provides automatic compliance and automatic filing of tax forms.

Rippling allows users to create reports from pre-built templates or they can fully customize their own. Rippling also integrates with over 400 apps to simplify your payroll and HR processes.

Learn more about RipplingKey Features

- Check printing

- Compensation management

- Deduction management

- Life insurance administration

Pros

- Intuitive user experience

- Sufficient integration options

Cons

- Limited customization options

- Unresponsive customer support

Pricing

Starts at $8/user/month Trial: Yes Free Plan: No

-

Paycom — Good for providing employees with a guided self-service experience

Available on

- Web

- iOS

- Android

- Windows

- Mac

Paycom is a payroll software that aims to empower employees to manage their own data.

Why I chose Paycom: Employees can do their own payroll – as well as their timecard, PTO, expenses, and benefits – with a guided self-service experience. The system checks the payroll to ensure there are no errors and helps employees fix mistakes. Paycom also provides garnishment administration and payroll tax management.

Learn more about PaycomKey Features

- Benefits management

- Check printing

- Compensation management

- Health insurance administration

Pros

- Simple to navigate

- Easy to use

Cons

- Prone to bugs

- Unengaging user interface

Pricing

Contact vendor for price Trial: No Free Plan: No

Compare the Best Payroll Software for Small Businesses

| Topic |

Start for free

Start for free

|

|

|

|

|

|

|

|

|

|

|

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reviews |

4.8

|

4.6

|

4.5

|

4.7

|

4.1

|

4.8

|

4.1

|

4.6

|

4.4

|

4.6

|

4.9

|

4.3

|

| Pricing |

Starts at just $29/month for the first 30 users

|

Starts at $40/month + $6/person/month

|

Contact vendor for price

|

Starts at $20/month + $10/user/month

|

Contact vendor for price

|

Starts at $8/month

|

Starts at $19/month + $4/user/month

|

Contact vendor for price

|

Contact vendor for price

|

Contact vendor for price

|

Starts at $8/user/month

|

Contact vendor for price

|

| Free Trial |

yes

14-day

|

no

|

yes

|

yes

30-day

|

no

|

yes

|

yes

|

no

|

no

|

yes

|

yes

|

no

|

| Free Plan |

yes

Free Up to 10 users

|

no

|

no

|

no

|

no

|

no

|

no

|

no

|

no

|

no

|

no

|

no

|

| Use cases |

Best all-in-one payroll software for small businesses

|

Good fora automating payroll processes

|

Good for automating recurring payroll

|

Good for automating state and federal tax filings

|

Good for new-hire reporting to government agencies

|

Good for accessing payslips online

|

Good for: running payroll from your mobile phone

|

Good for automating payroll taxes

|

Good for ensuring compliance

|

Good for managing payroll reports

|

Good for syncing HR data

|

Good for providing employees with a guided self-service experience

|

| Available on |

Web, iOS, Android

|

Web, iOS, Android, Windows, Mac

|

Web, iOS, Android

|

Web, iOS, Android

|

Web

|

Web, iOS, Android

|

Web, iOS, Android, Windows, Mac

|

What is Small Business Payroll Software?

Small business payroll software helps small businesses manage and process employee salaries and wages efficiently. It automates calculations for deductions, taxes, and net pay, ensuring compliance with relevant tax laws and regulations. Additionally, this software often includes features for tracking employee hours, managing benefits, and generating payroll reports, simplifying the payroll process for small business owners.

How Does Payroll Software Work?

Payroll software streamlines the process of calculating and distributing employee wages by automatically handling complex calculations for taxes, benefits, and deductions. It integrates employee data, such as hours worked, salary rates, and tax information, to accurately compute each employee’s net pay. The software also usually includes features for direct deposit, tax filing, and generating detailed payroll reports, ensuring compliance and efficiency in the payroll process.

Benefits of Payroll Processing Software

Time savings

Automates complex calculations and processes, freeing up time for other business activities.

Accuracy in payroll

This software reduces the risk of errors in payroll calculations and tax withholdings.

Tax compliance

Payroll software helps companies stay up-to-date with tax laws and regulations, helping to avoid penalties.

Cost-effective

Using payroll software for small businesses is often more affordable than hiring a dedicated payroll manager or outsourcing the task.

Employee self-service

The software allows employees to access their pay stubs and tax documents online, reducing administrative queries.

Record keeping

Using payroll management software helps maintain detailed records of payroll transactions for audit and reporting purposes.

Integrated features

The software often includes additional functionalities like time tracking, benefits management, and HR tools.

Allows for direct deposit

Payroll software facilitates easy and quick payment to employees’ bank accounts.

Customizable reports

The software generates various reports for financial analysis and business planning.

How Much Does Small Business Payroll Software Cost?

The cost of small business payroll software varies per provider and is often dependent on the size of your business and the number of users. Most small business payroll software providers also offer different feature bundles for different fees.

When choosing the best payroll software for your business, it is important to make sure that it is both budget-friendly and offers you the features you need. Some payroll software options for instance are affordable when you have less than 10 employees but get very expensive when your team grows. Others may be expensive altogether while lacking certain important features.

Our top pick, Connecteam, offers a completely free plan for small businesses with up to 10 employees and paid plans start at just $29/month for the first 30 users.

>> Get started with Connecteam today for free! <<

FAQs

Do small businesses need payroll software?

Yes, small businesses benefit significantly from payroll software because it streamlines the payroll process, ensuring accuracy and compliance with tax laws. It also saves time and reduces the likelihood of errors, which is crucial for maintaining efficient operations in any business environment.

What is the best payroll software for small businesses?

The best payroll software really depends on your needs and your budget. Connecteam is a great option because it’s affordable for small businesses and easy to use. The app totals up everyone’s hours and owed wages and then you can export it to a payroll processing software for easy and accurate payments.

Is payroll software hard to use?

Not all payroll software is easy to use, but some companies will provide a demo so you can see how the software works. After a demo, you’ll have a better understanding of whether it will be easy for you and your HR manager to use.

The Bottom Line on Payroll Software for Small Businesses

Without payroll software, it’s very difficult to pay your workers or comply with tax laws properly. So it’s no wonder there’s such a broad selection of payroll management and automation solutions out there.

Be sure to choose one that offers features that best allow you to streamline and run an accurate payroll process. Our number one pick, Connecteam, offers all the tools you need to track precise work hours, automate digital timesheets, and run these right through your preferred payroll software – all with one intuitive and fair-priced tool.